Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

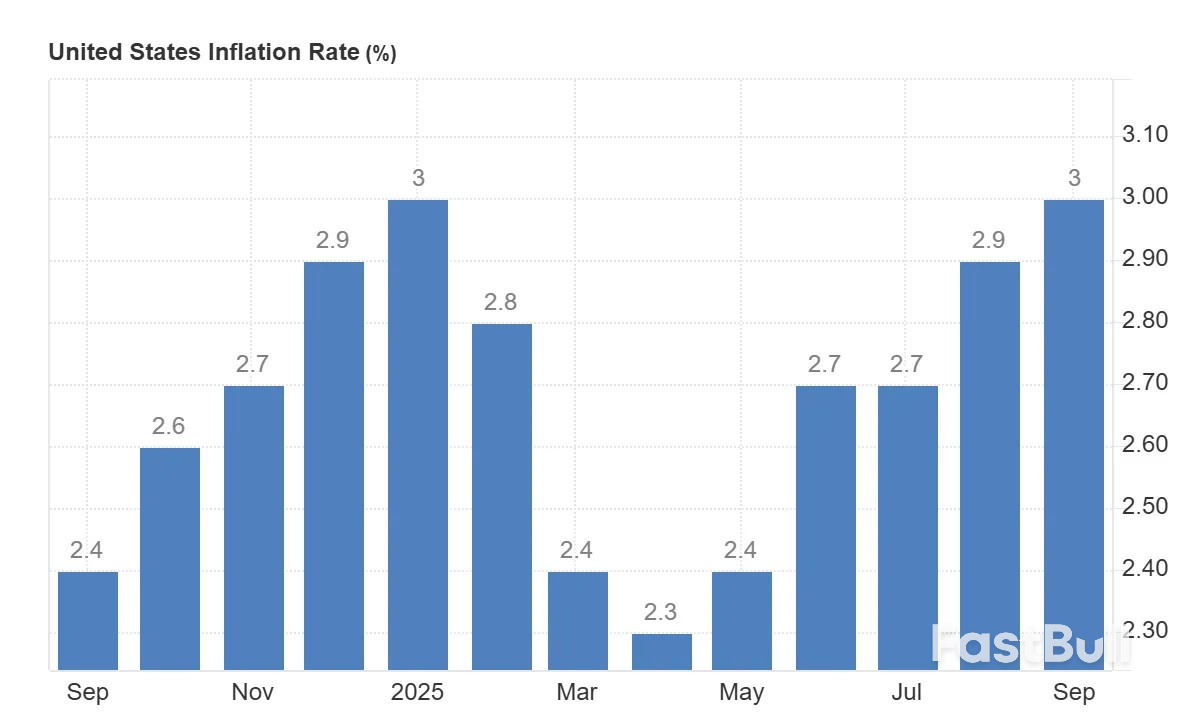

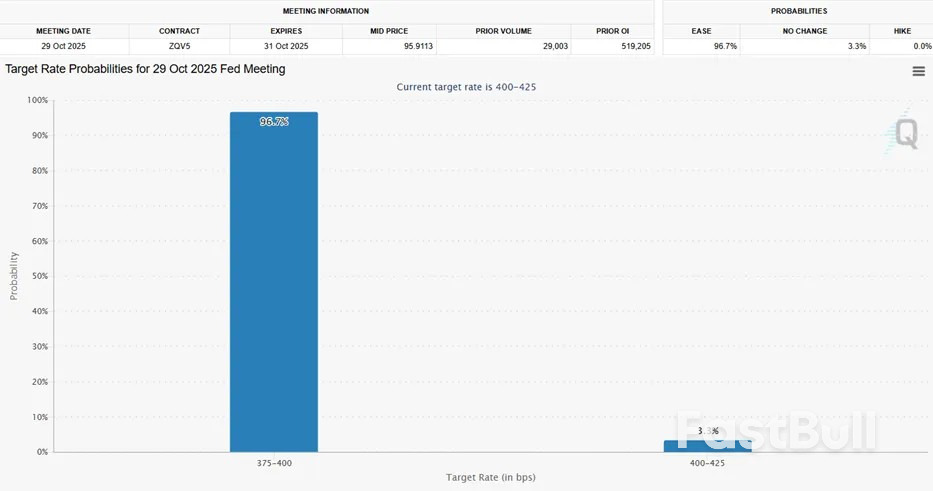

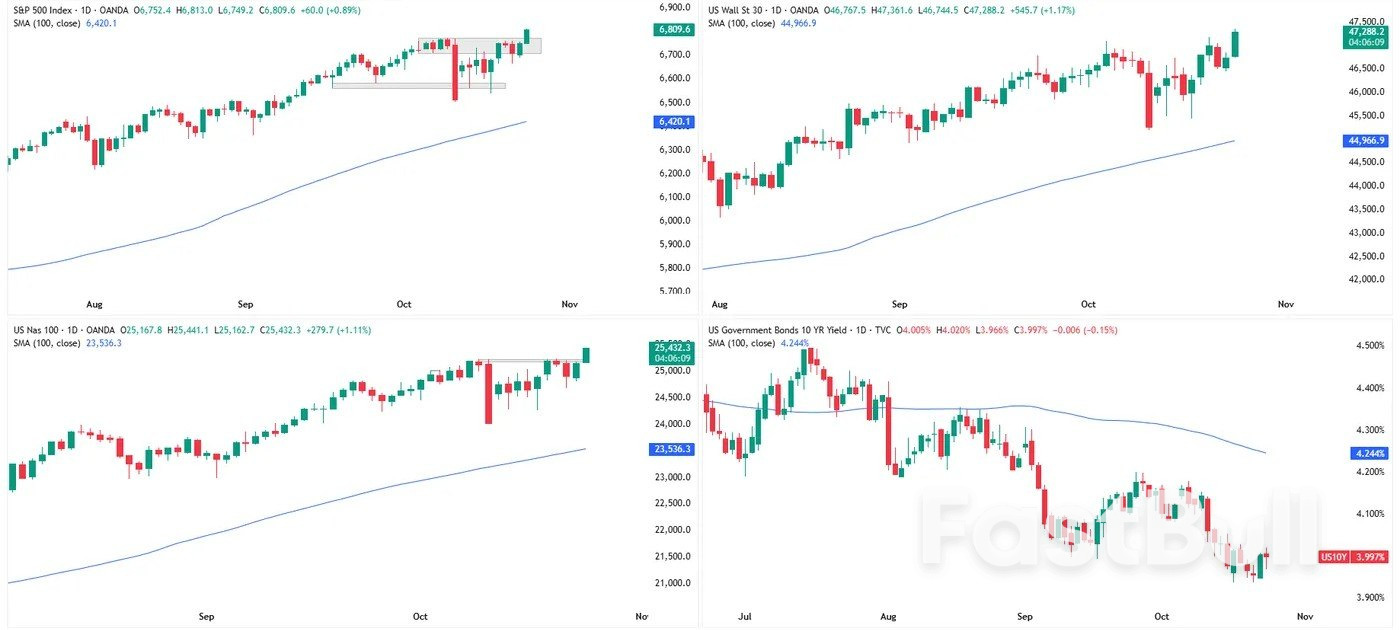

U.S. inflation eased to 3% in September, below forecasts, boosting expectations of Fed rate cuts in October and December. Stocks rallied, yields fell, and the dollar weakened, though tariff and sentiment risks persist.

U.S. Trade Representative Jamieson Greer announced moments ago that the U.S. has initiated a Section 301 investigation into China's implementation of the Phase One trade deal, a deal that has been out of public focus since President Trump's first term. This development comes less than one week before Trump and Chinese President Xi Jinping are scheduled to meet on the sidelines of the Asia-Pacific Economic Cooperation summit to ease trade tensions. The flurry of recent trade-related headlines, from rare earths to soybeans to jet engines, suggests that both economic superpowers are attempting to build leverage ahead of trade talks.

"President Trump made history in his first term when he stood up for the American worker and brokered the Phase One Agreement, establishing a more fair and reciprocal trade relationship with China," Ambassador Greer stated.

Greer wrote in a statement, adding, "The initiation of this investigation underscores the Trump Administration's resolve to hold China to its Phase One Agreement commitments, protect American farmers, ranchers, workers, and innovators, and establish a more reciprocal trade relationship with China for the benefit of the American people."

USTR provided additional context on the Phase One trade deal reached in December 2019, which required China to implement structural reforms in areas such as intellectual property, technology transfer, agriculture, and financial services, and to significantly increase purchases of U.S. goods and services. Beijing's shift toward sourcing agricultural products from the U.S. to Brazil has inflicted pain across America's Midwest farm belt, and is likely one key reason this probe was opened.

Five years after the agreement was signed, China has not fulfilled its commitments, particularly regarding non-tariff barriers, market access, and purchase targets. Ahead of next week's Trump-Xi meeting at APEC, Greer will investigate whether China's failure to comply with the Phase One deal violates U.S. trade rights under Section 301.

Despite the probe, President Trump said on Thursday, "I think we're going to come out very well and everyone's going to be very happy."

The Trump-Xi meeting also comes just before a trade truce between Washington and Beijing is set to expire on November 10. Trump has threatened to impose an additional 100% tariff on Chinese products on November 1 if Beijing does not ease shipments of rare earth minerals to the U.S. Trump said this week that upcoming talks with Xi will produce a "good deal" on "everything" related to trade.

Market attention now turns to any weekend statements from both sides. So far, the market reaction has been muted across equities, bonds, and FX, as a cooler CPI print in the U.S. has pushed main equity indexes to around noontime.

The Trump administration is launching a trade investigation that opens the door to new tariffs on Chinese goods, ratcheting up tensions ahead of a highly anticipated summit next week between the countries' leaders.

US Trade Representative Jamieson Greer on Friday announced the opening of a probe into whether China complied with a limited trade agreement reached in 2020 during President Donald Trump's first term.

The investigation "will examine whether China has fully implemented its commitments under the Phase One Agreement, the burden or restriction on U.S. commerce resulting from any non-implementation by China of its commitments, and what action, if any, should be taken in response," the agency said Friday in a statement.

The move threatens to exacerbate strained relations between Washington and Beijing, and could serve as another point of leverage for Trump in his meeting next Thursday with Chinese President Xi Jinping in South Korea.

The probe is being conducted under Section 301 of the Trade Act of 1974, which allows the administration to adjust imports from countries deemed to have adverse trade practices. Those investigations typically last several months, or more, but serve as the legal basis for the president to unilaterally impose tariffs.

Trump's first-term trade deal with China was based in part on Beijing's pledges to boost purchases of US agricultural products, a source of renewed tension this year.

The US and China have engaged in a tit-for-tat trade fight since Trump returned to office, which has reignited in recent weeks despite a truce that lowered levies between the two countries to allow for more negotiations. That pause on higher tariffs is set to expire mid-November.

The Trump administration has hit China with new curbs on exports of technology, while China has moved to restrict the flow of critical rare-earth minerals crucial to many sectors including energy, semiconductors and transportation. Trump has also threatened to add a new 100% tariff effective Nov. 1, if China does not relent on those rare-earth restrictions.

The trade fight has also seen China cut off purchases of US soybeans, hammering American farmers who have seen markets shrink amid the US president's trade war. Still, Trump has predicted he would reach a deal with Xi on trade and other matters, raising expectations for their long-awaited summit.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up