Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Expectations of a dovish Federal Reserve policy in September remain the main driver for the currency market.

Expectations of a dovish Federal Reserve policy in September remain the main driver for the currency market. The probability of a rate cut currently stands at 98%. Profit-taking and cautious investor interest in risk assets add to pressure on the US dollar.

EURUSD dynamics are shaped by the contrast between signals from the Fed and ECB, along with market reaction to fresh macroeconomic data. This review explores potential EURUSD scenarios in early September, considering revised US GDP figures, political pressure on the Fed, and developments within the eurozone.

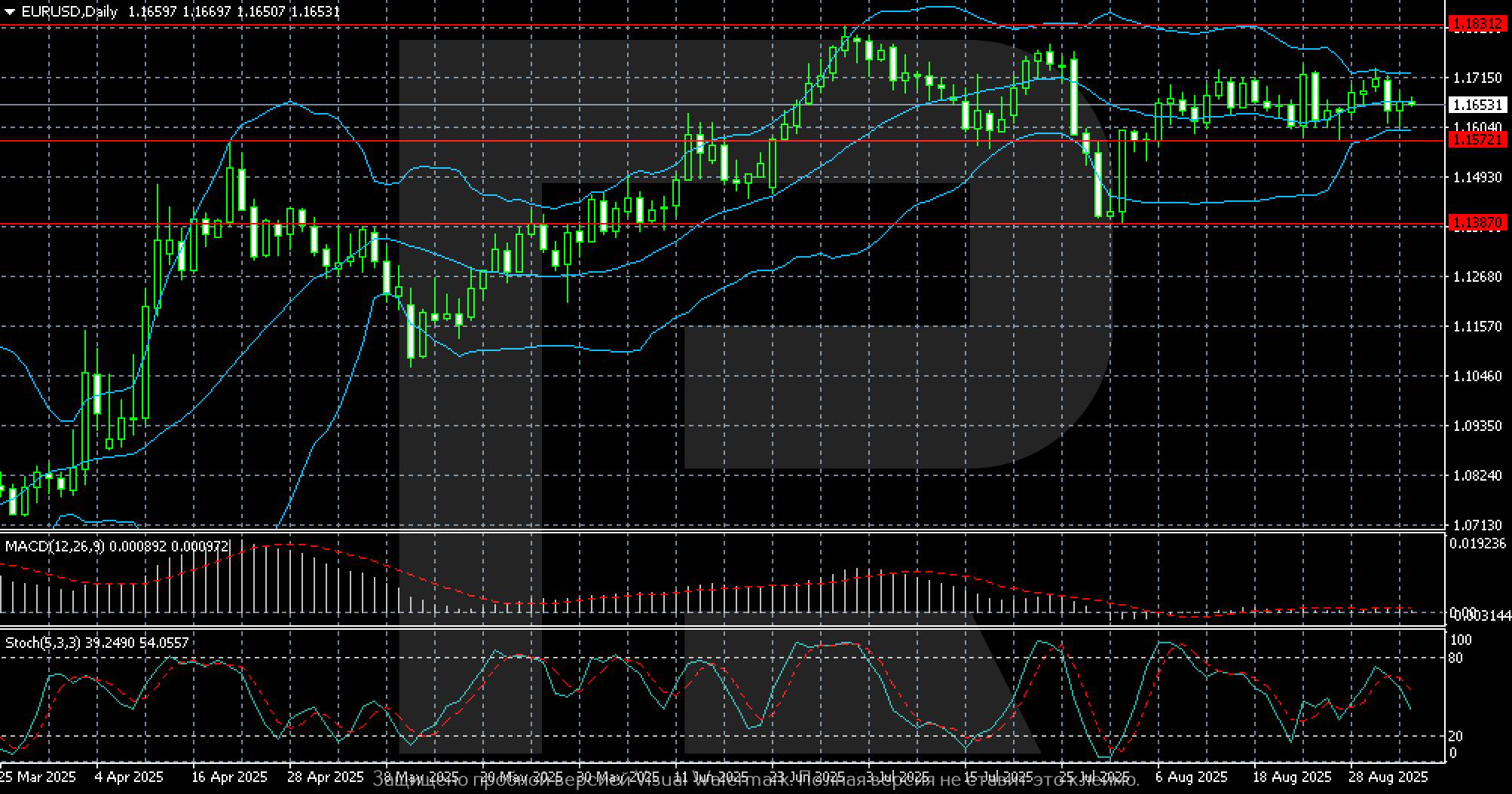

EURUSD forecast for this week: quick overview

The EURUSD pair closed the week of 1-5 September near 1.1660, remaining in the middle of the recent months’ range.

The dollar index hovered around 98 following weak US labour data (JOLTS showed job openings down to 7.18 million, the lowest since September 2024) and revised GDP growth of +3.3% q/q. The likelihood of a 25-basis-point Federal Reserve rate cut in September increased to 98%, up from 86% a week earlier. In the eurozone, the August CPI confirmed a slowdown in inflation (2.1% y/y), with unemployment stable at 6.2% and the PPI down to +0.2% y/y.

The pair remains within the range between the 1.1570 support level and the 1.1740 resistance level. The dollar receives mixed signals: the likelihood of an imminent Fed rate cut weighs on the greenback, while strong GDP data and concerns over Fed independence amid political pressure from Donald Trump limit downside. The euro is supported by moderate inflation data and labour market stability.

The baseline scenario suggests continued trading within the 1.1570-1.1740 range. Upside is possible on weak US labour data and dovish Fed commentary, with the pair likely to test 1.1830 in this case. A breakout below 1.1570 would increase pressure and shift the target towards 1.1380. Overall, the balance of factors remains neutral-to-cautious: the euro benefits from dovish Fed expectations and moderate eurozone data, while the dollar is backed by strong US macroeconomic indicators and demand for safe-haven assets.

Eurozone inflation data confirmed a decline in price pressure.

The preliminary CPI came in at 2.1% y/y in August, matching forecasts (the previous reading was 2.0%). Core inflation also remains moderate. July unemployment held steady at 6.2%, indicating continued labour market tightness. Meanwhile, the July PPI showed a modest 0.2% year-on-year increase, below previous readings, confirming reduced inflation risks. Taken together, this data points to a gradual cooling of the region’s economy, which restrains the euro’s strength.

The June JOLTS data showed 7.181 million job openings, below the forecast of 7.380 million and the previous reading of 7.357 million, marking the lowest level since September 2024.This week, investors also reviewed updated labour figures for August. Despite job growth, hiring momentum slowed, reinforcing expectations of imminent Fed easing. At the same time, the political factor persists, with Donald Trump’s pressure on the Federal Reserve and his attacks on Lisa Cook fuelling doubts about the regulator’s independence, adding to dollar volatility.

The key driver for the EURUSD pair remains Fed rate expectations. Markets now price in a 98% likelihood of a 25-basis-point rate cut in September. The euro remains supported by neutral inflation data and labour market stability in the eurozone, although the overall balance tilts in favour of the dollar as a safe-haven asset amid global political and debt instability.

On the daily chart, the EURUSD pair is trading in a narrow sideways range around 1.1650. The key support level lies at 1.1570, with resistance at 1.1740. A higher resistance level is seen at 1.1830.Bollinger Bands are narrowing, signalling consolidation and lower volatility. The price is hovering near the centre of the range, without clear momentum towards either boundary.

MACD remains near the zero line, indicating trend weakness and the lack of a strong impulse. The Stochastic oscillates in the mid-range, confirming neutral sentiment.Overall, the technical picture remains sideways, with the euro hovering between the 1.1570 support level and the 1.1740 resistance level. The future direction will depend on upcoming macroeconomic releases.

The EURUSD sentiment for the week remains neutral to cautious. Markets now price in a 98% probability of a Fed rate cut in September, up from 86% the previous week.The euro receives mixed signals: political tensions in France and dollar strength limit growth, yet the pair holds above 1.1620.

Long positions are possible if the pair holds above 1.1620-1.1650. Further confirmation would come from consolidation above 1.1650 and weak US macroeconomic data. Targets are 1.1710 and 1.1740; in a positive scenario, the pair may advance towards 1.1830.

Stop-loss is below 1.1580; a breakout here would increase selling pressure.

Short positions are viable if the pair breaks below 1.1580, especially amid strong US data and political uncertainty in the eurozone. Targets are 1.1500 and 1.1380 in the case of a sustained downward impulse.

Stop-loss is above 1.1675. Consolidation above this level would confirm a continued upward movement.

The EURUSD pair remains supported by expectations of a Federal Reserve rate cut in September. Markets now estimate the likelihood of a dovish move at 98%. Despite strong US economic data, including GDP growth and employment indicators, the dollar remains under pressure due to political instability around the Fed and tariff-related uncertainty.

Overall, sentiment remains moderately positive for the euro.

In the absence of new dollar catalysts, the pair has a chance to stay near the upper boundary of the current range.

Spanish telecoms group Telefonica is looking to buy telecom assets and free up resources by selling its Spanish-speaking Latin American assets, as CEO Marc Murtra plots a broader vision for Europe's telco sector.The group is eyeing assets in Germany, the UK, Spain and Brazil, Murtra told Reuters as he prepares his first strategic plan for Telefonica after taking the helm in January.While wanting to chase scale, the Spanish group must maintain itsinvestment grade credit rating, he said.

Regulators have long pushed back against mergers between European operators, fearing a few dominant players would be able to increase prices and margins to the disadvantage of the consumer, but Murtra argues that Europe's market is too fragmented.In 2024, there were 41 companies in Europe that offered mobile services to more than 500,000 customers each, compared with five in the United States, four each in China and Japan and three in South Korea, according to Connect Europe.Murtra, who was president of Spanish defence and technology group Indra until early this year, says the market is changing with the development of new technologies including AI, and Europe needs to keep up or lose out.

European telecom groups should be allowed to expand and in exchange invest in other, related sectors such as cybersecurity and infrastructure including data centers, as a "social contract" between authorities and companies, he said."If Europe wants strategic autonomy and technology, we're going to have to have large or titanic European technology operators," Murtra, 52, told Reuters.

"I don't want to be overly dramatic, but imagine a Europe where the satellite systems, the hyperscalers and artificial intelligence are in the hands of tech bros - and this could happen."Murtra, who is also Telefonica's executive chairman, has been speaking in recent months to regulators and leaders about his proposal, according to a person familiar with the talks. Reuters could not determine how those conversations were received."This does not require a titanic shift," Murtra said of his plan. "All it needs is to lift the brake pedal a little bit and allow the market to operate and consolidate."

The sector is showing some signs of M&A activity, including reports that Orange, Bouygues and Iliad are exploring a deal to carve out Patrick Drahi's French telecom operator SFR. Owner Altice said it had not received any offer.To give Telefonica financial headroom to do more dealmaking, the company has agreed to sell its units in Argentina and Uruguay, and is working with advisors on potential sales in Chile, Mexico and Ecuador, according to three sources with knowledge of the talks. Telefonica declined to comment.

The U.S. session overnight was marked by a mix of disappointing jobs data and increased political tension regarding the Fed and tariff policy, sparking volatility across equities, Treasuries, the dollar, gold, and select tech stocks as markets rapidly recalibrated for further rate cut possibilities and renewed flight-to-safety. The most impacted financial instruments included U.S. stock indices, Treasury yields, the U.S. dollar, and gold, while select tech stocks saw notable earnings-linked swings.

Asian markets open for the week in a fragile but opportunity-rich environment, driven by Fed rate cut anticipation, sector rotation into tech and value stocks, several major regional conferences, and volatile commodity moves. Traders should remain alert to U.S. data releases, policy signals, and sector- and event-specific catalysts, especially in technology, logistics, and commodities on Monday, 8th September 2025

The US dollar faces significant headwinds entering Monday, September 8, 2025, following Friday’s weak jobs data that has locked in Fed rate cuts. With the DXY at 1.5-month lows and 100% market pricing for September easing, the dollar’s near-term outlook remains challenged by both fundamental weakness and political uncertainty surrounding Fed independence.Central Bank Notes:

Next 24 Hours Bias

Medium Bearish

Monday, September 8th, 2025, marks a continuation of gold’s historic rally, with prices consolidating above $3,600 per ounce following Friday’s jobs data disappointment. The convergence of dovish Fed expectations, persistent central bank buying, and technical momentum suggests further upside potential toward $3,700-$3,800 levels. However, traders should remain vigilant for potential volatility as extreme positioning and seasonal factors could trigger short-term corrections. The fundamental backdrop remains supportive for gold’s role as both an inflation hedge and portfolio diversification tool in an environment of monetary easing and geopolitical uncertainty.Next 24 Hours Bias

Strong Bullish

The Australian Dollar’s positive performance on Monday, September 8, 2025, reflects several converging factors: robust Q2 GDP growth exceeding expectations, continued RBA monetary easing supporting domestic demand, stabilizing commodity prices, and improving China-Australia trade relations. While the currency faces headwinds from global uncertainty and commodity price volatility, the combination of domestic economic resilience and strategic trade partnerships positions the AUD favorably in the near term. Market participants remain focused on upcoming RBA meetings and China’s economic indicators as key drivers for the currency’s trajectory through the remainder of 2025.Central Bank Notes:

The New Zealand Dollar enters the week of September 8, 2025, from a position of cautious optimism, with recent technical momentum and supportive China data providing near-term strength around the 0.5880-0.5900 level. However, the currency remains vulnerable to broader economic uncertainties, with the RBNZ’s dovish policy stance and persistent domestic economic challenges likely to cap significant upside potential. The key drivers to watch include further RBNZ policy signals, China economic data releases, and any developments in US-New Zealand trade relations.Central Bank Notes:

● The next meeting is on 22 October 2025.

Next 24 Hours Bias

Medium Bearish

Monday, September 8, 2025, opens with significant political uncertainty following Prime Minister Ishiba’s resignation, likely creating additional downward pressure on the yen. While recent economic data shows some positive developments in wages and inflation trending toward target levels, the political instability and potential for looser monetary policy under new leadership are expected to dominate near-term yen movements. Analysts anticipate further yen weakness when Asian markets open, with the USD/JPY potentially testing higher levels as investors price in increased political and policy uncertainty.Central Bank Notes:

Next 24 Hours BiasMedium Bearish

Monday, September 8, 2025, represents a pivotal moment for oil markets as OPEC+ continues its production increase strategy despite clear signs of oversupply. With crude inventories building unexpectedly, technical indicators showing weakness, and fundamental analysis pointing to surplus conditions, oil prices face significant downward pressure. The market’s ability to hold key support levels around $60-$62 for WTI and $65-$67 for Brent will be crucial in determining whether the current bearish trend accelerates or finds stabilization. Geopolitical developments, particularly regarding the Ukraine conflict and US-Russia relations, remain the primary upside risk factors that could temporarily reverse the current downtrend.Next 24 Hours Bias

Medium Bearish

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up