Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

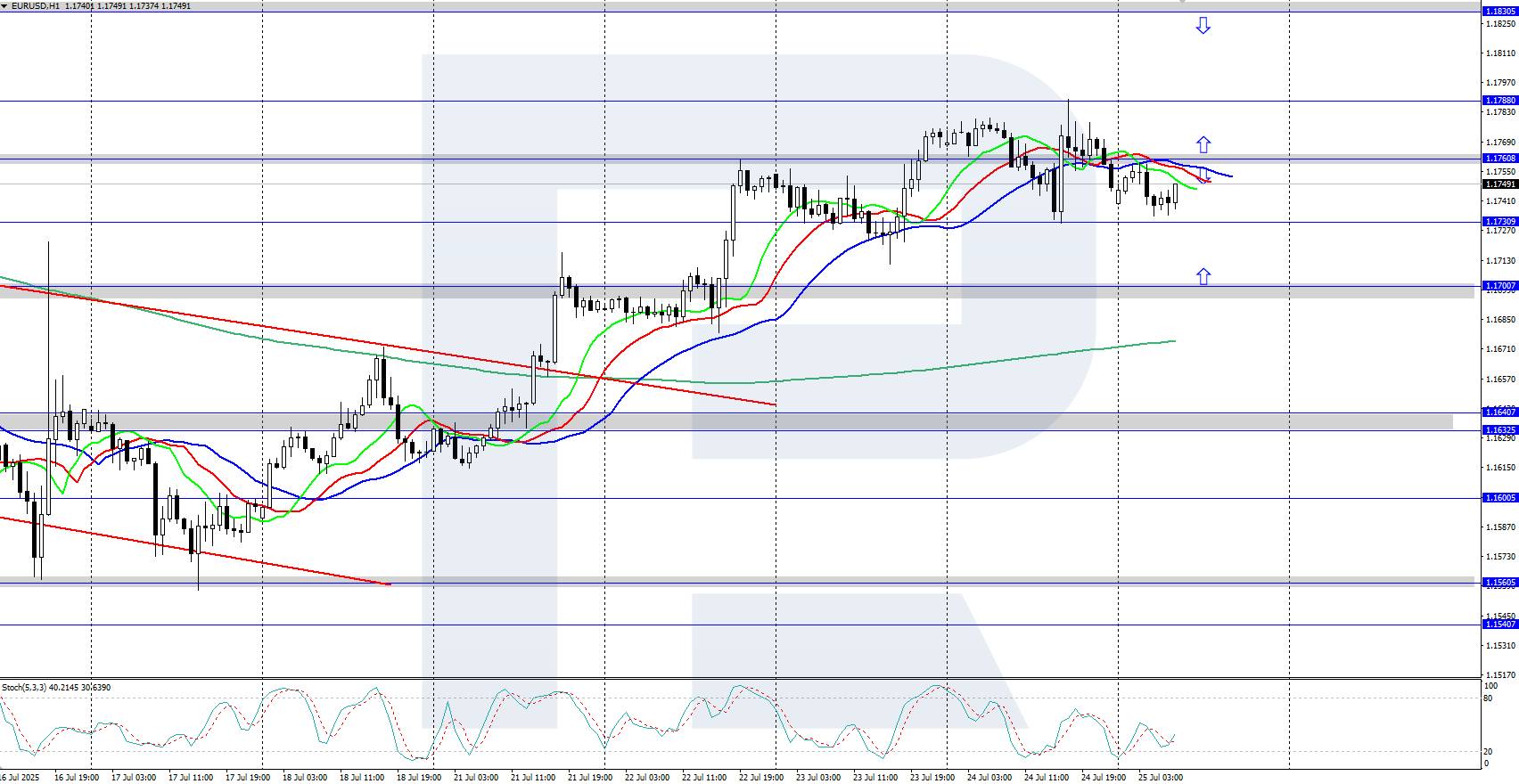

The EURUSD rate corrected towards the 1.1730 area following the ECB's decision to keep interest rates unchanged. The market awaits the outcome of trade agreement negotiations between the US and the EU. Find out more in our analysis for 25 July 2025.

The EURUSD rate corrected towards the 1.1730 area following the ECB's decision to keep interest rates unchanged. The market awaits the outcome of trade agreement negotiations between the US and the EU. Find out more in our analysis for 25 July 2025.

At yesterday’s meeting, the European Central Bank left key interest rates unchanged after eight cuts in the current cycle. The regulator noted that disinflation has progressed in line with expectations since the previous meeting in June.

ECB President Christine Lagarde stated that a more detailed assessment of the need for further rate cuts this year will require more economic data and clarity on the conditions of a potential trade agreement with the US.

Meanwhile, reports suggest that the US may agree to reduce tariffs on EU goods to 15% (the lower limit for duties on other countries) as part of an ongoing trade agreement actively being negotiated by EU diplomats.

On the H4 chart, EURUSD is undergoing a downward correction, falling this morning to the 1.1730 area, with further decline towards the 1.1700 support level possible. The daily trend for the pair remains upward, so after the correction ends, the rally may continue.

The short-term EURUSD forecast suggests a further decline towards 1.1700 in the near term if bears keep the price below 1.1760. However, if bulls push the pair above 1.1760, growth may resume towards the 1.1830 resistance level.

The EURUSD pair corrected to the 1.1730 area following the ECB’s decision to leave rates unchanged. The market’s focus now turns to trade negotiations between the US and the EU.

UK retail sales partially bounced back in June as Britons basked in heat wave conditions, adding to signs that the economy recovered from back-to-back monthly contractions during the spring.

The volume of goods sold online and in shops climbed 0.9% after plunging 2.8% in May, the Office for National Statistics said on Friday. The increase was slightly below the 1.2% gain expected by economists.

Stronger sales and an uptick in business surveys suggest the UK economy stabilized after GDP fell in both April and May amid the double blow of Labour’s tax rises and President Donald Trump’s US tariffs.

Last month was the second-hottest June on record for the UK as temperatures soared above 30 degrees Celsius in parts of England, prompting consumers to splash out on food and summer clothing.

While the boost will be welcomed by Chancellor of the Exchequer Rachel Reeves, it will do little to prevent a sharp economic slowdown in the second quarter from the bumper growth at the start of 2025. Retail sales rose just 0.2% over the quarter, contributing 0.01 percentage point to GDP, the statistics office said.

There were more ominous signs from GfK’s consumer confidence survey for July published earlier Friday. It showed that UK households are more inclined to save than at any point since the run-up to the financial crisis.

The highest unemployment rate in over four years and rising inflation may prompt already cautious consumers to slam the brakes on spending in the coming months. GfK also pointed to growing speculation that Reeves will need to raise taxes further to shore up the finances.

A cautious consumer has held back the UK economy in recent years with saving rates still well above pre-pandemic levels. Households have tightened their belts after a string of shocks to their finances, from the pandemic to double-digit inflation.

The United Nations Security Council is due to hold an emergency meeting on Friday to discuss the ongoing border clashes between Thailand and Cambodia.A long-running border dispute erupted into intense fighting on Thursday, with violence flaring near two temples on the border between Thailand's Surin province and Cambodia's Oddar Meanchey.Both countries blame the other for triggering the latest clashes.While Cambodia fired rockets and shells into Thailand, the Thai military scrambled F-16 jets to hit military targets across the border.

The fighting continued for a second day early on Friday, Thai authorities said.They also claimed that Cambodia was using heavy weapons, including artillery and rockets."Cambodian forces have conducted sustained bombardment utilizing heavy weapons, field artillery, and BM-21 rocket systems," the Thai military said in a statement. "Thai forces have responded with appropriate supporting fire in accordance with the tactical situation."The Thai Interior Ministry said the death toll on their side had risen to 14. It added that over 100,000 people from four border provinces had been moved to nearly 300 temporary shelters.

A Cambodian provincial official said on Friday that at least one Cambodian civilian was killed and five others injured.Around 1,500 Cambodian families from Banteay Ampil district in the Oddar Meanchey province near the conflict zone have been evacuated to safety, Meth Meas Pheakdey, a spokesperson for the provincial administration, said on Facebook.

The two nations are locked in disagreement over the Emerald Triangle — an area where the borders of both countries and Laos meet, and home to several ancient temples.Thailand and Cambodia, which share an 800-kilometer (500-mile) frontier, have been arguing over where the border should be drawn for years.Dozens of kilometers in several areas are contested.Fighting broke out between 2008 and 2011, but a UN court ruling in 2013 settled the matter for over a decade.

The international community has urged both sides to exercise restraint and halt the fightingImage: STR/AFP

The international community has urged both sides to exercise restraint and halt the fightingImage: STR/AFPThe current crisis erupted in May after both countries' militaries briefly fired at each other in a relatively small, contested border area that each nation claims as its own.Both sides said they acted in self-defense. One Cambodian soldier was killed.While Bangkok and Phnom Penh said afterwards they agreed to de-escalate the situation, tensions have remained high as Cambodian and Thai authorities continued to implement or threaten measures short of armed force.

China's Foreign Ministry said it was deeply concerned about the ongoing clashes and would play a constructive role in promoting de-escalation.The United States and France, Cambodia's former colonial ruler, urged an immediate end to the conflict.The EU said it was deeply concerned about the clashes and called for dialogue to end the fighting.

Edited by: Sean Sinico

Japan's government said on Friday that profits from a $550 billion investment package agreed in this week's tariff deal with the U.S. would be split between Japan and the U.S. according to the degree of contributions by each side.

The comment from a Japanese government official suggests the investment scheme would involve substantial contributions not just from Japan but also from the U.S. government or companies, though the structure of the scheme remains largely unclear.

The White House said earlier this week the U.S. would retain 90% of the profits from the $550 billion U.S.-bound investment and loans that Japan would make in exchange for lower tariffs on auto and other exports to the U.S.

The official told a briefing that resulting returns will be split 10% for Japan and 90% for the U.S. "based on the respective levels of contribution and risk borne by each side."

Japan has said the U.S. investment package includes loans and guarantees from state-owned Japan Bank for International Cooperation (JBIC) and Nippon Export and Investment Insurance (NEXI), to enable Japanese firms to build resilient supply chains in key sectors such as pharmaceuticals and semiconductors.

A law revision in 2023 has expanded the scope of JBIC, making foreign companies key to Japan's supply chains eligible for loans from the bank.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up