Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

While Europe braces itself against Donald Trump’s renewed tariff barrage, the more profound and systemic threat comes from China’s aggressive economic tactics

The options expiry on Deribit may add to the price pressure for BTC. The leading coin traded at $115,549.15, pressured closer to the level of maximum pain at $112,000.

Deribit announced a total of $15.45B in options, down from June’s $17B. The monthly event is still considered significant, as the crypto market has not experienced a summer slump.

The BTC options expiring have a notional value of $12.66B, while ETH expects a $2.75B expiry event.

While ETH maximum pain price at $2,800 is less probable, BTC may see last-minute pressure. For the past few months, both BTC and ETH have expired above their options maximum pain price.The put/call ratio signals a more moderate stance, though still retaining a bullish trend. Deribit has seen a faster accumulation of open interest, already building up over $37B for the quarter to date. At the end of Q2, the open interest at expiry was just $35B.

BTC still trades in greed territory, with an index of 67. However, this does not preclude short-term price moves. Overall BTC volatility is near an all-time low, though the price still fluctuates between key levels. The BTC volatility index is down to 1.27%, with a brief spike during the July rally.

BTC may easily dip to the $114,000 range, where an accumulation of short positions may trigger an attack. Despite this, BTC retains its bullish factors, with a new accumulation of short positions all the way to $119,000.Despite the complex trading, the end of the month has historically performed as a good entry point. BTC still expects a breakout to a new price range, despite temporary setbacks.

ETH retains the $3,600 range, though the token saw the largest share of long liquidations in the past 24 hours. ETH is traded with more exuberance, with signs of being overheated. The market dominance of ETH expanded to 11.4% as more traders switched their attention, while BTC dominance sank to 59.6%.

BTC and ETH had a drawdown mostly driven by long liquidations, ahead of the monthly options expiry. | Source: CoingGlass.

BTC and ETH had a drawdown mostly driven by long liquidations, ahead of the monthly options expiry. | Source: CoingGlass.In the past 24 hours, ETH was a leader of liquidations, with $152.13M in predominantly long positions. BTC saw $152.04M in long positions liquidated.

BTC also faces added pressure from spot selling. Despite the general accumulation trend, in the short term some whales are sending their coins to exchanges.Galaxy Digital, one of the intermediaries for both retail and institutional traders, has sent 11,910 BTC to multiple exchanges.

The crypto service provider also kept sending a few hundred BTC to Bybit and Bitstamp.

The spot sales originating from the Galaxy Digital wallet follows a recent reawakening of a wallet from 2011. The wallet moved 3,962 BTC, after making a test transaction. The old whale wallet received the typical messages of proving coin ownership, which have made other whales move their coins to new addresses and split them to avoid easy tracking.

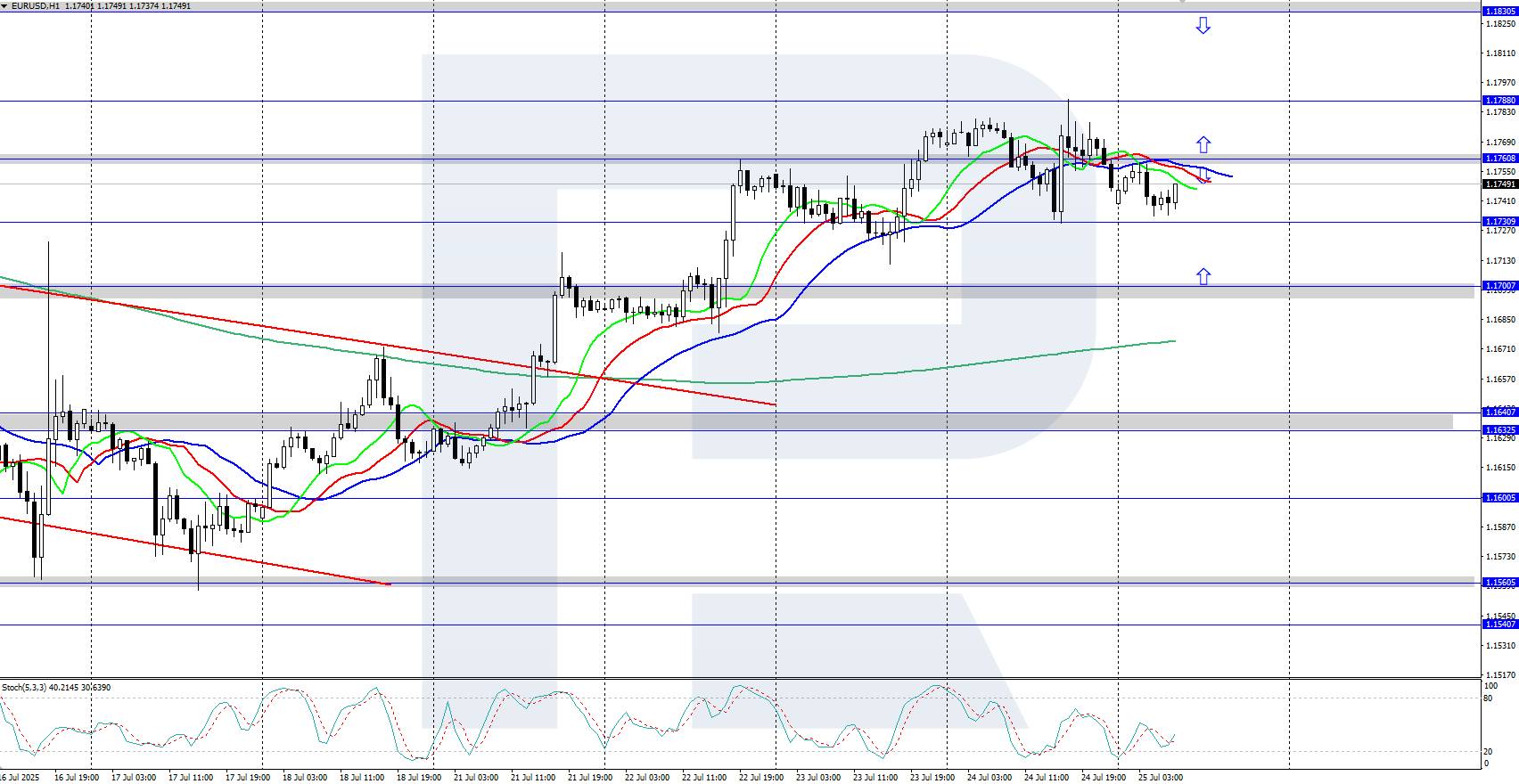

The EURUSD rate corrected towards the 1.1730 area following the ECB's decision to keep interest rates unchanged. The market awaits the outcome of trade agreement negotiations between the US and the EU. Find out more in our analysis for 25 July 2025.

At yesterday’s meeting, the European Central Bank left key interest rates unchanged after eight cuts in the current cycle. The regulator noted that disinflation has progressed in line with expectations since the previous meeting in June.

ECB President Christine Lagarde stated that a more detailed assessment of the need for further rate cuts this year will require more economic data and clarity on the conditions of a potential trade agreement with the US.

Meanwhile, reports suggest that the US may agree to reduce tariffs on EU goods to 15% (the lower limit for duties on other countries) as part of an ongoing trade agreement actively being negotiated by EU diplomats.

On the H4 chart, EURUSD is undergoing a downward correction, falling this morning to the 1.1730 area, with further decline towards the 1.1700 support level possible. The daily trend for the pair remains upward, so after the correction ends, the rally may continue.

The short-term EURUSD forecast suggests a further decline towards 1.1700 in the near term if bears keep the price below 1.1760. However, if bulls push the pair above 1.1760, growth may resume towards the 1.1830 resistance level.

The EURUSD pair corrected to the 1.1730 area following the ECB’s decision to leave rates unchanged. The market’s focus now turns to trade negotiations between the US and the EU.

UK retail sales partially bounced back in June as Britons basked in heat wave conditions, adding to signs that the economy recovered from back-to-back monthly contractions during the spring.

The volume of goods sold online and in shops climbed 0.9% after plunging 2.8% in May, the Office for National Statistics said on Friday. The increase was slightly below the 1.2% gain expected by economists.

Stronger sales and an uptick in business surveys suggest the UK economy stabilized after GDP fell in both April and May amid the double blow of Labour’s tax rises and President Donald Trump’s US tariffs.

Last month was the second-hottest June on record for the UK as temperatures soared above 30 degrees Celsius in parts of England, prompting consumers to splash out on food and summer clothing.

While the boost will be welcomed by Chancellor of the Exchequer Rachel Reeves, it will do little to prevent a sharp economic slowdown in the second quarter from the bumper growth at the start of 2025. Retail sales rose just 0.2% over the quarter, contributing 0.01 percentage point to GDP, the statistics office said.

There were more ominous signs from GfK’s consumer confidence survey for July published earlier Friday. It showed that UK households are more inclined to save than at any point since the run-up to the financial crisis.

The highest unemployment rate in over four years and rising inflation may prompt already cautious consumers to slam the brakes on spending in the coming months. GfK also pointed to growing speculation that Reeves will need to raise taxes further to shore up the finances.

A cautious consumer has held back the UK economy in recent years with saving rates still well above pre-pandemic levels. Households have tightened their belts after a string of shocks to their finances, from the pandemic to double-digit inflation.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up