Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Rubio: $200 Million From $500 Million Of Oil Sold Is Sitting In Account, $300 Million Went To Venezuelan Government

Industry Consultancy Cru Group Projects That The Global Real Average Price Of Copper Will Be $5.12 Per Pound In 2026. Key Drivers Include Increased Demand For Refined Copper In China And Globally. Global Copper Consumption Is Expected To Grow By Around 3% In 2026

Rubio: USA Has So Far Established A 'Very Respectful And Productive' Line Of Communication With Venezuela's Current Leaders

Rubio: We Think Very Quickly We'll Be Able To Open A USA Diplomatic Presence On The Ground In Venezuela

U.S. EIA Distillate Fuel Inventories Changed By 329,000 Barrels In The Week Ending January 23, Compared With An Expected Decrease Of 250,000 Barrels And A Previous Value Of 3.348 Million Barrels

The U.S. EIA Refinery Utilization Rate Changed By 2.4% In The Week Ending January 23, Compared With An Expected Decrease Of 0.65% And A Previous Decrease Of 2%

U.S. EIA Crude Oil Inventories For The Week Ending January 23 Changed By -2.295 Million Barrels, Compared To An Expected 1.95 Million Barrels And A Previous Reading Of 3.602 Million Barrels

U.S. Crude Oil Inventories In Cushing, Oklahoma, Fell By 278,000 Barrels In The Week Ending January 23, Compared With 1,478,000 Barrels In The Previous Week

U.S. EIA Gasoline Inventories Changed By 223,000 Barrels In The Week Ending January 23, Compared With An Expected 2.55 Million Barrels And A Previous Reading Of 5.977 Million Barrels

EIA - USA Total Product Demand Over Past 4 Weeks 20.27 Million Barrels/Day, Off 0.1% From Year Ago

Rubio: USA Made 'Multiple Attempts' To Get Maduro To Leave Venezuela Voluntarily, But 'He Is Not A Guy You Can Make A Deal With'

USA Secretary Of State Rubio: Short Term Oil Fund Is 'Short-Term' And Not Intended To Be Permanent Solution For Venezuela's Oil Revenues

[Bitcoin Dips Below $89,000, 24-Hour Gain Narrows To 1.4%] January 28Th, Bitcoin Fell Below $89,000, With A 24-Hour Gain Narrowing To 1.4%

USA Treasury Secretary Bessent: Trump Has Sought To Bring Down Temperature On ICE, Encouraging Lawmakers Not To Shut Down Government

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European stocks fell as the U.S. selloff spread, with AI-valuation fears, weak consumer signals, and uncertain Fed rate-cut prospects weighing on sentiment. Oil, metals, and gas declined, while PMIs showed slowing momentum.

Federal Reserve Bank of New York President John Williams said on Friday that the U.S. central bank can still cut interest rates "in the near term" without endangering its inflation goal.

Speaking at a Central Bank of Chile event, Williams acknowledged that progress on inflation has "temporarily stalled" and emphasized it was "imperative to restore inflation to our 2% longer-run goal on a sustained basis." He estimates current inflation is around 2.75%.

Will the Fed cut rates in December? See what Wall Street analysts think by upgrading to InvestingPro - get 55% off today

Despite the pause in inflation progress, Williams expressed confidence that price pressures would ease as tariff impacts work through the economy without creating persistent inflation. He also pointed to signs of softening in the labor market, noting September's unemployment rate rose to 4.4%, comparable to pre-pandemic levels "when the labor market was not overheated."

Williams described current monetary policy as "modestly restrictive" and said he sees "room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral." This approach would maintain balance between the Fed's dual goals of price stability and maximum employment.

His comments come amid ongoing debate among Fed officials about whether to cut rates at the upcoming December 9-10 meeting. Some policymakers have opposed further rate cuts until there is clear evidence inflation will drop to the 2% target.

As president of the New York Fed, Williams holds a permanent voting position on the rate-setting Federal Open Market Committee, giving his views significant weight in monetary policy decisions.

Sterling was little changed on Friday as investors awaited Britain's upcoming budget, with data showing the economy struggled before next week's major test for the currency and bond market.

The pound was last down less than 0.1% against the dollar at $1.3063. It was set to lose 0.8% for the week.

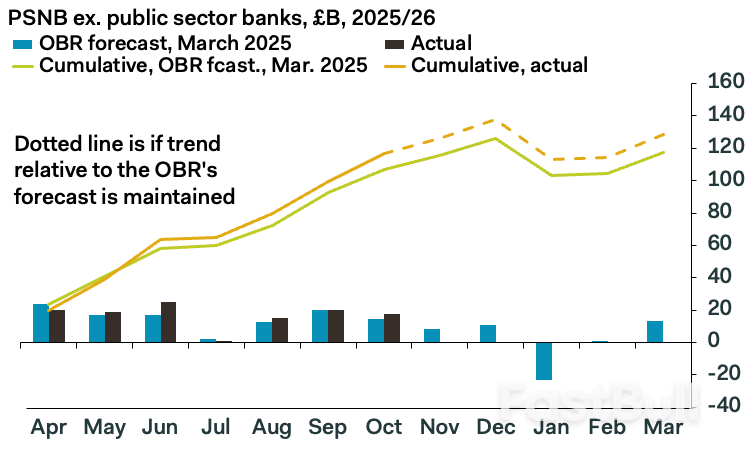

The last major economic releases before the budget next Wednesday painted a sombre picture, with borrowing hitting the highest on record outside of the COVID-19 pandemic in the first seven months of the year.

Business growth almost ground to a halt this month, retail sales tumbled in October, and a closely watched gauge of household sentiment fell.

"The data highlights the challenging position that the government is currently in ahead of the budget," Lee Hardman, senior currency economist at MUFG, said.

"The government borrowing figure is obviously worse than anticipated, but that won't feed into the government's budget proposals. It is too late for that."

British finance minister Rachel Reeves is expected to need to raise tens of billions of pounds to stay on track to meet her self-imposed fiscal targets.

Media reports last week that she would not raise income tax roiled British assets. Just days before she had appeared to prime the market that tax hikes were coming.

MUFG's Hardman said the timing of the budget will dampen the growth outlook heading into next year, putting pressure on the Bank of England to keep lowering interest rates.

"We think they'll cut rates in December and then deliver two more cuts by the summer," Hardman added.

The BoE kept interest rates unchanged in November in a tight 5-4 vote, but markets expect the central bank will resume its rate-cutting cycle when it convenes next month.

Money market traders are currently pricing in a more than 80% chance of a rate cut from the BoE in December.

Elsewhere, the pound was flat at 88.21 pence per euro, but declined against a strengthening yen after the Japanese currency found some support as officials stepped up their verbal intervention to stem the currency's decline.

Sterling was last down 0.5% at 204.71 yen, after rising to its highest since July last year on Thursday.

Britain is set to borrow billions more than expected this year, demonstrating the precarious state of public finances ahead of the bud.

Government borrowing in October was above expectations at £17.4 billion, contributing to a deficit overshoot for the first seven months of the fiscal year.

It's just one of the signs that Rachel Reeves has plenty of work to do to boost economic activity and fill a huge black hole in next week's budget.

In separate data this morning, retail sales plunged in October as jittery shoppers hibernated, and waited for Black Friday sales. Meanwhile, GfK found consumer confidence to be down across every measure - from views on the economy to personal finance - with middle-earners particularly anxious as Britons prepare for tax hikes.

The Chancellor faces a tricky task. She still needs to raise as much as £30 billion and, having U-turned on income tax, is likely to lean on a smorgasbord of smaller levers.

That, plus a triple balancing act of placating bond investors, respecting party pledges and appeasing the back bench.

What's your take? Ping me on X, LinkedIn or drop me an email at lmoon13@bloomberg.net. Oh, and do subscribe to Bloomberg.com for unlimited access to trusted business journalism on the UK, and beyond.

Energy bills will tick up slightly in the New Year, despite wholesale prices falling. The rise in the energy price cap is being driven by the need to fund government plans such as Sizewell C, Ofgem said.

ASOS recorded a larger-than-expected loss for the full year. The retailer, which brought Topshop back to the high street in that period, is in the middle of a turnaround and says the most difficult part is done. Shares slumped 9.7%.

In other company news, Babcock profit continued to grow in the first half as the defence firm benefits from a rise in military spending, particularly in nuclear. It's got a contract backlog of almost £10 billion, which it says reflects "significant" orders in the remainder of its financial year. Shares dropped 6.7%.

PPHE Hotel Group, the real estate firm behind Park Plaza Hotels in Europe, has started a strategic review to mull options including piling more capital into the business or selling up. Shares rose.

Meanwhile, Nashville-based IT firm Asurion is in advanced talks to buy Domestic & General, in a deal valuing it at £2.1 billion. The UK warranty and repair firm is currently backed by CVC Capital Partners.

Here's your daily snap analysis from Bloomberg UK's Markets Today blog:

The retail sales and borrowing data Louise ran through above don't a pretty picture paint ahead of the budget. That big risk event will arrive against a backdrop of tetchiness in the market.

We spent a large part of yesterday talking about how Nvidia had soothed nerves about frothy tech valuations and AI demand. But we also made clear that Nvidia isn't the place to look for solace for the specific worries that have gripped the stock market. Those are centred around the enormous AI-related spending by cloud giants and whether it will ultimately pay off.

A sizeable chunk of that money is going to Nvidia, so its revenue and profit is booming. That ultimately doesn't answer the question that's vexing investors.

And so, by the end of yesterday, the jitters were back with bells on. US stocks slid and global equities are now on track for their worst week since the tariff chaos that engulfed markets back in April. It's filtering into other risky areas of the market, particularly cryptocurrencies, where Bitcoin has been slammed. Despite its lack of tech stocks, UK equities haven't been spared.

This kind of twitchy mood among investors will make Rachel Reeves' task next week of keeping the bond market on side even more precarious than it already was.

The big thing on everyone's minds next week is the budget, at midday on Wednesday. It's expected to be a tax-raising event as Rachel Reeves attempts to shore up Britain's finances.

Aside from that, company updates are also due through the week. Those include caterer Compass Group, pub owners Marston's and Mitchells & Butlers, pork producer Cranswick, easyJet, Kingfisher and Pets At Home.

Hi, I'm David. I cover the money behind sport — and I was in Birmingham yesterday for the unveiling of Birmingham City FC's new stadium design. It's the brainchild of co-owner Tom Wagner who is on a mission to transform the club.

The co-founder of Knighthead Capital Management said the 62,000-seater would be "steeper, closer and louder" than any other. It would be a "mad house" on match days, and otherwise host music concerts, NFL games and more.

Still five years from completion, the stadium will be constructed with 12 chimney-form towers to reflect Birmingham's industrial history. UK-based Heatherwick Studio, the architects behind Google's new London headquarters, secured the design commission with Manica Architecture, from Kansas and behind the Inter Miami FC stadium.

It comes at an estimated price tag of £1.2 billion, according to Wagner, as part of a sports-quarter development set to cost up to £3 billion - financed with a mixture of debt and equity.

While the project is shiny - with former Birmingham City academy star Jude Bellingham featuring in the promotional video - there's more to do on the field. "We had a little blip with the club," he noted, reflecting on the team's relegation the season before last. But it was evident Wagner has no doubt fans will fill the stadium and his ambitions will pay off.

Private-sector activity in the euro area stayed strong in November, feeding hopes that economic growth can pick up in the last months of the year.

The Composite Purchasing Managers' Index compiled by S&P Global came in at 52.4, almost matching October's 52.5 and still comfortably above the 50 threshold separating growth from contraction. Analysts had predicted an unchanged reading.

Services recorded their best month in a year and a half, helping to offset unexpected weakness in manufacturing. Germany remained a driving force, despite slowing expansion that left its composite reading of 52.1 short of estimates. France, meanwhile – where persistent struggles over the budget are weighing – exceeded expectations, reaching just below 50.

"The euro zone is more or less maintaining its relatively robust expansion rate," Hamburg Commercial Bank economist Cyrus de la Rubia said Nov 21 in a statement. "Although the manufacturing sector is dampening growth performance, the high weight of the service sector in the overall economy means that the euro zone as a whole should grow faster in the final quarter than in the third."

Europe's economy has held up better than anticipated during the US trade storm and is expected to almost maintain 2025's pace of growth in 2026 as a wave of new investments in infrastructure and the military start to be felt. The headline number masks disparities among the euro area's 20 members, however, with about half of the bloc by output failing to grow in the third quarter.

For the European Central Bank, the situation doesn't currently warrant further reductions in interest rates, which have been halved from their 4 per cent peak. Inflation has been brought back to near the 2 per cent target and most officials see it remaining around there for the foreseeable future.

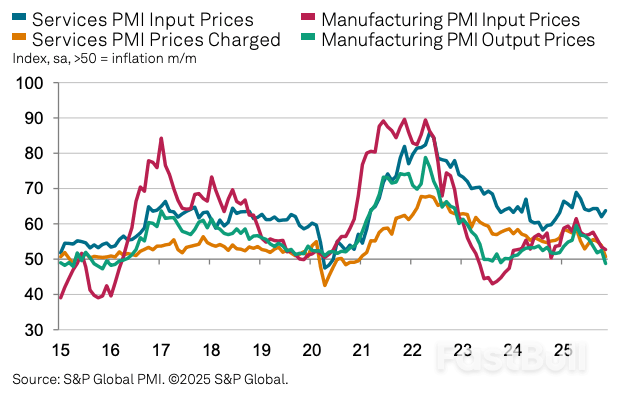

Mr De la Rubia said November's surveys show faster cost inflation in the closely watched services industry is being tempered by a slowdown in the pace of sales-price increases.

"On balance, the headaches for monetary policymakers, who are paying particular attention to the rate of inflation among service providers, should be limited," he said. "We expect interest rates to remain unchanged in December."

PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP. BLOOMBERG

In a stunning development that's sending shockwaves through financial markets, UBS has dramatically revised its EUR/USD forecast downward to 1.20 for 2026. This bold prediction comes as political instability across Europe creates unprecedented uncertainty for currency traders and investors worldwide.

UBS analysts point to multiple political factors reshaping their EUR/USD forecast outlook. The growing influence of far-right parties in key European economies, combined with fiscal policy uncertainties and potential trade disruptions, has created a perfect storm for the euro. This comprehensive UBS analysis suggests the traditional euro-dollar relationship faces fundamental challenges.

The European political landscape is undergoing significant transformation, directly affecting currency trends. Key concerns identified in the UBS analysis include:

| Institution | EUR/USD 2026 Forecast | Key Rationale |

|---|---|---|

| UBS | 1.20 | Political risks and structural challenges |

| Market Consensus | 1.25-1.30 | Gradual euro recovery post-crisis |

| Previous UBS Forecast | 1.28 | More optimistic political outlook |

This revised EUR/USD forecast signals deeper concerns about the European economy's trajectory. UBS analysts highlight several critical areas where political decisions could significantly impact economic performance:

For investors navigating these turbulent currency trends, the UBS analysis provides crucial guidance. Consider diversifying exposure away from euro-denominated assets and monitoring political developments closely. The 1.20 EUR/USD forecast suggests significant downside risk that requires careful portfolio management.

What specific political events influenced UBS's forecast?UBS cites upcoming elections in France and Germany, along with ongoing budget negotiations, as primary factors in their revised EUR/USD forecast.

How does this compare to other major banks' predictions?UBS's 1.20 target for 2026 is among the most bearish in the market, reflecting their unique assessment of political risks to the European economy.

What timeframe should investors focus on?The UBS analysis suggests monitoring political developments through 2024-2025, as these will likely determine whether their 2026 EUR/USD forecast proves accurate.

The UBS EUR/USD forecast revision to 1.20 for 2026 represents a stark warning about the intersection of politics and currency markets. As political risks continue to reshape the European landscape, investors must remain vigilant and adapt their strategies accordingly. This analysis underscores the critical importance of monitoring political developments alongside traditional economic indicators when assessing currency trends.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up