Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum faces $4K resistance; a breakthrough could lead to a surge toward $6K. A rejection at $4K may trigger a pullback to $3,500-$3,200. ETH trading volume remains strong, but market caution prevails as it tests key resistance.

Ethereum (ETH) has been trading at a significant price point, with the digital asset now nearing a key resistance level of $4000. This mark has drawn attention due to its potential to shape the next movement in the market.

According to Crypto Patel, Ethereum's recent price rally has sparked optimism among investors, especially those who purchased the asset when its value was below $1500. As ETH continues its upward trajectory, traders are focused on the $4000 level, which has been acting as a multi-month resistance.

Ethereum breakout | Source: X

Ethereum breakout | Source: XEthereum breaks through this level, and there are expectations that it could head towards its previous all-time high (ATH) of $6000 or more. A sustained breakout above this resistance could signal continued strength in the asset's price. If rejected at this level, some experts anticipate a decline, potentially pulling ETH back below the $3500-$3200 range.

Crypto analyst ZAYK Charts notes that if Ethereum manages to break above $4,000, it could open the door for a potential surge toward the $6,000 mark, a significant increase from its current price.

A successful breakout could indicate continued strength and set the stage for further price growth in the coming months. However, it could also establish the $4000 level as a new support zone, further reinforcing the bullish sentiment surrounding Ethereum.

Ethereum Bullish | Source: X

Ethereum Bullish | Source: XBoth short-term traders and long-term investors closely watch this price action. Many are considering the potential for Ethereum to move higher if the resistance at $4000 is cleared.

At the time of writing, ETH is priced at approximately $3,890, reflecting a 3.10% increase in the last 24 hours. Ethereum remains active in terms of trading volume, with over $34 billion in transactions reported within the past 24 hours.

Despite this significant trading activity, market observers remain cautious as Ethereum faces its next critical decision point. Should the asset manage to surpass this level, a strong bullish trend may continue.

Conversely, a rejection could lead to a consolidation phase or a downward adjustment in price. Traders are advised to monitor this crucial level closely.

The S&P 500 Index’s relentless advance to record highs faces a crucial test this week, with four technology behemoths worth a combined $11.3 trillion reporting earnings over a two-day stretch.

This earnings season is off to a solid start, but now all eyes are on quarterly results from Microsoft Corp. and Meta Platforms Inc. on Wednesday, and Apple Inc. and Amazon.com Inc. on Thursday. The announcements will give investors a key glimpse into the health of businesses ranging from electronic devices and software to cloud-computing and e-commerce.

A strong showing is critical to sustaining the S&P 500’s rally. The four firms — members of the Magnificent Seven — account for a fifth of the market-capitalization-weighted benchmark. What’s more, Meta and Microsoft are among the top three point gainers in the S&P this year, after Nvidia Corp. With valuations climbing, the focus will be not only on whether they beat estimates, but also on their outlook for the coming quarters.

“The bar is set pretty high,” said Michael Arone, chief investment strategist at State Street Investment Management. “The Magnificent Seven in particular, they really need to deliver now to keep this momentum going.”

So far, Corporate America appears to be taking President Donald Trump’s tariffs in stride. With about a third of S&P 500 members having reported, roughly 82% have beaten profit forecasts, on track for the best quarter in about four years, data compiled by Bloomberg Intelligence show. The performance has helped lift the benchmark by about 2% since the cycle kicked off around two weeks ago.

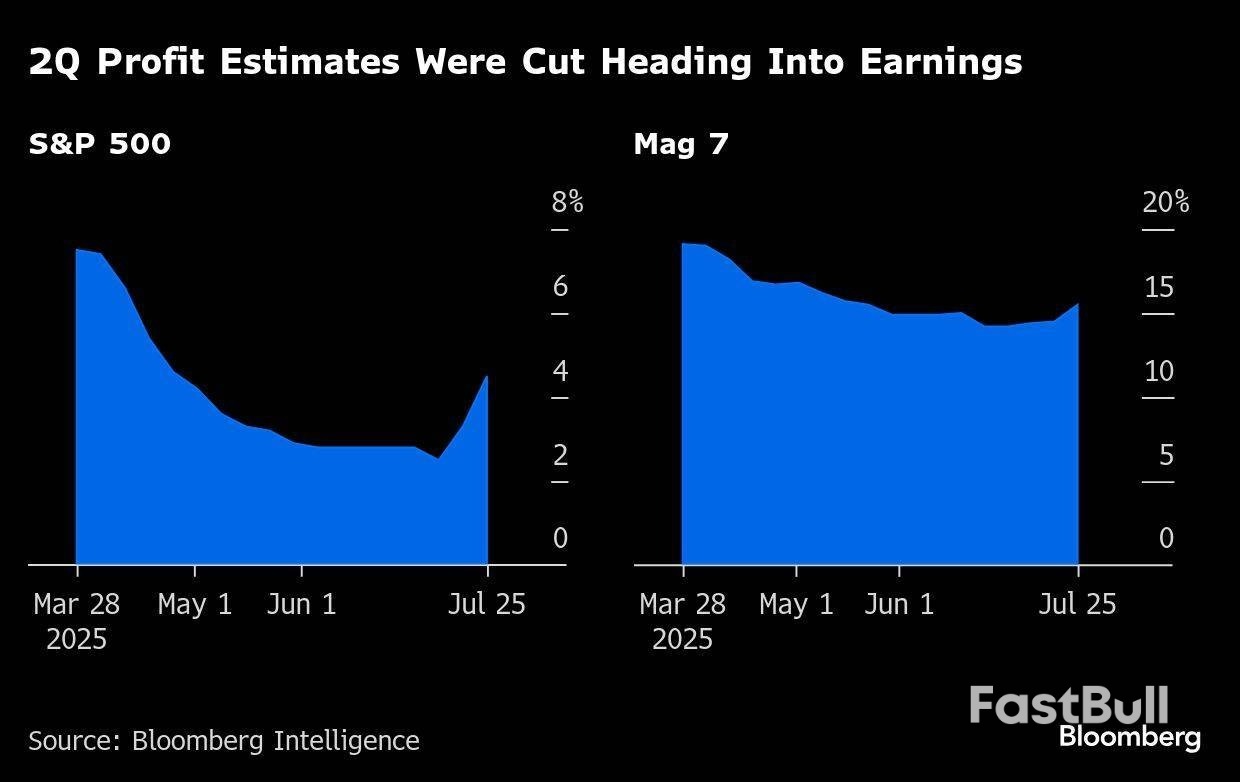

To be fair, analysts had slashed estimates over the past few months amid concerns about the impact of tariffs on consumer spending and profit margins. While Big-Tech projections have come down too, the surge in stock prices has kept expectations elevated.

The Magnificent Seven, which also includes Nvidia, Alphabet Inc. and Tesla Inc., is projected to deliver combined year-over-year earnings growth of 16% in the second quarter, according to data compiled by BI. That’s down from expectations of 19% at the end of March, before Trump announced his sweeping tariffs. Nvidia is the final member of the group to report, in late August.

The S&P 500, meanwhile, is expected to show annual profit growth of 4.5%, down from the 7.5% projected in March.

The striking of a better-than-feared trade deal with the U.S. last week has removed a significant economic uncertainty for Japan, further bolstering the improving fundamentals of the country, and helping lift equities to near-record highs.

Driving this was some relief among investors that while the agreed 15% tariffs on Japanese imports is higher than the 10% rate that was in force while the countries negotiated, it is lower than the 25% levy President Donald Trump had threatened. Importantly, Japan’s automotive sector, a pillar of the country’s economy and biggest contributor to its $63 billion trade surplus with the U.S., will incur the 15% rate and face no quotas on the volume of imports.The greater clarity that comes with the deal is welcome. However, in recent days, fresh political uncertainties have emerged in Japan following the July 20 elections, when the ruling coalition led by Prime Minister Ishiba lost control of the upper house of parliament.

This was the third major election defeat after losing a majority of seats in the October 2024 lower house election and most recently in the Tokyo prefectural (metropolitan assembly) vote, which have led to calls within Ishiba’s own party for him to resign. Ishiba has said he has no plans to step down. However, mounting speculation over the Prime Minister’s potential successor and the prospect of them forming a coalition with any one of the resurgent opposition parties, which have been calling for more fiscal stimulus and lower taxes, has led to a fresh spike in long-dated Japanese government bond yields.

As we highlighted in our analysis last month, Japan has led the march higher this year in long-dated government bond yields among advanced economies amid a renewed and sharper focus by investors on fiscal stability.

In our view, such political machinations and volatility in the government bond market are to be closely watched, but they don’t alter our long-held constructive view on the country. We were overweight Japan equities before the U.S. trade deal was announced on July 22.

Indeed, we see the election results as unsurprising given a number of factors—including the current administration’s mishandling of inflation and political scandals—and view any change in leadership as immaterial to Japan’s sustainable economic growth and development over the medium term. Seen another way, we believe any potential change in leadership (Ishiba was still in power at the time of writing although the situation is fluid) could even help to bring in new views and ideas on sustaining the country’s growth trajectory.There are fundamental reasons why we remain constructive on the country, as we outlined earlier this year in our white paper on Japanese equities and more recently in our Q3 Equity Market Outlook.

First, Japan’s economy continues to gain momentum. Inflation is modestly stabilizing above the Bank of Japan’s targeted 2% and is high enough in our view to invigorate revenue and profit growth, while low unemployment and recent wage increases due to structural labor shortages have helped to boost spending among Gen-Z and Millennials. Meanwhile the stronger Japanese currency versus year-ago levels has helped to curb imported cost inflation.

Second, thanks to the corporate governance and capital management reforms of the past several years, Japanese companies are becoming increasingly conscious of corporate value from a shareholder’s perspective. This has resulted in companies reducing their cash hoard and streamlining their cross-shareholdings, as well as making better use of their capital through growth investments, which we view as accretive for EPS growth over the medium to long term.

Third, despite potentially stronger growth, record corporate buybacks and ongoing shareholder-friendly corporate reforms, Japanese equities remain under-owned and relatively attractive compared to global peers. For instance, the aggregate forward price-to-earnings ratio represented by the MSCI Japan Index currently stands at 15.2 times compared to 19.0 times and 22.4 times for the MSCI ACWI and S&P 500 indexes, respectively. *

As we continue to closely watch the political situation and any fresh developments in the government bond market, we maintain our constructive outlook on Japan, choosing to look through these short-term moments of flux in a country that is in a new period of economic transition.Clearly near-term risks remain, including volatile currency swings from monetary policy adjustments, which disrupted equity markets last August, but we believe high-quality Japanese companies may be an attractive long-term investment opportunity.

The United States and the European Union agreed on aframework trade deal, ending months of uncertainty for industries and consumers on both sides of the Atlantic.

Here are the main elements of the deal:

* Almost all EU goods entering the U.S. will be subject to a 15% baseline tariff, including cars, which currently face 27.5%, as well as semiconductors and pharmaceuticals. The 15% tariff is the maximum tariff and is not added to any existing rates.

* The U.S. is to announce the result of its 232 trade investigations in a few weeks and decide on tariff rates for the sectors under investigation. But the EU-U.S. deal already secures a 15% tariff for European chips and pharmaceuticals, so the results of the investigations will not change that, U.S. officials said. It is not yet clear, however, if the same 15% rate has been set for timber and copper, which are also under U.S. 232 investigation.

* The U.S. and EU will have zero-for-zero tariffs on all aircraft and their components, certain chemicals, certain generic drugs, semiconductor equipment, some agricultural products, natural resources and critical raw materials. More products would be added.

* The situation for wine and spirits - a point of friction on both sides of the Atlantic - is still to be established.

* Tariffs on European steel and aluminium will stay at 50%, but European Commission President Ursula von der Leyen said these would later be cut and replaced by a quota system.

* The EU pledged to make $750 billion in strategic purchases, covering oil, gas, nuclear, fuel and chips during U.S. President Donald Trump's term in office.

* The EU pledged to buy U.S. military equipment.

* European companies are to invest $600 billion in the U.S. over the course of Trump's second term. Unlike Japan’s package - which Tokyo says will consist of equity, loans and guarantees from state-run agencies of up to $550 billion to be invested at Trump's discretion - EU officials said the Europe's $600 billion investment pledge is based on private sector projects already in the pipeline.

The euro is busy on Monday morning. EUR/USD started the week in positive territory and rose as much as 0.30%, but has reversed directions in the European session and is trading at 1.1677, down 0.54% on the day.

US President Trump can add another feather to his MAGA cap, with news that the European Union and the United States reached a trade agreement over the weekend. President Trump had threatened to hit the EU with 30% tariffs if a deal wasn’t reached by Aug. 1 and the specter of a nasty trade war between the largest two economies in the world has been averted.

A deal is of course good news but it’s important to keep in mind that the sides have agreed to a framework agreement, which is thin on details. Some contentious issues remain, such as the US tariff of 50% on steel and aluminum.

The deal mirrors the US-Japan agreement which was announced last week. The US will eliminate some tariffs, such as on aircraft parts and generic drugs, but most European products will face a tariff of 15%, which will make European imports more expensive for US consumers. The EU has also agreed to increase investment in the US by $600 billion and purchase $750 billion in US energy products.

The German auto industry is one of the deal’s big winners, as the 15% tariff will be easier to swallow than the current rate of 27.5%. The US-Japan deal puts a 15% tariff on Japanese motor vehicles, which would have put European automakers at a major disadvantage without a EU-US deal.

Trump is moving ahead and reaching deals with major trade partners, which is removing uncertainty and raising risk appetite. Investors are hoping that other key nations, such as Canada and South Korea, will follow soon with trade agreements with the US.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up