Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum jumped nearly 29% to $2,400 following its major Pectra upgrade, which enhanced scalability and staking. The rise also followed easing trade tensions, boosting Ethereum-based tokens across the crypto market.

Key Takeaways:

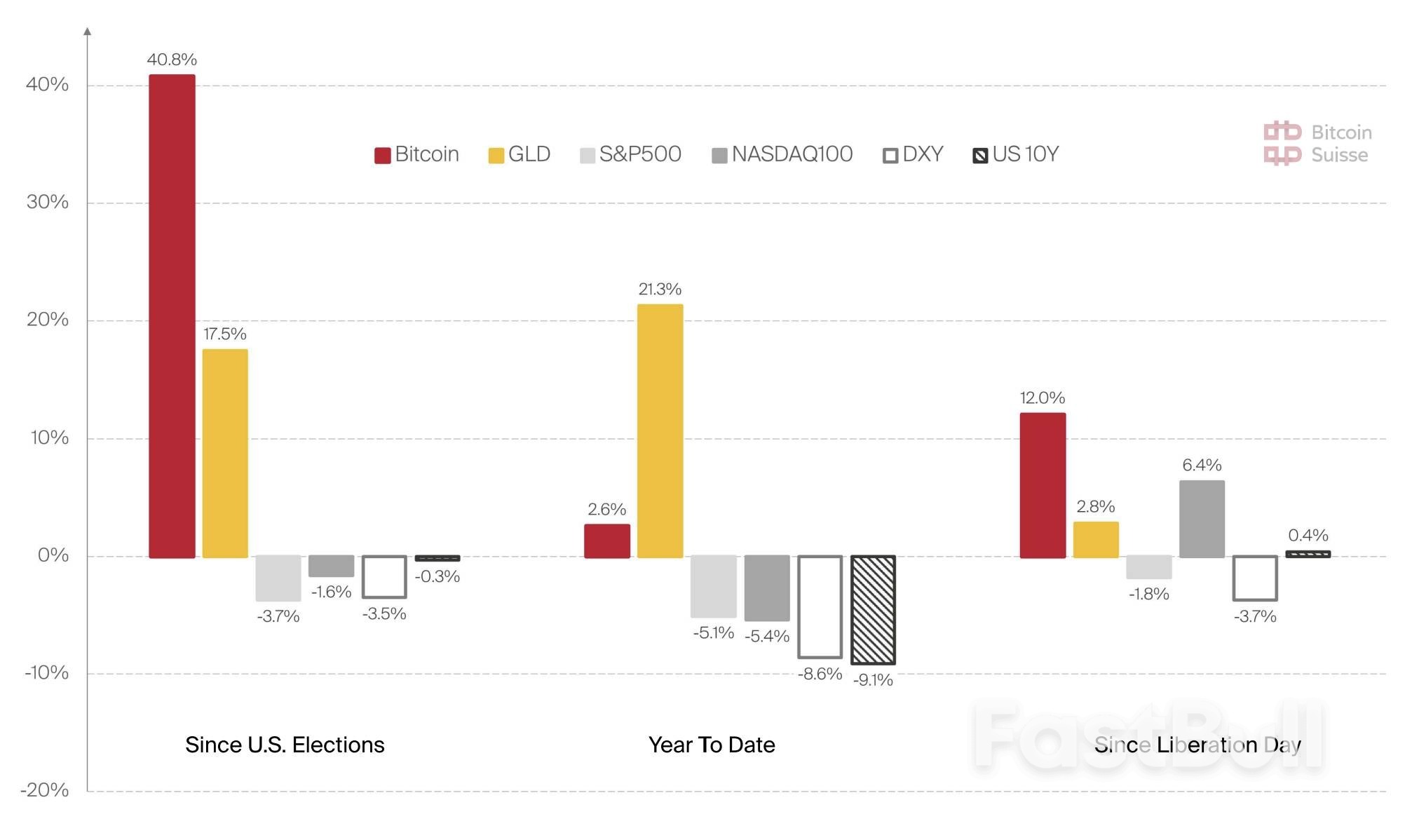

● Bitcoin is driven by its ability to perform well in risk-on and risk-off environments, according to Bitcoin Suisse.

● Bitcoin’s Sharpe ratio of 1.72, second only to gold, underscores its maturity as an asset, offering superior risk-adjusted returns.

● A buyer-dominant market signals strong institutional and retail interest that could drive a supply squeeze and break new highs in May.

Bitcoin (BTC) price breached the $100,000 mark for the first time since January, fueling speculation of a new all-time high above $110,000 in May. According to Bitcoin Suisse, a crypto custody service provider, BTC’s bullish momentum stems from its ability to thrive in risk-on and risk-off environments since the US presidential elections.

Data from its “Industry Rollup” report highlights Bitcoin’s high Sharpe ratio of 1.72, a key financial metric that measures risk-adjusted returns by dividing an asset’s average return (minus the risk-free rate). A higher Sharpe ratio reflects superior risk-adjusted returns, and in 2025, Bitcoin’s robust score, surpassed only by gold, highlights its growing maturity as an asset.

Source: Bitcoin Suisse

Source: Bitcoin SuisseOver the past two quarters, BTC excelled as a dual-purpose investment. It acts as a macro hedge in risk-off climates, benefiting from geopolitical tensions and de-dollarization concerns. In risk-on scenarios, it behaved as a high-conviction growth asset, with over 86% of its supply in profit. As illustrated in the chart, Bitcoin maintained a positive net return through various key phases since November 2024. Bitcoin Suisse head of research Dominic Weibei said,

“In this environment, Bitcoin has emerged as the Swiss army knife asset. Whether equities rally or bonds crumble, BTC trades on its supply-demand fundamentals, delivering a win-win profile that traditional assets simply can't offer.”

Cointelegraph reported that Bitcoin is gearing up for the next leg of an “acceleration phase,” according to Fidelity Digital Assets’ Q2 2025 Signals Report. Fidelity analyst Zack Wainwright explained that Bitcoin’s historical tendency to enter explosive price surges is characterized by “high volatility and high profit.”

On May 7, Bitcoin spot taker cumulative volume delta (CVD) over 90 days turned buyer dominant for the first time since March 2024. The 90-day spot taker CVD, which measures the net difference between market buy and sell volumes, reflects buyer or seller activity over a prolonged period. This shift to “taker buy dominant” aggressive buying pressure, driven by institutional interest and spot Bitcoin ETF inflows, i.e., over $4.5 billion spot inflows since April 1.

This structural change in demand and Bitcoin’s robust Sharpe ratio could allow BTC to capitalize on current market conditions. As corporations and institutions rush into Bitcoin, a supply squeeze may propel prices past $110,000 in May.

Waller noted the significant contributions of John Taylor, a key figure in the realm of monetary policy rules, and highlighted a broader discussion from the early 1980s about the advantages and disadvantages of rules versus discretion in monetary policy. Waller also acknowledged the influential work of Finn Kydland and Ed Prescott, who in 1977 argued that policy promises made today may not be kept in the future if there are benefits to breaking those promises.

The Fed Governor explained how Kydland and Prescott’s model suggested that a central bank might break its promise to keep inflation low, as doing so could stimulate the economy and decrease unemployment. However, this would lead to higher expectations for future inflation, forcing the central bank to validate these expectations with higher inflation to avoid a recession. This would result in a high-inflation equilibrium with no gains from increased output or lower unemployment.

Waller further discussed the importance of a central bank’s commitment to following a rule to set policy, which would prevent it from breaking its promises. This approach, he noted, would keep inflation low while maintaining the same outcomes for output and employment, thereby demonstrating that rules could outperform discretion.

Robert Barro and David Gordon’s 1983 study on reputation building by the central bank was also mentioned by Waller. The study showed that the central bank could establish a reputation for fulfilling promises, even in a world where commitment isn’t feasible.

Waller then introduced his own research journey, which began in 1983 after reading the Barro and Gordon paper. He explored the role of individual credibility in central bank policy and the potential impact of changes in leadership on the bank’s credibility. Waller’s research led him to study central bank design and the importance of central bank independence.

In his speech, Waller also referenced Ken Rogoff’s paper on "conservative" central bankers, who are more averse to inflation than the rest of society. Waller explained that these conservative central bankers could choose a lower inflation rate, but this would result in greater instability of output and employment. To ensure the credibility of these promises to control inflation, the central bank needed to be independent and protected from threats to its independence.

Waller concluded his speech by emphasizing the importance of having an independent policy board set monetary policy. He argued that this structure, which is currently in place at the Federal Reserve, improves social well-being and enhances economic stability. Waller also expressed his hope that this structure will continue to be in place for years to come.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up