Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

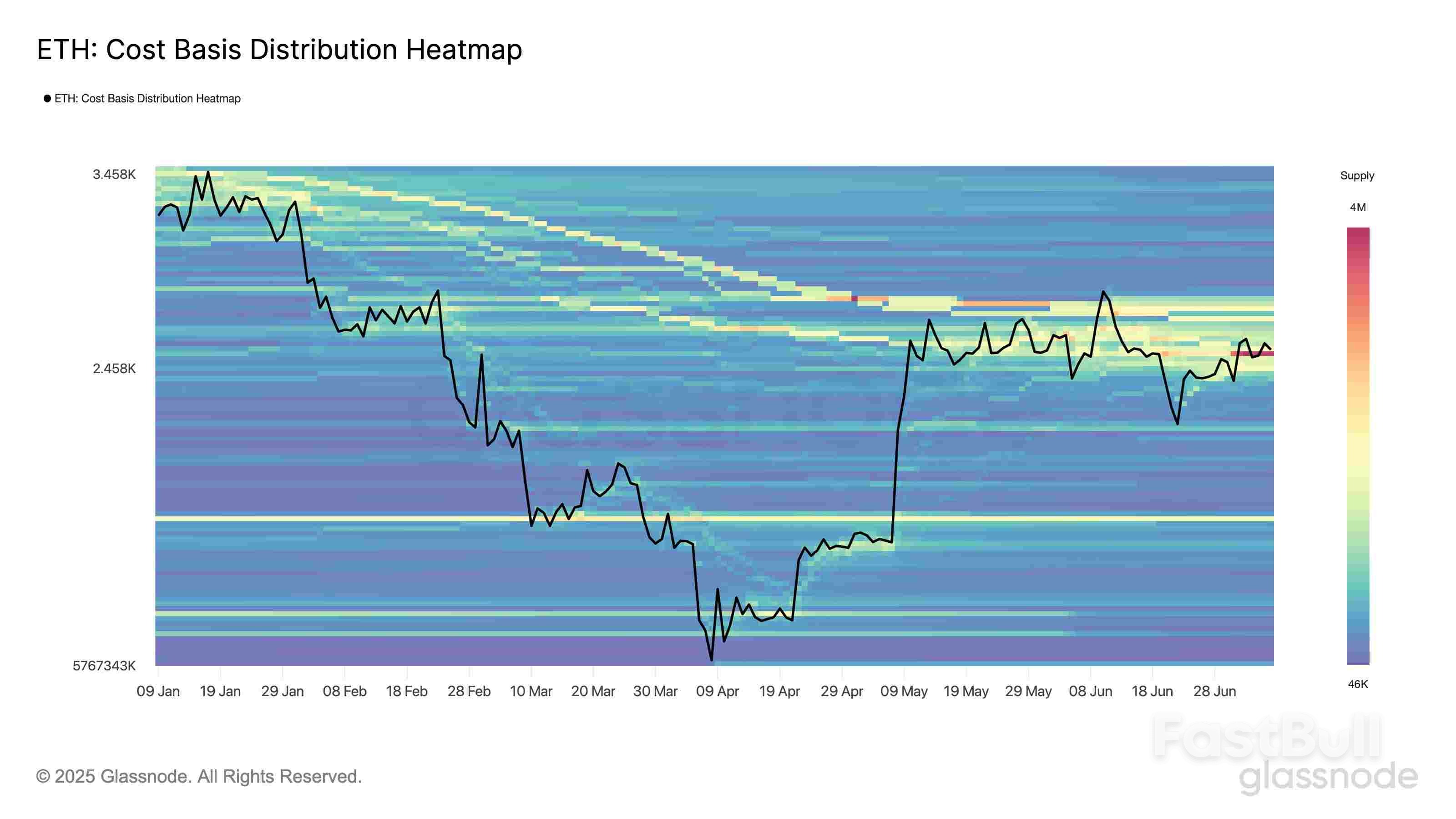

Ethereum is eyeing a breakout toward $3,400 as it consolidates within a bull pennant, echoing classic continuation patterns from past rallies.

Fears earlier this year that President Donald Trump's tariffs would result in a sharp inflation spike have completely receded, according to a New York Federal Reserve survey released Tuesday.

The central bank's monthly Survey of Consumer Expectations shows that respondents in June saw inflation at 3% 12 months from now. That's the same level it was in January — before Trump took office and began saber-rattling over trade.

The level marked a 0.2 percentage point decline from May and a retreat from the 3.6% peak hit in March and April.

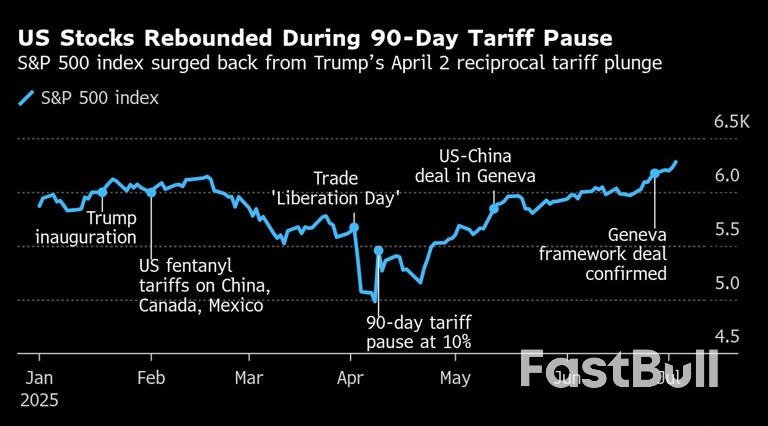

Since April, Trump has gone from slapping across-the-board 10% tariffs plus a menu of so-called reciprocal duties against U.S. trading partner to a more conciliatory approach involving ongoing negotiations.

Thus far, tariffs have yet to show up in most inflation readings. The consumer price index rose just 0.1% in May, according to the Bureau of Labor Statistics, though the annual inflation rate of 2.4% remains above the Fed's 2% goal.

Inflation expectations at the three- and five-year horizons were unchanged at 3% and 2.6% respectively, according to the survey.

While the headline inflation outlook eased, respondents still expect higher prices in several key individual categories. The survey pointed to expectations for a 4.2% increase in gas prices, 9.3% for medical care — the highest since June 2023 — and 9.1% for both college education and rent. The outlook for food price increases was unchanged at 5.5%.

Employment metrics also showed some improvement, with a 1.1 percentage decrease in the expectation for a higher unemployment rate a year from now. Also, the average expectation for losing one's job fell to 14%, a 0.8 percentage point drop and the lowest reading since December.

One of the Bank of Japan’s newest board members alluded to a possible upward revision to the central bank’s inflation view this month, an outcome that would keep open the possibility of another rate increase this year.

“Inflation for rice and food-related items has been stronger than expected,” Junko Koeda said Monday in her first media interview since joining the board in March. “I’m closely watching potential secondary effects on underlying inflation from rice, which is a staple food.”

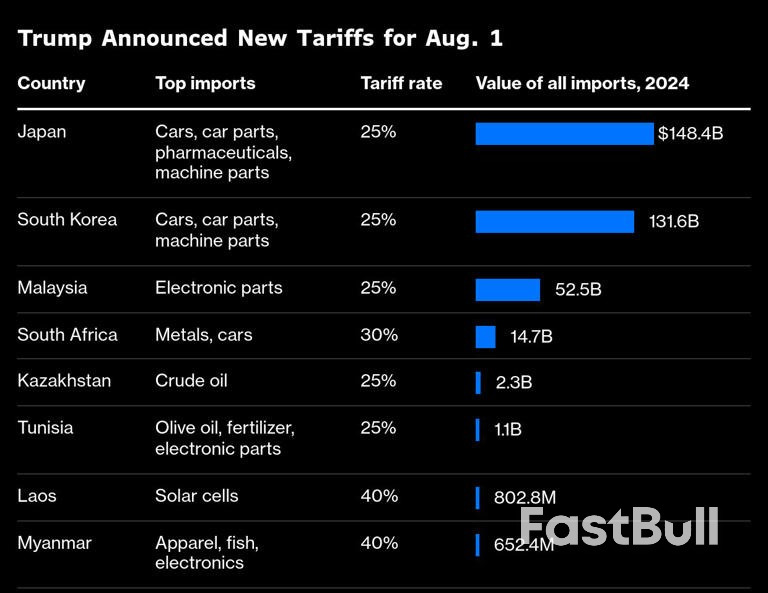

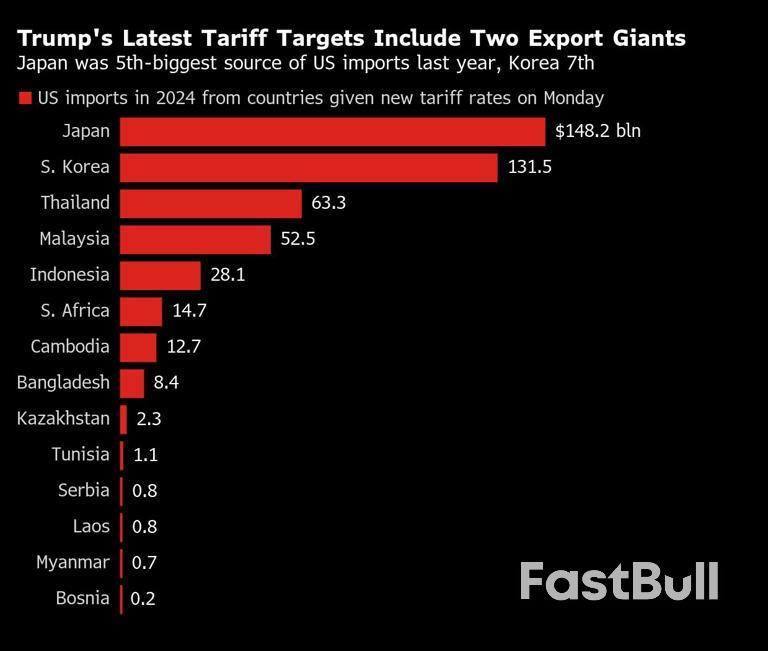

Koeda spoke before President Donald Trump announced a new tariff level of 25% on Japan. The board member stressed there are high economic uncertainties stemming from the US levies as she underscored the need to assess incoming data before considering any policy moves.

“Given ongoing high uncertainties, it’s inappropriate to talk about a specific timing for the next rate hike,” Koeda said. “We need to decide by closely looking at the economy, inflation and financial markets without missing a sign of change.”

Governor Kazuo Ueda’s board delivers its next policy decision on July 31 and will update its quarterly economic outlook. With a stand-pat decision widely expected, the main focus is on whether the BOJ will raise its inflation forecasts, a key factor in mulling the likely timing of rate hikes once there’s more clarity over US tariffs.

Trump has now set Aug. 1 as the new day when higher “reciprocal tariffs” kick in, thereby giving countries another three weeks or so to reach trade deals.

Japan’s key inflation gauge showed an acceleration to 3.7% from a year earlier in May, the highest level among Group of Seven nations. Price growth has remained at or above the BOJ’s 2% target for more than three years with the cost of rice among the drivers recently. The nation’s staple food surged 102% in May, the fastest pace in half a century.

The central bank currently expects the cost of living to rise 2.2% in the year ending March 2026, lower than 2.4%, the median estimate of private economists.

“There are both upside and downside risks for inflation,” Koeda said, echoing Ueda’s remarks last month. The comments suggest a potential change in the BOJ’s risk balance assessment, after the central bank’s April outlook report mentioned only downside risks for prices in that section.

Koeda assumed her five-year term on March 26 in a career shift from her position as an economics professor at Tokyo’s Waseda University. She became known among BOJ watchers after the BOJ’s think tank published a paper of hers in 2018, highlighting positive aspects of scrapping the negative interest rate policy. The paper was perceived as a hint at coming changes and contributed to her reputation for leaning toward hawkishness.

Koeda is also known for her research on the BOJ’s balance sheet and Japan’s debt market. While the central bank has trimmed its bond buying over the last year, it decided last month to slow down its withdrawal from the market after super-long bond yields hit a record high in May in a sign of instability.

Despite the central bank’s move, the market continues to be hit by volatility, with 30-year bond yields rising Tuesday on concerns over fiscal policy after an upper house election on July 20.

“Long-term interest rates should be determined by financial markets in principle,” Koeda said. The BOJ should step into the market only “in exceptional cases when yields surge in an abnormal manner.”

At 49, Koeda is the youngest of the nine-member board and her presence marks the first time the board has had two female members, a sign of progress in raising the representation of women at the bank. She said the BOJ is well positioned to achieve its goal of having women fill 20% of management positions by June next year.

“Productivity overall can be boosted by making the work environment friendlier to the needs of each employee,” Koeda said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up