Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum's price spike follows a $112 million short squeeze. Significant impact on market sentiment, futures liquidations. Potential reaching of the $2,800 resistance zone.

Ethereum's latest price surge, driven by a $112 million short squeeze primarily on Binance, has traders eyeing a potential $2,800 breakout, generating increased market interest and activity as of June 2025.

Ethereum's price spike is pivotal, affecting market dynamics and trader sentiment, and could signify a broader market rally.

Market Dynamics

The recent Ethereum price surge was triggered by a significant $112 million short squeeze, predominantly on Binance. This event caused a ripple effect in derivatives markets, with increased volatility and trading volume as traders reacted.

Key Figures

Key figures include Ethereum co-founder Vitalik Buterin and Binance's Changpeng Zhao. The squeeze reflects no direct capital inflow but rather forced liquidations, notably influencing Ethereum's potential price targets. As Vitalik Buterin stated, "The upcoming 'Pectra' upgrade is expected to double Layer-2 blob space and raise validator staking limits."

Impact on the Market

Effects include a surge in ETH trading volume and increased market volatility, impacting Bitcoin and other DeFi assets. Traders remain optimistic about Ethereum's climb toward the $2,800 mark.

Historical Trends

Historical trends indicate that similar squeezes often result in short-term rallies followed by retracements. No recent regulatory remarks have surfaced, but the Ethereum community's focus remains on upcoming network upgrades like "Pectra."

Potential Outcomes

Potential outcomes include a shift in market expectations if momentum continues, influenced by technological advancements and further liquidations. The market's reaction will be closely watched, providing insights into Ethereum's future trajectory.

Two weeks from President Donald Trump’s self-imposed deadline to reach deals with the US’ major trading partners, some of the most-watched talks aimed at clinching agreements to avoid higher tariffs are struggling to get over the finish line.

There’s a lot at stake: As of July 9, exporting nations without a bilateral accord in place will face Trump’s so-called “Liberation Day” tariffs that are much higher than the current baseline 10% level applied to most countries.

Only the UK has secured something on paper, though that pact kept the 10% so-called reciprocal rate in place and left unresolved one of Britain’s pain points — 25% steel duties. On a separate track is China, which has a fragile truce with the US that extends into mid-August to give time for negotiations to play out.

Countries engaged in what Washington views as productive discussions may get their deadline extended. Court challenges to Trump’s legal authority for tariffs have provided an added element of uncertainty for companies that have spent the past 10 weeks either front-loading orders or hoping his threats of higher import taxes are just a negotiating tactic.

Here’s a rundown of where various talks stand:

European Union

The best-case scenario remains an EU-US agreement on principles that would allow the negotiations to continue beyond the early July deadline, Bloomberg has reported. Trump complained last week about the EU talks, threatening to give up and impose unilateral tariffs. The EU, which has been seeking a mutually beneficial deal, will assess any end-result and at that stage decide what level of asymmetry — if any — it’s willing to accept or whether it will push ahead with countermeasures to correct any imbalances.

India

Trade officials from India and the US are still keen to clinch an interim deal before the deadline, but the two sides appear to be digging in their heels on some key issues, particularly on agricultural goods. The US is seeking access to India’s markets for its genetically modified crops, a request India has denied, while New Delhi wants an exemption to the reciprocal tariffs as well as sectoral duties. Indian Prime Minister Narendra Modi missed an opportunity to advance the trade deal with Trump when the US leader left the Group of Seven meeting in Canada earlier than planned last week.

Vietnam

Communist Party chief To Lam is set to lead a delegation of officials and business executives to the US, aiming to meet with Trump and clinch additional deals with US firms to help finalise an agreement. The nation has offered to boost purchases of American products from Boeing airplanes to agricultural goods to get a deal. Negotiators are close to a framework agreement under which Vietnam is pushing for tariffs in the range of 20% to 25%, Bloomberg News previously reported.

Japan

US auto tariffs appear to be the key barrier to a deal between Washington and Prime Minister Shigeru Ishiba’s government, which is bracing for talks to drag on. Trump and Ishiba failed to reach an agreement at the Group of Seven leaders’ summit in Canada, despite holding three prior calls to discuss the tariffs. Opposition leader Yoshihiko Noda said after a meeting with Ishiba that the US is most concerned about the auto trade deficit and that no consensus has been reached. Both sides are now trying to schedule the next round of high-level trade talks. The US is set to raise tariffs on Japan to 24%, on top of existing duties of 25% on cars and 50% on steel and aluminum.

South Korea

South Korea has yet to make meaningful progress in trade negotiations. New Trade Minister Yeo Han-koo met with US officials in Washington on June 23, aiming to secure exemptions from tariffs, including those already imposed on cars and steel. This comes after a planned meeting between President Lee Jae Myung, who took office earlier this month, and Trump at the G-7 summit was called off at the last minute as Trump left the event early amid rising tensions in the Middle East. South Korea faces the risk of a 25% tariff, further squeezing its export-dependent industries already strained by the sectoral duties.

Thailand

Thailand, which has been threatened with a 36% tariff, began its delayed talks with the US last week. Permanent Secretary for Commerce Vuttikrai Leewiraphan said last Wednesday that Thailand’s proposals are good and stand a chance to bring down the tariff to the 10% baseline. The official proposal was submitted to Washington last week and detailed negotiations are underway, the finance minister said Tuesday. The US was Thailand’s largest export market last year, accounting for nearly one-fifth of the country’s total outbound shipments.

Malaysia

Prime Minister Datuk Seri Anwar Ibrahim said that Malaysia’s negotiations with the US have been going well after officials met with US Commerce Secretary Howard Lutnick in Washington. Anwar said the imposition of the US tariffs was a “significant challenge” and added that about 60% of semiconductor products from Malaysia was exported to the US alone. Malaysia is seeking to reduce the US tariffs to below 10% for sectors critical to both economies. Both sides have agreed to finalise the talks before the tariff reprieve expires, Malaysia’s trade ministry said this week.

Switzerland

The European nation, also facing among the highest tariff rates of US allies, sketched a compromise around easing market access for some agricultural products, with Economy Minister Guy Parmelin saying he aimed to reach an agreement by early July. Since then, the US Treasury added Switzerland to its list of countries monitored for foreign exchange practices earlier this month. And Trump’s erratic trade policies contributed to the Swiss central bank cutting policy rates by 25 basis points last week after a surge of the franc.

Canada

Targeted with tariffs other than the reciprocal levies, the US’s northern neighbour is seeking to make a deal by mid-July, according to Prime Minister Mark Carney who met Trump on the sidelines of the G7 meeting. There are still differences between the two nations, according to the US president, who’s complained in the past about undocumented migration and fentanyl issues along the border. Canada is preparing to increase tariffs next month on steel and aluminum — currently at 25% — if talks stall.

Mexico

Mexico and the US were earlier this month nearing a deal that would remove Trump’s 50% tariffs on steel imports up to a certain cap, Bloomberg News reported. President Claudia Sheinbaum expected to meet with Trump soon after their planned encounter was canceled when he departed early from a G-7 summit in Canada. A formal start to the review of the USMCA — the free trade agreement between Canada, US and Mexico — is expected to begin later this year.

Recent tensions in the Middle East have begun to test the resilience of European stock markets, according to analysts at Barclays.

But in a note to clients, the brokerage said concerns over the implications of the conflict between Israel and Iran have added to "fatigue" rather than "stress" in the region’s equity markets, which have risen so far this year despite these potential headwinds.

"Investors remain watchful of the situation, although there are little signs of panic yet," the strategists led by Emmanuel Cau said in a note.

They added that "recent Middle East crises" could end up offering a "good buying opportunity," arguing that shocks from ructions in oil markets tend to be "short lived."

"In fact if the conflict results in bringing more stability and peace to the Middle East, it could be seen as bullish for risk assets over the medium term," the analysts said.

Still, they acknowledged that European equity-market price action could be "choppier" depending on the state of the fighting in the Middle East.

Against this backdrop, the Barclays strategists said they "remain skeptical of a structural re-rating" of an energy sector that has been largely tethered to movements in oil prices sparked recently by fighting between Israel and Iran.

On Tuesday, Israel accused Iran of violating a ceasefire agreement previously announced by U.S. President Donald Trump. Tehran has denied the claim.

Oil prices, which had fallen sharply amid hopes for easing tensions in the Middle East and fading worries over potential disruptions to oil supply flows through the region, trimmed some of these losses.

Elsewhere, the Barclays analysts flagged renewed trade-related risks facing European equities. An early July expiration of Trump’s delay to his punishing "reciprocal" tariffs is just weeks away, with questions swirling around whether this temporary relief will be extended.

This uncertainty, coupled with a stronger euro, have dented this year’s outperformance in European stocks, they said.

Bitcoin reclaimed the $106,000 level on Monday, recovering from a brief drop below $98,500 the day before. The rebound followed U.S. President Donald Trump’s announcement of a “total ceasefire” between Israel and Iran, which calmed global markets and helped restore confidence among risk-on investors.

Despite the sharp price movement, Bitcoin’s derivatives market showed surprising resilience. The downturn triggered $193 million in liquidations of long leveraged positions, roughly 0.3% of total open interest. Still, the total value of leveraged positions remains steady at around $68 billion, suggesting that most traders are holding their positions rather than exiting in panic.

The 4.4% drop over 12 hours, while notable, is not unprecedented. Similar dips have occurred three times over the last month. While traders remain cautious, especially given ongoing geopolitical tensions in the Middle East, many believe BTC has strong enough momentum to retest the $110,000 level in the coming days—assuming further escalation is avoided.

One potential area of concern is Bitcoin’s hashrate, which dropped 8% between Sunday and Thursday—from 943.6 million terahashes per second (TH/s) to 865.1 million TH/s.

Some market observers speculated that mining disruptions in Iran or neighboring regions may have contributed to the decline, especially amid reports that unauthorized Iranian miners consume up to 2 gigawatts of electricity. However, these estimates remain speculative due to the lack of verifiable data.

Experts like Daniel Batten cautioned against drawing direct geopolitical conclusions from short-term hashrate fluctuations. In many cases, similar declines have been linked to temporary power issues elsewhere.

For instance, on April 22, a 27% drop in hashrate followed intense storms and tornadoes across Texas and Oklahoma, which severely disrupted local power grids and mining operations.

Alongside Bitcoin’s recovery, oil prices dropped sharply after peaking at $77 on Sunday. This shift, paired with a 1% rise in the S&P 500, bolstered expectations of a U.S. Federal Reserve interest rate cut.

According to CME’s FedWatch tool, the probability of rates remaining at 4.25% through November dropped to just 8.4%, while the odds of a cut to 3.75% or lower rose to 53%.

Although Bitcoin’s next move is uncertain, its swift recovery above $100K suggests that institutional demand remains strong—regardless of short-term geopolitical or macroeconomic concerns.

The post Bitcoin Bounces Back Above $106K After Trump-Brokered Ceasefire appeared first on TheCoinrise.com.

German companies are the most upbeat about the economy in more than two years as an imminent boost to public spending outweighs concerns over US tariffs and wars in the Middle East and Ukraine.

An expectations index by the Ifo institute rose to 90.7 in June from a revised 89 in May. The reading is the highest since April 2023 and exceeds the 89.9 median estimate in a Bloomberg poll of analysts. A measure of current conditions also rose.

“Expectations brightened in particular,” Ifo President Clemens Fuest said Tuesday in a statement. “The German economy is slowly building confidence.”

The numbers raise hopes that Europe’s largest economy is gaining momentum, despite powerful headwinds, to emerge from years of stagnation.

Business surveys published Monday by S&P Global already showed activity unexpectedly returned to growth in June after a month of contraction, also thanks to the prospect of much higher defense and infrastructure outlays under the new government.

This year’s budget, delayed due to February’s snap election, was signed off in cabinet on Tuesday and will now be sent to parliament for approval. Chancellor Friedrich Merz wants to boost military spending to 3.5% of gross domestic product by 2029 and has created a €500 billion ($574 billion) fund for infrastructure investments.

Analysts polled by Bloomberg expect German output to start rising again in 2025, with GDP to edge up 0.2%. That’s a rosier outlook than the stagnation anticipated by most other forecasters recently.

GDP expanded more than anticipated at the start of the year. While this was partly down to firms and exporters front-running US tariffs, private consumption and investments also surged.

Yesterday morning, Iran launched a missile attack on the US military’s Al Udeid Air Base in Qatar in retaliation for US airstrikes on Iranian nuclear facilities the previous day.

The attack involved short- and medium-range ballistic missiles, with Qatar reporting that its air defenses intercepted most of them, and no casualties were reported. Earlier in the day, President Donald Trump thanked Iran for giving the United States advance notice of the coming missile strike!

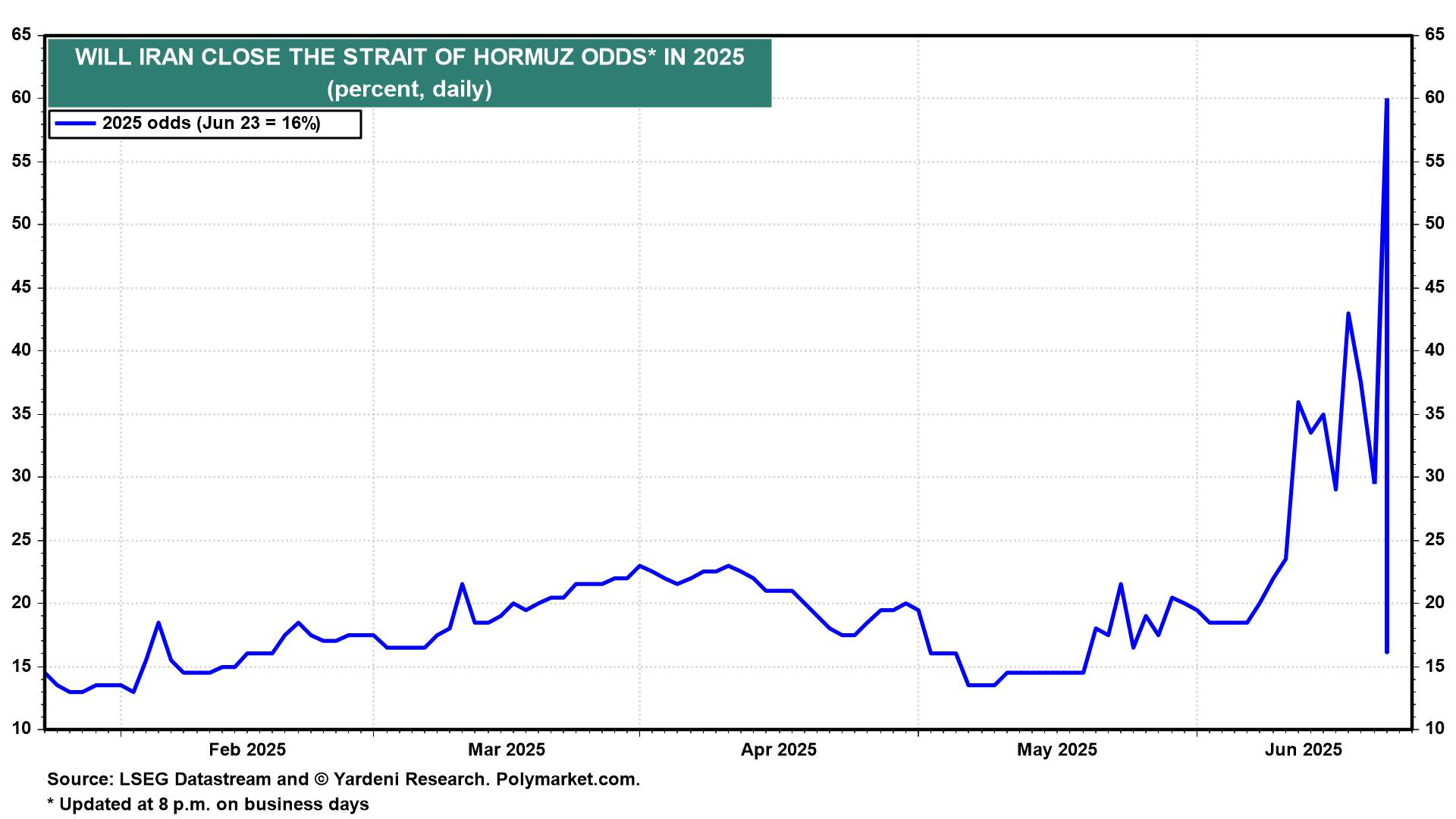

Stock prices rallied on the news because it greatly reduced the likelihood that Iran would retaliate by blocking the Strait of Hormuz. Polymarket.com showed that the odds of this outcome plunged from 60% on Sunday to 16% (chart).

The odds of a US recession in 2025 edged down to 27% from 66% on May 1. Instead of a blockade, we had reckoned that Iran would sue for peace. Last evening, Trump declared on social media that the "12-day war" between Israel and Iran was set to end in a ceasefire. (There was no immediate word from either country on the ceasefire, and the terms of the announced deal were unclear.)

The price of a barrel of Brent crude oil plunged 11.1% to $68.49 this evening, reflecting widespread relief that Iran staged a phony retaliation event in Qatar rather than a real one in the Strait of Hormuz. The ceasefire is also bearish for oil. The US might lift sanctions imposed on Iranian oil exports if Iran behaves better.

Meanwhile, the 10-year US Treasury bond yield remained around 4.35% as a second Fed official turned more dovish. Now there are two Fed governors who support cutting the federal funds rate at the July meeting of the Federal Open Market Committee (FOMC). Governor Christopher Waller told CNBC on Friday that he thinks the Fed should do so. Yesterday, Federal Reserve Governor Michelle Bowman seconded Waller’s motion.

Both of them have become less concerned about the inflationary impact of Trump’s tariffs and more willing to bolster the labor market by easing credit conditions.

"I think it is likely that the impact of tariffs on inflation may take longer, be more delayed, and have a smaller effect than initially expected, especially because many firms frontloaded their stocks of inventories," Bowman said.

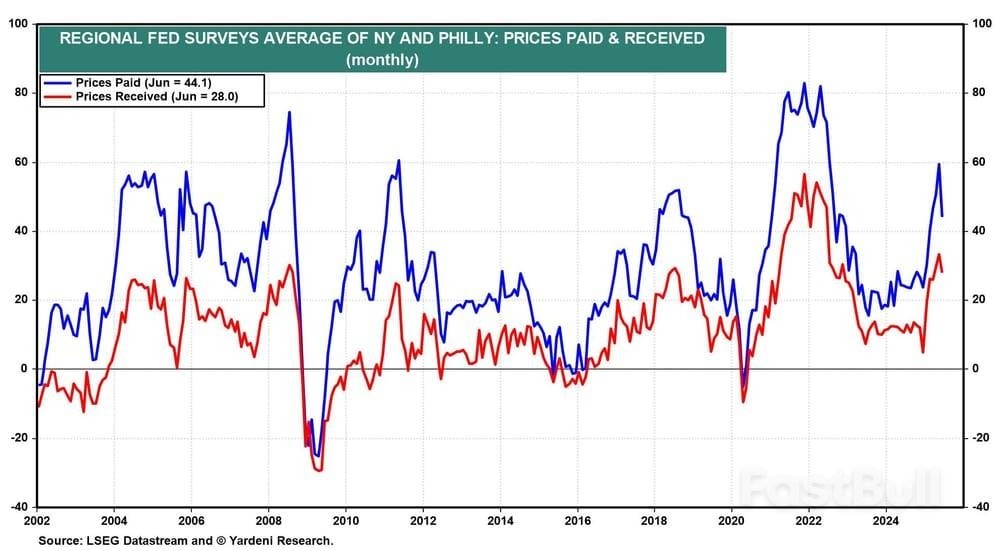

The average of June’s prices-received and prices-paid indexes for the New York and Philly Fed districts rose sharply earlier this year, but might have peaked in May, as both indexes dipped in June.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up