Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The (EF) has launched “Ethereum for Institutions,” a new online portal designed to guide enterprises, financial institutions, and developers looking to build on Ethereum’s infrastructure.

1/ Now live: the Ethereum for Institutions siteEthereum is the neutral, secure base layer where the world's financial value is coming onchainToday, we’re launching a new site for the builders, leaders, and institutions advancing this global movement — Ethereum Foundation (@ethereumfndn)

In a series of posts on X, the foundation said the initiative marks Ethereum’s continued evolution into the backbone of the global on-chain economy — uniting privacy-preserving technology, real-world assets, and institutional staking within a single framework.A New Institutional Gateway to Ethereum

The launched by EF’s Enterprise Acceleration team, provides a roadmap for organizations adopting Ethereum. The platform offers resources and technical pathways to support institutional adoption.

“Ethereum is the neutral, secure base layer where the world’s financial value is coming onchain,” stated. “Clear pathways are essential as institutions build.”

The site highlights Ethereum’s decade-long reliability — with over 1.1 million validators and continuous uptime — while spotlighting leading companies such as BlackRock, Visa, eToro, and Coinbase, which already manage billions in assets and trillions in transaction volume using Ethereum-based solutions.ZK Privacy and Compliance: The Next Institutional Frontier

Recognizing privacy as a key institutional requirement, the Ethereum Foundation emphasizes the use of zero-knowledge (ZK) proofs, fully homomorphic encryption (FHE), and trusted execution environments (TEEs) to enable compliant, audit-ready applications on public rails.

Projects like Chainlink, RAILGUN, Aztec Network, and Zama are featured for pioneering privacy-preserving smart contracts that allow secure counterparties and business logic without sacrificing transparency or composability.

These advancements represent a leap for institutions balancing compliance mandates with the need for secure, programmable finance. “Privacy solutions are no longer theoretical — they’re live and scaling in production,” Ethereum Foundation notes.Tokenization, Stablecoins, and Real-World Assets

Ethereum said it dominates the real-world asset (RWA) and stablecoin sectors, hosting over 75% of all tokenized RWAs and 60% of global stablecoin supply.

Institutions can now explore market infrastructure at institutions.ethereum.org/rwas-stablecoins, where tokenized treasuries and onchain credit platforms are reshaping capital markets.

From BlackRock and Securitize to Ondo Finance, Centrifuge, and Maple, major financial firms are deploying tokenized instruments that offer 24/7 settlement, transparency, and composability.

Stablecoins issued by Tether, Circle, PayPal, and Ethena Labs are also highlighted for their role in accelerating global onchain payments.Restaking, Layer-2s, and the Composable Financial Stack

The foundation said Ethereum’s Layer-2 networks — including Linea, Starknet, Base, Scroll, and Unichain — now secure over $50 billion in value, offering the throughput and cost efficiency required for global-scale applications.

At the same time, staking and restaking protocols like Ether.fi, EigenLayer, Lido, RocketPool, and Symbiotic are enabling institutions to participate in Ethereum’s security model while earning yield on staked ETH.

With 67% of DeFi’s total value locked (TVL) and the deepest liquidity across any blockchain, Ethereum continues to lead as the settlement layer for institutional-grade decentralized finance.

The new Ethereum for Institutions portal is a living resource, continuously updated to feature ecosystem builders, regulatory innovations, and enterprise-grade integrations.

Institutions can engage directly with the Ethereum Foundation’s Enterprise Acceleration team via — joining a growing global movement to bring finance fully onchain.

What to Know:

Dogecoin remains bullish, believe analysts, despite a 4% drop over the last 24 hours, suggesting a $0.22 breakout if momentum recovers in this Q4.

$DOGE lost its footing following October 10’s market crash, which vaporized $19B in leveraged positions, causing it to crash by 27.8% in just two days.

Since then, the coin struggled to regain momentum, but failed to consolidate in the green, partly because Bitcoin didn’t make it either. $BTC also failed to retain momentum above $115K on three different occasions and is now trading at $112.6K on a 2.46% 24-hour loss.

Despite this bearish performance, the market is confident in $DOGE’s Q4 performance and Maxi Doge’s ($MAXI) $3.8M presale could contribute to that.

Can $DOGE Reclaim $0.22?

$DOGE shows signs of a bullish tendency, which could support a push to $0.22 if momentum starts to build up.

Analysts like Trader Tardigrade go even farther than that, suggesting a price point of $0.248 in case of a breakout from the Symmetrical Triangle pattern.

But how is a breakout possible considering $DOGE’s rather bearish recent performance, which largely stems from massive sells? As analyst Ali points out, whales sold over 500M $DOGE over the past week.

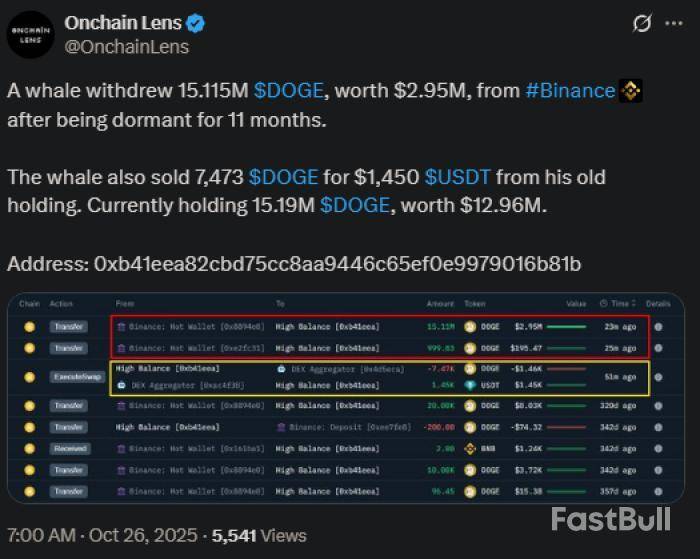

The answer is that this is a problem of perspective. While some whales sold in bulk, others started their accumulation phase. As Onchain Lens noted, one whale wallet withdrew over 15M $DOGE from Binance, worth $2.95M. Only sold $1,450-worth of tokens.

This type of whale activity is usually a sign of consolidation in preparation for a coming bull phase and $DOGE’s chart performance shows exactly that.

With the coin now at $0.1936 and whales making massive moves ahead of the coming FOMC meeting, we expect a momentum buildup into November. A breakout above $0.20 could fuel a more consistent push to $0.22 and above.

The hints are there, especially with $DOGE’s 24h trading volume which is now 33.75% in the green. It was over 60% earlier today, suggesting increased investor movements. The price remained stable throughout, though, which means something big may be coming this week. And let’s not forget House of Doge’s decision to acquire a majority stake in the Italian soccer team, US Triestina Calcio 1918, which expands on $DOGE’s real-world utility, adding even more legitimacy into the mix.

Long-term, $DOGE will likely break above $0.250, especially with projects like Maxi Doge ($MAXI) adding more flavor to the dish.

How Maxi Doge Makes Trading Fun

Maxi Doge ($MAXI) turns trading into a big boy’s game, where only the toughest can survive.

The Maxi Doge philosophy is simple and it fuels the entire ecosystem: retire at 22. There are no shortcuts, excuses, or barriers to overcome. Everything goes in a straight line with no plan Bs or safety nets.

This explains why Maxi Doge trades at 1000x leverage, buys green candles, and chases pumps while on a diet of Red Bull and Maxitren 9000.

Maxi Doge presents itself as the solution to moderate, lukewarm trading, and offers unhinged investing as the alternative.

The solution is in your face:

Maxi Doge embodies sheer willpower: lift, trade, repeat. The $MAXI community channels that energy, sharing leveraged strategies, competitions, and meme-driven camaraderie to unlock maximal gains together.

—Maxi Doge, Official whitepaper

The presale has been doing very well recently, raising over $3.8M as investors took notice and started succumbing to the FOMO fever. $MAXI now sells at $0.0002655, which means this is the best time to invest, given the project’s potential and meme impact.

If $MAXI can replicate even a fraction of $DOGE’s 34,441% all-time ROI, we’re looking at a slam dunk.

Don’t take this as financial advice. Do your own research (DYOR) before investing.

Authored by Aaron Walker, NewsBTC: https://www.newsbtc.com/news/dogecoin-022-maxi-doge-soars

The crypto market consolidated on Wednesday as traders positioned cautiously, with Bitcoin falling below $113,000. At press time, Bitcoin was trading at $112,913, having reached an intraday low of $112,075, extending its drop from Monday's high of $116,410 into the third day.

Key catalysts from a macro perspective this week include the Federal Reserve interest rate decision due later today.

The world’s largest cryptocurrency remained up 3.92% over the past week but fell 1.45% in the past 24 hours, mirroring modest losses across major cryptocurrencies.

The Fed is widely expected to cut rates by a quarter point at the conclusion of its meeting Wednesday, but less certain is whether Chair Jerome Powell will strike a dovish tone in his post-meeting comments. Investors are counting on another interest rate cut from the central bank at its December meeting.

Peter Brandt highlights possibility for Bitcoin price

In a tweet indirectly addressed to Bitcoin holders, the veteran trader highlighted a possibility for the Bitcoin price as he asked holders to consider a chart pattern (most likely triangle pattern) in AIRR.

Peter Brandt@PeterLBrandtOct 29, 2025Nice chart. I accept this as a possibility https://t.co/PGQYxJArBx

Brandt asked them to state if and when the pattern is either confirmed or negated: "Most highly recommend that those bullish on a certain crypto starting with the letter 'B' learn to understand if and when this pattern is either confirmed or negated."

An X user responded, praising his analysis and adding that if the pattern is negated, Bitcoin might be ready for a huge bull run, as it might yield a bullish megaphone pattern, which might push the BTC price higher.

This Brandt agreed to, saying, "Nice chart. I accept this as a possibility." Brandt later shared another chart, this time on Dow futures, which he used to confirm his agreement on the possibility. "Here is another example. I agree with your chart as a possibility," Brandt wrote.

Earlier in October, Brandt indicated that Bitcoin was forming a pattern similar to soybeans' 1977 broadening top, which led to a 50% drop in value.

Solana staking exchange-traded funds have a promising future on traditional stock exchanges after Bitwise’s fund debut on the New York Stock Exchange surpassed $56 million in first-day trading volume.

Matt Hougan, Bitwise chief investment officer, described the Bitwise Solana Staking ETF (BSOL) as “the missing part of the puzzle” in conversation with Cointelegraph’s Chain Reaction daily show, as the product attracted millions of dollars in investment on the NYSE.

Gareth Jenkinson@gazza_jenksOct 29, 2025So, @BitwiseInvest Solana Staking ETF totalled $56M in trading volume after its debut on @NYSE 💰

As @EricBalchunas reported, it's the biggest ETF debut in 2026.@Matt_Hougan described $BSOL as "the missing part of the puzzle".

Here's why @solana staking ETFs WILL attract… pic.twitter.com/syFGy6Dwm9

Hougan said that until this point, investors stood to gain more by owning Solana in ways that allowed them to directly stake the asset and earn yield than invest in an ETF or product that didn’t allow for staking.

“Once you put it into an ETF, you get all the great things about an ETF. Extremely low costs, institutional custody. You can purchase it in your brokerage account. It's push-button easy. And you get that staking done for you,” Hougan said.

Investors want custody AND staking yield

Hougan unpacked the difference between conventional crypto ETFs like Bitcoin and Ethereum products, which primarily give investors exposure to the underlying asset. Staking ETFs have a twofold benefit for investors, as Hougan explained.

Hougan said the product also helps decentralize and secure the Solana network. The $BSOL ETF launched $222 million in assets, amounting to over 1.1 million SOL tokens.

Bloomberg senior ETF analyst Eric Balchunas reported that Bitwise’s SOL staking ETF had the largest trading volume of any ETF on debut in 2025.

Regulatory change made Solana staking ETFs possible

Hougan also credited a regulatory U-turn in the US as a catalyst for the eventual greenlight for Solana staking ETFs. During Gary Gensler’s term at the helm of the SEC, Bitcoin and Ether ETFs took years to get the regulatory green light.

The Bitwise executive said that Solana staking ETFs would not have been “even remotely possible” if there had not been a significant change in attitude toward the cryptocurrency sector from US regulators.

“Even just Solana unstaked was impossible, right? We barely got Ethereum through the Gary Gensler pinhole,” Hougan said. “And there was no way you were going to get anything else through that pinhole. And then to add staking on top of it, staking is more complex.”

Related: Bitwise SOL staking ETF debuts with $223M assets, shows strong institutional demand

He said a number of complexities also stumped regulators, including liquidity and tax implications. However, the launch of BSOL and Grayscale’s Solana Trust ETF (GSOL) could well open the door for other TradFi investment products linked to proof-of-stake protocols.

“Not only have we done it now, but this also opens the door for a variety of other ETPs to launch that have staking as well. So this is like a major proof-of-concept in the history of crypto ETPs in the US.”

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Cardano Founder Charles Hoskinson went head-to-head with long-time Bitcoin critic Peter Schiff. Hoskinson argued that Schiff has repeatedly failed in his price forecasts for Bitcoin.

Charles Hoskinson mocks Bitcoin critic

In an X post, Hoskinson dismissed the Bitcoin price forecasts of Peter Schiff. Hoskinson claimed that Schiff’s anti-Bitcoin takes no longer move markets or sways serious investors.

He highlighted previous BTC forecasts by Schiff that turned out wrong. According to Hoskinson, Schiff was wrong when he predicted Bitcoin at $100, $1000, $10,000 and $100,000.

Charles Hoskinson@IOHK_CharlesOct 29, 2025Peter continues to be wrong and utterly irrelevant. He was wrong at 100 dollar bitcoin. He was wrong at 1000 dollar bitcoin. He was wrong at 10,000 dollar bitcoin. He is wrong at 100,000 dollar bitcoin.

He will be wrong at million dollar bitcoin. https://t.co/hpTVATc1qf

Hoskinson added that Schiff would still be wrong with a $1 million Bitcoin projection. The Cardano founder believes Schiff’s prediction model is broken, as he has been wrong four times.

Note that Schiff has consistently called Bitcoin a "bubble" or "Ponzi scheme" since its early days.

In a recent X post, which Hoskinson responded to, Schiff highlighted a divergence between Bitcoin, the NASDAQ and gold.

Schiff noted that BTC is still far behind in percentage distance from its all-time high (ATH) compared to NASDAQ and gold.

According to Schiff, Bitcoin is still over 10% below its ATH. He added that Strategy stock (MSTR) is down 48% from its record high set in November 2024.

Schiff sees this divergence as proof that Bitcoin is not digital gold but a speculative asset. He concluded that BTC is primed for a crash.

These remarks come shortly after Schiff said buying Bitcoin is a bet against gold. He argued that the value of gold stems from its ancient role as a tangible store of wealth, while Bitcoin remains speculative and volatile.

Current state of Bitcoin

The ongoing discourse raises bigger questions about whether Bitcoin is indeed a revolutionary asset. In 2025, Bitcoin has seen rising adoption from both retail and institutions, forcing proponents like Hoskinson to sharpen their arguments.

In addition, BTC has gained recognition this year from several governments. Strategy Executive Chairman Michael Saylor recently celebrated the U.S. government for recognizing BTC as a treasury asset.

In a related development, French politician Eric Ciotti introduced a proposal to create a national strategic Bitcoin reserve.

As of press time, BTC is priced at $113,036, down 1.8% over the previous day. Still, analysts and investors are bullish on BTC, with some eyeing $116,000 as a short-term target.

Grayscale Investments, the world’s largest digital asset-focused investment platform, announced that its Grayscale Solana Trust ETF (GSOL) is now officially trading on NYSE Arca as an exchange-traded product (ETP).

This marks a major milestone, making it the first of Grayscale’s staking products to uplist under the new SEC-approved generic listing standards.

Grayscale@GrayscaleOct 29, 2025Introducing Grayscale Solana Trust ETF (Ticker: $GSOL), offering investors exposure to @Solana BINANCE:SOLUSDT, one of the fastest-growing digital assets. $GSOL features:

⚡ Convenient Solana exposure paired with staking benefits.

🔑 Exposure to a high-speed, low-cost blockchain.… pic.twitter.com/TgVNlhqBPO

Leading Solana ETP Manager

With GSOL now trading on NYSE Arca, Grayscale is now among the leading Solana ETP managers in the U.S. by assets under management. This builds on its strong track record in crypto asset management and leadership across Bitcoin and Ethereum products.

GSOL offers exchange-listed, low-cost exposure to Solana and its staking rewards through a familiar ETP format, backed by an institutional staking program.

GSOL was launched in 2021 and began staking in October 2025. Staking returns are captured in NAV, giving investors the potential to compound over time. Grayscale intends to pass through 77% of all staking rewards accrue to GSOL investors on a net basis.

Peter Mintzberg@PeterMintzbergOct 29, 2025Today, @Grayscale celebrates the latest milestone in our history of innovation, as

Grayscale Solana Trust ETF (ticker: $GSOL) began trading on @NYSE Arca, offering investors exposure to Solana and the ability to earn staking rewards.

Grayscale was among the first to enable…

GSOL is not subject to the same regulations as traditional ETFs or mutual funds and carries higher risk. Grayscale also notes that while GSOL holds Solana, an investment in GSOL is not a direct investment in Solana.

Digital Assets in Modern Portfolios

Inkoo Kang, Senior Vice President of ETFs at Grayscale, notes that the GSOL launch reinforces the company’s belief that modern portfolio now includes digital assets for growth and diversification alongside traditional assets like equities, bonds, and alternatives.

“Bitcoin and Ethereum ETPs were just the start, and with GSOL, we’re expanding investor choice, backed by the scale, education, and operational infrastructure advisors and institutions expect,” he added.

Investor Participation in Network Growth

President of the Solana Policy Institute, notes that the rails of global finance is being rebuilt on Solana and millions of investors can now gain exposure to it through Solana staking ETPs like Grayscale’s GSOL.

Through staking in these products, investors are not just gaining exposure to Solana, they also have the opportunity to help secure the network, support developer innovation and earn rewards from one of the most dynamic digital assets.

A Busy Week for Crypto ETFs

This comes after three new crypto ETFs hit Wall Street on Tuesday. Bitwise launched its Solana Staking ETF on the NYSE while Canary listed its Litecoin ETF and HBAR ETF on Nasdaq.

Binance founder Changpeng “CZ” Zhao has spoken out against a newly launched meme coin inspired by him, making it clear that he has no interest in being part of the hype. He even warned users not to buy the memecoin, calling it a scam using his name without permission.

What started with excitement soon turned sour, as the token’s price fell by around 86% just hours after launch.

CZ Rejects the “CZStatue” Hype

CZ began his post by acknowledging the gesture behind the meme but quickly dismissed it, saying that the coin’s creator “probably just wanted to make a quick buck off an interaction from me.”

He made it clear that such behavior is not something he appreciates and directly warned: “Don’t buy the meme.”

This isn’t the first time crypto traders have tried to capitalize on his popularity. Over the years, multiple meme coins using his name or Binance’s brand have appeared, often rising and crashing within days.

CZ 🔶 BNB@cz_binanceOct 29, 2025While I want to appreciate the gesture, the fact that there is a meme coin associated with this means the creator probably just wanted to make a quick buck off an interaction from me. This is something I don't appreciate. Don't buy the meme.

I would also never accept a statue of… https://t.co/GLmBgxqP6C

CZ’s latest message aims to stop that trend before it causes more losses for unsuspecting investors.

“I Would Never Accept a Statue of Myself”

Adding humor and humility to his message, CZ also addressed another fan-made gesture. He recalled a similar moment when someone gifted him a T-shirt with his own face printed on it, joking, “Who has the ego to wear a shirt with their own face on it? As if seeing it once isn’t enough.”

CZ’s quick response to the memecoin received widespread community appreciation, with many praising him for speaking up and warning people about the risks.

CZ STATUE Memecoin’s Token Fell 86%

The newly launched Zhao-themed memecoin, released on the BNB Chain, initially soared, reaching a $5.7 million market cap with over 600 holders.

However, doubts soon appeared after a new wallet earned $57,000 in quick profits, suggesting possible insider activity and a lack of transparency.

Within just hours after the launch, CZ STATUE’s price crashed by 86%, and the unclear token ownership raised major red flags among traders.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up