Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Supervisors from the European Central Bank (ECB) are urging some of the region’s lenders to evaluate their need for U.S. dollars in times of financial stress.

Opec has downgraded its 2025 and 2026 non-Opec+ liquids supply growth forecasts for a second month in a row, mainly driven by lower output expectations from the US.

In its Monthly Oil Market Report (MOMR), published today, Opec revised down by 100,000 b/d its non-Opec supply growth forecasts for 2025 and 2026 to 810,000 b/d and 800,000 b/d, respectively. This follows identical downgrades of 100,000 b/d for each year in Opec's previous report.

While Opec did not give a reason for its supply revisions, the recent decline in oil prices is likely to have played a role. Production growth in the US, particularly in the shale patch, is highly sensitive to price movements, for example.

US shale producer Diamondback Energy chief executive Travis Stice earlier this month said US onshore crude production had likely peaked as drilling activity slowed in response to lower oil prices.

Opec sees US supply growing by 330,000 b/d in 2025 and 280,000 b/d in 2026, compared with 450,000 b/d and 460,000 b/d in its March MOMR.

Lower non-Opec+ supply expectations may have played a role in the decision by some Opec+ members to accelerate their planned supply increases for May and June.

Opec kept its global oil demand growth forecasts unchanged for this year and next at 1.3mn b/d and 1.28mn b/d, respectively. These forecasts remain bullish compared to those of the IEA and US' EIA.

Opec+ crude production — including Mexico — fell by 106,000 b/d to 40.92mn b/d in April, according to an average of secondary sources that includes Argus. Opec puts the call on Opec+ crude at 42.6mn b/d in 2025 and 42.9mn b/d in 2026.

Bitcoin (BTC) remained largely stable after the release of the US Consumer Price Index (CPI) for April 2025, which came in below expectations. The data suggests inflation is continuing to cool, a potentially positive sign for risk-on assets like BTC.

The Bureau of Labor Statistics reported a 0.2% increase in April CPI, slightly under the 0.3% forecast. While the figure marked a rebound from the -0.1% decline recorded in March 2025, it still pointed to subdued inflationary pressures.

Year-over-year (YoY), CPI rose by 2.3% – the slowest annual increase since February 2021. Core CPI, which excludes volatile food and energy prices, rose by 0.2% in April compared to 0.1% in March. This was also below the consensus estimate of 0.3%. On a YoY basis, Core CPI remained steady at 2.8%, in line with expectations.

The lower-than-expected inflation data supports the Federal Reserve’s cautious “wait and watch” stance on interest rate cuts, bolstering the case for holding current policy until further macroeconomic clarity emerges.

Despite the positive macro backdrop, Bitcoin’s price reaction was muted. At the time of writing, BTC is trading in the low $100,000 range – approximately 5.1% below its all-time high (ATH) of $108,786 set in January 2025.

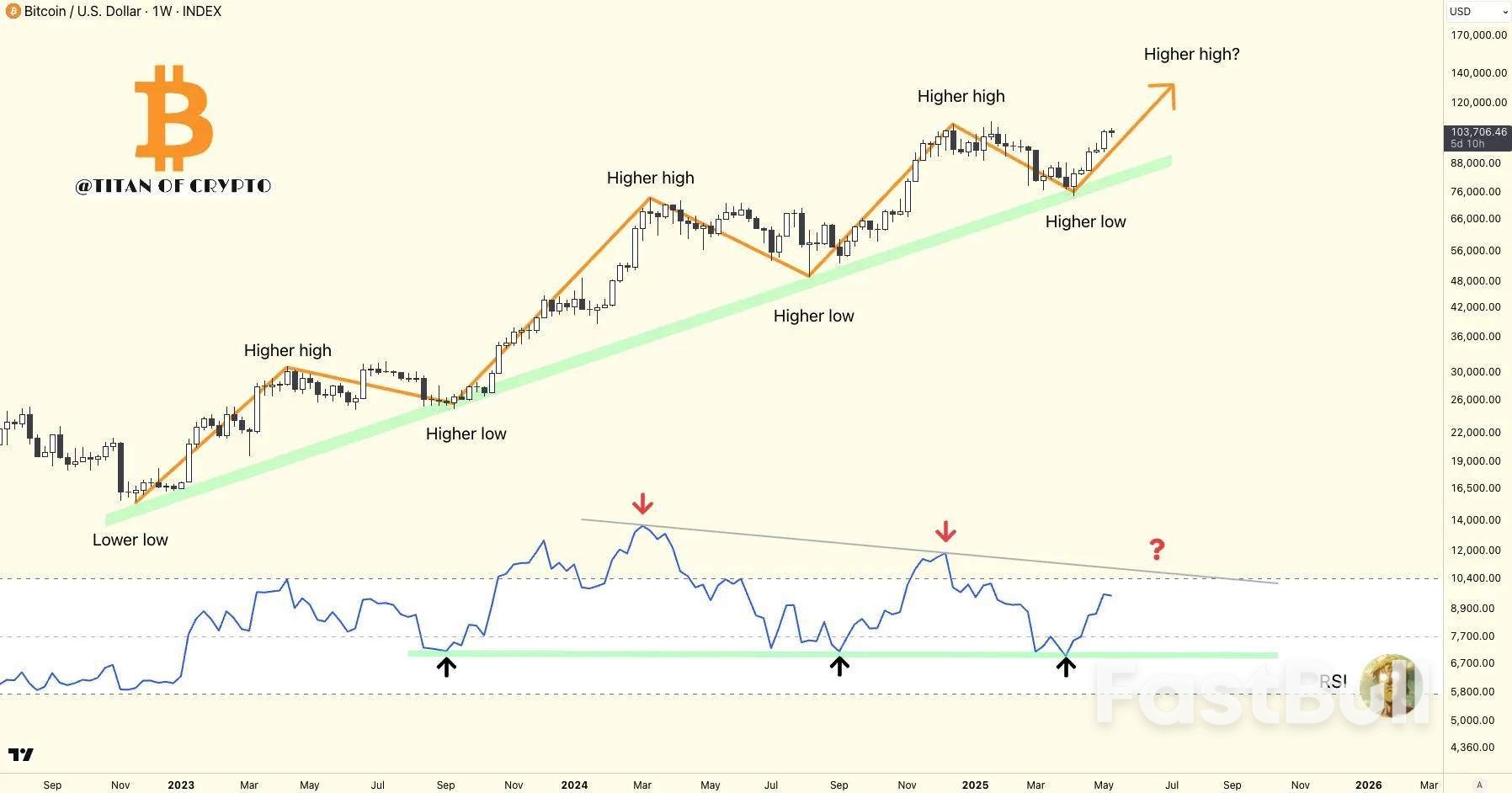

Although the price response was mild, technical analysts remain optimistic. Noted crypto analyst Titan of Crypto shared the following chart indicating a potential move to new all-time highs, driven by a strengthening weekly Relative Strength Index (RSI).

Source: Titan of Crypto on X

Source: Titan of Crypto on XSimilarly, crypto analyst Jelle commented on BTC’s resilience around the $102,000 level, suggesting this may act as a strong support zone. “Not much is left to hold BTC back now,” the analyst noted, indicating confidence in a continued rally.

Source: Jelle on X

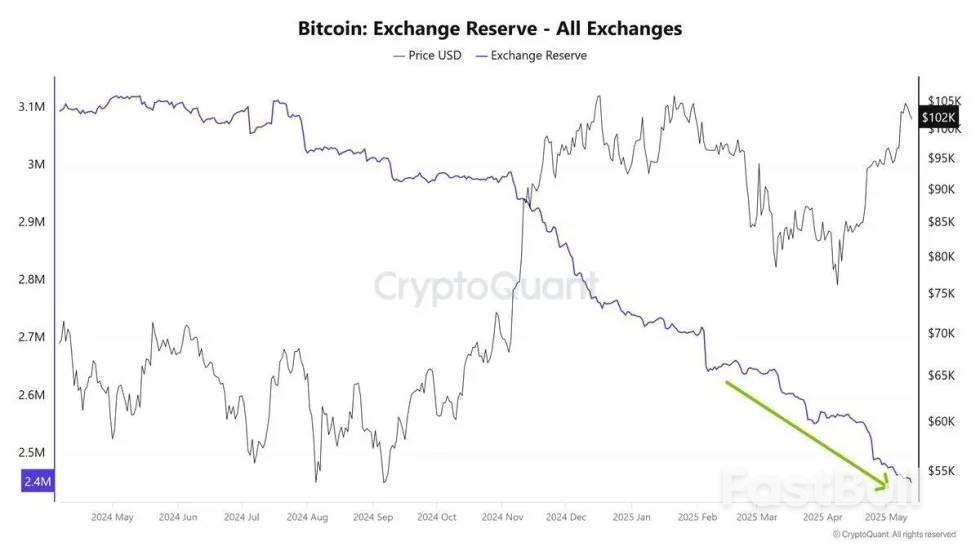

Source: Jelle on XOn-chain data also supports the bullish outlook. Crypto influencer Davinci Jeremie pointed out in a recent X post that Bitcoin reserves on centralized exchanges have dropped significantly and are now hovering around 2.4 million BTC – a level that could contribute to a looming supply shock.

Source: Davinci Jeremie on X

Source: Davinci Jeremie on XLower BTC reserves on crypto exchanges are likely to bolster the supply shock narrative for the flagship cryptocurrency, which may lead to a parabolic price action. Data also shows that large investors are accumulating BTC.

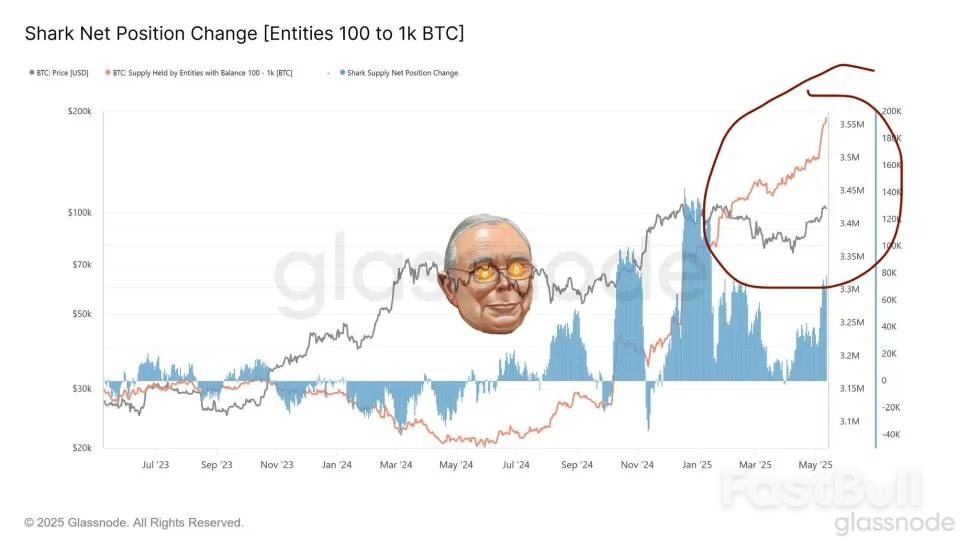

In a separate X post, crypto analyst Bitcoin Munger shared the following chart which shows that BTC sharks – wallets holding 100 to 1,000 BTC – have been accumulating BTC at a rapid pace. Currently, these entities hold more than 3.55 BTC collectively.

Source: Bitcoin Munger on X

Source: Bitcoin Munger on XThat said, recent data shows that open interest has not risen in tandem with the rise in BTC price, which may be a cause for concern. At press time, BTC trades at $103,311, up a modest 0.1% in the past 24 hours.

BTC trades at $103,311 on the daily chart | Source: BTCUSDT on TradingView.com

BTC trades at $103,311 on the daily chart | Source: BTCUSDT on TradingView.comNZD/USD dropped to Monday’s low of 0.5845 before bouncing back to retest its 20-day simple moving average (SMA) at 0.5945, as the euphoria about the US-China trade deal faded, weighing on the US dollar. With the price still hovering around this line and near the 50% Fibonacci retracement level of the September–April downleg, the key question now is whether the bulls have enough momentum to break through that resistance and push into the 0.6000 area.

The positive rotation in the RSI and the stochastic oscillator, coupled with the bullish engulfing candlestick pattern formed on Tuesday, may help sustain buying interest. However, some caution is warranted, as the RSI remains on a downward slope, and the MACD continues to ease below its red signal line.

A continuation above the 61.8% Fibonacci level at 0.6020-0.6035 could place the pair back on a bullish track in the short-term picture, with resistance likely emerging near the 0.6100 level or even higher in the 0.6180–0.6220 region. Further gains beyond that could pave the way toward the October 2024 high of 0.6377.

In a bearish scenario, where the pair falls below the 38.2% Fibonacci level at 0.5825, the sell-off could accelerate toward the 0.5670–0.5695 region. A failure to stabilize there could drag the price further down to 0.5540–0.5580 and potentially toward the pandemic low of 0.5468.

Overall, NZD/USD may remain supported in the short term, though a sustained move above 0.6020 is needed to confirm a return to a bullish trajectory.

The 2.80% spike in the overall crypto market cap has pushed it to $3.38 trillion, with the greedy sentiment lingering as the fear and greed index value positioned at 74. All the major assets have been charted in green, reclaiming their recent highs. Notably, the largest altcoin, Ethereum, has achieved its recovery attempt.

ETH has escaped the downside pressure by securing an 8.97% gain over the last 24 hours. The altcoin could continue trading on the upside if the bulls sustain. Also, a breakout above the $3K threshold is essential to fuel an aggressive upward move.

The altcoin opened the day trading at the bottom range of $2,453. After the bulls came into command, the price rose toward the $2,736 mark, breaking the crucial resistances at $2,577 and $2,706.

Ethereum trades at around $2,675 at press time, with a market cap of $322 billion. The daily trading volume has increased by over 11.94%, reaching $36.64 billion. Furthermore, the market has seen a liquidation of $158.04 million in ETH, as per Coinglass data.

The four-hour trading chart has exhibited a brief upside pressure, lighting up the green candle. Ethereum could likely climb to the crucial resistance at the $2,710 range. An extended upside correction might send the price toward $2.8K. A sustained bullish momentum triggers a prolonged upward move.

Assuming the bears came in command, the price could retrace to the $2,606 support level. Further downside price action triggers the death cross to emerge, and Ethereum might fall back to the former low at $2.5K or even lower. Additional setbacks could slow down and complicate the recovery.

ETH chart (Source: TradingView)

ETH chart (Source: TradingView)ETH’s Moving Average Convergence Divergence (MACD) line is settled above the signal line. This implies a bullish crossover, and the asset’s price may gain upward strength. It is often seen as a buy signal. Moreover, the Chaikin Money Flow (CMF) indicator value is found at -0.10 hints at mild selling pressure in the market, with the capital flowing out of the asset.

ETH chart (Source: TradingView)

ETH chart (Source: TradingView)The altcoin’s daily relative strength index (RSI) at 67.14 indicates that the asset is approaching the overbought territory. This bullish momentum may face resistance or a potential pullback. Besides, Ethereum’s Bull Bear Power (BBP) reading of 180.06 suggests sturdy dominance of bulls in the market.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up