Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Has Russia’s President Vladimir Putin finally overplayed his hand by challenging NATO? It’s too soon to know, but some signs are emerging that the US and Europe may be ready to apply the kind of sustained pressure needed to persuade him he has — and that his own interests would lie in ending the war in Ukraine.

Has Russia’s President Vladimir Putin finally overplayed his hand by challenging NATO? It’s too soon to know, but some signs are emerging that the US and Europe may be ready to apply the kind of sustained pressure needed to persuade him he has — and that his own interests would lie in ending the war in Ukraine.The first indication is that Donald Trump, after a disturbing display of nonchalance last week when Russia fired drones into Poland , has set the terms under which he says he’d ramp up sanctions on Moscow.

The second is that the European Commission appears, at last, to have backed a plan to fully use Russia’s frozen central bank assets – worth about $330 billion – against it.Trump named his conditions in a letter he wrote to North Atlantic Treaty Organization members and posted on Truth Social on Sunday, saying that all NATO states must first end their consumption of Russian oil and then join him in sanctioning China and India to deter their much larger purchases until the war is over.

It’s hard to know whether Trump is genuine or by setting the bar so high is just looking for another way to avoid responsibility for his de facto abandonment of Ukraine. Sunday’s post read less like a threat to Moscow than a complaint against US allies. Putin, as usual, didn’t get a mention.Even so, this counts as progress. Trump has now set clear terms for pressuring Moscow to the negotiating table and allies can try to meet them. The European Union already drastically reduced its reliance on Russian crude since the start of the war in 2022, but was forced to make carve outs for Hungary and Slovakia — both led by Trump allies who also bat for the Kremlin. The two countries remain umbilically connected to supplies of Russian crude by the tragicomically named Druzhba, or Friendship, pipeline.Trump is right that oil sanctions aren’t working and that they’re a Kremlin vulnerability that should be better exploited.

Even in peace time oil revenue paid for 30% to 50% of the state budget. Eliminate most or all of that income and it would become far more difficult for Putin to pursue his war, without imposing much more severe financial costs on his own population.Russia’s economy has weathered the leaky Western sanctions remarkably well, but this would be an especially effective time for the US and Europe to double down. As Putin has retooled hiseconomy to serve the war effort, distortions have begun to pile up, making it more vulnerable to pressure. Banks have become overloaded with bad debt, much of it undisclosed, to keep the weapons production going. It’s a phenomenon that Craig Kennedy, a former US banker who focused on Russian energy, has been tracking for some time, estimating that 42% to 54% of Russian defense spending is off budget, and that corporate debt surged by 71%, or $446 billion, since in the first three years of the full-scale war.The amount of credit pumped into defense industries, combined with a shortage of labor as men either were recruited to the front or fled, has also driven up inflation, forcing Russia’s vigilant central bank to raise its key interest rate as high as 21%.

That’s now damping growth even as the government’s budget deficit expands. At the same time, Ukraine’s growing long-range drone and missile campaign against storage tanks and refineries has taken a significant if variable bite out of Russian oil output. Together with a determined US-European effort to slash Russian oil export revenue and a politically viable way for Europe to fund Ukraine’s defense for the next several years, this could go a long way toward changing Putin’s calculations.All of this, however, remains hypothetical. Trump has yet to follow through on any of his threats to get tough on Russia. And for Europe to put 100% tariffs on exports from China and India is easier said than done, as Trump himself has found. Equally, the EU remains conflicted over whether to seize Russian assets protected by sovereign immunity. That’s especially true of Belgium, which hosts most of the frozen funds.Reports that the European Commission has finally settled on a mechanism to tap those are encouraging all the same.

The chosen proposal is one I promoted in July for its potential to circumnavigate some of the thorny legal questions that would surround any outright seizure of protected sovereign assets. The plan would turn the money into loans, repayable to Russia just as soon as it pays the reparations that a United Nations-appointed commission will inevitably find due, in years to come.The concern remains that none of this emerges as part of a coherent, committed strategy to stop Putin in Eastern Ukraine, but as something more ad hoc and therefore frail. Because if Putin is to be persuaded there is no value in trying to press his war further, he has to believe that the European and US commitments to back Kyiv “for as long as it takes” are ironclad.Trump doesn’t do ironclad.

Europe lacks critical resources and is subject to political constraints, as centrist leaders who grasp the reality of the Russian threat are replaced by populists from the far right who don’t, fantasizing instead about Putin as an ally in the only conflict they’re truly concerned about - their own culture war with liberalism. These populists include not just Hungary’s Viktor Orban and Robert Fico of Slovakia, but also leaders of the National Assembly in France, the UK’s Reform party, and Alternative fur Deutschland in Germany. Putin’s right that the clock is ticking on Ukraine. It can tick for him, too, but only if Trump and Europe finally resolve to make that happen.

US Industrial production rose 0.1% MoM in August (better than the small 0.1% MoM decline expected) and a modest rebound from July's weakness. YoY growth in production dipped to 0.9%...

On the Manufacturing side, data also surprised to the upside with a 0.2% MoM gain versus expectations of a 0.2% decline.

Mining output grew 0.9 percent in August after falling 1.5 percent in July.

In August, the index for utilities decreased 2.0 percent, as a 2.3 percent decline in the output of electric utilities more than offset a 0.2 percent increase in the output of natural gas utilities...

But,on the darker side of the ledger, Capacity Utilization continues to trend lower...

So much for the tariff terror's impact on American manufacturing...

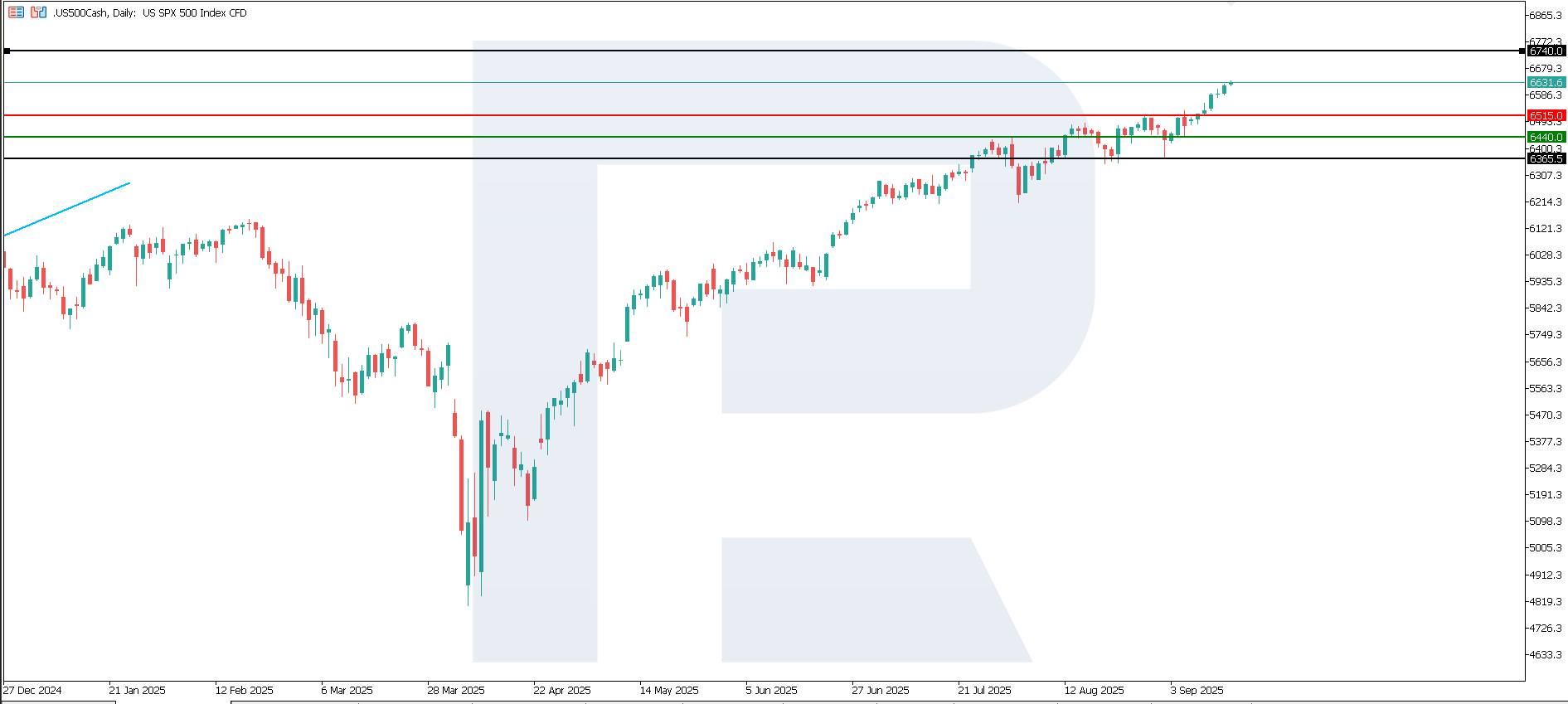

The US 500 index reached a new all-time high within an uptrend. The US 500 forecast for today is positive.

US 500 forecast: key trading points

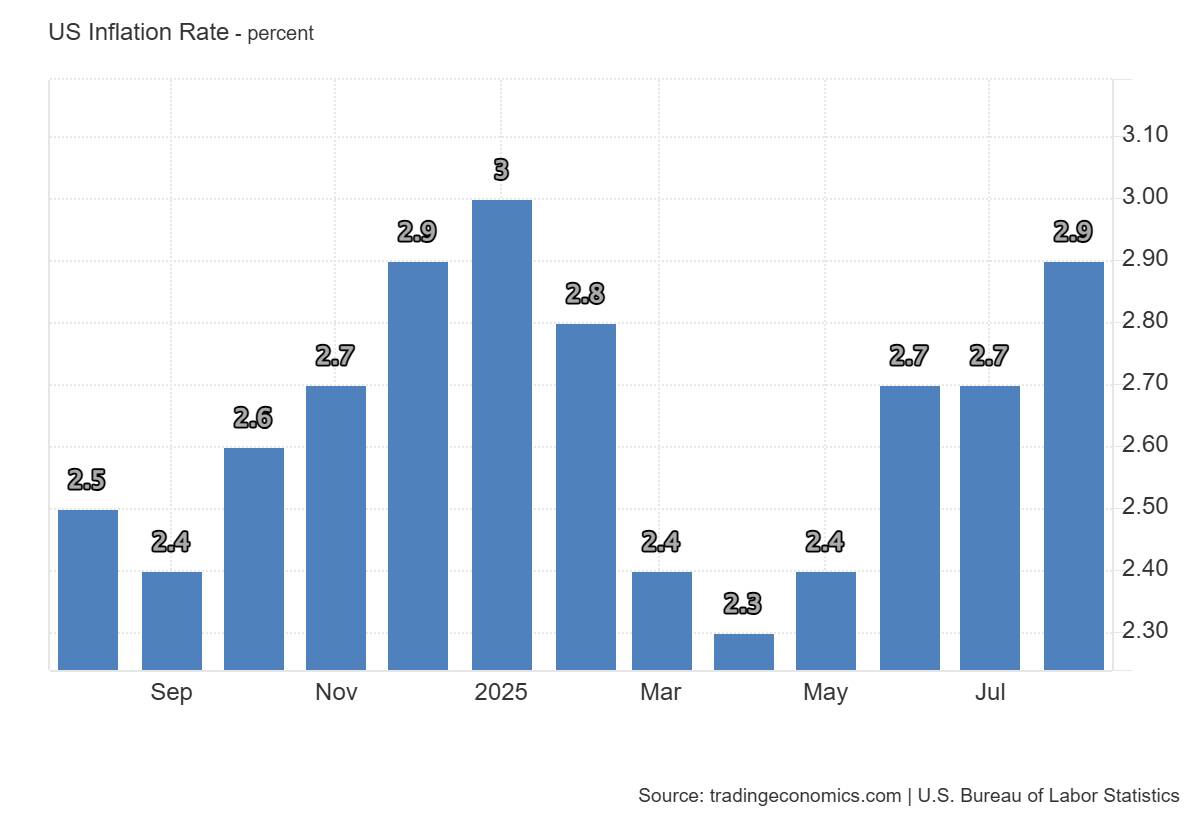

Annual CPI inflation in the US stood at 2.9%, exactly in line with market expectations but higher than the previous month’s 2.7%. Formally, this indicates disinflation progress relative to the 2022–2023 peaks, but also a pause in month-on-month improvement. The fact that the yearly pace accelerated compared to the previous month increases the likelihood that the Fed will move cautiously when easing policy: the path of rate cuts could become more gradual and highly dependent on upcoming inflation and labour market data.

The impact of inflation data varies across the US 500 sectors. Technology and communication services remain most sensitive to interest rate dynamics: higher yields increase valuation pressure, while stable yields keep reactions muted. The consumer discretionary sector is vulnerable to weaker purchasing power, but companies with strong pricing power and low debt levels benefit most.

After reaching a new all-time high, the US 500 continues to move upwards within a bullish trend. The current support level is at 6,435.0, while the nearest resistance level is yet to form. The most likely scenario is continued growth, with a target near 6,740.0.

The following scenarios are considered for the US 500 price forecast:

US 500 technical analysis for 16 September 2025

Inflation at 2.9% provides no clear signal for monetary easing and caps risk appetite. Support for the index comes from resilient corporate earnings and expectations of a soft economic landing. The key risk is inflation stabilising near 3.0%, which would pressure margins and borrowing costs. From a technical perspective, the US 500 is likely to maintain its upward trajectory towards 6,740.0.

China's carmakers are racing to develop smart-driving semiconductors in-house. It's a perilous journey, but even the slim prospect of immense rewards can be too alluring to ignore.

Only a handful of companies worldwide have successfully designed their own chips. The technological complexities - processors today have billions of transistors - plus the astronomical costs mean most businesses will just buy from specialists like Nvidiaor Qualcomm, which offer off-the-shelf components, or license existing designs from Arm. Among smartphone makers, only a few - led by giants Apple, Huawei and Samsung Electronics- have succeeded after years of heavy investments. Partly thanks to its vertical integration, the company run by Tim Cook boasts a 40% gross margin for its iPhone, according to Visible Alpha.

It is a formidable feat that $16 billion Niodebuted models this year featuring self-developed smart-driving AI chips. Rival Xpengalso unveiled its own advanced driver-assistance system processor for its cars last year, while Li Autoand BYDhave similar ambitions.

The rationale to do so is compelling. Developing chips alongside software such as Nio's homegrown SkyOs makes it easier to design and continuously upgrade a coherent, efficient system that fully utilises the hardware's computing power, especially for uncertain technology that's still evolving quickly. And in-house operations can bolster fragile supply chains: the disruptions to them sparked by COVID-19 meant that even in 2022 Chinese manufacturers were facing waits of as long as a year for semiconductors. Today, Washington's export controls and sanctions also pose a risk to Chinese firms.

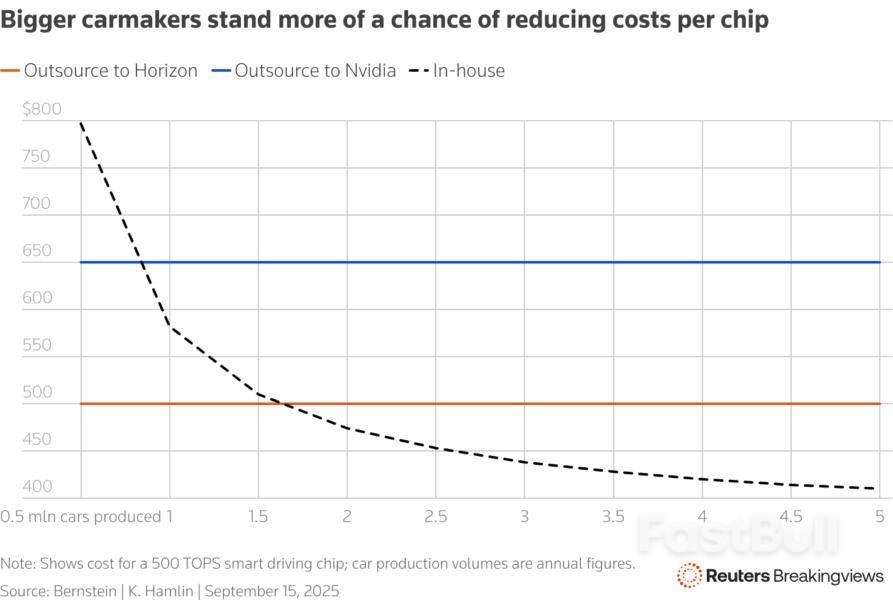

But the financial case is harder to justify, because outsourcing is simply cheaper and more efficient. Developing a chip can take five years or more, per consultancy AlixPartners. And it will require hiring thousands of engineers. BYD's intelligent driving team, for instance, has swelled to over 4,000 people covering both software and hardware. Analysts at Bernstein estimate that only auto manufacturers with annual production exceeding 1.5 million vehicles stand any chance of being able to make in-house chips more cost-effective than buying from Nvidia or Beijing-based Horizon Robotics.

That bodes ill for smaller brands like Nio. The group is on track to sell around 350,000 cars this year, per Visible Alpha, at an operating loss of nearly $2 billion. It isn't expected to make more than 1 million vehicles annually this decade. Meanwhile its annual R&D expenses have quintupled to $1.8 billion since 2020 and accounted for a fifth of its top line in 2024. Last week, the company announced it would sell shares to raise $1 billion for smart car technology, among other items.

That is hardly enough. Handset-to-car maker Xiaomisaid it will invest at least 50 billion yuan ($7 billion) over the next decade to develop its own chips. For China's auto brands and their investors, it will be a long time, if ever, before they see any returns.

US retail sales rose in August for a third month in a broad advance, rounding out a resilient summer of spending.

The value of retail purchases, not adjusted for inflation, increased 0.6% after a similar gain in July, Commerce Department data showed Tuesday. That beat all estimates in a Bloomberg survey of economists. Excluding cars, sales climbed 0.7%.

Nine out of 13 categories posted increases, led by online retailers, clothing stores and sporting goods, likely reflecting back-to-school shopping. Motor vehicle sales rose at a slower pace.

Tuesday’s report adds to evidence that consumers are still spending even as tariffs boost the cost of some goods, sentiment remains subdued and the labor market shows signs of faltering. Though wage growth has cooled, many workers’ pay gains continue to outpace inflation, and others, particularly the wealthy, are benefiting from a stock market rally.

Federal Reserve officials are closely tracking consumer spending — which supports two-thirds of US economic activity — as they decide the trajectory of interest rates. While they’re still assessing the impact President Donald Trump’s tariffs will ultimately have on prices, they’re widely expected to cut rates at the end of their two-day meeting Wednesday in an effort to shield the labor market from further deterioration.

Stock futures remained higher and Treasury yields rose after the report.

The retail sales report showed so-called control-group sales — which feed into the government’s calculation of goods spending for gross domestic product — climbed 0.7% in August, so far indicating a healthy third quarter. The measure excludes food services, auto dealers, building materials stores and gasoline stations.

The retail sales figures largely reflect purchases of goods, which comprise roughly a third of overall consumer outlays. Because the data are not adjusted for inflation, an advance could also reflect the impact of higher prices. A report on real spending on goods and services for August will be released later this month.

Spending at restaurants and bars, the only service-sector category in the retail report, advanced 0.7% after declining in the prior month.

Inflation data out last week suggested companies largely refrained from price hikes last month, as many firms have been wary that steep markups could push customers away.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up