Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Index climbs from 23 (Extreme Fear) to 28 (Fear); Reflects a modest recovery in investor sentiment; Still signals caution as fear dominates.

The Crypto Fear and Greed Index, a popular tool to measure market sentiment, has risen from 23 to 28 within a day. While both numbers fall under the "Fear" category, the jump from "Extreme Fear" to "Fear" reflects a modest but notable shift in how investors are currently feeling about the crypto market.

This change suggests that some confidence may be returning after a period of high uncertainty and selling pressure. However, with the index still below 30, market participants remain cautious, and the overall mood is far from bullish.

The Fear and Greed Index analyzes various factors—such as volatility, trading volume, social media trends, and surveys—to quantify the emotional state of the market. A score closer to 0 represents extreme fear, while 100 signals extreme greed.

Today's move to 28 still suggests investors are wary, but they're not in panic mode like they were yesterday. This small shift could indicate stabilization after a rough patch, or it might be a short-lived reaction to a minor positive development—such as slight price recoveries or encouraging news.

Understanding market sentiment is essential for crypto traders and investors. When fear dominates, opportunities may arise for long-term believers to enter at lower prices. On the other hand, excessive greed can signal that the market is overheated and due for a correction.

Even a small rise in the Crypto Fear and Greed Index can help gauge market direction. As of now, the index is showing early signs of a possible trend reversal, but fear still lingers. Investors should stay informed and watch for further sentiment shifts that might affect price movements.

Business activity in the eurozone expanded at its fastest pace in two-and-a-half years in November as a robust service sector more than offset manufacturing weakness, a survey showed on Wednesday.

HCOB's Eurozone Composite Purchasing Managers' Index (PMI), compiled by S&P Global and seen as a good gauge of overall economic health, rose to 52.8 in November from 52.5 in October, marking its sixth consecutive monthly increase.

PMI readings above 50.0 indicate growth in activity, while those below that level point to a contraction.

"The service sector in the eurozone is showing clear signs of recovery," said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

"The strong performance in the service sector was even enough to more than offset the weakness in the manufacturing sector, meaning that economic output in the eurozone grew slightly faster in November than in the previous month," de la Rubia added.

The services PMI climbed to 53.6 last month from 53.0 in October, reaching its highest level since May 2023 as new business volumes grew at the strongest pace in 18 months.

Most countries surveyed recorded expansions, with Ireland leading the way as its growth rate hit a three-and-a-half-year high. Spain maintained robust growth despite slowing from October, while Italy posted its strongest expansion since April 2023.

In France, private business activity expanded for the first time in 15 months, while activity moderated in Germany from October's 29-month peak.

Manufacturing showed signs of struggling, however, with factory production growth slowing to a nine-month low and new orders declining marginally.

Employment across the eurozone continued to increase in November, though the pace of job creation slowed to only a fractional rate. The services sector maintained hiring momentum, while manufacturing firms reduced staff at the sharpest rate since April.

Business confidence improved slightly but remained below its long-run average, suggesting companies remain cautious about future conditions.

On the inflation front, input costs rose at the fastest pace in eight months, driven by renewed increases in manufacturers' purchasing costs and accelerating service sector expenses.

However, the prices firms charged customers rose at a softer pace, with output price inflation easing to a six-month low.

"The inflation rate in the service sector, which the European Central Bank is monitoring with particular attention, has weakened significantly again in terms of sales prices," de la Rubia said.

"All in all, the ECB is likely to feel supported in its clearly communicated line of leaving interest rates unchanged at the upcoming central bank meeting."

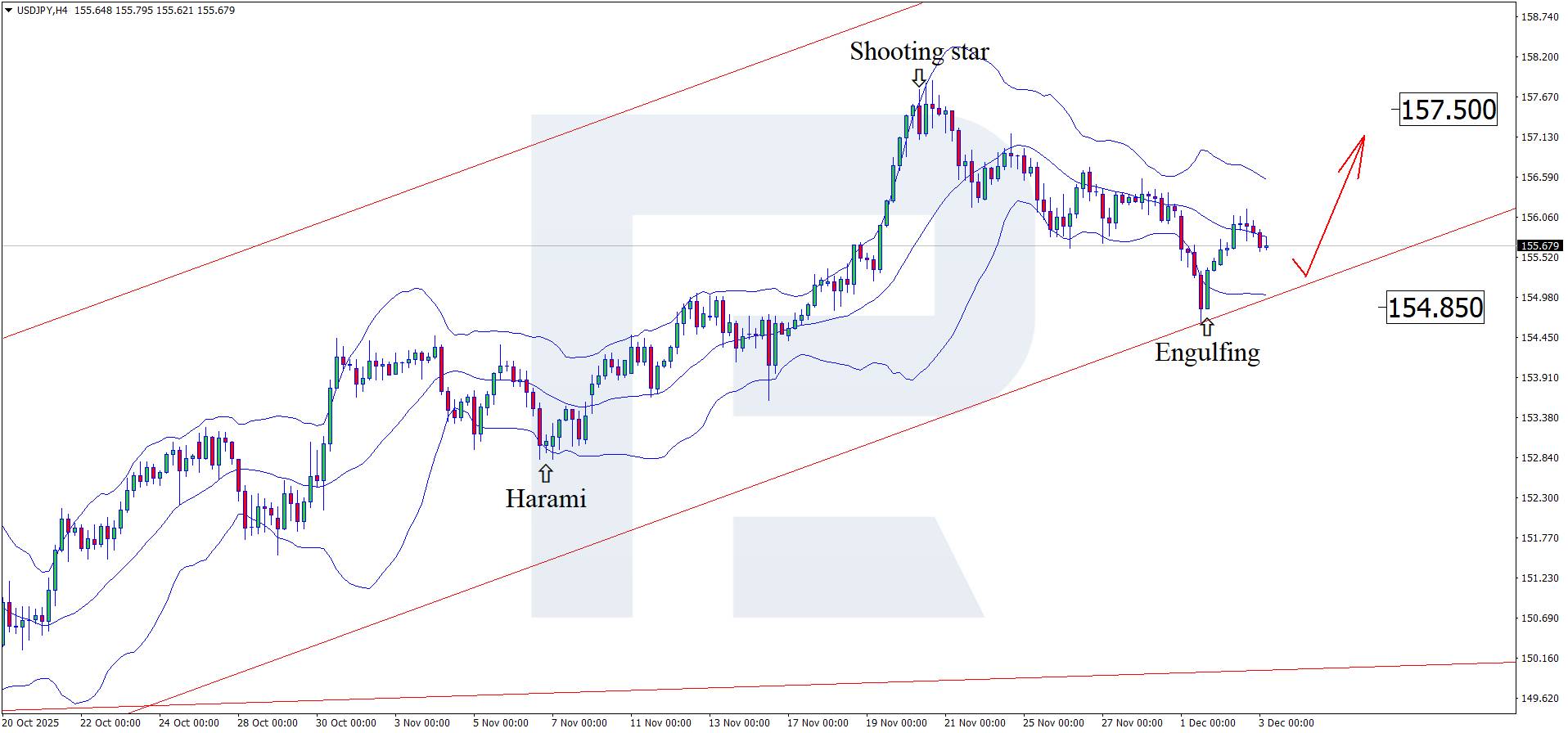

Positive US fundamental data may trigger a rally in USDJPY towards 157.50.

The forecast for 3 December 2025 considers that the USDJPY pair continues its correction, trading near 155.80.

Japan's services PMI covers multiple industries, including transport and communications, financial intermediation, business and household services, information technologies, hospitality, and food services.

The USDJPY forecast for today appears moderately optimistic for the Japanese yen, with the PMI up to 53.2 from 53.1 previously. At the moment, the PMI is above the 50.0 threshold, which may add support to the yen.

The US services PMI is also expected to rise to 55.0 from the previous 54.8. In this case, the increase in momentum may be slightly stronger, but it is still only a forecast. The actual figure may differ significantly, adding either support or pressure to the USD.

According to the forecast for 3 December 2025, ADP nonfarm employment change in the US may fall to 7 thousand, but this is only a projection. Last month, the number of employed grew more strongly than expected. The USDJPY forecast for today takes into account that a stronger-than-expected reading could support the US dollar and push the USDJPY rate higher towards 157.50.

On the H4 chart, the USDJPY pair has formed an Engulfing reversal pattern near the upper Bollinger Band and is currently trading around 155.80. At this stage, it may continue an upward wave following the pattern's signal, with a potential upside target at 157.50.

At the same time, the USDJPY forecast also considers an alternative scenario, where the price corrects towards 154.85 before rising.

Stronger US economic indicators may support the USD. The USDJPY technical analysis suggests a rise towards 157.50 after a correction.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

France's dominant services sector expanded slightly more than first estimated in November, hitting a 15-month high as new business gained momentum in the euro zone's second-biggest economy, a survey showed on Wednesday.

The HCOB France final purchasing managers index (PMI) for the services sector, compiled by S&P Global, stood at 51.4 - up from 48.0 in October - marking the first time the figure has topped the 50 threshold separating growth from contraction since August 2024.

November's flash services PMI was at 50.8.

The composite PMI, which includes both manufacturing and services, also entered positive territory, climbing to 50.4 in November from 47.7 in October and versus a flash estimate of 49.9.

However, manufacturing output continued to decline, widening the gap between the two sectors.

"Finally, some positive news. For the first time in over a year, output in France's private sector has increased. However, manufacturing remains a drag on overall performance, posting its steepest fall in nine months," said Jonas Feldhusen, junior economist at Hamburg Commercial Bank.

While the services sector's rebound is encouraging, Feldhusen cautioned that it remains to be seen whether this is the start of a sustained recovery or a temporary uptick.

Business expectations improved but remained cautious, with firms hopeful for a more stable policy environment to boost household consumption and business investment.

And, despite this positive development, the survey highlighted ongoing challenges.

Employment in the services sector fell slightly, reversing a robust hiring trend from the previous three months. Competitive pressures also limited companies' ability to raise prices, with output prices remaining largely unchanged despite rising input costs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up