Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Crude oil rebounded on cautious OPEC+ guidance and sanction risks. Price holds above 61.45, testing 64.00 resistance; buyers target 66.00, sellers await rejection. Key U.S. data ahead.

Crude oil daily

Crude oil daily Crude oil 4 hour

Crude oil 4 hour Crude oil 4 hour

Crude oil 4 hourIsrael said it would step up airstrikes on Gaza on Monday in a "mighty hurricane", to serve as a last warning to Hamas that it will destroy the enclave unless fighters accept a demand to free all hostages and surrender.

Residents said Israeli forces had bombed Gaza City from the air and blown up old armoured vehicles in its streets. Hamas said it was studying the latest U.S. ceasefire proposal, delivered on Sunday with a warning from President Donald Trump that it was the militant group's "last chance".

"A mighty hurricane will hit the skies of Gaza City today, and the roofs of the terror towers will shake," Israeli Defence Minister Israel Katz wrote on X.

"This is a final warning to the murderers and rapists of Hamas in Gaza and in the luxury hotels abroad: Release the hostages and lay down your weapons - or Gaza will be destroyed, and you will be annihilated."

Katz's post appeared before reports ofshooting at a bus stop in Jerusalemthat killed six people including one Spanish citizen. Hamas praised the attackers.

The Israel Defense Forces (IDF) bombed a 12-floor block in the middle of Gaza City where dozens of displaced families had been housed, three hours after urging those inside and in hundreds of tents in the surrounding area to leave.

In a statement, the IDF said Hamas militants who had "planted intelligence gathering means" and explosive devices had been operating near the building and "have used it throughout the war to plan and advance terror attacks against IDF forces".

According to a senior Israeli official, the latest U.S. proposal calls for Hamas to return all 48 remaining living and dead hostages on the first day of a ceasefire, during which negotiations would be held to end the war.

Hamas has long said it intends to hold onto at least some hostages until negotiations are complete. It said in a statement it was committed to releasing them all with a "clear announcement of an end to the war" and the withdrawal of Israeli forces.

Israel launched a major assault last month on Gaza City, where hundreds of thousands of residents are living in the ruins having returned after the city experienced the most intense fighting of the war's early weeks nearly two years ago.

Residents said Israeli forces pounded several districts from the air and ground, and detonated decommissioned armoured vehicles laden with explosives, destroying clusters of homes in the Sheikh Radwan, Zeitoun and Tuffah neighbourhoods.

Among at least 25 Palestinians reported killed in Gaza on Monday was Osama Balousha, a journalist for Palestinian media, medics said. Fifteen other people were killed in separate Israeli strikes and gunfire across the enclave, medics said, taking Monday's death toll to at least 40.

Nearly 250 journalists have been killed in Gaza duringthe war, according to Palestinian authorities, making it by far the world's deadliest war for news media in living memory. Israel bars all foreign reporters from Gaza, so all journalists killed there have been Palestinians. Palestinian officials say Israel has deliberately targeted some journalists, which Israel denies.

On Sunday, U.S. President Donald Trump suggested a deal could come soon to secure the release of all the hostages held by Hamas. An Israeli official said Israel was "seriously considering" Trump's proposal but did not elaborate.

The war began with an assault by Hamas-led fighters on southern Israel in 2023. The attackers killed 1,200 people and took more than 250 hostages to Gaza. Most of the hostages were released in ceasefires in November 2023 and January-March 2025, but the group has kept others as a bargaining chip.

Israel's assault has reduced much of the enclave to rubble and caused a humanitarian catastrophe. More than 64,000 Palestinians have been confirmed killed, according to health officials in Gaza.

Six more Palestinians, including two children, died of malnutrition and starvation in the space of 24 hours, the territory's health ministry said on Monday, raising deaths from such causes to at least 393 people, most in the past two months.

Israel, which controls all supplies into Gaza, says the extent of hunger there has been exaggerated and the reported deaths are due to other causes.

Throughout the conflict, efforts to negotiate an end to the war have faltered over Israel's insistence that Hamas free all hostages and surrender. Hamas says it will not lay down its arms until Palestinians have an independent state.

A survey conducted shortly before Indonesia saw massive protests over lawmakers’ perks found a majority of people want an opposition presence in parliament, underscoring public unease about the dominance of President Prabowo Subianto’s coalition.An Aug. 11-14 Kompas survey released Monday found that 58.4% of respondents want at least one party to counterbalance the government in the legislature, where Prabowo’s allies hold about 81% of the seats. The Indonesian Democratic Party of Struggle, or PDI-P, holds the other seats but has declared it is not an opposition, even as it remains outside the administration.

The survey helps explain why revelations of hefty lawmaker housing allowances in late August triggered massive violent demonstrations, with parliamentary buildings attacked and at least 10 people killed. The Prabowo administration, which has since agreed to scrap the controversial perks, has the largest majority since Indonesia returned to democracy after the fall of the late dictator Suharto, raising concerns about a weakening of checks and balances.The survey, which polled more than 500 respondents across 38 provinces with a margin of error of 4.2%, highlighted disappointment with political parties, with 56% of respondents saying they fail to represent their aspirations due to corruption, broken promises, and poor public engagement. The poll also found differences between supporters of different parties in the ruling coalition.

Backers of Prabowo’s own Gerindra party and those from Suharto’s Golkar favor bringing PDI-P into the bloc. Supporters of other parties see the role of PDI-P, which acted as the opposition under Suharto and former president Susilo Bambang Yudhoyono, as critical for holding the government accountable.However, PDI-P Chairperson Megawati Soekarnoputri said in an early August speech that the party was not the opposition. Days after her remarks, a close aide who had been jailed was among several people granted amnesty by Prabowo.

At least 228 protests have taken place across 35 provinces since Aug. 28, according to the Ministry of Home Affairs, though the weekend was relatively quiet.On top of losing the controversial allowances, House Deputy Speaker Sufmi Dasco Ahmad on Friday said lawmakers would face additional cuts after a review of electricity, communications, and transport costs.And in a closed-door meeting with local media, Prabowo said he was paying attention to demands circulating widely on social media, calling some reasonable and describing others as open to debate, Kompas and others local media reported.

But he repeated concerns that the protests have been excessive, accusing some people of trying to provoke anger and pit the public against the government. He also defended the presence of soldiers on city streets, citing threats of arson and terrorism, while stressing that democracy is a constitutional right.The former general vowed to enforce the law fairly, noting that some officers have been prosecuted or even dismissed. He also signaled openness to forming an independent investigative team, the media said.

Oil prices have risen as much as 1.8% at the start of the week as Oil pares last week’s losses. The rally this morning has come as a surprise to some quarters after eight OPEC + members agreed to lift output by 137,000 bpd from October.

However, the move by OPEC + was seen as more modest than expected and thus saw market participants shrug off the potential consequences. On top of that, markets are focused on the possibility of more sanctions on Russian crude.after Russia hit Ukraine with its biggest air attack since the start of the war.

For now, concerns around Russian supply are keeping Oil prices supported.

Frederic Lasserre, an expert from the energy trading company Gunvor, stated on Monday that new sanctions against countries that buy Russian oil could disrupt the global oil supply.

This comes after Russia carried out its largest air attack of the Ukraine war over the weekend, which set fire to a government building in Kyiv and killed at least four people, according to Ukrainian officials.

On Sunday, Donald Trump said that several European leaders would visit the U.S. to talk about how to solve the conflict.

Over the weekend, the investment bank Goldman Sachs released a note saying it expects a slightly larger surplus of oil in 2026. They believe that increased oil production in the Americas will be greater than the decrease in supply from Russia and the stronger demand worldwide. Goldman Sachs kept its oil price forecast for 2025 the same, and for 2026, it predicts the average price for Brent crude to be $56 a barrel and for West Texas Intermediate crude to be $52 a barrel.

OPEC+, a group of major oil producers led by Saudi Arabia, announced a surprise plan to increase oil production. Although this might seem like a risk to a market that already has too much oil, the actual effect on prices will likely be small.

The decision is more about politics. Saudi Arabia is using this to show its leadership, gain a bigger share of the market, and strengthen its relationship with the U.S.

The group agreed to gradually undo 1.65 million barrels per day of production cuts that were supposed to last until the end of 2026. They will increase their output by 137,000 barrels per day in October. At this rate, it will take them a year to fully reverse those cuts.

While the market is expected to have a surplus of oil due to increased production from countries like the U.S. and Argentina, the actual amount of new oil added by OPEC+ will probably be less than announced. This is because most members are already producing as much as they can.

However, Saudi Arabia is a major exception. It has a lot of extra production capacity, unlike Russia, which is limited by sanctions. This puts Saudi Arabia in a strong position to increase its market share, especially from U.S. oil companies that may slow down production as prices fall.

This pivot by Saudi Arabia has been something which has been building over the past few months. The strategy does seem to be a sound one and time will tell whether the Saudis will reap the benefits.

For now though, this move may keep further Oil price gains in check as oversupply concerns also remain a concern.

From a technical analysis standpoint, Oil is eyeing a recovery after last week’s selloff.

However, the fundm=amentals might continue to keep a prolonged rally in check as uncertainties continue to dominate the agenda.

Immediate resistance rests at the 100-day MA which rests at 64.65 before the 66.15 and 67.30 handles come into focus.

A move lower from current prices, could bring last week’s swing low around 61.50 before the 60.70 and the YTD low at 55.10 come into focus.

WTI Oil Daily Chart, September 8, 2025

Looking at OANDA client sentiment data and market participants are long on WTI with 89% of traders net-long. I prefer to take a contrarian view toward crowd sentiment and thus the fact that so many traders are long means WTI prices could decline in the near-term.

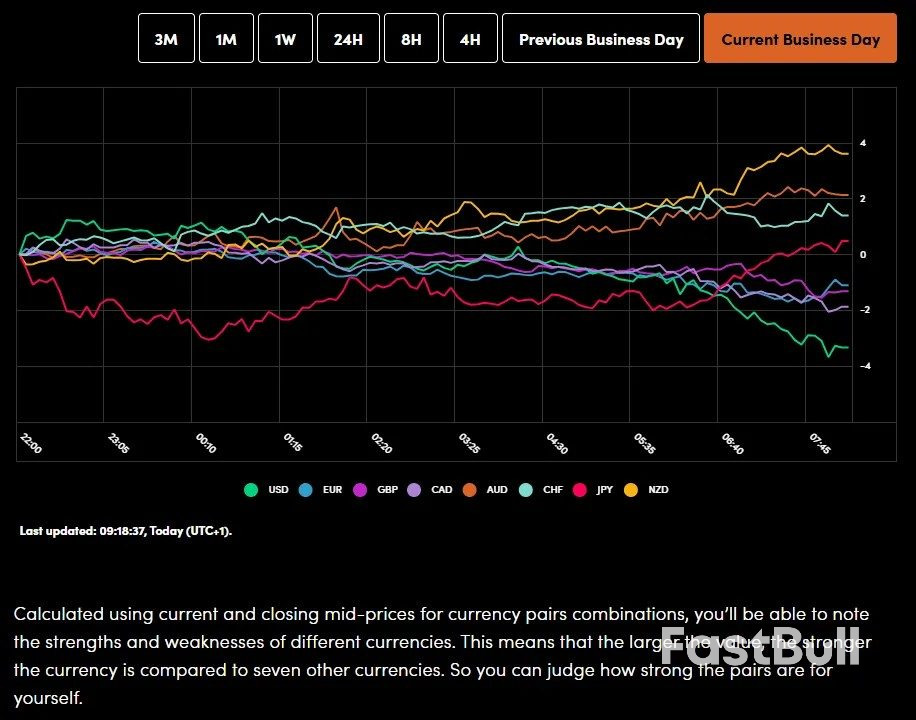

The yen eased on Monday after Japanese Prime Minister Shigeru Ishiba announced his resignation over the weekend, while the dollar was on shaky ground as Friday's weak U.S. jobs report cemented expectations of a Federal Reserve rate cut this month.

The focus for markets will also be on French Prime Minister Francois Bayrou's confidence vote later in the day, which he is expected to lose. The announcement of the vote, which Bayrou himself called, has plunged the euro zone's second-largest economy deeper into political crisis.

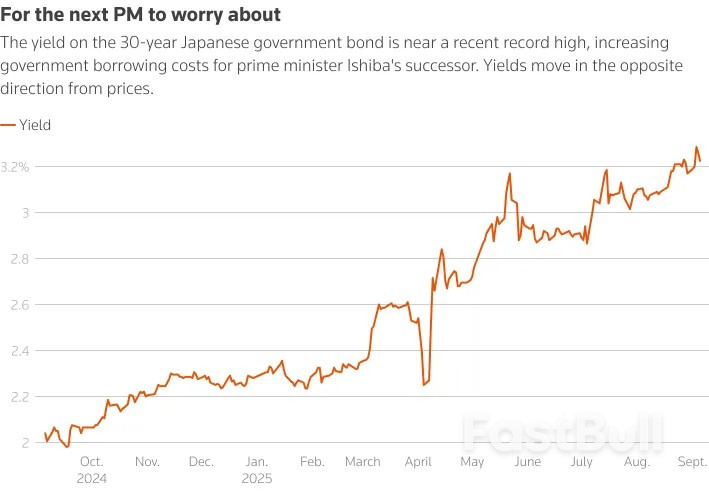

Japan's Ishiba on Sunday said he would step down, ushering in a potentially lengthy period of policy uncertainty for the world's fourth-largest economy, the most heavily indebted industrialised nation.

The yen weakened sharply in Asia trade, leaving the dollar up by as much as 0.78% at one point before steadying to trade with a 0.26% gain on the day at 147.77.

The Japanese currency similarly slid to its lowest in more than a year against the euro, which rose 0.3% on the day to 173.25 yen.

Investors are focusing on the chance of Ishiba being replaced by an advocate of looser fiscal and monetary policy, such as Liberal Democratic Party veteran Sanae Takaichi, who has criticised the Bank of Japan's interest rate hikes.

"The probability of an additional rate hike in September was never seen as high to begin with, and September is likely to be a wait-and-see," Hirofumi Suzuki, chief currency strategist at SMBC, said of the BOJ's next move.

"From October onwards, however, outcomes will in part depend on the next prime minister, so the situation should remain live."

Japanese stocks surged while government bonds (JGBs) were steady, though yields on super-long JGBs hovered near record highs.

"With the LDP lacking a clear majority, investors will be cautious until a successor is confirmed, keeping volatility elevated across yen, bonds and equities," said Charu Chanana, chief investment strategist at Saxo.

"Near term, that argues for a softer yen, higher JGB term-premium, and two-way equities until the successor's profile is clear."

The yen hardly reacted to data on Monday showing Japan's economy expanded much faster than initially estimated in the second quarter.

The dollar struggled to recoup its heavy losses after falling sharply on Friday on data that showed further cracks in the U.S. labour market.

The nonfarm payrolls report showed U.S. job growth plunged in August and the unemployment rate increased to nearly a four-year high of 4.3%.

Investors ramped up bets of an outsized 50-basis-point rate cut from the Fed later this month following the release and are now pricing in a 10% chance of such a move, as compared to none a week ago, according to the CME FedWatch tool.

Sterlingedged up 0.1% to $1.3534, having risen more than 0.5% on Friday, while the eurosteadied at $1.1725, after hitting a more than one-month high on Friday.

The dollar indexedged down 0.2% to 97.7, having tumbled more than 0.5% on Friday.

"(The payrolls report) has resulted in the dollar index falling back below support at the 98.000-level although the negative impact on the U.S. dollar is more modest than implied by the drop in short-term U.S. yields," MUFG currency strategist Lee Hardman said in a note on Monday.

"The weak nonfarm payrolls report for August has reinforced expectations that the Fed will resume cutting rates this month, and has even encouraged expectations that they could begin with a larger 50-bp rate cut similar to last September."

U.S. Treasury Secretary Scott Bessent on Friday called for renewed scrutiny of the Fed, including its power to set interest rates, as the Trump administration intensifies its efforts to exert control over the central bank.

PresidentDonald Trumpis considering three finalists to replace Fed Chair Jerome Powell, whom he has criticised all year for not cutting rates as he has demanded.

Elsewhere, the Australianand New Zealand dollarseach rose 0.5% to $0.6585 and $0.5926, respectively.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up