Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Jerome Powell, the Federal Reserve Chair, is facing a criminal referral over alleged perjury during testimony on Fed headquarters renovations. The matter could affect stability in financial markets, with potential changes influencing monetary policy direction.

What to Know:

Jerome Powell, the Federal Reserve Chair, is facing a criminal referral over alleged perjury during testimony on Fed headquarters renovations. The matter could affect stability in financial markets, with potential changes influencing monetary policy direction.

Rep. Anna Paulina Luna has initiated a criminal referral against Jerome Powell for alleged perjury concerning the $2.5 billion renovation of the Federal Reserve Building. Powell, appointed Fed Chair in 2018, allegedly misled Congress about project details, claimed Luna.

The criminal referral has prompted scrutiny of Powell's actions, though financial markets show no immediate reaction. Comments criticize the project's transparency and cost management. Powell confirmed efforts were made to oversee work carefully.

Comparatively, disputes between Fed chairs and political figures are rare, with the Nixon-era controversies being similar historical examples. If Powell's leadership ends prematurely, it could unsettle markets and incite volatility, echoing past reactions to abrupt Fed changes.

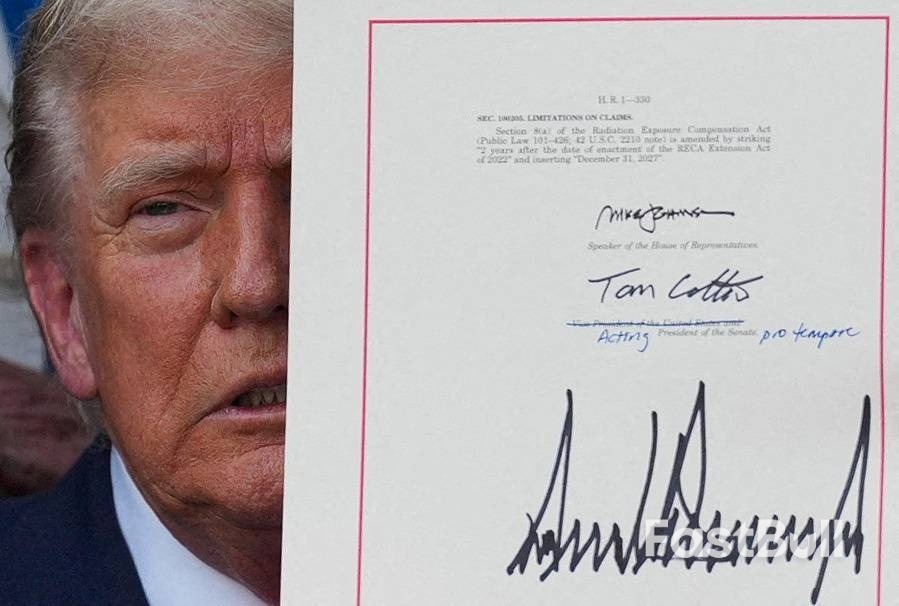

US President Donald Trump said he had reached a trade deal with Japan on Tuesday.

Under the new terms, the US will place a 15% tariff on goods imported from Japan, down from a previously threatened 25% tariff.

"This deal will create hundreds of thousands of jobs — there has never been anything like it," Trump posted on Truth Social.

He added that the United States "will continue to always have a great relationship with the country of Japan."

After Trump's post, Japanese Prime Minister Sherigu Ishiba said he was ready to meet or speak over the phone with Trump after being briefed on the details by Japan's top trade negotiator Ryosei Akazawa, who has been in Washington for talks.

When we talk about a Europe trade deal, we’re referring to the intricate economic relationship between the United States and the European Union. These two economic giants represent a substantial portion of global GDP and trade. Historically, their trade relations have been complex, marked by periods of cooperation and tension over various issues, including tariffs, subsidies, and regulatory standards. An update, especially one coming from a figure like Donald Trump, signals potential shifts that could redefine these dynamics.

Why is this significant? Consider these points:

The original report, as cited by South Korean news outlet Edaily, simply stated that an update on a trade deal with Europe would be announced. This brief statement, however, opens up a world of speculation and anticipation about what specific details might be revealed and how they could shape the future of international commerce.

Given the history of U.S.-EU trade relations, an ‘update’ could cover a wide spectrum of possibilities. It might range from minor adjustments to existing agreements to more substantial shifts in policy. Here are some potential areas an announcement could touch upon:

One of the most common points of contention in trade negotiations revolves around tariffs. During his presidency, Donald Trump often utilized tariffs as a negotiating tool. An update could signify:

Trade deals are often granular, focusing on specific sectors. An update on the Europe trade deal might highlight progress or changes in areas like:

A crucial part of any trade agreement is how disputes are resolved. An update might address modifications to existing mechanisms or propose new ones to ensure smoother trade relations and prevent prolonged conflicts.

The announcement of an update on the Europe trade deal from Donald Trump, while brief, carries substantial weight for global economics. Its implications, though indirect, are certainly relevant to the cryptocurrency market, which is increasingly sensitive to traditional financial market movements and investor sentiment. Whether it signals a period of renewed cooperation or heightened trade tensions, the details will undoubtedly shape economic narratives for the foreseeable future.

U.S. President Donald Trump on Tuesday announced a trade deal with Japan that he said will result in Japan investing $550 billion into the United States and paying a 15% reciprocal tariff.

In a post on Truth Social, Trump added that Japan will open to trade for cars, trucks, rice and certain agricultural products, among other items.

"This is a very exciting time for the United States of America, and especially for the fact that we will continue to always have a great relationship with the Country of Japan," he said.

Trump's announcement follows a meeting with Japan's top tariff negotiator, Ryosei Akazawa, at the White House on Tuesday, according the Asahi newspaper.

The newspaper also reported that Akazawa held meetings with U.S. Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent.

President Trump on Tuesday said the US had reached a trade deal with the Philippines, which will see the country's imports face a 19% tariff into the US. Trump said US exports will face no import tax in the Philippines as part of the deal.

The White House also unveiled new details of a confirmed trade agreement with Indonesia. Yahoo Finance's Ben Werschkul reports that a 19% tariff will apply to Indonesian goods, as well as a 40% rate on any “transhipped” goods. Officials said no tax would apply to "99%" of US imports.

The deal developments come as prospects for larger pacts with India and the European Union have soured. An interim deal between the US and India before an Aug. 1 deadline looks increasingly unlikely, according to Reuters. Talks remain deadlocked due to disagreements on key agricultural and dairy products.

Meanwhile, the European Union still wants a trade pact with the US, but the bloc said to be readying its counterattack as Trump plays hardball and makes a no-deal outcome more likely. EU member states are pushing for new and stringent measures to retaliate against US companies, The Wall Street Journal reported, while its officials are meeting this week to draw up a plan for reprisals.

“If they want war, they will get war,” a German official told the WSJ.

Trump is reportedly pushing for higher blanket tariffs on imports from the EU, throwing a wrench in negotiations ahead of an Aug. 1 deadline for sweeping duties to take effect. He has threatened 30% tariffs on all imports.

Last week, Trump said he would soon send letters to over 150 smaller US trade partners, setting blanket tariff rates for that large group. Trump has already sent letters to over 20 trade partners outlining tariffs on goods imported from their countries.

Earlier in July, Trump announced a 35% tariff on Canadian goods and followed that up with promises of 30% duties on Mexico and the EU. The letters have at times upended months of careful negotiations, with Trump saying he is both open to reaching different deals but also touting his letters as "the deals" themselves.

Treasury Secretary Scott Bessent on Tuesday said he expected many deals to take shape over the next several days.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up