Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Despite escalating trade tensions and widespread tariff disruptions, tech giants such as Alphabet, SK Hynix, Infosys, and global consumer brands like Nestlé and Roche delivered stronger-than-expected earnings...

Britain’s private sector lost momentum in July as the fallout from the Labour government’s first budget and a febrile global backdrop prompted firms to cut jobs and new orders, according to a closely watched survey.

S&P Global’s purchasing managers’ index slipped to 51 in July from the nine-month high of 52 the previous month. It was slightly worse than the 51.8 reading expected by economists surveyed by Bloomberg.

While the index held above the 50 threshold separating growth and contraction, S&P said July’s survey implied a tepid quarterly growth rate of just 0.1%.

It showed the UK economy struggling to shake off the twin hits of Labour’s tax-raising budget and a volatile geopolitical environment caused by Donald Trump’s US tariffs. The survey chimed with recent official data suggesting the economy slowed sharply from the bumper 0.7% growth seen in the first quarter.

“The sluggish output growth reported in July reflected headwinds of deteriorating order books, subdued business confidence and rising costs,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. He said these were “widely linked to the ongoing impact of the policy changes announced in last autumn’s budget and the broader destabilising effect of geopolitical uncertainty.”

The manufacturing output index improved to a still-stagnant score of 50, suggesting an eight-month contraction in production ended. However, the UK’s powerhouse services sector suffered a slowdown to reading of 51.2, down from 52.8.

Firms cut employment at the fastest pace in five months after being hit in April by a £26 billion ($35 billion) increase in payroll taxes and a hike in the minimum wage. S&P said this was being done through a mixture of hiring freezes and redundancies.

New orders declined after picking up in June, while export sales fell for a ninth straight month as firms delay shipments and investment decisions amid the White House’s volatile tariff announcements. Input price inflation rose, fueled by April’s jump in employment costs.

On Thursday, Brent prices rose to 68.21 USD per barrel, ending a four-day decline. The market found support from progress in trade negotiations.The US and EU are aligning their positions on a new deal that may impose 15% tariffs on most European goods, following the model of the deal already struck with Japan. This boosted optimism among market participants and eased concerns that prolonged trade disputes could harm global oil demand.

Further support came from US Department of Energy data: crude oil inventories fell by 3.2 million barrels last week – more than expected. Gasoline stocks dropped by 1.7 million barrels, while distillates rose by 2.9 million.Traders are also watching the upcoming meeting between US Treasury Secretary Scott Bessent and Chinese officials in Stockholm. The discussions will focus on extending the trade truce and may also address Chinese purchases of sanctioned oil from Russia and Iran.The Brent forecast is favourable.

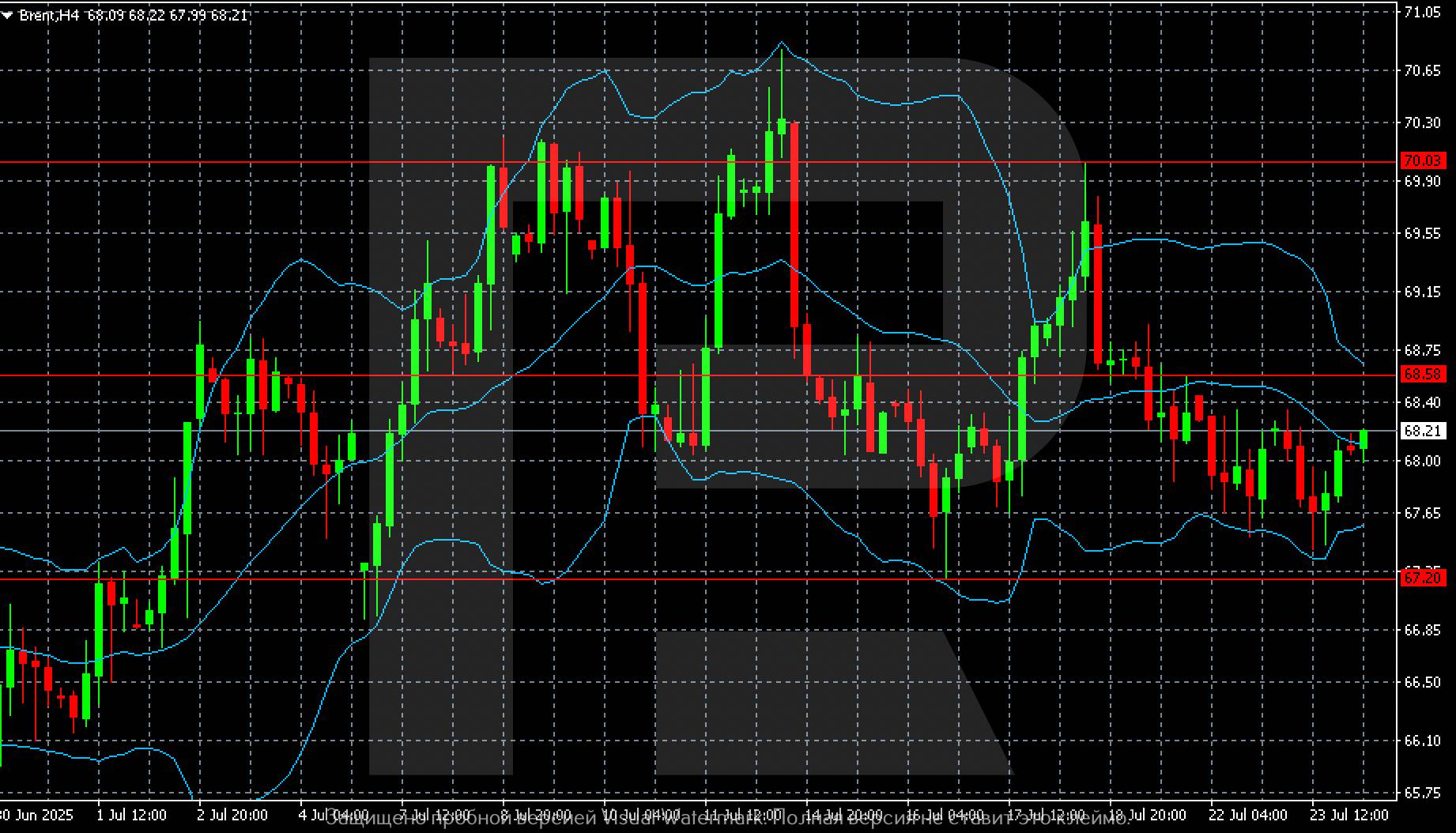

The H4 chart shows Brent trading within a sideways range with moderate volatility. After an unsuccessful attempt to break above the 70.03 resistance level between 11 and 16 July, prices pulled back and consolidated below 68.58.

The quotes currently stand near 68.21, around the middle Bollinger Band. The lower boundary of the support channel is at 67.20, which twice held back declines (on 18 and 23 July). The upper resistance boundary lies at 68.58. While prices remain between these levels, the market stays in a consolidation mode.

Technically, the movement potential remains limited: a breakout above 68.60 may open the way to 70.00, while a breakdown below 67.20 could deepen the correction. The direction will largely depend on news regarding demand and US trade negotiations with key partners.

Brent crude remains in consolidation despite the current rise. The Brent forecast for today, 24 July 2025, suggests a potential attempt to break above 68.60.

Amazon has been one of the best investments money can buy over its nearly three decades on the stock market. It's up more than 233,000% since its first-day closing price, and if you'd invested $1,000 then, you'd have more than $2.33 million today.

But the growth story isn't finished. There are many reasons to believe Amazon stock can soar some more. Here's the biggest reason why.

One theme CEO Andy Jassy mentions at almost every opportunity is the shift to the cloud. Amazon Web Services (AWS) is Amazon's cloud solutions business, and it's the largest in the world, with 30% of the market, according to Statista. It's one of the company's fastest-growing segments, up 17% in the 2025 first quarter, and it's responsible for most of Amazon's operating income -- 63% in the quarter.

However, according to Jassy, cloud services are still a small percentage of the company's information technology (IT) spend. Jassy says that 85% to 90% of IT spend is still on the premises, but over the next 10 to 20 years, that's going to switch.

If clients were already starting to make the switch before the advent of generative artificial intelligence (AI), they're even more interested now, because the cloud is where there are the greatest opportunities to engage with and benefit from AI. That's a natural growth driver for Amazon, and even more important for the bottom line.

Amazon is investing more than $100 billion in developing its AI business in 2025 alone to offer the most competitive platform and maintain its lead, and it's well-positioned to benefit from the shift to the cloud over the next decade or two. That makes its stock a buy.

Euro zone business activity accelerated faster than forecast this month, supported by a solid improvement in the bloc's dominant services industry and with manufacturing showing further signs of recovery, a survey showed on Thursday.

HCOB's preliminary composite euro zone Purchasing Managers' Index, compiled by S&P Global and seen as a good guide to growth, rose to an 11-month high of 51.0 points from 50.6 in June.

That was above the 50.0 mark separating growth from contraction and above expectations for 50.8 in a Reuters poll.

"The euro zone economy appears to be gradually regaining momentum. The recession in the manufacturing sector is coming to an end, and growth in the services sector accelerated slightly in July," said Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank.

For the first time in over a year, overall demand did not decline, though there was no expansion. The composite new business index came in bang on 50, its highest level since May 2024.

The services PMI rose to 51.2 from 50.5, exceeding the Reuters poll forecast for a more modest lift to 50.7.

Inflationary pressures eased with the services input and output prices indexes falling. The input prices index fell to a nine-month low of 56.7 from 58.1.

Inflation was at 2.0% in June, official data showed earlier this month, right where the European Central Bank wants it.

The ECB will hold policy steady later on Thursday, according to all 84 economists surveyed in a Reuters poll, while a small majority expect one more interest rate cut - most likely in September.

A manufacturing PMI, which has been sub-50 for three years, climbed to 49.8 from June's 49.5, just ahead of the poll estimate for 49.7, while an index measuring output dipped slightly to 50.7 from 50.8.

Although some of that activity was driven by completing past orders, factories did so at the slowest rate in around three years. The backlogs of work index rose to 49.0 from 47.1.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up