Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Foreign investors are returning to China’s VC scene amid AI optimism, IPO momentum, and policy support. U.S. dollar funds are rising, with strong interest in ByteDance, AI, and overseas expansion by Chinese startups.

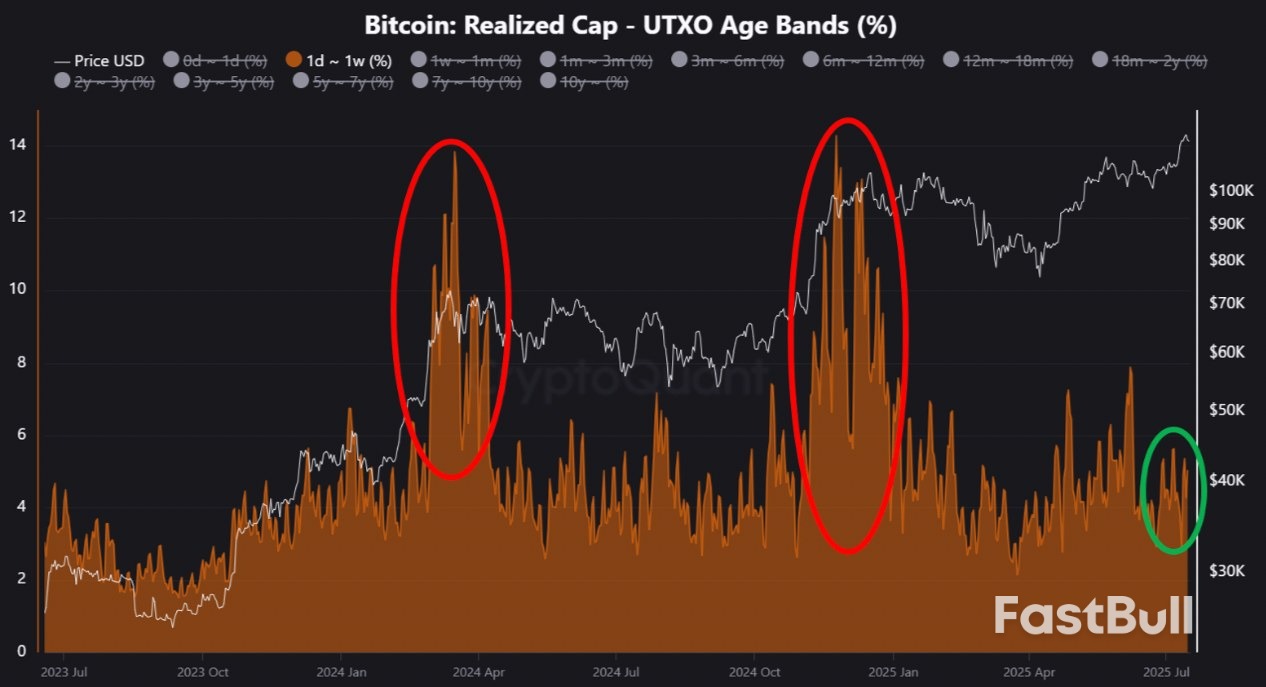

Bitcoin: Realized Cap - UTXO age bands (%). Source: CryptoQuant

Bitcoin: Realized Cap - UTXO age bands (%). Source: CryptoQuant Bitcoin STH cost basis. Source: CryptoQuant

Bitcoin STH cost basis. Source: CryptoQuant

Federal Reserve Governor Michael Barr emphasized that regulation must evolve with the financial system, issuing a warning as Trump-era officials look to ease rules for big banks and shift to a lighter touch.

“It is striking to see the pattern of regulatory weakening during a boom, including the failure of the regulatory environment to keep pace with the evolving financial sector, and how this weakening lays the foundation for a subsequent bust,” Barr said in prepared remarks for a Brookings Institution event on Wednesday.

Barr added that weakened rules often drive risk-taking and increases bank fragility during the boom, making the ensuing bust more painful.

The Fed official’s comments follow early wins for the banking industry as the new administration pursues the deregulation agenda President Donald Trump campaigned on last year. Trump’s pick for vice chair for supervision, Michelle Bowman, took her seat in June after being lauded by Wall Street for her drive to scale back rules and tailor supervision.

Bowman was nominated to be the Fed’s top bank cop after Barr resigned from that role in a bid to bypass a potential battle with Trump over his position.

Barr said booms have historically been characterized by a multitude of good things: fast economic growth, sidelined workers re-entering the workforce and financial innovations, which often make credit or investments more readily available.

He warned that at the same time, some of these same characteristics of a boom economy can sow the seeds of busts — economic activity and lending contract and asset prices decline, leading to rapid de-leveraging and dislocation throughout the financial system.

Barr said in the past insufficient thought was given to how the easing of regulation may create new weaknesses.

“A bit of humility would have helped,” Barr said.

A former senior Treasury Department official who played a key role in shaping the 2010 Dodd-Frank Act, Barr’s comments come 15 years after the sweeping regulatory reforms were enacted. Some advocates and lawmakers argue that recent attempts to relax key provisions of that law go far beyond Trump’s partial rollback during his first administration.

“It is well within our ability, and is our duty as regulators, to learn from these episodes to avoid making the same mistakes,” Barr said.

The Trump administration, Congress and the Federal Reserve are mired in a beltway clash over renovations to the central bank’s Washington headquarters. To an outside observer, this may appear to just be a fight over the cost of marble, but it could be something deeper.

Reports have surmised that the White House may be building a case to fire Fed Chair Jerome Powell for cause and replace him with someone more willing to follow the administration’s preferences in setting interest rates. That could have a profound impact on the economy and the cost of living for Americans.

At a minimum, such a move would make the Fed less effective at fulfilling its dual mandate, which is to implement monetary policy in a way that promotes full employment while keeping prices stable throughout the economy. The bigger issue is that it could backfire spectacularly if markets started to believe the Fed is taking its cues from politicians or is being forced to accommodate government borrowing.

President Donald Trump is demanding the Fed slash its target for the federal funds rate from the range of 4.25% to 4.5%. Cuts could be defensible, especially if one sees the economic weakness induced by tariffs outweighing any potential related increase in prices. Indeed, the median estimate among the Fed’s rate-setting Federal Open Market Committee is for two quarter percentage-point reductions this year and one in 2026.

But Trump has called for more than minor adjustments, demanding the Fed lower the target rate to around 1% to 2%. A major problem is that such a drastic reduction goes well beyond what would be consistent with the Fed’s dual mandate. The unemployment rate over the last three months has averaged 4.2%, which is in line with conventional estimates of full employment, while inflation as measured by the core Personal Consumption Expenditures index was 2.7% in May, above the Fed’s 2% target.

A conventional Taylor Rule would look at this unemployment rate, the still-too-high inflation rate and the FOMC’s estimate of a 1% neutral federal funds rate, and recommend nominal rates be set at around 4.1%, which is essentially only one cut below where they currently reside. If neutral was higher than the 1% the Fed predicts — a plausible scenario given what forward rates in the financial markets imply and the anticipated further rise in the government’s debt trajectory following passage of the tax and spending bill — then monetary policy may not even be tight at all. If the Fed cut to 1%, or even 2%, it would likely spur faster inflation at a time when gains in consumer prices are not even back to target in the first place.

The other problem is that a politically captive Fed would prove counterproductive to the White House’s goal of lowering the long-term interest rates that impact Americans the most when taking out mortgages, auto loans and other borrowings.

The Fed mainly has control over very short-term rates. Longer-term rates, such as those on benchmark 10-year US Treasury notes, are only indirectly affected by short rates, and respond more to investors’ perceptions of things such as future rates of inflation and economic growth. So although when the Fed cuts rates, the goal is to make borrowing cheaper, boost investment and support jobs, that only works if investors believe the central bank is acting to achieve its dual mandate and not to help politicians win elections or finance government deficits.

If investors believe otherwise, they will push up the yields they demand to own long-term bonds, lifting borrowing costs in the process. In many ways, this is the opposite of the “conundrum” faced by former Fed Chair Alan Greenspan. When the central bank lifted short-term rates under his stewardship from 1% in 2004 to 5.2% in 2006, long-term rates barely budged, mostly because investors believed the moves would contain inflation – and they did.

In other words, long-term rates can be thought of as a built-up layer cake of different expectations from market participants. The first layer is expectations for future real, or inflation-adjusted, federal funds rates set by the Fed. If the market thinks a new Chair will keep policy artificially low in the future, this layer would fall. The problem is that other layers may rise if investors see a politically captive Fed and expect more inflation than before, needing to be compensated with higher yields.

Likewise, the term premium — the additional yield investors demand for the risk of holding a long-dated security to maturity — could rise as the uncertainty of a captive Fed raises risks. As The Budget Lab described in a report last year, such a Fed erodes the safe harbor premium and makes domestic investment more expensive. This trade-off appears to be exactly the dynamic happening now. A model of the 10-year Treasury’s term structure suggests that over the past year, while expectations of future average policy rates have fallen by 80 basis points, this has been almost exactly offset by higher term premia.

Undermining trust in the Fed for short-term political gain is a recipe for higher costs and lower living standards for all Americans over time. When policymakers are less effective at achieving the central bank’s mandates, everyday Americans pay more for groceries and rent as prices rise, while also getting less than otherwise would be expected on mortgages and other loans.

The lesson of economic history is unambiguous in that a captive Fed is a less effective Fed. If the goal is lower rates of inflation and stable economic growth, it’s critical to give the Fed the independence it needs while continuing to answer to the people through Congress. Politicians should hold the Fed accountable for its performance, but should resist the urge to expediently undermine its independence in ways that impair the very goals Congress itself gave the central bank.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up