Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's producer deflation showed signs of easing in August, reflecting the success of Beijing's efforts to curb excessive competition and price cuts in key industries...

A judge temporarily blocked President Donald Trump from removing Federal Reserve Governor Lisa Cook, allowing her to remain on the job as she challenges the president’s efforts to oust her over allegations she committed mortgage fraud.In an early win for the embattled economist, US District Judge Jia Cobb in Washington granted Cook’s request to continue working for now. The ruling means Cook can likely attend a highly anticipated Fed policy meeting Sept. 16-17 to vote on whether to lower interest rates.

The Justice Department is likely to swiftly appeal the ruling and the US Supreme Court may ultimately have the final say.The judge concluded that the alleged mortgage misconduct likely didn’t amount to “cause” to fire her under the Federal Reserve Act, and that the way in which she was dismissed likely violated her due process rights under the Constitution.

“The best reading of the ‘for cause’ provision is that the bases for removal of a member of the Board of Governors are limited to grounds concerning a Governor’s behavior in office and whether they have been faithfully and effectively executing their statutory duties,” the judge wrote.Cook’s lawyer Abbe Lowell said in a statement that Cobb’s decision “recognizes and reaffirms” the Fed’s independence from political interference.“Allowing the president to unlawfully remove Governor Cook on unsubstantiated and vague allegations would endanger the stability of our financial system and undermine the rule of law,” Lowell said.

A Fed spokesperson declined to comment. The agency hasn’t taken a side in the legal fight and has said it will respect the court’s decision.The Justice Department said that it doesn’t “comment on current or prospective litigation including matters that may be an investigation.”The White House didn’t immediately respond to a request for comment on the decision Tuesday evening.

Trump said last month he was firing Cook after Federal Housing Finance Agency Director Bill Pulte accused her of fraudulently listing homes in Michigan and Georgia as a “primary residence” when she obtained mortgages in 2021 to secure more favorable terms on loans. Pulte later added a claim involving a third mortgage in Massachusetts.

Some contradicting headlines are influencing the US Dollar in a battle of wits right ahead of quintessential inflation data.Markets have been unable to provide a clear answer on how the upcoming FOMC (September 17th) and its rate cut expectations will affect the future outlook for the Dollar.The thesis had been that despite negative news (Jerome Powell’s change in tone at Jackson Hole or the recent Non-Farm Payrolls), traders have failed to sell the US Dollar convincingly, with the DXY doomed in sideways action.

The freshly released downward revisioned BLS report (bearish for the USD) and the rising tensions in the Middle East with Israel-Hamas war taking another turn (bullish for the USD) are once again prevented a clear path ahead for the Greenback.However, some interesting technical patterns might be getting into play as we approach the surely decisive pair of inflation reports in the US PPI (8:30 E.T. tomorrow) and Thursday’s CPI report.

Let’s take a look at the Dollar Index.

The upcoming PPI report should bring back memories of the previous humoungous beat in the past month (0.9% vs 0.2% exp) pushing inflation expectations higher for the consecutive University of Michigan surveys (the FED hates that).This comes as Participants started to be less and less cocnerned by tariffs and their impact.Despite hurting producers before consumers, fears are that Producer Prices increases will repercutate in upcoming CPI releases, highlighting Thursday’s number even more.

A relatively weak PPI could help to support current sentiment quite largely, indicating that the past month increase was just a one off – This should support a 50 bps cut further (Dollar down).

CPI will really be in focus however as Participants look to see if the higher producing costs have started to bite in consumers pockets.Reactions should be similar to the PPI, but their extent could be much larger: A higher inflation for Consumers should prevent a 50 bps entirely, towards more gradual cut and spark stagflation fears.

US Dollar could hence maintain its sideways movement.

Dollar Index intraday outlook

Dollar Index 4H Chart

Last week’s data has brought some renewed selling momentum as bears have managed to form a downward tight bear channel (bear candles overlapping each other).The weekly open hence formed a small gap to test the July support/pivot zone, and this morning of action actually saw a decent rebound, undoing some of the bear advantage.Arriving at a key technical standpoint, bears entering here could take the hand by rejecting the 97.60 to 97.80 range lows (break-retest style).

Keep in mind that action will be swift tomorrow (expect spikes) and prices may just dawdle around until then.

Key levels of interest for the Dollar Index:

Support Levels:

Resistance Levels:

Dollar Index 30m Chart

Looking closer to the short-timeframe, the support zone that is currently trading will be a major test for bulls.Managing to hold the lows of the current support (97.40, immediate short-term support) would indicate balanced action, which would be more in the bulls favor after failing to hold lower.On the other hand, sellers appearing at the immediate short-term resistance (97.70) could trigger break-retest selling reactions.

A breakout in any direction should see continuation.

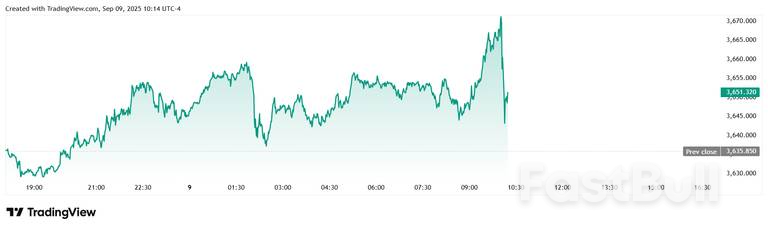

Gold prices spiked then sold off sharply after the preliminary revisions to U.S. employment subtracted nearly one million jobs – three times lower than the 10-year average and the worst print on record.

The preliminary estimate of the Current Employment Statistics (CES) national benchmark revision to total nonfarm employment for March 2025 is -911,000 (-0.6 percent), the U.S. Bureau of Labor Statistics (BLS) reported today.

The revision is 300% worse than the average over the last decade, the BLS said. “The annual benchmark revisions over the last 10 years have an absolute average of 0.2 percent of total nonfarm employment,” they wrote. Before today, 2009 saw the largest downward revision with 902,000, but today’s number is now the worst in the series’ history.

Gold prices saw significant volatility around the employment revision release, which is often a non-event, but which has added importance this year following the massive downward revisions over the previous quarter.

Spot gold spiked to a session high of $3,674.69 in the moments after the 10 am EDT release, but fell all the way to $3,643 less than ten minutes later.

Spot gold last traded at $3,651.42 per ounce, and remains up 0.43% on the daily chart.

Each year, CES employment estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW). These numbers are derived primarily from state unemployment insurance (UI) tax records.

“The preliminary benchmark revision reflects the difference between two independently derived employment counts, each subject to their own sources of error,” they said. “It serves as a preliminary measure of the total error in CES employment estimates from March 2024 to March 2025.”

The BLS said that preliminary research indicates that the overestimation of employment growth was “likely the result of two sources—response error and nonresponse error.”

“First, businesses reported less employment to the QCEW than they reported to the CES survey (response error),” they wrote. “Second, businesses who were selected for the CES survey but did not respond reported less employment to the QCEW than those businesses who did respond to the CES survey (nonresponse error).”

The final benchmark revision will be incorporated into official estimates with the publication of the January 2026 Employment Situation news release in February 2026.

Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management, told Kitco News that the revisions could hurt the broad market rally.

"The jobs picture keeps deteriorating, and while that should make it easier for the Fed to cut rates this fall, it could also throw some cold water on the recent rally," he said. "Worse still, if the CPI shows a worsening trend of higher inflation on Thursday, then the market will begin worrying about stagflation."

"The bull market has been extremely resilient this year, but we could be approaching an inflection point where it is tested again."

Oil rose for a third session after President Donald Trump told European Union officials he’s willing to slap new tariffs on India and China in an effort to get Russia to negotiate with Ukraine.

However, it came with a caveat — Trump will only impose levies if EU nations do so as well. West Texas Intermediate climbed to trade near $63 a barrel during early Asian trading, while Brent closed above $66 on Tuesday. Futures gained in the previous session after Israel conducted a strike in Doha targeting senior Hamas leadership, raising concerns about escalating tensions.

The strike marks Israel’s first attack in Qatar’s capital since the onset of the nearly two-year conflict that has roiled global oil markets. It also threatens to derail US-led peace talks between Israel and Hamas, which might have eased lingering geopolitical risk premiums in crude prices. Israel has claimed full responsibility and Trump distanced himself from the attack.

Meanwhile, Trump’s tariff proposal amounted to a challenge given that nations including Hungary have blocked more stringent EU sanctions targeting Russia’s energy sector in the past. The US president has so far hit India with crushing levies for its oil trade with Moscow, but skipped similar measures on China.

Key points:

Indonesia's Finance Minister Sri Mulyani Indrawati was chairing a meeting with top ministry officials when she received a call from President Prabowo Subianto's office informing her she would be replaced within an hour, two sources said, underscoring the abruptness of the longtime finance czar's sacking.Sri Mulyani, known for her cautious steering of Southeast Asia's largest economy that won the confidence of markets, was widely regarded as one of the few checks on Prabowo's big growth and spending promises that had unnerved many investors.

Prabowo kept her on when he took power last year in a signal of policy continuity from the largely stable reign of his predecessor, but the relationship came to a sudden end less than a year in.Two sources with direct knowledge of events leading up to Sri Mulyani's ousting on Monday told Reuters on condition of anonymity that she was in a meeting after 2:30 p.m. (0730 GMT) when she got a call from one of Prabowo's closest aides.The official announcement came less than an hour later that she had been replaced by economist Purbaya Yudhi Sadewa.

"She was supposed to have a (meeting) agenda with the president in the morning that day, but it was cancelled," said one of the sources, who is close to Sri Mulyani.Sri Mulyani and the President's office did not immediately respond to Reuters' requests for comment.It had previously been unclear if she resigned or was removed. The sources, both close to the ousted minister, one of whom was in the ministry, confirmed Sri Mulyani was asked to leave.One more government source confirmed she did not resign, but did not comment on the chain of events.

Sri Mulyani and Prabowo were peers in the cabinet of President Joko Widodo from 2019 to 2024, with the latter serving as defence minister.One of the sources said Prabowo only hired Sri Mulyani because of a push from three former presidents and to give stability to the markets.They said Sri Mulyani's prudent approach was at odds with Prabowo's big spending plans, with projects such as the ambitious - and expensive - free meals programme for 82.9 million Indonesians.

The programme will get a massive boost with a $20.7 billion budget in 2026 - almost double that of this year - while other areas such as funding for regional governments were cut to control the fiscal deficit.While Sri Mulyani - who served under three presidents across two stints as finance minister - tried to accommodate Prabowo's policies, the two barely met, the source said, as communication with the president had become increasingly difficult.The sources told Reuters Sri Mulyani was shaken after one of her homes was looted during two weeks of protests and unrest against government spending priorities and tax plans.Prabowo asked during a cabinet meeting if she was okay after the looting and she responded in the affirmative and continued in the role, two sources said, adding everything ran normally until Monday.

While it was unclear why Sri Mulyani was replaced, economists believe the two did not see eye-to-eye on fiscal matters.Earlier this year, Prabowo established a new sovereign wealth fund and appointed high-profile advisers known for risk-taking in business and investment, with the aim of strategically leveraging more of its assets to spur growth.A source in the fund, who declined to be identified, said at least one adviser told Prabowo Sri Mulyani's fiscal conservatism was not compatible with higher growth targets.

Indonesian law says the fiscal deficit cannot exceed 3% of GDP - a safeguard against the kind of economic instability that rocked the country in the late 1990s under authoritarian leader Suharto.While that law has long been respected - particularly under Sri Mulyani - many detractors see fiscal conservatism as a growth impediment, including Prabowo, who said prior to taking office that Indonesia could take on more debt.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up