Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

SocGen warns that heavy central-bank gold buying—driven largely by China—could strain the physical market and trigger a short squeeze. Opaque reserves data and rising geopolitical uncertainty amplify risks of tighter global gold supply.

Russia expects to reach its OPEC+ oil production quota by the end of 2025 or early 2026, according to Deputy Prime Minister Alexander Novak.

"I think this (will happen) in the next few months, maybe by the end of the year or early next year. We'll see how companies do," Novak told reporters on Wednesday when asked about the timeline for meeting the quota.

Russia's current quota for November stands at approximately 9.5 million barrels per day.

Novak indicated that Russia is steadily increasing oil production in November, with the growth rate slightly exceeding that of October. Last month, the country fell short of its quota by 70,000 barrels per day.

The Russian government has maintained its forecast for liquid hydrocarbon production at 510 million tons for the current year, according to Novak.

He also stated that U.S. sanctions imposed in October against Russian oil giants Rosneft and Lukoil have not affected oil production in Russia. These sanctions were implemented in response to stalled peace talks regarding Ukraine.

Novak confirmed that Russia has fully completed compensating for its previous oil overproduction under the OPEC+ agreement and does not plan to voluntarily reduce output.

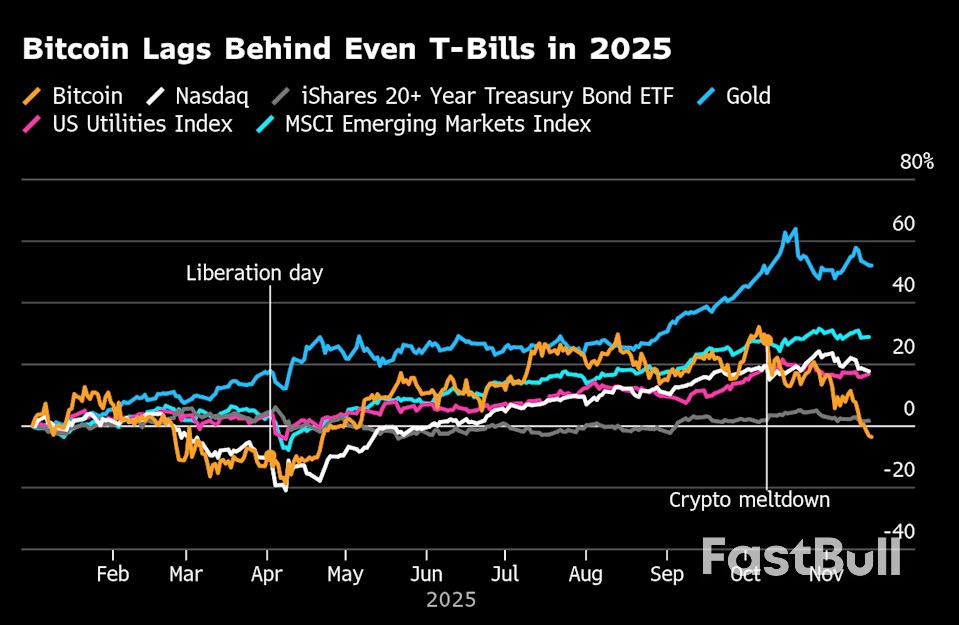

The cryptocurrency market is under pressure as traders feel the heat with Bitcoin (BTC) struggling to recover, along with Ethereum (ETH). With more than $1 trillion lost in value over the past six weeks, there have been concerns of a broader correction. Weakness in tech valuations, coupled with uncertainty over U.S. interest rate policies, has triggered broad-based selling across speculative assets.

Bitcoin slipped to $89,000 earlier today to indicate a 43-day correction, similar in duration to the drawdown in April 2025, though that lasted nearly twice as long. The top cryptocurrency currently trades at $91,591.91 with a 24-hour volume of $74.33 billion, according to CoinMarketCap.

Ethereum is also under pressure, trading just above $3,000. As of writing, the cryptocurrency was trading at $3,085.78 rising 1% in the past day, down 23% monthly.

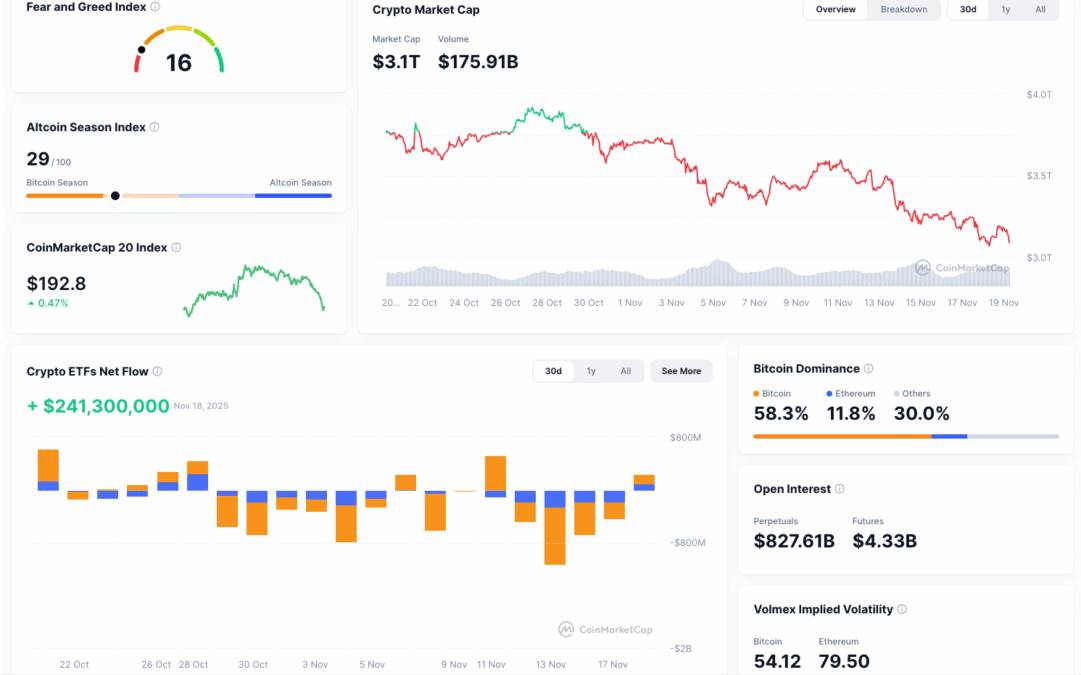

Altcoins on the other hand are having mixed performance during these volatile conditions. XRP stands at $2.14, BNB at $923.12, and Solana at $138.96, with all three up a small amount today but still down 5–13% on the week. The total cryptocurrency market capitalization stands at $3.1 trillion, with 24-hour trading volume around $163 billion.

CoinMarketCap data further shows Bitcoin still rules the crypto market, making up 58.3%, while Ethereum holds 11.8%, and all other coins share 30%. The current market drop is mostly driven by Bitcoin, but altcoins are starting to steady. Investor sentiment remains very cautious, with the Fear and Greed Index at 16, showing deep fear in the market.

Market Overview, Source: CoinMarketCap

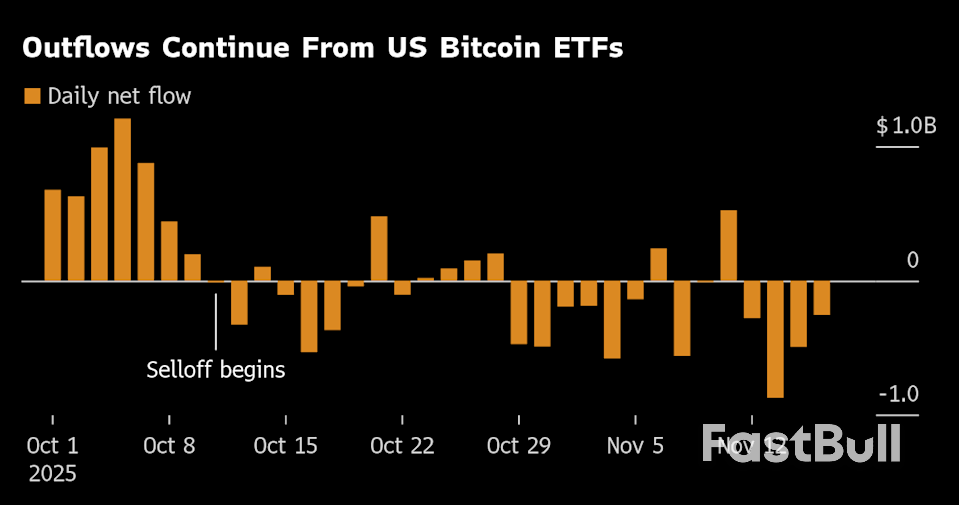

Market Overview, Source: CoinMarketCapMoreover, the Altcoin Season Index sits at 29, showing altcoins are trailing while Bitcoin grabs the most market attention. ETF activity is mixed: recent weeks saw outflows, but November 18 brought $4447 million outflows in crypto ETFs, hinting at lower institutional interest due to ongoing market swings.

Perpetual Futures markets show heavy trading, with $788.57 billion and 4.35 billion in open interest. Bitcoin's implied volatility is 53.17, Ethereum's 78.25, signaling high market risk. As analyst Bull Theory noted in his thread on X, Bitcoin's movements mostly drive altcoin declines, but signs suggest altcoins may start stabilizing soon.

Analyst Bull Theory offered more insights on unusual altcoin behavior during this correction. He explained, "BTC breaking below $90,000 for the first time in ~7 months should have destroyed altcoins. But this time, alts are not collapsing with $BTC."

According to the analyst's thread, structured institutional selling drove the initial BTC drop, followed by panic selling from retail traders. However, altcoins had already reached sellers' exhaustion, which prevented broader collapse.

He added, "Normally during a BTC crash, dominance spikes as traders run into BTC for safety. But right now, dominance is below the 50-week EMA. BTC dumping while dominance falls means alts are not being abandoned."

ETH/BTC recently lost its 50-week EMA but is now attempting recovery. This trend, combined with stronger altcoin performance, indicates that selling pressure is concentrated in Bitcoin, suggesting the market may be approaching a bottom.

Ethereum is still under pressure according to TradingView data on a 24 hour chart. Its price recently moved between $2,989 and $3,123. Technical indicator Bollinger Band, shows that volatility is shrinking and the trend is downward.

Ethereum 24 hour chart, Source: TradingView

Ethereum 24 hour chart, Source: TradingViewBollinger Bands shows price volatility using a moving average with upper and lower bands; wider bands mean higher volatility. Ethereum's price is staying near the lower band hence, it signals that selling pressure is still strong and buying interest remains weak.

MACD readings stay negative, indicating dominant bearish momentum. The indicator usually shows trend and momentum by comparing two moving averages; crossovers signal potential buy or sell opportunities, with histogram indicating strength.

Crypto analyst Crypto Patel shared insights on Ethereum, saying, "$ETH has locked in a downside BOS at $2,943 & Smart money is now pulling price into premium for mitigation. Next draw on liquidity: FVG $3,270–$3,363." Meanwhile, MACD indicators stay in negative territory, showing ongoing bearish momentum. Past recovery attempts couldn't break the middle Bollinger Band, highlighting sellers still control the market.

Bitcoin and Ether are still facing tough times, but some altcoins are holding up better than expected. Big investors mostly sold Bitcoin, leaving altcoins less affected. This pattern suggests the market might be getting closer to the end of this correction.

Financial plumbing becoming news is rarely a bullish signal. The head of the New York Federal Reserve last week called in the big institutions for an unscheduled meeting prompted by spikes in its standing repo facility — the central bank's money-market backstop.

While that brainstorming put monetary liquidity in the spotlight, the unspoken concern was leverage, especially borrowing by hedge funds.The proliferation of multi-pod hedge funds has brought about a major increase in their share of government bond trading globally.

Their use of leverage and low regulatory oversight make them potentially unstable counterparties and so threaten the stability of the benchmark markets for all other financial assets. There's been much hand-wringing over the scale of the US Treasury bond futures basis trade — a relative-value bet between a cash bond and its equivalent futures contract — but US authorities have done little to address it.

But there is a beacon of hope, and — importantly — nuance, emerging from one unlikely source: The Bank of England. The UK central bank seems to recognize whacking on more onerous regulations isn't the way to reduce systemic risk.

For example, the bank's Financial Policy Committee notes five hedge funds constitute 80% of sterling interest-rate derivatives trading, which has an umbilical financing link to the repo market. That seems crazy, but the solution is not to slam on the brakes — it's to let the trades gently unwind. Victoria Saporta, BOE executive director for markets, acknowledged in a speech on Nov. 7 in Frankfurt that hedge fund activity in the gilt market is putting upward pressure on repo rates. I warned about this in February, and it's been a full year since the BOE's system-wide exploratory scenario was published. However, wheels are finally turning.Lee Foulger, BOE director for financial stability, strategy and risk, made clear in a Nov. 12 speech that \He focused on two initiatives to counteract hedge fund dominance: Mandatory centralized repo clearing and minimum haircuts (or margining) on repo trades that are settled bilaterally. The revelation was that clearing should be tailored specifically for differing risk profiles and liquidity needs. Furthermore, he implied a one-size-fits-all approach to haircuts could easily impair liquidity for no discernible benefit, just making trading more expensive.

Slamming big margins on trades when there is a rush to unwind risk is highly likely to exacerbate a potential crisis. Similarly, cramming all trades into a centralized clearing funnel is too crude a solution. Finally, a major regulator has acknowledged that regulation can be too much of a good thing. It undoubtedly helps that Governor Andrew Bailey is also the new head of the Financial Stability Board, the global central bank forum, so the message can be uniform.

There's no longer any escaping volatility in repo markets. The Bank of Canada and the BOE have both remarked that up to half the volume in government bond auctions and repo markets is from hedge funds. The International Monetary Fund has expressed concern repeatedly. European Central Bank Executive Board member Isabel Schnabel highlighted on an X thread that even in the constrained euro government bond markets, hedge funds account for half of electronic bond trading volume.

Improving market functioning takes clear signaling from regulators, but a sensible global consensus could do a lot of heavy lifting and speed up insight into dark corners. Banks since the 2008 financial crisis have been onerously overregulated, whereas hedge funds have amazingly escaped anything like the same scrutiny — even after occasional blowups (See Archegos).Central bank regulators have to appreciate the differences between systemic risk and market arbitrage that helps finance national governments. If US Treasury cash bonds trade cheaply versus futures, then the system is simply working to exploit that anomaly. Repos act as the systemic lubricant but cross-counterparty exposure needs constant improvement to avoid another Lehman Brothers Holdings Inc. implosion.

Regulatory roadblocks thrown up out of panic or misunderstanding risk making trading more expensive and crimping liquidity. The BOE is onto something — others should listen.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up