Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

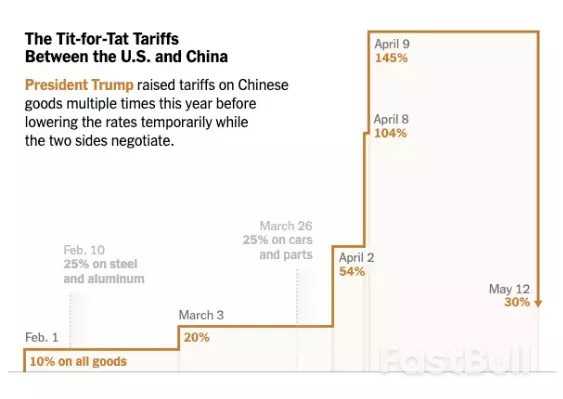

China's State Council Tariff Commission announced on May 13, 2025, that tariffs on US imports will drop from 34% to 10%, effective the following day. The move could affect economic relations.

China's State Council Tariff Commission announced on May 13, 2025, that tariffs on US imports will drop from 34% to 10%, effective the following day. The move could affect economic relations. This tariff reduction, part of a reciprocal agreement, may influence market sentiment across various sectors. Cryptocurrencies could see indirect effects due to shifts in macroeconomic confidence.

China's State Council Tariff Commission declared a significant tariff reduction on American goods. Effective May 14, 2025, the tariff rate drops from 34% to 10%, while the 24% surcharge will be suspended for 90 days. This decision aligns with a US-China trade agreement.

These tariff changes are anticipated to enhance US-China economic relations temporarily. The immediate implications include potential stabilization of trade ties and a reduction in trade-related uncertainties. Markets sensitive to US-China interactions may respond accordingly.

This adjustment may influence the broader economic environment and market sentiment, particularly for assets sensitive to US-China trade relations.

Did you know? The US and China have had a long history of trade negotiations, often impacting global markets significantly.

Market reactions have been mixed, with stakeholders monitoring potential effects. While no prominent cryptocurrency industry figures have commented publicly, the broader market sentiment might shift, impacting digital assets tethered to economic conditions between these major economies.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 14:19 UTC on May 13, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 14:19 UTC on May 13, 2025. Source: CoinMarketCapRecent developments in multiple cryptocurrency policies, such as Binance's significant new investments, could add more layers of complexity to market reactions.

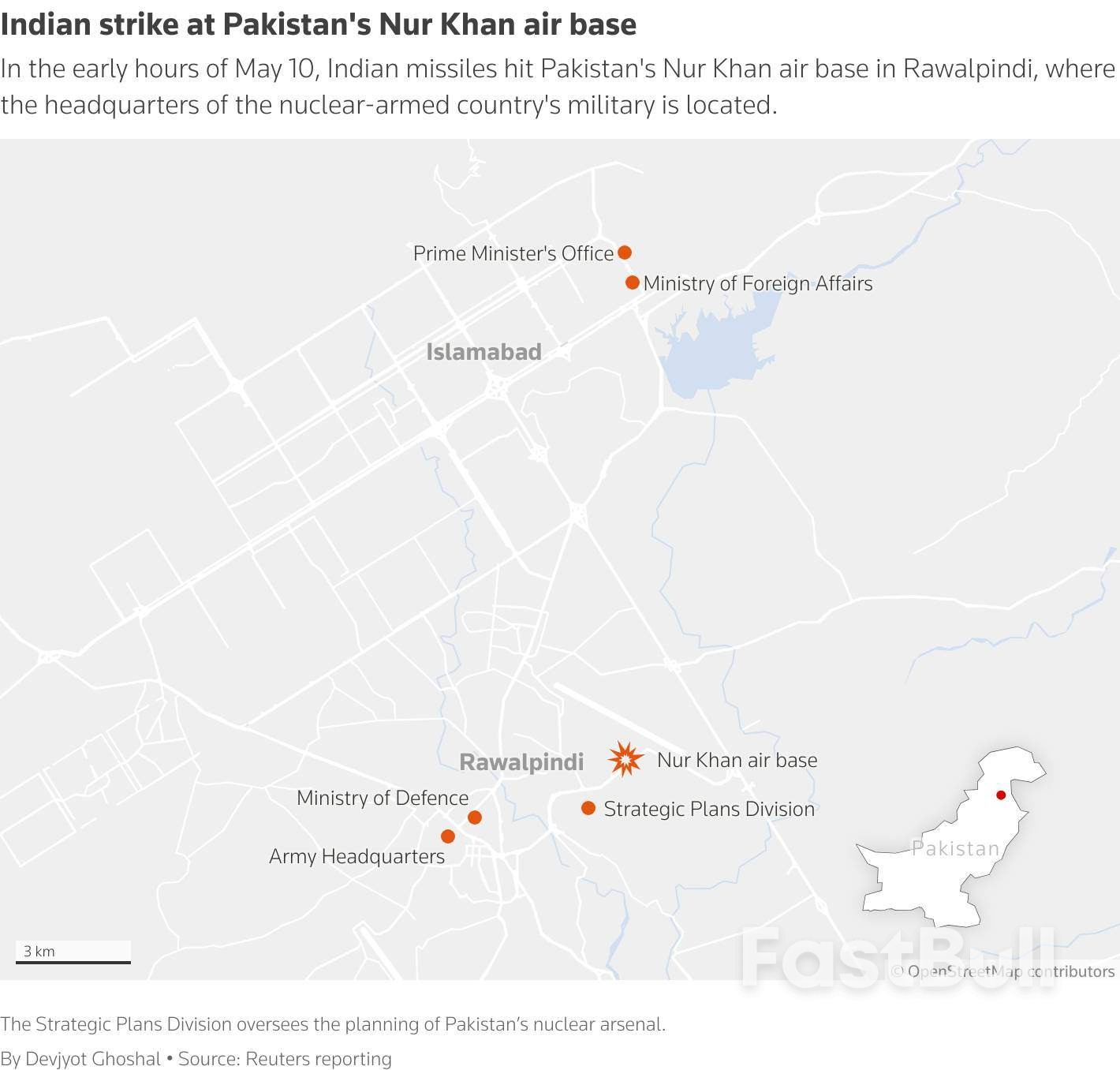

At 2.09 am on Saturday, Ahmad Subhan, who lives near an air base in the Pakistan military garrison city of Rawalpindi, heard the first explosion that rattled the windows of his house - and took South Asia to the brink of war.

As dawn broke, the heaviest fighting in decades between nuclear-armed India and Pakistan reached a crescendo, after nearly three weeks of escalating tensions.

Fighter jets and missiles crisscrossed the skies of one of the world's most populated regions. Pakistani officials said they would convene an emergency meeting of their top nuclear decision-making body.

The critical eight-hour window also saw Indian missile barrages on three major Pakistan air bases and other facilities, including Nur Khan, which is ringed by civilian homes like Subhan's, and just a 20-minute drive to the capital, Islamabad.

After the initial blast, Subhan and his wife grabbed their three children and ran out of their home. "We were just figuring out what had happened when there was another explosion," said the retired government employee, who remembered the precise time of the strike because he was just about to make a call.

This account of Saturday's events - which began with the looming specter of a full-blown war and ended with an evening cease-fire announcement by U.S. President Donald Trump - is based on interviews with 14 people, including U.S., Indian and Pakistani officials, as well as Reuters' review of public statements from the three capitals.

They described the rapid escalation of hostilities as well as behind-the-scenes diplomacy involving the U.S., India and Pakistan, and underscore the key role played by Washington in brokering peace.

The attack on Nur Khan air base saw at least two missile strikes as well as drone attacks, according to Subhan and two Pakistani security officials, who like some of the people interviewed by Reuters, spoke on condition of anonymity.

The barrage took out two roofs and hit the hangar of a refuelling plane, which was airborne at the time, according to one of the officials, who visited the base the next day.

A senior Indian military officer, however, told reporters on Sunday that an operation command center at Nur Khan had been hit.

"The attack on Nur Khan... close to our capital, that left us with no option but to retaliate," Pakistan Foreign Minister Ishaq Dar told Reuters.

Nur Khan is located just over a mile from the military-run body responsible for Pakistan's nuclear planning.

So, an attack on the facility may have been perceived as more dangerous than India intended - and the two sides shouldn't conclude that it is possible to have a conflict without it going nuclear, said Christopher Clary, an associate professor at the University at Albany in New York.

"If you are playing Russian roulette and pull the trigger, the lesson isn't that you should pull the trigger again," said Clary.

India's defense and foreign ministries, as well as Pakistan's military and its foreign ministry, did not immediately answer written questions submitted by Reuters.

A U.S. State Department spokesperson did not directly respond to questions from Reuters about the American role, but said that further military escalation posed a serious threat to regional stability.

In the early hours of May 10, Indian missiles hit Pakistan's Nur Khan air base in Rawalpindi, where the headquarters of the nuclear-armed country's military is located.

India and Pakistan have fought three major wars and been at loggerheads since their independence. The spark for the latest chaos was an April 22 attack in Indian Kashmir that killed 26 people, most of them tourists. New Delhi blamed the incident on "terrorists" backed by Pakistan, a charge denied by Islamabad.

It was the latest of many disputes involving Kashmir, a Himalayan territory ravaged by an anti-India insurgency since the late 1980s. Both New Delhi and Islamabad claim the region in full but only control parts of it.

Hindu-majority India has accused its Muslim-majority neighbor of arming and backing militant groups operating in Kashmir, but Pakistan maintains it only provides diplomatic support to Kashmiri separatists.

After a go-ahead from Prime Minister Narendra Modi, the Indian military on May 7 carried out air strikes on what it called "terrorist infrastructure" in Pakistan, in response to the April attack in Kashmir.

In air battles that followed, Pakistan said it shot down five Indian aircraft, including prized Rafale planes New Delhi recently acquired from France. India has indicated that it suffered losses and inflicted some of its own.

Senior U.S. officials became seriously concerned by Friday, May 9 that the conflict was at risk of spiralling out of control, according to two sources familiar with the matter.

That evening, Modi took a call from Vice President J.D. Vance, who presented a potential off-ramp to the Indian prime minister that he described as a path the Pakistanis would also be amenable to, the people said.

Vance's intervention came despite him saying publicly on Thursday that the U.S. was "not going to get involved in the middle of war that's fundamentally none of our business."

The sources didn't provide specifics but said that Modi was non-committal. One of the people also said that Modi told Vance, who had been visiting India during the Kashmir attack, that any Pakistani escalation would be met by an even more forceful response.

Hours later, according to Indian officials, that escalation came: Pakistan launched attacks on at least 26 locations in India in the early hours of May 10.

Pakistan said their strikes occurred only after the pre-dawn Indian attack on its air bases, including Nur Khan.

A little over an hour after that Indian attack began, Pakistan military spokesman Lt. Gen. Ahmed Sharif Chaudhry confirmed Indian strikes on three air bases.

Some Indian strikes on Saturday, May 10 also utilized the supersonic BrahMos missile, according to a Pakistani official and an Indian source. Pakistan believes the BrahMos is nuclear-capable, though India says it carries a conventional warhead.

By 5 a.m. local time on Saturday, Pakistan's military announced it had launched operations against Indian air bases and other facilities.

About two hours later, Pakistani officials told journalists that Prime Minister Shehbaz Sharif had called a meeting of the National Command Authority, which oversees the nuclear arsenal.

Dar told Reuters on Tuesday that any international alarm was overblown: "There was no such concern. There should not be. We are a responsible nation."

But signalling an intention to convene NCA reflected how much the crisis had escalated and "may also have been an indirect call for external mediation," said Michael Kugelman, a Washington-based South Asia expert.

About an hour after the NCA announcement, the U.S. said Secretary of State Marco Rubio had spoken to Pakistan Army Chief Gen. Asim Munir - widely regarded as the most powerful man in that country - and was pushing both sides to de-escalate.

Rubio also soon got on the phone with Dar and Indian Foreign Minister S. Jaishankar.

"Rubio said that Indians were ready to stop," Dar told Reuters. "I said if they are ready to stop, ask them to stop, we will stop."

An Indian official with knowledge of Rubio's call with Jaishankar said that Rubio passed on a message that the Pakistanis were willing to stop firing if India would also cease.

Pakistan Defense Minister Khawaja Muhammad Asif, who only days earlier warned of conflict, dialled into a local TV news channel at around 10:30 am on Saturday.

Two-and-a-half hours after Pakistani officials shared news of the NCA meeting, Asif declared that no such event had been scheduled, putting a lid on the matter.

The international intervention anchored by Rubio paved the way to a cessation of hostilities formalized in a mid-afternoon phone call between the Directors General of Military Operations (DGMO) of India and Pakistan. The two spoke again on Monday.

Pakistan Lt. Gen. Chaudhry said in a briefing that New Delhi had initially requested a call between the DGMOs after the Indian military's May 7 strikes across the border.

Islamabad only responded to the request on Saturday, following its retaliation and requests from international interlocutors, according to Chaudhry, who did not name the countries.

Almost exactly 12 hours after Pakistan said it had launched retaliatory strikes against India for hitting three key air bases, Trump declared on social media there would be a cessation of hostilities.

"Congratulations to both Countries on using Common Sense and Great Intelligence," he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up