Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China's economy grew 4.8% in Q3 2025, the slowest pace in a year, but officials remain confident in reaching the full-year growth target of around 5% thanks to strong exports and new fiscal support...

WHERE WE STAND – A rather famous old market adage is ‘there's nothing like price to change sentiment'. I might change that a bid, to ‘there's nothing like a TACO to change sentiment'.Yes, that's right, after participants spent the back end of Thursday brushing up on funding markets and fretting (unnecessarily) about the state of US regional banks, a couple of positive trade-related snippets from ‘The Donald', and signs of easing money market stress stateside, were good to spark a bout of optimism as we moved into the weekend.

Fine, conditions were still incredibly choppy, and yes it wasn't as if the risk-on vibe that took hold was the most convincing of things that you're ever going to see, but at least participants appear to no longer be pointlessly worrying about insignificant financial institutions that nobody has ever heard of, and re-focusing on what remains a constructive setup for risk assets as we move towards year-end.I'll get to that in a second, but first just want to touch on the banking sector. Last week's jitters appeared to stem from a couple of relatively small banks writing off bad loans – one of these was Zions Bancorp, who took a $50mln write-down on a fraudulent loan, but have a $90bln (with a ‘B'!) balance sheet, which at best makes that seem ‘small beer'.

In many ways, those jitters last week were a bit of a ‘perfect storm', with idiosyncratic loan write-downs coinciding with sizeable funding pressures stemming from the California tax filing deadline, as well as Treasury auction settlements, thus creating notable tightness in funding markets. Said tightness subsided on Friday, with no institutions tapping the Fed's SRF, while in any case the Fed are alert to the lack of ‘wriggle room' that they now have, with RRP usage basically zero, and Chair Powell having already flagged that balance sheet run-off will probably wrap up sooner rather than later. December is the base case on that front, though risks skew towards it happening sooner.

Anyway, markets already appeared on surer footing as those fears subsided, before we got a ‘TACO' for lunch to help steady things up even more. That, of course, came by virtue of comments from President Trump, who continued to dial down the rhetoric in terms of US-China trade tensions, confirming that he will be meeting President Xi in a fortnight, that high tariffs on Chinese goods are ‘not sustainable', and again noting that things will be ‘fine' with China in due course. Treasury Sec Bessent confirming he'll meet his Chinese counterpart this week provided a bit of a helping hand as well.

Given the above, equities on Wall St ended the week in the green, with this rally resulting in the major benchmarks notching a weekly gain, despite what was quite the rollercoaster ride over the last five days. Though conditions have clearly been turbulent, I remain an equity bull, with earnings growth solid, underlying economic growth resilient, the monetary backdrop becoming looser, the present round of trade tensions likely to soon be de-escalated, corporate buybacks being on the verge of resuming, as well as the typical FOMO/FOMU buying into year-end. All that feels like a very powerful force that I'd not want to fight.

Speaking of powerful forces, relentless selling pressure was felt across the precious metals complex as the week wrapped up, with spot gold falling back towards $4,200/oz, and spot silver notching its biggest one-day drop in half a year. It must be said that there wasn't anything especially obvious to drive these moves, besides perhaps a combination of fading haven demand coupled with an unwind of relatively fresh momentum-based longs, in a market that had undoubtedly come a very long way, in a very short space of time.

I'm not going to sit here and call a ‘top' in the complex, not least considering that the bull case which has underpinned a 60% YTD gain in gold, and near-80% YTD gain in silver, continues to hold water, amid the risk of inflation expectations un-anchoring, continued runaway DM fiscal spending and, most importantly, incredibly high levels of physical demand. That said, if Friday's moves were to prove the start of a pullback in this uptrend, you'd initially be looking for support at $4,000/oz in gold, and $50/oz in silver, where I'd be keen to buy into any dips – one to keep on the radar for the week ahead.

Speaking of buying dips, I was reassured by the way in which the dollar not only snapped a 3-day losing run as the week wrapped up, but how the DXY held above both the 50- and 100-day moving averages as well. Although conditions in the G10 FX space have become akin to watching paint dry in recent weeks, the Fed's ‘run it hot' approach skews risks towards us returning to the RHS of the ‘dollar smile' as risks to the US economic outlook increasingly tilt to the upside.

That same approach, though, should tilt risks to Treasuries, especially at the long-end, to the downside as well, however that's not a call I'd have especially much conviction in for the time being, not least until we can be confident that sentiment is on much steadier footing.

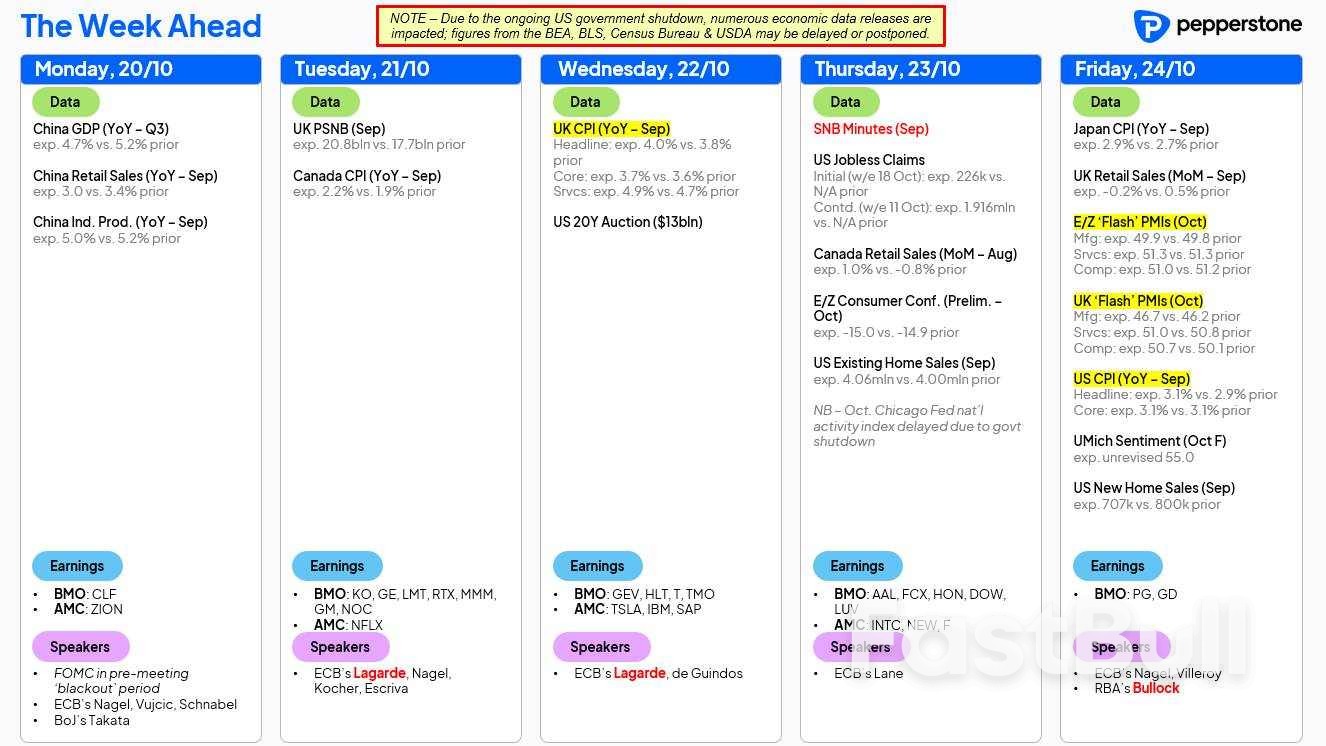

LOOK AHEAD – As the US government shutdown rolls on, the economic calendar remains something of a mess, with market participants continuing, by and large, to operate in a data vacuum.

That said, we will at least get the September US CPI figures this week, with that print on Friday highlighting the data docket. Both headline and core CPI are seen having risen by 3.1% YoY last month, as tariff-induced price pressures continue to make themselves known, though it's very tough indeed to imagine the data materially altering the Fed policy outlook, with 25bp cuts this month, and in December, effectively locked in amid mounting downside labour market risks.For those curious, the CPI data is being released due to it being required in calculating the annual Social Security cost of living adjustment, no other BLS-calculated figures will be released until the shutdown comes to an end.

Elsewhere, we also get inflation figures from here in the UK this week, with headline CPI seen having risen to 4.0% YoY in September, and services CPI pushing 5.0% YoY once more. The BoE expect that this will be the peak in price pressures this cycle, though are unlikely to take any more steps to remove policy restriction until they are sure of that fact, meaning my base case is now that the ‘Old Lady' stands pat until delivering a 25bp cut next February. Meanwhile, ‘flash' PMIs from pretty much every major economy, as well as Canadian inflation, and US consumer sentiment are also due.

From a policy perspective, the FOMC are now (mercifully!!) in the pre-meeting ‘blackout' period, though plenty of ECB speakers will fill that particular void. We also receive the first ever set of minutes from an SNB decision this week, where comments on the valuation of the CHF are likely to be of particular interest.Earnings season also steps up a gear this week, with 90 S&P 500 set to report this week, including notable releases from the likes of Netflix (NFLX), Tesla (TSLA), and Intel (INTC).Finally, focus will of course also remain on incoming trade and tariff news flow, especially with Treasury Secretary Bessent meeting his Chinese opposite number in Malaysia at some point this week.

As always, the full week ahead calendar is below.

Renewables specialist FairWind is set to boost its Asia-Pacific (APAC) presence and accelerate global growth by reaching agreement to acquire Cosmic Group, a leading Australian wind installation and maintenance provider.This strategic acquisition reinforces the company's existing presence in Australia and expands its footprint into New Zealand and Japan. The transaction is expected to close in Q4 subject customary regulatory approval, and will see the Brisbane-based business and its team of 100 technicians become part of FairWind.

Together with Cosmic, FairWind will be able to leverage local expertise while aligning the team with its global systems, standards, and strategic direction. The business will become the regional hub for FairWind's APAC operations with one of its founders, Matt Crossan, appointed as Regional Director. Cosmic, will continue to operate under the Cosmic name - ensuring continuity for its existing projects and clients.Stewart Mitchell CEO FairWind said: "This collaboration with Cosmic is a significant step in our growth strategy. There are great synergies between the two organisations, with shared values and unwavering commitment to safety. By joining forces with a team known for delivering to the highest standards, we're extending our geographic reach while strengthening our capability to support customers wherever they operate.

"Together, our deep technical expertise and track record in onshore and offshore wind create a powerful platform in our mission to help advance the global energy transition. We look forward to working closely together and unlocking new opportunities across the region's renewables landscape."Matt Crossan commented: "With the installed turbine base set to continue to increase and the next generation of wind turbines being introduced to the region by our customers, there is significant potential for growth across Asia Pacific.

"We are proud of what we have built at Cosmic to become one of the leading wind services providers, by joining FairWind we have a partner who enhances our existing capability and we are excited for the next phase of the business."FairWind has a workforce of more than 2,000 people in more than 40 countries across Europe, North America, South America, Asia, and Oceania. The business provides complete lifecycle solutions for the installation and maintenance of onshore and offshore wind turbines around the world.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up