Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China deepened a trade spat with Canada, filing a lawsuit at the World Trade Organization over import restrictions on steel just days after slapping fresh duties on Canadian canola.

China deepened a trade spat with Canada, filing a lawsuit at the World Trade Organization over import restrictions on steel just days after slapping fresh duties on Canadian canola.

The WTO case targets tariffs and quotas on steel launched by Canada last month. Those measures were “typical trade protectionism” that disregarded China’s legitimate rights and interests and flouted WTO rules, China’s Ministry of Commerce said in a statement on Friday.

“We urge Canada to take immediate action to correct its erroneous practices, uphold the rules based multilateral trading system, and promote the continuous improvement of China-Canada economic and trade relations,” the ministry said.

Trade tensions between the two sides spiked last year, after Canada opened trade measures against not just steel, but also aluminum and electric vehicles. On Tuesday, Beijing announced preliminary anti-dumping tariffs against Canadian canola seed, after putting a 100% tariff on canola oil and meal in March.

Canadian Prime Minister Mark Carney is trying to reduce the amount of imported steel largely as an aid to domestic producers hurt by US President Donald Trump’s levies on the sector.

Countries without a free-trade agreement with Canada — including China — can ship half of last year’s volumes, with a 50% tariff applying to any additional tons. China was subject to an additional 25% tariff on all steel “melted and poured” in China prior to the end of July.

Canada accounted for about 0.6% of China’s total steel exports in 2024, according to Bloomberg Intelligence.

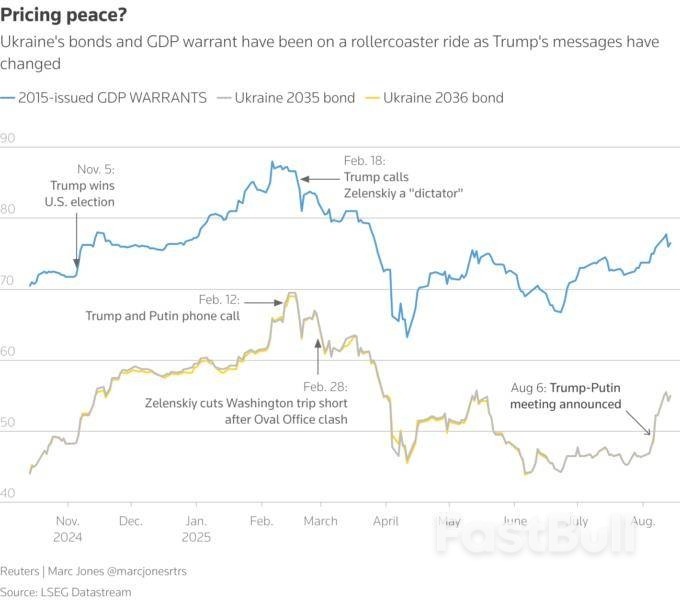

Investors are tempering expectations thatFriday's summitbetween U.S. PresidentDonald Trumpand Russia'sVladimir Putinwill deliver a significant breakthrough on thewar in Ukrainedespite some hopeful signs.

Ukraine's government bonds - key indicators of the mood - rallied when news of the summit emerged this month but have largely stalled at a still-distressed 55 cents on the dollar amid the pre-meeting posturing.

Trump himself said it will be more of a "listening exercise" although he hopes it will go well enough for another involving Ukraine's President Volodymyr Zelenskiy soon afterwards - and threatened "severe consequences" if it doesn't.

Europe's leaders meanwhile have been encouraged by Trump's signals on participating in security guarantees, while Putin has praised Trump for "sincere efforts" to stop the hostilities.

Kathryn Exum, an analyst at emerging market-focused fund Gramercy, said the fact Ukraine's bonds remain well below the highs they hit when Trump regained the White House despite their near 20% rally this month reflected limited market expectations.

"The bar is pretty high for any meaningful progress given the red lines of the parties seem deeply entrenched," Exum said.

"I think the market is pricing in a symbolic truce," such as on long-range missiles and drones, she added. "Ultimately though it doesn't change the game for any side."

Diliana Deltcheva, head of emerging market debt at Robeco, said EU leaders' calls with Trump on Wednesday, when he offered a potentially significant but vague security offer, were a "modest positive".

But she too thinks Friday's summit, which is due to start at around 11 a.m. Alaska time (1900 GMT), is unlikely to yield substantive progress.

"We had a small overweight (in Ukraine bonds) but now we have neutralised it," Deltcheva said. "From our position, it is too difficult to call the situation ... there have been too many false starts."

Ukraine's massive funding needs mean it may require another debt restructuring at some point too, she added.

Analysts at U.S. investment bank JPMorgan said the chances for a peace deal this year remained "insignificant" and that even a full ceasefire appears unlikely.

Geopolitical analyst at research firm TS Lombard, Christopher Granville, however, thinks whatever its ostensible outcome, Friday's meeting will mark the "definitive start of the concluding phase of the Ukraine war".

"One way or the other, the situation is on a quickening path," Granville said. Either the sides would find a path towards a lasting ceasefire, or the war would ratchet up and ultimately force the issue.

Ukraine's bonds, part of a $20 billion restructuring last year, inched up on Friday, leaving them just below the five-month highs they hit earlier in the week (XS2895057177=TE), (XS2895057334=TE).

Oil and gas prices have fallen over the last fortnight too, traders say, on hopes of a post-summit "peace dividend" that could avoid costly so-called "secondary" tariffs targeting major Russia crude buyers like India and China or even pave the way for the U.S. and Russia to start drilling in the Arctic.

Investment bank surveys show the majority of fund managers have a small "overweight" position on Ukraine's bonds, although it has been reducing over the last six months.

Gramercy's Exum said investors remain wary because Trump has repeatedly changed tack on the war.

His trolling of Zelenskiy as a "dictator" in February and the ugly Oval Office clash shortly afterwards, constituted "a wakeup call" for overly optimistic investors, she said.

Robeco's Deltcheva described that meeting as "traumatising", both in terms of the human aspect and for assumptions around the U.S. position.

"We all saw how Zelenskiy got treated and how Trump's opinion changed," which, she said, made it more difficult for investors to rely on Trump's stance.

If Friday's discussion surprises on the positive side though, "then we will probably have to react," she said.

JPMorgan's analysts meanwhile predicted Poland, Hungary and the Czech Republic's currencies could surge as much as 4% if a full ceasefire happens, or drop 1% if the summit proves a flop.

Chinese steel and coal output fell in July, as bad weather affected operations and the government’s efforts to rein in overcapacity intensified.Both industries are in the crosshairs of Beijing’s campaign to control supply and halt ruinous competition, which has taken on much greater urgency as deflationary pressures mount in the economy.Steel production dropped 4% year-on-year to less than 80 million tons, it’s lowest this year and a third monthly decline in a row. The fall was less steep than in May and June as reduced supply helped lift margins. Still, output over the first seven months has fallen 3.1% from last year to its weakest level since 2020.

Coal output fell 3.8% to just over 380 million tons, marking its first year-on-year decline in over a year, although production for the first seven months was still at record levels.While industrial demand for commodities is in a seasonal lull, the weather was also factor, as scorching temperatures and heavy rains forced mines, factories and building sites to curtail activity up and down the country. The coal hubs of northern China, in particular, were heavily affected by downpours that closed pits and disrupted transport.

The coal industry is also contending with government inspections targeting mines that produce above permitted levels. Meanwhile, pollution curbs to ensure blue skies for next month’s military parade in Beijing are likely to keep the pressure on steel output, a large proportion of which is clustered around the capital.Thermal coal producers are shielded from swingeing cuts to production due to the country’s reliance on the fuel for power generation, which has spiked over the summer as temperatures have soared. But the steel industry — and the miners that deliver coking coal for its blast furnaces — have much less protection.

The collapse in China’s property market has stripped back a key pillar of demand. Bloomberg Intelligence estimates that excess steel capacity last year was 142 million tons, almost four times the level in 2020. A boom in exports has taken up some of the slack, but rising protectionism around the world is likely to cap sales.

Donald Trump and Vladimir Putin hold talks in Alaska on Friday, focused on the U.S. president's push to seal a ceasefire deal on Ukraine but with a last-gasp offer from Putin of a possible face-saving nuclear accord on the table too.

The meeting of the Russian and U.S. leaders at a Cold War-era air force base in Alaska will be their first face-to-face talks since Trump returned to the White House. Ukrainian President Volodymyr Zelenskiy, who was not invited to the talks, and his European allies fear Trump might sell Kyiv out and try to force it into territorial concessions.

Trump is pressing for a truce in the 3-1/2-year-old war that would bolster his credentials as a global peacemaker worthy of the Nobel Peace Prize.

For Putin, the summit is a big win before it even starts as he can use it to say that years of Western attempts to isolate Russia have unravelled and that Moscow has been returned to its rightful place at the top table of international diplomacy. He has also long been keen to talk to Trump face-to-face without Ukraine.

The White House said the summit will take place at 11 a.m. Alaska time (1900 GMT).

Trump, who once said he would end Russia's war in Ukraine within 24 hours, conceded on Thursday that the conflict, Europe's biggest land war since World War Two, had proven a tougher nut to crack than he had thought.

He said that if his talks with Putin went well, quickly setting up a subsequent three-way summit with Zelenskiy would be even more important than his encounter with Putin.

One source close to the Kremlin said there were signs that Moscow could be ready to strike a compromise on Ukraine. Russian Foreign Minister Sergei Lavrov, a veteran of Russian diplomacy and part of its Alaska delegation, said Moscow never revealed its hand beforehand.

Ukraine and its European allies were heartened by a call on Wednesday in which they said Trump had agreed Ukraine must be involved in any talks about ceding land. Zelenskiy said Trump had also supported the idea of security guarantees for Kyiv.

Putin, whose war economy is showing some signs of strain, needs Trump to help Russia break out of its straitjacket of ever-tightening Western sanctions, or at the very least for him not to hit Moscow with more sanctions, something the U.S. president has threatened.

The day before the summit, the Russian president held out the prospect of something else he knows Trump wants - a new nuclear arms control agreement to replace the last surviving one, which is due to expire in February next year.

Trump said on the eve of the summit that he thought Putin would do a deal on Ukraine, but he has blown hot and cold on the chances of a breakthrough. Putin, meanwhile, praised what he called "sincere efforts" by the U.S. to end the war.

The source close to the Kremlin told Reuters it looked as if the two sides had been able to find some common ground.

"Apparently, some terms will be agreed upon ... because Trump cannot be refused, and we are not in a position to refuse (due to sanctions pressure)," said the source, who spoke on condition of anonymity because of the matter's sensitivity.

They forecast that both Russia and Ukraine would be forced to make uncomfortable compromises.

Putin has so far voiced stringent conditions for a full ceasefire, but one compromise could be a truce in the air war.

Analysts say Putin could try to look like he's giving Trump what he wants while remaining free to escalate.

"If they (the Russians) are able to put a deal on the table that creates some kind of a ceasefire but that leaves Russia in control of those escalatory dynamics, does not create any kind of genuine deterrence on the ground or in the skies over Ukraine... that would be a wonderful outcome from Putin's perspective," said Sam Greene, director of Democratic Resilience at the Center for European Policy Analysis.

Zelenskiy has accused Putin of playing for time to avoid U.S. secondary sanctions and has ruled out formally handing Moscow any territory.

Trump has said land transfers could be a possible way of breaking the logjam.

Putin, whose forces control nearly one fifth of Ukraine, wants to start reviving the shrunken economic, political and business ties with the U.S. and, ideally, for the U.S. to decouple that process from Ukraine.

But it is unclear whether Putin is willing to compromise on Ukraine. In power for a quarter of a century, the Kremlin chief has staked his legacy on securing something he can sell at home as a victory.

Chief among his war aims is complete control over the Donbas region in eastern Ukraine, which comprises the Donetsk and Luhansk regions. Despite steady advances, around 25% of Donetsk remains beyond Russian control.

Putin also wants full control of Ukraine's Kherson and Zaporizhzhia regions; NATO membership to be taken off the table for Kyiv; and limits on the size of Ukraine's armed forces.

Ukraine has said these terms are tantamount to asking it to capitulate.

The US dollar slipped on Friday as investors remained cautious about the rate outlook ahead of import price data, after recent figures suggested inflation could accelerate in the coming months.

The yen outperformed the euro and the pound after surprising strong Japanese growth datawhich showed export volumes held up well against new US tariffs.

All eyes will be on a meeting in Alaska later on Friday between US President Donald Trump and his Russian counterpart Vladimir Putin, though hopes of sealing a ceasefire agreement on Ukraine remain uncertain.

US import price figureswill be more closely watched than usual after data on Thursday showed a surprisingly sharp jump in US producer priceslast month, pushing the dollar higher.

If import prices keep rising, it may signal that US companies are fully absorbing the tariffs, leaving them with two options: pass the costs on to consumers, potentially stoking inflation, or take the hit to profit margins.

Money markets reflect a 95% chance of a 25-basis point Fed rate cut in September. They fully priced a 25-bp cut and a 5% chance of a larger 50-bp move before Thursday's US data.

Markets also await next week's Jackson Hole symposium for clues on the Fed's next move. Signs of weakness in the US labour market combined with inflation from trade tariffs could present a dilemma for the Fed's rate cut trajectory.

The yen was up 0.4% against the dollar at 147.20, helped by data showing Japan's economy grew much faster than expected in the second quarter.

US Treasury Secretary Scott Bessent's remarks earlier this week that the Bank of Japan could be "behind the curve" in dealing with the risk of inflation proved to be another tailwind for the yen.

"Although BoJ Governor Ueda, may choose to disregard Bessent’s remarks, the Japanese authorities will not want the value of the yen to become more of a concern to the Trump administration than it already is," said Jane Foley senior forex strategist at RaboBank.

The euro rose 0.25% versus the dollar to US$1.1675.

Most analysts expect Europe's single currency to benefit from any ceasefire deal in Ukraine.

"The Trump-Putin meeting and any better clarity on the path ahead in the Ukraine conflict have longer-lasting implications for the euro than for the dollar," said Francesco Pesole, forex strategist at ING.

"There is a chance that today might be the first step in the direction of de-escalation, and markets may tread carefully for now," he added.

The pound was up 0.20% against the US currency at US$1.3553.

The Australian dollar was up 0.2% versus the greenback at 0.6508.

The Chinese yuan pulled back from a two-week high as weaker-than-expected economic readings weighed on sentiment.

Elsewhere, Bitcoin and ether rose after dropping about 4% each on Thursday. Bitcoin had at one point touched a record high on Thursday on shifting Fed rate-cut expectations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up