Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China is preparing to mobilize companies owned by the central government in Beijing to purchase unsold homes from distressed property developers, following the limited success of a previous initiative that relied on local governments, according to people familiar with the matter.

China is preparing to mobilize companies owned by the central government in Beijing to purchase unsold homes from distressed property developers, following the limited success of a previous initiative that relied on local governments, according to people familiar with the matter.Regulators are planning to ask some of the biggest state-owned enterprises and bad debt managers including China Cinda Asset Management Co. to help clear the housing glut, said the people, asking not to be identified discussing a private matter. The firms will be allowed to tap 300 billion yuan ($41.8 billion) of funding that the central bank earmarked for the program last year, one of the people said.

The renewed effort, which is still under discussion, could help speed up the clearance of China’s 408 million square meters of excess inventory - larger than the size of Detroit - and ease the financial burden of the troubled developers. Officials are also considering scrapping a price cap for the program, in a bid to accelerate the process and improve the economics of the plan for both developers and state buyers, people familiar said in March.

While the move to enlist bad-debt managers might help improve sentiment, the impact may be limited by the firms’ own stretched finances. The plan comes as China’s property sector hits a new low with the delisting of China Evergrande Group and new-home sales by the 100 largest developers falling more than 20% for two consecutive months.The People’s Bank of China launched a nationwide relending program in May 2024 to help local state-owned companies buy unsold homes, and said a few months later it will ramp up the initiative. There are about 60 million unsold apartments in the country, which will take more than four years to sell without government aid, Bloomberg Economics estimated in May last year.

However, progress has been slow with less than 6% of the announced loans approved so far, according to a Bloomberg Intelligence report early this month. Acceleration of the program might be unlikely given a mismatch in the locations of unsold homes and demand for affordable housing, the report said.When China’s property sector started falling into distress more than four years ago, Beijing sought help from bad-debt managers. Regulators told firms including Huarong Asset Management Co. and Cinda to participate in the restructuring of weak developers, acquire stalled property projects and buy soured loans.

Then, in early 2023, the PBOC channeled 80 billion yuan of loans through these bad banks to selected developers at an annual interest rate of 1.75%, while encouraging the bad banks to match that amount with funds from their own reserves, people said at the time.However, few projects have actually been implemented under the policy, and its effect has been lackluster. The four largest bad-debt managers themselves were grappling with souring loans after over-extending during China’s real estate boom.

Regulators have also yet to offer more drastic stimulus. Chinese President Xi Jinping called for the acceleration of a “new model” for property development at the Central Urban Work Conference last month, promoting a more balanced approach to urban planning and renovation — while falling short of some investors’ expectations for more aggressive measures.The country’s home sales extended their slump in July as declining prices failed to attract buyers. Analysts including those from UBS Group AG have delayed expectations of China’s property recovery to mid-to-late 2026.

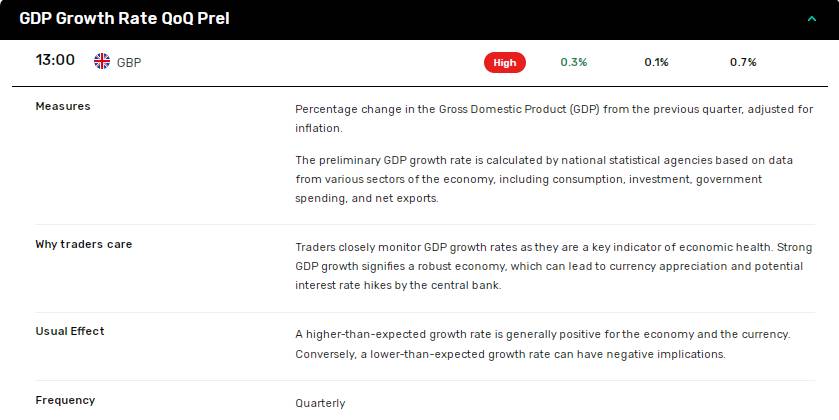

Britain's economy grew by a faster-than-expected 0.3% in the second quarter of 2025 after growth of 0.7% in the first three months of the year, offering a boost to finance minister Rachel Reeves, official figures showed on Thursday.

Economists polled by Reuters, as well as the Bank of England, had forecast 0.1% growth in gross domestic product for the April-June period.

Thursday's data from the Office for National Statistics showed British GDP rose by 0.4% in June alone after a 0.1% fall in output in May due to surprisingly strong growth across services, industrial output and construction.

Output in the second quarter overall was up 1.2% from the same period last year compared to a median forecast from economists for 1.0% growth.

Sterling rose slightly against the dollar after the data.

Reeves has been keen to highlight that British economic growth in the first quarter of the year was the fastest in the Group of Seven large advanced economies, but the outlook for the second half of 2025 is more subdued.

Britain faces headwinds from ongoing global trade uncertainty due to increased US import tariffs as well as a slowdown in hiring at home — partly reflecting higher employment taxes and a big increase in the minimum wage.

Last month the International Monetary Fund forecast Britain's economy would grow 1.2% this year and 1.4% in 2026 — slightly faster than the euro zone and Japan but slower than the United States and Canada.

Will June GDP recovery put Bank of England policy easing on ice? Here’s what the data, experts, and markets are saying.

The UK economy grew 0.4% month-on-month in June, recovering from May’s 0.1% contraction, and above a consensus of 0.1%.

On a quarterly basis, the economy expanded by 0.3% in Q2, down from 0.7% in Q1. However, annual growth accelerated from 0.7% in Q1 to 1.2% in Q2. Economists had expected quarterly and annual growth of 0.1% and 1%, respectively, in the second quarter.

According to the Office for National Statistics:

Overall, the data signaled a pickup in economic momentum, with services, private consumption, and manufacturing providing upward momentum.

The latest GDP figures may reduce market expectations for the BoE to cut rates in September. Softer wage growth may signal a pullback in consumer spending, dampening demand-driven inflation. Average earnings, including bonuses, rose 4.6% in June, down from 5% in May. However, inflation forecasts could challenge expectations of further policy easing.

James Smith, Research Director at the Resolution Foundation, remarked:

“Elsewhere, there was grim news about the cost of living… Let’s start with inflation – that is now expected to peak at 4.0% in September, having previously been expected to peak at 3.7%. Inflation is expected to now be higher across the BoE’s forecast period.”

The Bank of England reduced interest rates by 25 basis points to 4% on August 7. A 5-4 vote in favor of cutting rates reflected a divided Monetary Policy Committee, likely increasing focus on inflation.

The next UK CPI report, out on August 20, will likely dictate near-term bets on further BoE rate cuts. Economists forecast the annual inflation rate to rise from 3.6% in June to 4% in July. The BoE may be reluctant to cut rates if inflation climbs higher, pushing back a potential rate cut to November or possibly December.

ING Economics signaled a November BoE rate cut, stating:

“We still think the Bank’s concerns about inflation will prove overblown. There’s no reason in and of itself that inflation will become more entrenched, simply because headline CPI is sitting above target. It relies on workers being able to chase higher wages, as they bid to retain purchasing power.”

However, ING Economics warned:

“We’re sticking to our call, but were the next couple of inflation reports to surprise to the upside, or if the recent falls in private-sector employment start to ease off, then we’ll be rethinking.”

Before the UK GDP Report, the GBP/USD fell to a low of $1.35639 before climbing to a high of $1.35919.

However, in response to the report, the GBP/USD briefly tumbled to a low of $1.35685 before rising to a high of $1.35858 amid easing bets on a September BoE rate cut.

On Friday, August 14, the GBP/USD was up 0.05% to $1.35806.

GBPUSD – 5 Minute Chart – 140825

GBPUSD – 5 Minute Chart – 140825White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up