Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Canadian economy contracted for the first time in nearly two years as the trade war with the US pinched exports and business investment.

The Canadian economy contracted for the first time in nearly two years as the trade war with the US pinched exports and business investment.

Canada’s gross domestic product shrank at a 1.6% annualized pace in the second quarter, Statistics Canada reported Friday from Ottawa. That’s the biggest decline since the Covid-19 pandemic and the first contraction in nearly two years.

While roughly in line with the Bank of Canada’s forecasts, it’s a worse print than was expected in a Bloomberg survey of economists, which had forecast a 0.7% decline.

The loonie tumbled to a session low versus the US dollar after the report, trading at C$1.3770 as of 8:35 a.m. in Ottawa. Canadian debt rallied across the curve, with the two-year yield falling to 2.66%.

Exports fell 27% on an annualized basis as US tariffs on Canadian goods shattered the country’s shipments abroad. That more than reversed a temporary first quarter boost in trade activity that was driven by shippers trying to front-run President Donald Trump’s tariff barrage. Imports declined 5.1%.

Business investment contracted 10.1% after rising just 1.1% in the first quarter, highlighting the mounting pessimism facing Canadian firms as they contend with the uncertain and constant changes to US levies and policy.

The data capture the severe damage inflicted by the trade war, which started earlier in 2025 as Trump threatened and then imposed tariffs on imports of many Canadian products, including on steel, aluminum, autos and other goods. The US is Canada’s largest trading partner.

At the same time, the report shows some evidence that the trade damage isn’t rapidly creeping through the broader economy.

On a monthly basis, preliminary industry-level data suggests Canada’s economy expanded 0.1% in July, after unexpectedly contracting 0.1% in June, the statistics agency said. There are some signs of strength in final domestic demand, which rose 3.5% in the second quarter, driven by a 4.5% increase in household consumption — an acceleration despite a major slowdown in population growth.

At the same time, the resilience of households is likely to be tested in coming months. Disposable income rose just 1.3% in the three months between April and June, the weakest growth in more than two years, likely reflecting persistent looseness in the country’s labor market.

The data also show Canadian firms are still adding to their stockpiles despite the subdued export demand from the US — inventory investment rose about C$19 billion in the second quarter, the most since 2022, when the country’s firms were putting more wares aside amid snarled supply chains.

General government expenditure rose 5.1%. Investment in residential structures rose 6.3%.

Bank of Canada officials said they’re open to further rate reductions if the economy weakens and price pressures are contained. Their next decision is on Sept. 17.

Before the release, traders in overnight swaps put the odds off a rate cut at the next meeting at about 40%. The policy rate is 2.75%.

At around 5% to 7%, the effective tariff rate that the US imposes on imports of Canadian goods remains among the lowest in the world. That’s because of a carve-out for goods that cross the border under the USMCA, the trade treaty between Canada, the US and Mexico that will be renegotiated in coming years.

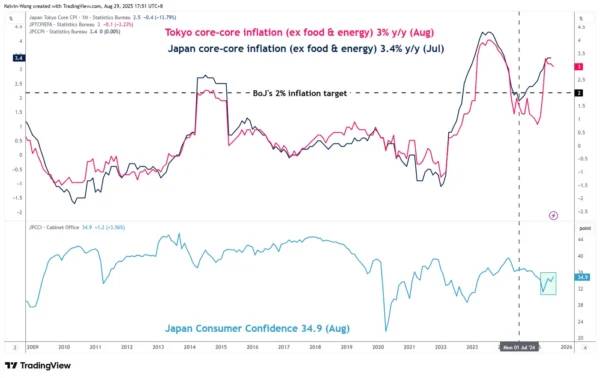

Today’s Tokyo inflation data and August consumer confidence figures reinforce expectations of a potential 25-basis-point rate hike by the Bank of Japan in October, as it continues along its path of monetary policy normalization.

Tokyo inflation and Japan consumer confidence support another BoJ rate hike

Tokyo core-core inflation (excluding food and energy) rose by 3% y/y in August, a slight slowdown from July’s print of 3.1% but still well above BoJ’s long-term inflation target of 2% (see Fig. 1).

Japan’s consumer confidence index improved further to 34.9 in August from its current year-to-month low of 31.2 printed in April. This marked the highest reading since January seen across all the components; overall livelihood (32.7 vs 31.4 in July), income growth expectations (39.4 vs 38.5), employment outlook (39.3 vs 37.6), and willingness to purchase durable goods (28 vs 27.4).

Preferred trend bias (1-3 days)

Bearish bias below 148.00/148.18 key short-term pivotal resistance.

A break below 146.40 intermediate support (minor swing low area of 14 August 2025) opens the scope for a further potential slide towards the next supports at 145.85 (minor swing lows of 8 July/10 July/24 July 2025) and 145.50 (the lower boundary of the ascending range configuration) (see Fig. 2).

Key elements

Alternative trend bias (1 to 3 days)

The key near-term risk event is the upcoming release of July’s US core PCE inflation, along with personal income and spending data later today, which will play a pivotal role in shaping Federal Reserve rate cut expectations ahead of the September FOMC meeting.

A clearance above 148.18 invalidates the bearish scenario and sees a squeeze up towards the upper limit of the medium-term ascending range configuration for the next intermediate resistance to come in at 148.75 (also close to the 200-day moving average).

Germany’s ruling CDU/CSU bloc is demanding stricter limits on welfare, with party leaders pointing to high rates of reliance on the citizen’s allowance among Afghans and Syrians.

Deputy parliamentary group leader Mathias Middelberg said job centers must do more to place these groups into work, stressing there is “still considerable potential for catching up in terms of taking up employment.”“Just 100,000 more people in work instead of relying on the citizen’s allowance could, depending on wage levels, relieve the federal budget in the low single-digit billion range every year,” the lawmaker told Bild.

According to government figures cited by Middelberg, 52.8 percent of Syrians and 46.7 percent of Afghans in Germany rely on the citizen’s allowance, while only 36.7 percent of Syrians and 37 percent of Afghans hold jobs subject to social security contributions.“We cannot accept that hundreds of thousands of young asylum seekers here in Germany are unemployed for decades,” he said.

The call comes amid soaring welfare costs, with annual spending on the citizen’s allowance at around €52 billion. Statistics from the Federal Employment Agency (BA) last year showed that of the more than 4 million people who can work but receive social benefits, more than 2.5 million have a migration background, constituting 63.5 percent.

At the start of 2024, of the 2.6 million non-Germans registered for benefits, 706,000 were from Ukraine, 512,000 from Syria, and 201,000 from Afghanistan.CSU leader Markus Söder and CDU General Secretary Carsten Linnemann said that those unwilling to work should no longer receive support.Chancellor Friedrich Merz reinforced the message over the weekend, warning that Germany’s welfare model is no longer sustainable. “The welfare state as we have it today is no longer financially viable with what we are achieving economically,” he said.

Rising unemployment, bankruptcies, and inflation risks are also evidence of the mounting strain.Alternative for Germany (AfD) co-leader Alice Weidel slammed the Grand Coalition government for continuing to oversee Germany’s economic decline on Tuesday, pointing to figures cited by Welt, which revealed 114,000 industrial jobs had been lost within the last year.“The politically motivated deindustrialization continues unabated, even more than six months after the new elections. No economic turnaround without the AfD!” she wrote.

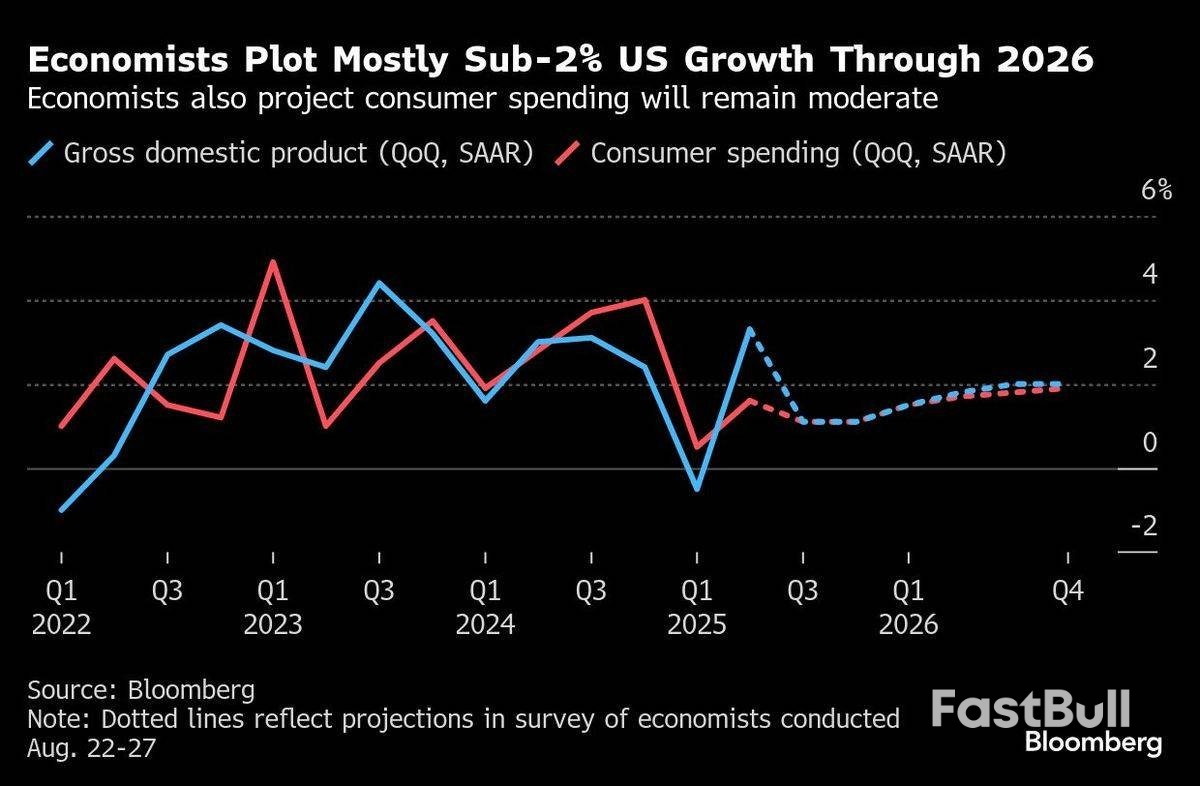

(Aug 29): Economists anticipate ho-hum US economic growth for the remainder of the year and well into 2026, with steady, tariff-driven inflation buffeting consumers.

Gross domestic product is now set to grow 1.1% in the second half of the year, a downshift from average growth of 1.4% during the first six months, according to the latest Bloomberg monthly survey of economists. Consumer spending, the economy’s primary growth engine, is also seen expanding at a 1.1% pace in both the third and fourth quarters.

At the same time, economists expect core inflation — measured by the personal consumption expenditures price index — will top out at an average of 3.2% in the fourth quarter. While year-on-year inflation is expected to gradually ease through 2026, it will remain above the Federal Reserve’s 2% target.

The results underscore expectations that higher import duties imposed by President Donald Trump will feed through more broadly into consumer prices and only gradually dissipate next year.

The Aug 22-27 survey of 79 forecasters points to an economy that will continue to adjust to the effects of the president’s trade and investment policies that he hopes will spark stronger growth. It also indicates the Fed will remain challenged by stubborn price pressures and uninspiring economic activity.

Fed chair Jerome Powell last week said the effects of higher tariffs on prices is “now clearly visible,” but he carefully opened the door to an interest-rate cut in September given the greater risk the job market could falter. Economists in the Bloomberg survey expect the unemployment rate to rise to 4.4% in the fourth quarter and stay there through most of 2026.

Still, forecasters now put the chances of a recession in the next 12 months at 32%, the lowest since March. While overall economic growth is expected to be modest, respondents see an acceleration in the growth of business investment through 2026.

The Bureau of Economic Analysis reported on Thursday that the US economy expanded in the second quarter at a slightly faster pace than initially estimated, helped by a bigger increase in intellectual property products and business equipment.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up