Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

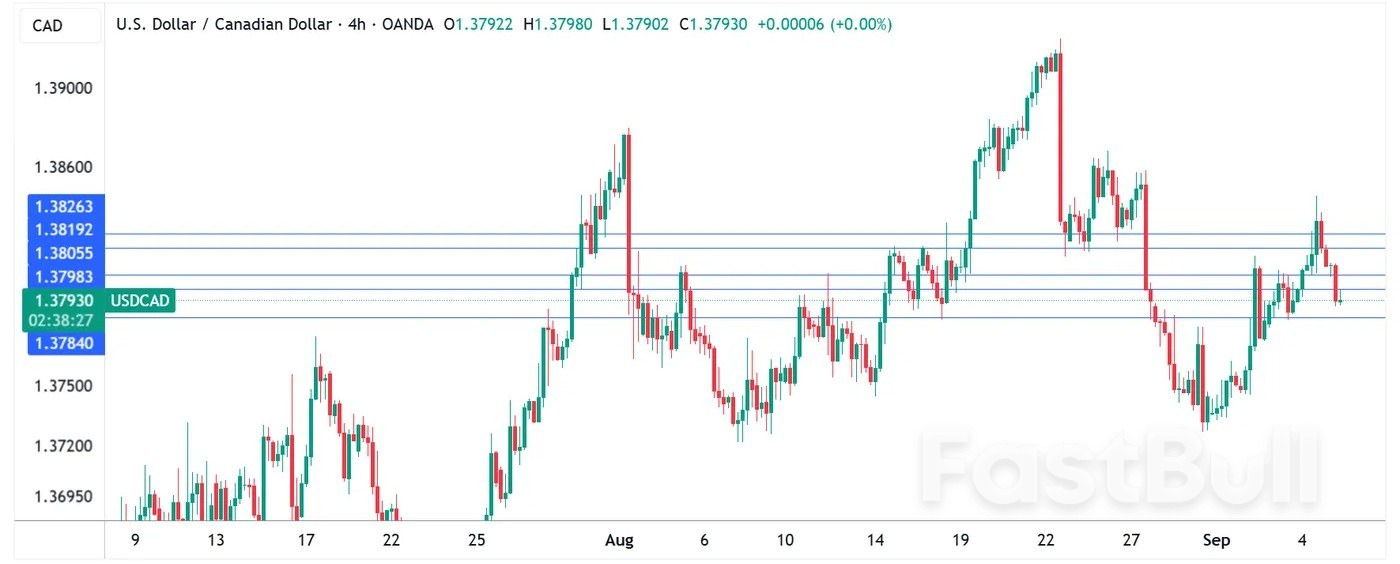

The Canadian dollar dipped ahead of Canada and U.S. jobs data. Markets expect modest Canadian job gains and weak U.S. payrolls, reinforcing Fed cut bets. USD/CAD trades near 1.3793, testing key support.

Canada’s economy lost 66k jobs (-0.3% m/m) in August, adding to 41k jobs lost in July. The job losses concentrated in part-time positions (-60k), while full-time employment was little changed.

The unemployment rate rose to a new cycle high of 7.1%. The increase would have been worse were it not for 31k fewer workers in the labour force.

Job losses were seen across several industries. The biggest losses were in professional, scientific and technical services (-26k; -1.3%), transportation and warehousing (-23k; -2.1%), and manufacturing (-19k; -1.0%). However, construction employment bounced back (+17k; +1.1%) from July’s decline (-22k; -1.3%).

Wage growth slowed to 3.2% in August, slightly lower than 3.3% in July.

July and August’s job losses have now more than reversed June’s outsized gain, and the Canadian economy has lost 39k jobs since January. The unemployment rate has risen half a percentage point over the same time period. It could be worse though, a slowdown in labour force growth is keeping the unemployment rate from rising too high, despite weak labour demand.

August’s report is consistent with the Bank of Canada’s characterization of “an excess supply of labour” in July’s Monetary Policy Report. However, it hasn’t yet prompted them to lower rates beyond the pre-emptive cuts made early in the year. Markets are now putting odds on the next cut coming in September. We have long expected two more cuts this year, with the inflation report on September 16th likely to help cement the timing of the next cut.

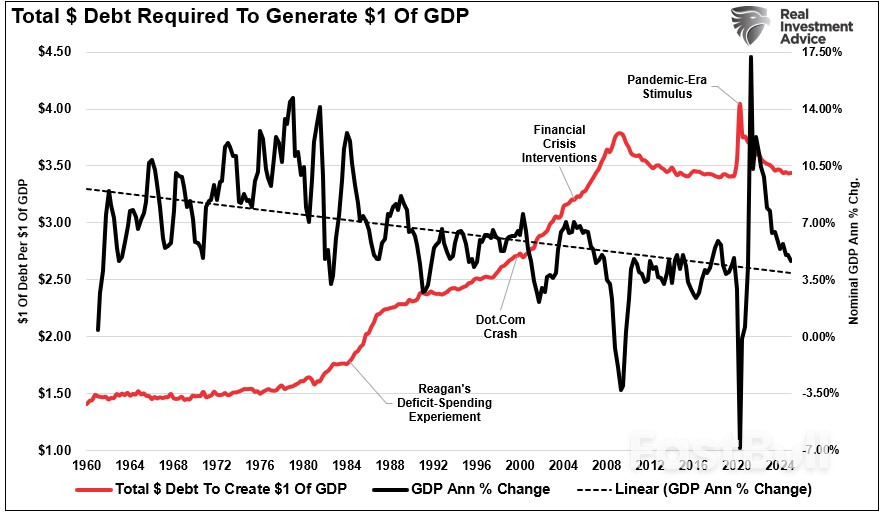

How long does it take for conventional wisdom to make a 180 degree U-turn? In the case of anything Trump related, it's just under 6 months.It was in early April, just after Liberation Day's reciprocal tariffs were announced, that US bond markets suddenly cratered, sparking a collapse in hundreds of billions of basis trades, and triggered fears of a global economic shock. That's when tariffs were widely seen as bad and anyone who dared to say it's never that black or white - such as this website - were blasted as economic illiterates. Well, fast forward to today when quietly conventional wisdom has been turned on its head and the mere possibility of tariffs getting pulled is now seen as one of the biggest threats to the stability of the bond market!

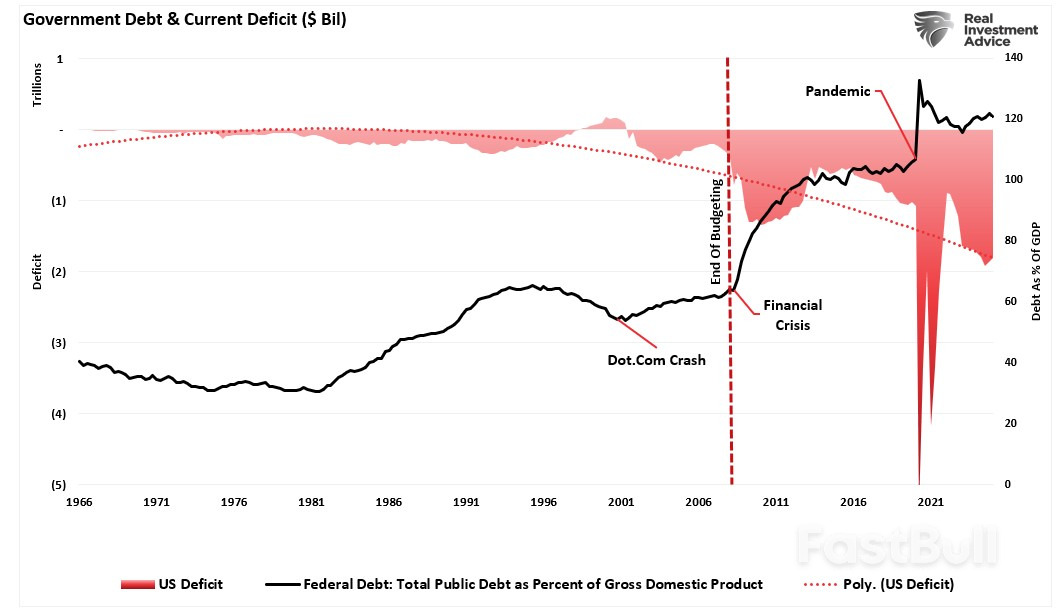

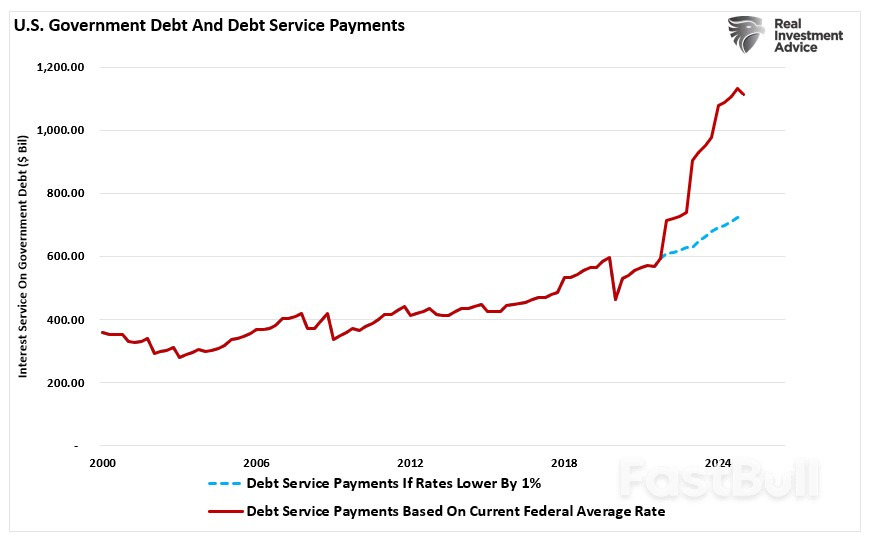

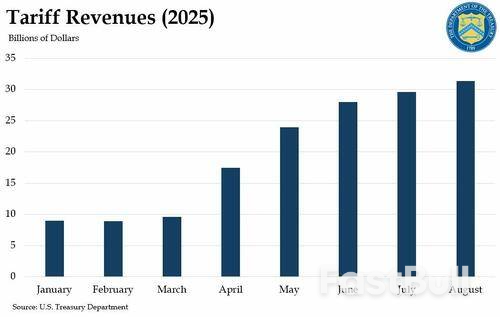

That's right: if the Financial Times is to be believed - and it is, since it loathes Trump with a passion and would never say anything even remotely complementary if it could avoid it - Trump’s tariffs are now a key factor keeping Treasury investors on board (the same tariffs that were widely blamed for the relentless selling back in April). According to the paper, the tariff revenues - which so many of the establishment economists never even considered in April - are now seen as a crucial income stream that offsets the costs of the Big Beautiful Bill, and investors are now counting on hundreds of billions of dollars raised by the remaining tariffs to offset Trump’s tax cuts and keep a lid on US borrowing.

“The only way I can see for the US government to reduce its outstanding debt in the near term is to use the tariff revenue,” said Andy Brenner, head of international fixed income at NatAlliance Securities, citing also revenues from chipmakers’ China sales. “If all of the sudden the tariff revenue will not be there, that is a problem.”Not only that, but as we noted two weeks ago, both S&P and Fitch recently conceded that tariff revenues for the US federal government were one factor that prevented them from downgrading the sovereign.

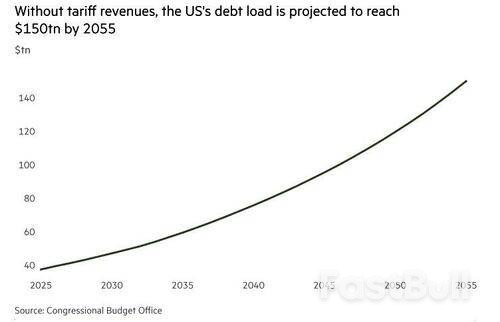

The Congressional Budget Office last month forecast Trump’s tariffs would boost US government revenues by $4tn over the coming decade. That would help pay for tax cuts in Trump’s One Big Beautiful Bill Act, which is projected to increase borrowing by $4.1tn over the same period.The shift in market sentiment comes after months of turmoil in Trump’s economic strategy, including his trade war with trading partners such as China and his attacks on the US Federal Reserve.

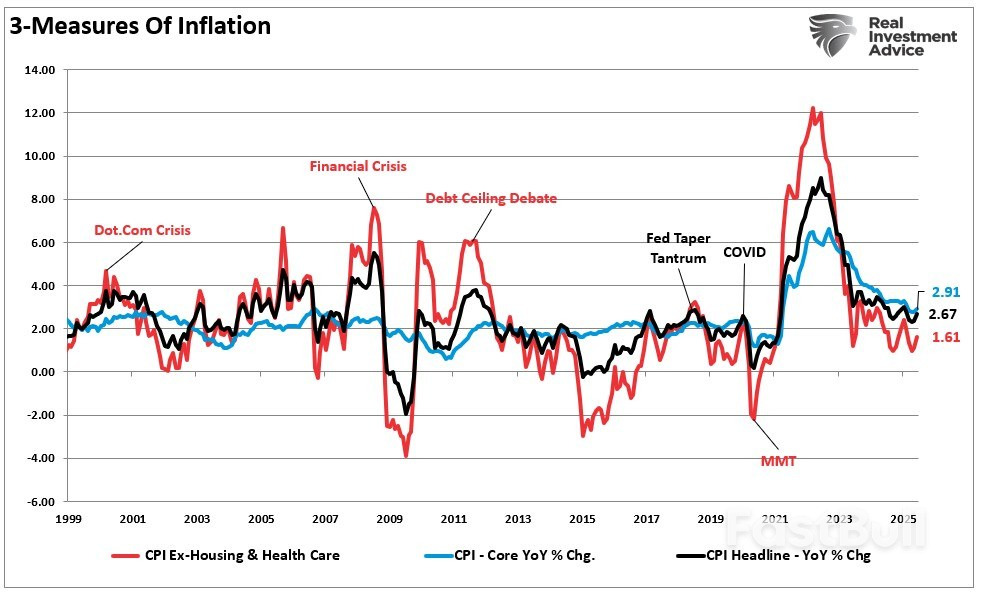

Indeed, the appeals court ruling - which overturns Trump's tariffs - was the catalyst behind the US Treasury bond sell-off on Tuesday and Wednesday, analysts said, as investors worried that reduced tariff revenues would lead to a greater glut of Treasury issuance.Thierry Wizman, a global rates strategist at Macquarie Group, said: “If the bulk of Trump’s tariff programme is nullified by the courts some analysts will cheer, inflation will subside, growth may improve, and the Fed may be more inclined to ease monetary policy. But if the focus is on debt and deficits at that time, the bond market may riot.”

Indeed, the appeals court ruling - which overturns Trump's tariffs - was the catalyst behind the US Treasury bond sell-off on Tuesday and Wednesday, analysts said, as investors worried that reduced tariff revenues would lead to a greater glut of Treasury issuance.Thierry Wizman, a global rates strategist at Macquarie Group, said: “If the bulk of Trump’s tariff programme is nullified by the courts some analysts will cheer, inflation will subside, growth may improve, and the Fed may be more inclined to ease monetary policy. But if the focus is on debt and deficits at that time, the bond market may riot.”

He added: “The risk that tariffs go away but the [One Big Beautiful Bill Act] stays may become the dominant risk for [US Treasuries] over the next few weeks.”Robert Tipp, head of global bonds at PGIM Fixed Income, said there was “a hope that tariff revenue can help control the budget deficit”.To be sure, even with tariff revenues, investors warn about the daunting scale of the US government’s borrowing needs.Des Lawrence, senior investment strategist at State Street Investment Management, said if the tariffs “were put on pause, it deprives Uncle Sam of a revenue source”. But the “bigger negative picture” is the sheer scale of government spending, he said. Without tariff revenue, the CBO expects US debt relative to GDP to surpass its second world war peak by 2029.

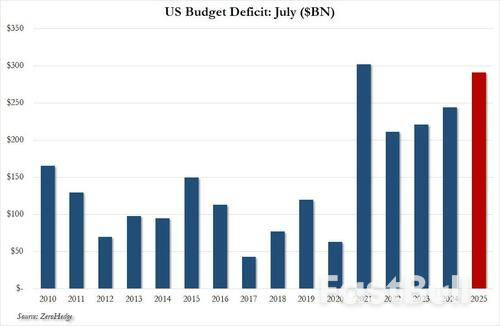

“It’s helpful in plugging a gap, but there’s still a big issue in America spending much more than it’s receiving,” Lawrence said, and he too is right as we showed a few weeks ago when we demonstrated that despite record tariff revenue, the US budget deficit hit a whopping $291bn in July, the second highest deficit for the month on record.

And now the fate of the US bond market is in the hands of a handful of supreme court justices, whose decisions are never taken on the merits of the underlying argument but are purely and unapologetically political. Last week, the Court of Appeals ruled against the Liberation Day tariffs, arguing that the emergency powers law did not give the US president the legal authority to impose these tariffs. And last evening, the Trump administration appealed this decision before the Supreme Court, and the enforcement of the earlier ruling has been delayed until the Supreme Court can review the case. So, pending the Supreme Court decision, tariffs remain in effect.

But if Trump loses this appeal, that key source of revenue would quickly dry out. Undoubtedly the administration will already have alternatives up its sleeve –with sectoral tariffs a key candidate– but it would unleash a new wave of uncertainty that could sap confidence. No wonder Trump has said that if the Supreme Court does not overturn the Appeal court decision, the consequences would be catastrophic for the US: he is, after all, correct.

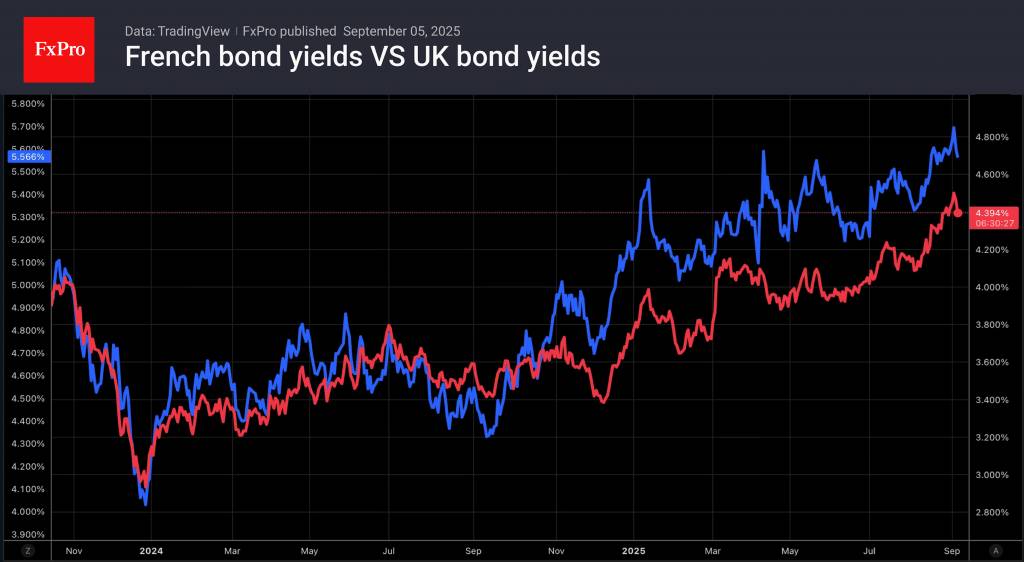

For a while, the US dollar became the cleanest shirt in a laundry basket. Treasuries were not being sold off as quickly as European bonds. Yields on British gilts soared to their highest levels since 1998, for French debt it was the highest since 2008, and for German bunds since 2011, against the backdrop of concerns about fiscal discipline. Investors are concerned that Rachel Reeves will not be able to close the 35 billion pound budget gap, that François Bayrou’s government will resign, and that Friedrich Merz has gone too far with fiscal stimulus.

Against the backdrop of political unrest in France and fears over the global debt crisis, the US dollar was bought as a safe-haven asset. Rumours of Hiroshi Moriyama’s resignation as leader of Japan’s ruling Liberal Democratic Party did not allow the yen to resist the dollar.

Disappointing US labour market statistics helped bring the greenback bulls back down to earth. Job vacancies fell to their lowest level in 10 months, hiring slowed, and the unemployed needed more time to find new jobs. As a result, the futures market raised the chances of the Fed’s monetary expansion in September to almost 100%. The USD index retreated from the upper limit of the consolidation range from 97.6 to 98.6.

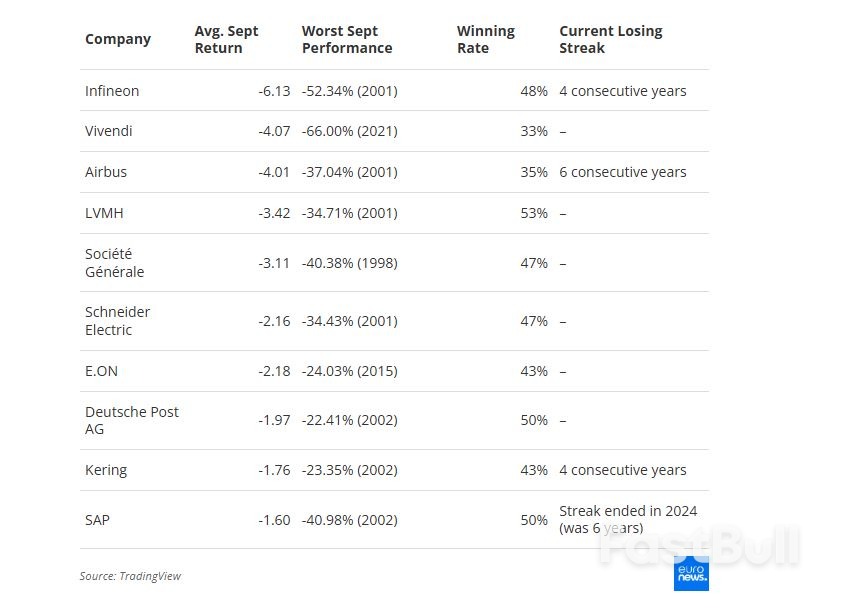

The US stock market began a difficult period with a decline but quickly recovered. September is the worst month for the S&P 500. According to research by Bank of America, since 1927, the broad stock index has fallen in 56% of cases, by an average of 1.17%. The first year of a presidential term has been even worse, with 58% cases of decline, averaging 1.62%. UBS claims that over the past decade, the market has fallen by an average of 2% in September.

The S&P 500’s fundamental valuations do indeed appear to be overestimated. They exceed 22 times expected annual earnings, which has not happened in 35 years, except for the dot-com bubble and the pandemic. Market concentration is now at its highest, with the share of six technology giants in the broad stock index exceeding 30%. In such conditions, news from large issuers can shake the entire market.

Unsurprisingly, news that Alphabet had avoided a strict antitrust ruling to sell Chrome and that Apple intended to launch AI-based web search tools for Siri, allowed the S&P 500 to quickly recover its lost ground.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up