Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A large overhang that threatened the Japanese equity market is being removed with the central bank laying out a century-long plan to offload its massive holdings of exchange-traded funds.

A large overhang that threatened the Japanese equity market is being removed with the central bank laying out a century-long plan to offload its massive holdings of exchange-traded funds.

While benchmark stock gauges fell Friday in a knee-jerk reaction when the Bank of Japan said it would be selling its ¥75 trillion ($507 billion) stockpile, traders quickly pared much of the decline as focus turned to the very gradual nature of the program. The BOJ intends to reduce its holdings by about ¥620 billion by market value per year.

The announcement also came at the end of a week that saw the blue-chip Nikkei-225 and broader Topix index set fresh record highs. The market’s resilience to shocks over the past two years underscores the confidence, with shares recovering first from the BOJ ending negative interest rates in 2024 and more recently rallying in the face of tariffs from the US. Futures contracts point to gains in Tokyo on Monday.

“Investors had been nervous about when the BOJ would start selling ETFs — a lot of them have been asking me about it,” said Seiichi Suzuki, chief equity analyst at Tokai Tokyo Intelligence Laboratory Co. The timeframe for the sell-down of ETFs is positive and suggests limited market impact, he said.

Global investors have contributed to the advance in Japanese stocks as they seek to diversify their portfolios, with equities in Tokyo trading at lower price-to-earnings and price-to-book valuations than those in the US.

Corporate governance reforms have also helped by encouraging buybacks, M&A activity and the emergence of activist investors as a powerful force for championing focus on shareholder returns.

The BOJ’s ETF sales could begin early next year, a person familiar with the matter has said.

Before then, the market still faces potential turbulence from uncertainty over the ruling Liberal Democratic Party selecting a new leader, and the continued risk of economic fallout from tariffs.

Given that the BOJ indirectly owns about 7% of Japanese stocks via ETFs, any miscalculation in its sales that exceeded market demand could still be damaging.

Yet the current amount indicated by the central bank should be easily absorbed, said Kohei Onishi, senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities Co. He noted that Japanese companies, under pressure from regulators and shareholders to stop cash hoarding, are buying back a large amount of their own shares annually.

Investors will be closely watching the impact of ETF sales on stocks with heavy weighting on the Nikkei average, such as casual clothing chain operator Fast Retailing Co. and billionaire Masayoshi Son’s SoftBank Group Corp. Fast Retailing shares slid 4.5% on Friday while SoftBank’s stock rose 0.7%.

Japanese equities may see some short-term stress but the BOJ’s plan won’t scupper the market’s bull trend, according to Anna Wu, cross-asset strategist at VanEck Associates Corp. in Sydney.

“If we ask ourselves, will the new prime minister be pro-growth? Will fiscal expansion continue? And are foreign investors going to continue investing in Japan equities as part of US diversification trade? The answers are likely to be yes for all three,” she said.

U.S. stock index futures fell slightly on Sunday evening, cooling after optimism over interest rate cuts by the Federal Reserve pushed Wall Street to record highs last week, with technology shares rising the most.

Focus this week is on a host of key economic indicators, while several Fed officials, including Chair Jerome Powell, are also set to speak in the coming days.

S&P 500 Futures fell 0.1% to 6,715.25 points, while Nasdaq 100 Futures fell 0.1% to 24,849.50 points by 19:37 ET (23:37 GMT). Dow Jones Futures fell 0.1% to 46,587.0 points.

Wall St hits record high on rate cut cheer, tech strength

Wall Street indexes finished at record highs last week after the Fed cut interest rates by 25 basis points and signaled that more easing was likely in the coming months.

The central bank said that it was attempting to avoid further weakness in the labor market, and warned that sticky inflation would still factor into its decisions.

Markets largely welcomed the prospect of lower rates, especially amid some signs of cooling economic growth in the country.

The S&P 500 rose 0.5% to a record close of 6,664.36 points on Friday. The NASDAQ Composite rose 0.7% to finish at a peak of 22,631.48 points, while the Dow Jones Industrial Average rose 0.4% to 46,315.27 points.

Tech shares were the biggest driver of Wall Street, with Apple Inc (NASDAQ:AAPL) among the best performers as early sales indicators for its iPhone 17 line pointed to strong year-on-year growth.

Chipmaking and cloud stocks also benefited from optimism over sustained artificial intelligence demand, while positive earnings from delivery firm FedEx Corporation (NYSE:FDX), which usually act as a bellwether for the U.S. economy, also spurred gains.

Fed speakers, PMI data, and inflation on tap this week

A host of Fed officials are set to speak in the coming days, most notably Chair Jerome Powell on Tuesday.

Markets will be watching for any more cues from the Fed on interest rates, with the central bank having signaled a largely data-driven approach to future easing.

To that end, a host of key U.S. economic readings are also due this week. Purchasing managers index data for September is expected to provide more cues on U.S. business activity.

A final reading on second-quarter gross domestic product growth is also due this week.

PCE price index data– the Fed’s preferred inflation gauge– is due on Friday and is expected to provide more definitive cues on the central bank’s plans to cut interest rates.

Core PCE inflation is expected to remain largely above the Fed’s 2% annual target, while focus will be on any signs of higher inflation from increased trade tariffs.

European equity markets are witnessing heightened performance dispersion across countries, sectors and individual stocks as the region seeks to get to grips with an uncertain and fast-evolving global landscape.In an environment of intrinsic uncertainty driven by geopolitical instability, deglobalisation and an unfolding AI revolution, we think active, research-driven investors are well-positioned to identify opportunities that others may overlook — even more so if they are willing to take a contrarian approach and look beyond short-term volatility and macro headlines to uncover companies with long-term earnings potential that the market is currently missing.

In our view, Europe’s structural transition presents a particularly compelling opportunity for a contrarian investment philosophy. For us, the key elements of building a resilient, core European equity portfolio to navigate today’s new economic era include:

We advocate a focus on companies where the market is pricing in negative earnings revisions indefinitely, despite their solid fundamentals and the potential for long-term growth. That means uncovering durable business models that have the financial resilience to weather cyclical downturns and benefit from secular trends.

In practice, we think investors should start by homing in on the opportunity set. In our process, for instance, we screen for signs of mispricing to identify companies that have experienced significant share price declines and negative earnings revisions, but where the pace of negative earnings revisions is slowing, which can signal a potential turning point. We look at around 200 to 300 names and assess:

We revisit the investment thesis regularly, using a detailed checklist-based process to ensure each company continues to execute as expected and remains on an upward trajectory.

In our view, understanding and aligning with the longer-term factors that drive performance is key to the potential success of our investment approach. The rapid changes currently occurring in Europe make this even more essential. For instance, our research has identified a number of companies in the food and building materials sectors that we believe stand to benefit from long-term structural drivers such as shifting consumer demand patterns, regulatory changes that enhance growth potential and company-specific advantages like leadership in R&D.

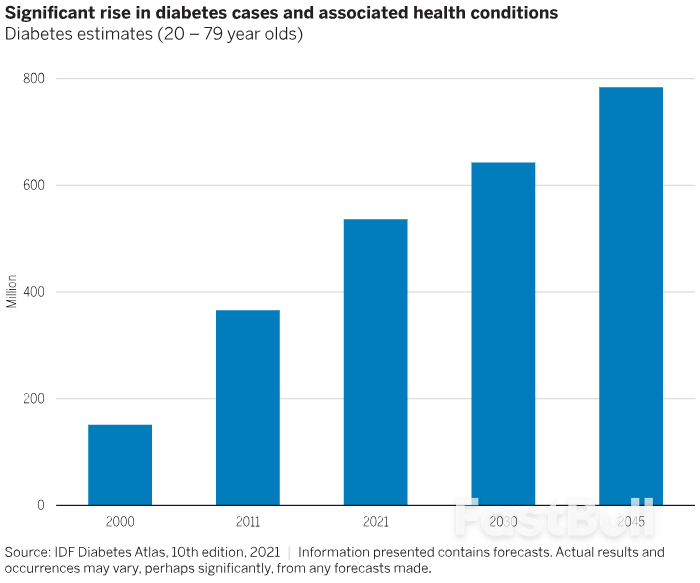

The food sector is undergoing a major transformation, and we see significant opportunities in underappreciated food ingredient companies where the likely ongoing dramatic rise in diabetes cases (Figure 1) should continue to drive innovation and demand.

We’ve invested, for example, in a global leader in low-calorie sweeteners and added fibre — products that support healthier lifestyles and help reduce the risk of diabetes. Over the past five years, this company’s innovations have enabled the removal of 9 million tons of sugar from global diets, which is equivalent to 36 trillion calories. We expect sustained demand for healthier ingredients to drive its ongoing, long-term growth.

Figure 1

In the building materials sector, stricter building regulations and the pressing need for improved energy efficiency and climate-resilient infrastructure are driving significant investment. Between 2021 and 2027, for example, the EU has allocated over €100 billion to various programmes aimed at improving buildings’ energy efficiency.

Through our research, we’ve identified a leading manufacturer of plastic piping systems used in residential, commercial and infrastructure projects. The company also provides ventilation and water infrastructure solutions. We believe it is well-positioned to benefit from a recovery in housebuilding activity and the growing adoption of piping systems for indirect heating — an approach aimed at lowering energy consumption, and one that requires enhanced ventilation.

These examples illustrate the breadth of opportunities we’re seeing in attractively valued European equities with strong structural tailwinds and solid fundamentals. Above all, a long-term mindset is essential. Identifying quality companies that are temporarily out of favour requires the patience to hold them through periods of market dislocation until fundamentals and sentiment align. For investors willing to look through today’s volatility, we believe the rewards of a contrarian, bottom-up approach will be well worth the wait.

WASHINGTON, Sept 21 (Reuters) - U.S. President Donald Trump's administration is imposing new restrictions on media coverage of the U.S. military, requiring news organizations to agree they will not disclose information that the government has not approved for release.

In a memo on Friday, the Department of Defense said journalists who publish unauthorized sensitive material could have their press credentials revoked. Media advocates said the restrictions would stifle independent reporting.

Asked by reporters outside the White House whether the Pentagon should be in charge of what the press can report, Trump replied on Sunday, "No, I don't think so. Nothing stops reporters." Trump was not specifically asked about the new policy.

The memo said news organizations will be required to acknowledge that disclosing, accessing or attempting to access sensitive information without authorization could be grounds for having their Pentagon press credentials denied or revoked.

The department "remains committed to transparency to promote accountability and public trust. However, DoW information must be approved for public release by an appropriate authorizing official before it is released, even if it is unclassified," the memo stated, using the acronym for the Department of War. Trump has ordered the department to rename itself the Department of War, a change that will require action by Congress.

The move marks the latest instance of the Trump administration applying government pressure on media organizations in the U.S. that Trump has long viewed as biased against him. It also represents an expansion of restrictions on press access to the Pentagon under Defense Secretary Pete Hegseth, a former Fox News host.

The memo said reporters who lose their credentials will be denied access to all U.S. military installations, which would include the Pentagon itself. Such a ban would raise serious questions about coverage of the U.S. military, from major Pentagon announcements to its actions in conflicts and disaster relief.

The move was quickly condemned by media organizations including the New York Times, Reuters, the Washington Post, the Wall Street Journal. The head of the National Press Club in Washington, which advocates for a free press, said it was a "direct assault" on independent journalism.

"If the news about our military must first be approved by the government, then the public is no longer getting independent reporting. It is getting only what officials want them to see," National Press Club President Mike Balsamo said in a statement.

More than two dozen news organizations operate at the Pentagon, including Reuters, reporting on the daily activities of the U.S. military.

Republican Representative Don Bacon of Nebraska, a U.S. Air Force veteran and a member of the Armed Services Committee in the House of Representatives, criticized the restrictions in a post on X.

"A free press makes our country better," Bacon wrote. "This sounds like more amateur hour."

Pentagon spokesperson Sean Parnell said in a statement that these "are basic, common-sense guidelines to protect sensitive information as well as the protection of national security and the safety of all who work at the Pentagon.

In February, the department removed four media organizations from their designated Pentagon office spaces, beginning a rotation with other outlets that included right-leaning publications. In May, Hegseth also issued orders that require journalists to have official escorts within much of the Pentagon building.

U.S. Senate Minority Leader Chuck Schumer (D-NY) holds a press conference following a vote in the U.S. Senate on a stopgap spending bill to avert a partial government shutdown that would otherwise begin on October 1, on Capitol Hill in Washington, D.C. U.S., Sept. 19, 2025.

Senate Democratic Leader Chuck Schumer on Sunday urged President Donald Trump to meet with Democrats to strike a deal to avoid a government shutdown as the funding deadline looms.

"I hope and pray that Trump will sit down with us and negotiate a bipartisan bill," Schumer said on CNN's "State of the Union," days before federal funding is set to expire on Sept. 30.

Schumer's push comes after the Senate last week rejected both Republican and Democratic proposals to keep the government funded at least temporarily, raising the likelihood of a shutdown.

As the threat of a shutdown intensifies, both parties are eager to paint the other party as being responsible if funding ultimately runs out.

"It's the Republicans shutting down the government first," Schumer insisted on Sunday.

Congressional Democrats have made health care a red line in negotiations.

Specifically, lawmakers are demanding that any funding legislation include an extension of the Affordable Care Act's enhanced tax credits, which are currently set to expire at the end of this year.

Republicans, however, appear unlikely to yield to Democrats' demands, underscoring the stalemate.

Schumer in March voted with Republicans to avert a government shutdown, sparking strong backlash from his party.

This time, however, he appears to be holding the line.

But on Sunday, when pressed multiple times whether he would ultimately vote against a GOP funding bill if Republicans do not negotiate, Schumer avoided a direct answer. "We hope it doesn't come to that," he said.

Schumer and House Minority Leader Hakeem Jeffries, also of New York, on Saturday sent a letter to Trump urging him to meet with Democrats "to reach an agreement to keep the government open."

Trump said late Saturday that he would "love" to meet with Democrats in Congress, but added he did not think "it's going to have any impact."

Senate Majority Leader John Thune, R-S.D., for his part, insists that the upper chamber can pass legislation to avert a shutdown — without concessions.

"All it takes is a handful of Democrats to join the Republicans in keeping the government open and funded, and to ensure we have a chance to get the appropriations process completed in the way it was intended," Thune said last week, according to the Associated Press.

Any legislation will need 60 votes to pass, and with Republicans' razor-thin majority, some Democrats would need to vote with Republicans to clear that threshold.

Both chambers are scheduled to be on recess this week, putting further pressure on lawmakers to strike a deal on a tight timeline.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up