Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bank of America Securities remains bearish on the U.S. dollar, but has closed its long EUR/USD position, citing...

Bank of America Securities remains bearish on the U.S. dollar, but has closed its long EUR/USD position, citing near-term geopolitical risks.

The bank entered the trade on April 10, with a spot reference of $1.1061 and an initial target of $1.15, which it revised up to $1.19 on April 22.

At 07:05 ET (11:05 GMT), EUR/USD traded 0.2% higher at $1.1524.

Bank of America Securities remains bearish on the dollar, continuing to forecast EUR/USD at $1.17 by the year-end, on a mix of negative USD and positive EUR developments, but geopolitical tensions pose near-term risks.

With this in mind, the bank has decided to close its long EUR/USD recommendation on the back of elevated geopolitical risks in the Middle East and reassess at a later stage.

“We certainly continue to see space for the USD to sell off further, including vs the euro,” analysts at the bank said, in a note dated June 19. “But with the USD sentiment at bearish extremes and the market clearly long EUR/USD, we cannot take the European Real Money EUR dip-buying bias for granted should Middle East tensions escalate further.”

The bank also noted that the latter stages of a euro rally are often choppier, especially in comparison to the first two thirds that tend to be fast and furious - 2023 serves as a good example of this.

“If this is again the case, the euro may be at a point where it corrects this summer back to $1.1200/ $1.1065 and makes a modestly higher low than May (which was $1.1065),” BofA added.

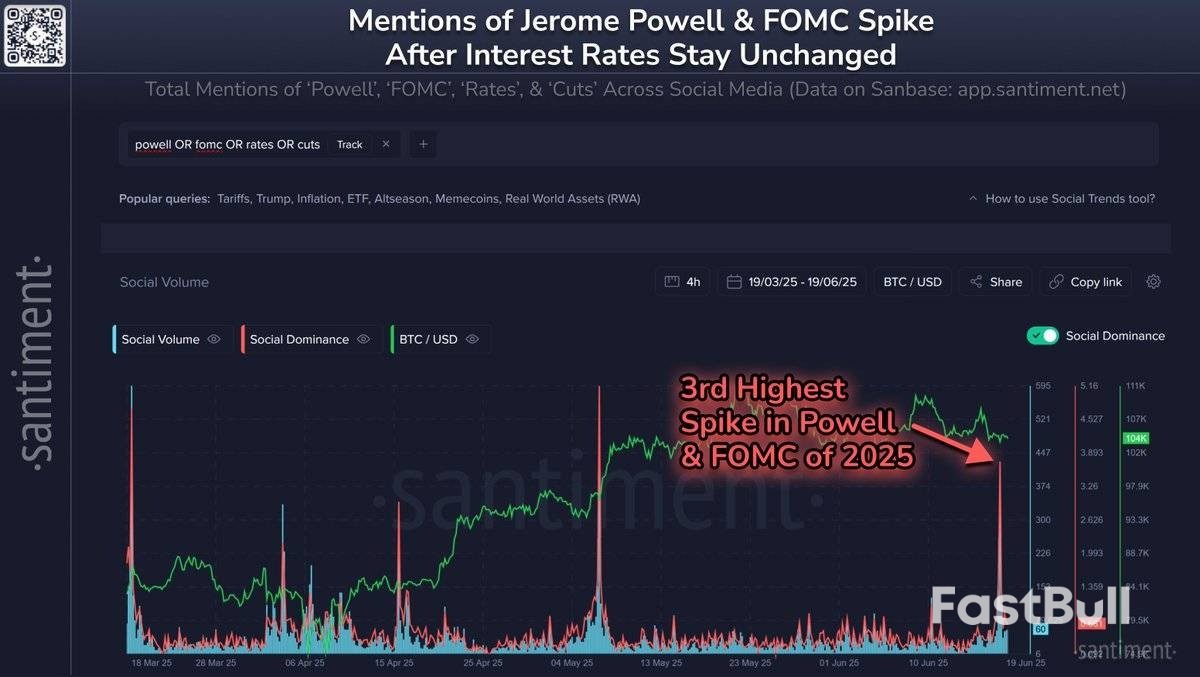

According to data from Santiment, mentions of Powell and the FOMC spiked to their third-highest level in 2025, underlining the heightened attention the issue has drawn among traders and analysts.

At present, Bitcoin trades 6.8% below its May 22 all-time high, while the S&P 500 sits 2.6% under its February 19 peak.

The market reaction suggests that investors are watching the standoff between the Trump administration and the Fed closely, anticipating whether political pressure might translate into accommodative monetary policy.

Trump is expected to maintain pressure on Powell to cut rates in order to stimulate market sentiment and economic growth. However, Powell may resist such political influence and continue advocating a more cautious, data-driven policy based on inflation metrics and broader economic indicators.

For crypto markets, especially Bitcoin, the debate holds key implications. Historically, rate cuts have served as bullish catalysts for digital assets and equities alike. While the Fed’s current stance has paused immediate upside momentum, a reversal could fuel a strong crypto rebound.

With social media already pricing in the possibility of upcoming cuts, the trajectory of crypto assets may soon hinge on whether Powell bends to political demands—or holds the line on monetary tightening.

Geen echte verrassing vanuit Threadneedle Street gisteren. De Bank of England (BoE) hield de rente onveranderd op 4.25%. Er waren wel enkele accentverschuivingen, zowel in het stempatroon als in de inhoudelijke analyse. Het blijven onzekere tijden, maar voorzitter Bailey en zijn beleidscomité blijven op koers om de rente geflankeerd door een driemaandelijks beleidsrapport in augustus opnieuw met 25 bpn bij te vijlen. Dat tempo is al in voege sinds de start van de versoepelingscyclus in augustus vorig jaar.

Inflatie ging de voorbije maanden over een hobbelig parcours. Na een stevige opwaartse verrassing in april, koelden prijsstijgingen in mei wat af. We schrijven wel nog steeds 3.4% J/J (was 2.6% in februari). De opsprong had onder meer te maken met wijzigingen in energie- en andere gereguleerde prijzen. Toch blijft de BoE hoopvol dat het onderliggende desinflatieproces zich doorzet. Omwille van technische factoren blijft inflatie dit jaar waarschijnlijk nog nabij het huidige niveau om volgend jaar (hopelijk) terug te keren richting 2%. De BoE blijft zich bewust van een tweezijdig risico (loonstijging & diensteninflatie, olieprijs, tariefonzekerheid versus het neerwaarts risico van een zwakkere vraag). Inzake groei zijn er na een sterk eerste kwartaal (0.7% kw/kw), tekenen van vertraging, zowel in de output als op de arbeidsmarkt. Dat laatste moet ook de loongroei temperen.

Wat de concrete beleidsbeslissing betreft, stemden drie van de negen raadsleden om de rente nu al met 25 bpn te verlagen. Twee ‘standaard-duiven’ en één bijkomende stem. Zij hebben vooral oog voor de afkoeling op de arbeidsmarkt. De zes andere leden willen nog iets meer duidelijkheid/bevestiging. Het beleidscomité vindt hoe dan ook dat het beleid nog even restrictief moet blijven en enkel volgens de weg van de geleidelijkheid kan worden teruggeschroefd. De terughoudende toon van Bailey op de persconferentie in mei en de inflatieopsprong deed de markt vorige maand twijfelen of er ruimte was voor meer dan één bijkomende verlaging dit jaar. Na de recent softere data (bevestigd door de BoE-analyse gisteren) aligneerden die geldmarkten zich opnieuw met het ‘één-per-kwartaal patroon’ (cumulatief 50 bpn tegen jaareinde tot 3.75%).

Het recente verlies aan rentesteun was geen hulp voor het pond. Na een kortstondige test beneden EUR/GBP 0.84 eind mei, deemstert het pond opnieuw weg tot boven EUR/GBP 0.85. Dat had echter ook te maken met de algemene onzekerheid/risico-aversie en met de moeilijke Britse budgettaire context (beperkte beleidsruimte, mogelijke druk op het lange eind van de Britse rentecurve). Die thema’s blijven sluimeren en wegen evenzeer op de Britse munt. Die krijgt vanmorgen overigens nog bijkomende tegenwind van uiterst zwakke kleinhandelsverkopen (mei). We zien EUR/GBP geleidelijk hoger trekken in de 0.8350/0.8740 handelsband met 0.8600/24 als intermediaire weerstand.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up