Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

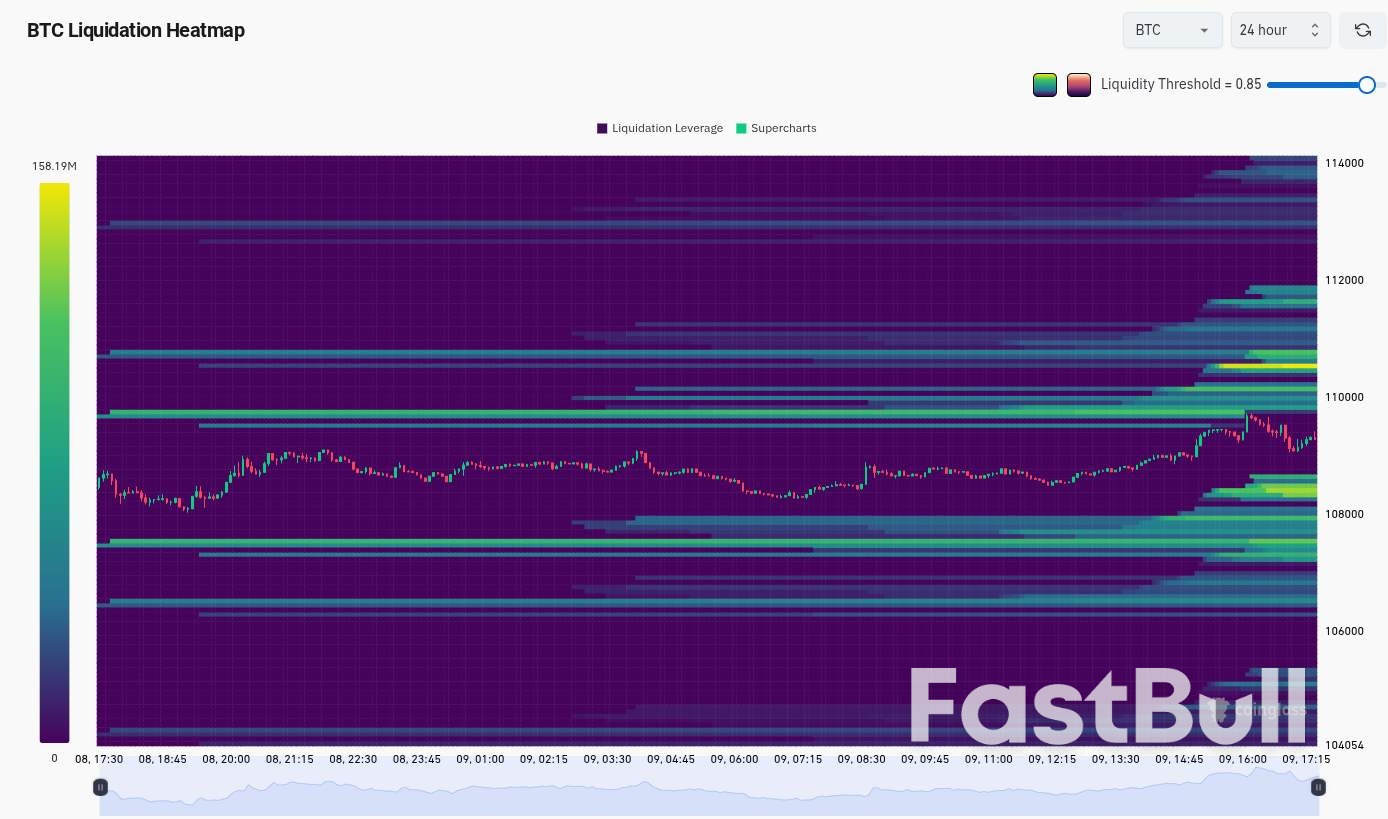

Bitcoin price performance frustrates bulls as $110,000 stays out of reach, but the clock is ticking to even more risk-asset volatility.

BTC/USDT 3-day chart with RSI data. Source: BitBull/X

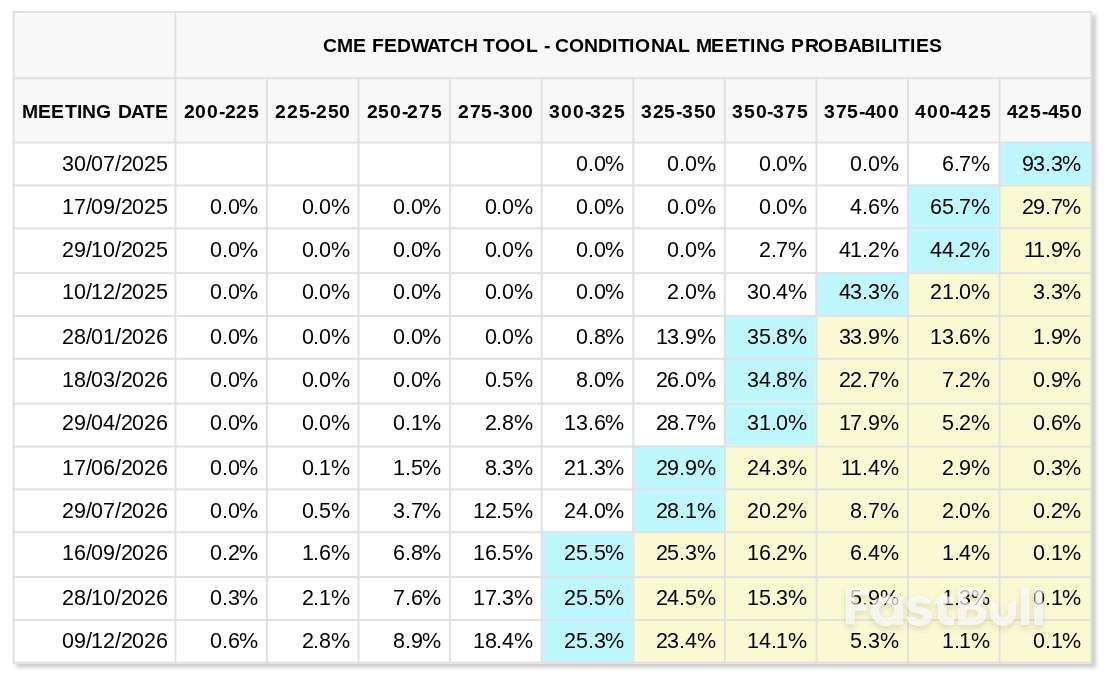

BTC/USDT 3-day chart with RSI data. Source: BitBull/X Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool

Fed target rate probabilities (screenshot). Source: CME Group FedWatch Tool

The Energy Information Administration (EIA) released its weekly report on Crude Oil Inventories, a key indicator of the number of barrels of commercial crude oil held by US firms. The report showed a significant increase in crude oil inventories, defying expectations and surpassing previous levels.

The actual number of barrels reported by the EIA reached 7.070 million, a figure that exceeded both the forecasted and previous numbers. The forecast had predicted a decrease of 1.700 million barrels, making the actual figure a substantial deviation from expectations.

This upswing in crude oil inventories also represents a significant contrast to the previous data. The prior week’s report showed 3.845 million barrels, meaning the current figure nearly doubled the amount of crude oil held by US firms.

The level of inventories plays a crucial role in influencing the price of petroleum products, which in turn can have an impact on inflation. This unexpected increase in crude inventories implies weaker demand, which is bearish for crude prices.

A higher than expected increase in inventories can be interpreted as a sign of weaker demand, which could lead to a fall in crude prices. On the other hand, if the increase in crude is less than expected, it implies greater demand and is bullish for crude prices.

The EIA’s Crude Oil Inventories report is one of the most closely watched indicators by investors and analysts in the energy market, due to its potential to influence not only energy prices but also broader financial markets and the economy.

This unexpected surge in US crude oil inventories will be a key factor for investors and analysts to monitor in the coming weeks, as it could potentially signal shifts in the energy market and broader economic trends.

President Donald Trump signaled he would send more letters Wednesday dictating new U.S. tariff rates on a slew of countries' imports, leaning into his aggressive approach to resetting America's global trade relationships.

The Trump administration "will be releasing a minimum of 7 Countries having to do with trade, tomorrow morning," Trump wrote in a Truth Social post on Tuesday evening.

An "additional number of Countries" will be "released" Wednesday afternoon, he wrote.

While the wording of Trump's post was unclear, he appeared to be suggesting that he will repeat his actions from Monday, when he shared screenshots of letters telling 14 countries' leaders that their exports to the U.S. would face steep new tariffs starting Aug. 1.

The nearly identical two-page letters signed by Trump were sent to Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, Myanmar, Bosnia and Herzegovina, Tunisia, Indonesia, Bangladesh, Serbia, Cambodia and Thailand.

The rates for each country range from 25% to 40%. The letters note that the U.S. will "perhaps" consider adjusting the new tariff levels, "depending on our relationship with your Country."

Many of those rates are close to what Trump had imposed as part of his "liberation day" tariff rollout on April 2, which set a 10% baseline levy for nearly all countries on earth and slapped much higher duties on dozens of individual nations.

That announcement sparked a week of turmoil in global trading markets, which only ended when Trump abruptly said he would pause those higher rates for 90 days.

That reprieve was set to expire Wednesday. But on Monday, Trump signed an executive order delaying the tariff deadline until Aug. 1.

In another post earlier Tuesday, Trump asserted that "there will be no change" to the August start date.

"No extensions will be granted," he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up