Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The cryptocurrency market has seen a much-needed revival in recent weeks. After a brutal Q1 that saw Ethereum (ETH) fall by 45%, the second-largest...

The cryptocurrency market has seen a much-needed revival in recent weeks. After a brutal Q1 that saw Ethereum (ETH) fall by 45%, the second-largest crypto has now surged over 62% in the past month and is trading near $2,600 — its highest level in months. This renewed bullish sentiment is not just limited to ETH. It’s lifting altcoins across the board, including Bitcoin Cash (BCH).

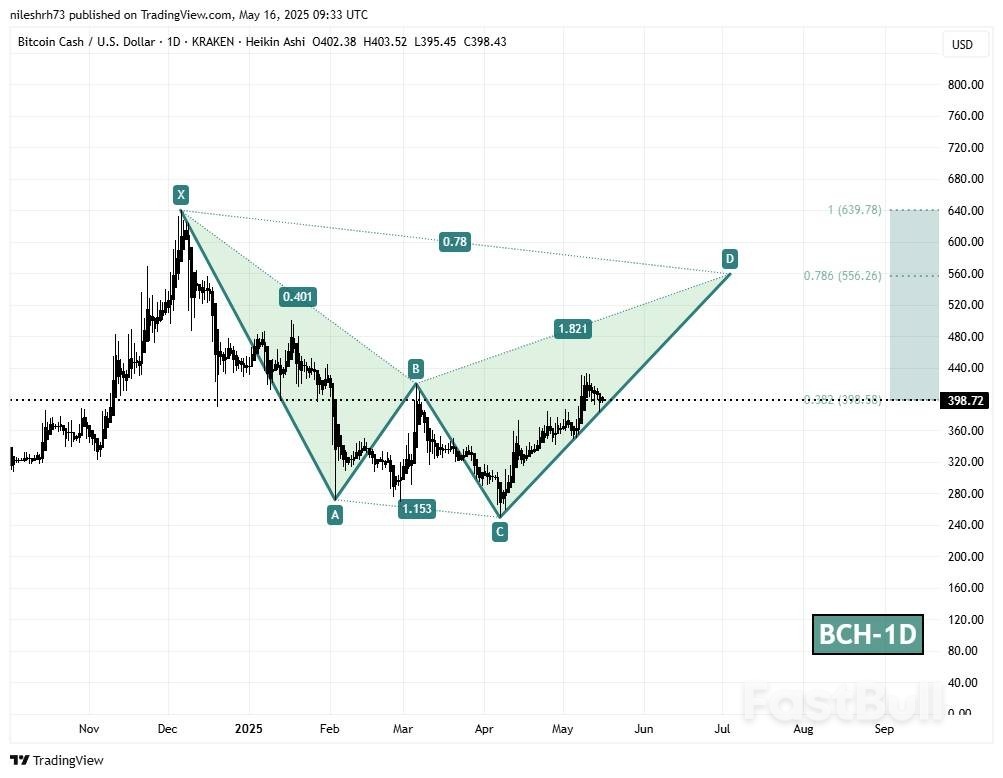

BCH has gained over 24% in the last month, cutting its yearly losses to just 8%. While this alone is a sign of strength, technical analysis reveals something even more promising — a developing harmonic pattern that hints at further upside.

Source: Coinmarketcap

Source: CoinmarketcapThe daily chart of BCH shows a Bearish Cypher Pattern in progress. Despite the “bearish” label, the pattern still has room to complete its structure to the upside before any major resistance sets in.

The pattern began in early December 2024, when BCH failed to hold the $639 level (marked as point X), triggering a sharp sell-off. The token dropped over 60%, bottoming out near $249 (point C) in early April 2025.

Bitcoin Cash (BCH) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin Cash (BCH) Daily Chart/Coinsprobe (Source: Tradingview)Since then, BCH has been staging a steady comeback and is now forming the CD leg of the Cypher. If the pattern continues to play out, BCH could climb toward point D, which is projected near $556 — a key Fibonacci resistance level. From the current price near $398, that suggests a potential 40% rally.

The area near $556 is a critical zone to watch. This level corresponds to the 78.6% Fibonacci retracement of the initial XA leg — a traditional reversal zone for Cypher patterns. If bulls manage to push BCH through this resistance, a full recovery toward $639 (point X) could be on the cards, offering a 59% upside from current levels.

However, failure to break this level could trigger some profit-taking or consolidation, typical of harmonic pattern completions.

Ultimately, whether BCH can maintain this momentum may hinge on broader market strength. Ethereum’s continued rally, for instance, could be a major catalyst for altcoins like BCH.

President Donald Trump said he would set tariff rates for US trading partners “over the next two to three weeks,” saying his administration lacks the capacity to negotiate deals with all of its trading partners.

Trump said Friday that Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick “will be sending letters out essentially telling people” what “they’ll be paying to do business in the United States.”

“I think we’re going to be very fair. But it’s not possible to meet the number of people that want to see us,” the president said during a meeting with business executives in the United Arab Emirates.

The US president asserted there are “150 countries that want to make a deal.” He didn’t say how many, or which, nations would receive letters.

The White House and Commerce Department didn’t immediately respond to requests for comment overnight in the US.

Trump announced higher tariffs on dozens of trading partners on April 2, but later paused them for 90 days amid investor panic to give foreign governments time to negotiate. Yet the president in recent weeks has moved away from the idea he would engage in a back-and-forth with every partner.

While the Trump administration is prioritizing trade talks with more than a dozen nations, a lack of manpower and capacity makes it impossible to hold concurrent negotiations with all the countries caught up in the president’s so-called reciprocal tariffs plan.

Tariffs are charged at the border by US Customs and Border Protection, but the extra costs are often passed on in part or full to US consumers.

Earlier this month, Trump said he would simply dictate tariff levels for many nations looking to avoid higher duties.

Negotiations are still ongoing with several economies, including the Japan, South Korea, India and the European Union. Trump recently agreed to a trade framework with the UK and to a mutual temporary tariff reduction with China to buy more time for talks.

The US president said Thursday that New Delhi made an offer to drop tariffs on US goods, a proposal that the Indian government did not confirm.

“We have four or five other deals coming immediately,” Trump said on May 9, as he touted his UK blueprint. “We have many deals coming down the line. Ultimately, we’re just signing the rest of them in.”

Federal Reserve Bank of Atlanta President Raphael Bostic said he expects the US economy to slow this year but not fall into recession, and reiterated that he sees one interest-rate cut in 2025.

Bostic said economic growth could come in at 0.5% or 1% this year, as uncertainty and concerns about the outlook weigh on consumers. Fluctuating trade policy has also made businesses more reluctant to make important decisions, Bostic said.

“I have one cut for the year,” Bostic said during a May 14 interview for Bloomberg’s Odd Lots podcast. “In part, it’s because I think the uncertainty is unlikely to resolve itself quickly.”

Bostic pointed to the 90-day delays in the implementation of so-called reciprocal tariffs along with the latest US-China trade de-escalation, noting the final results of the negotiations are still unclear. When asked in the podcast, which aired Friday, if the recent trade truce between the US and China had changed his outlook, Bostic replied, “a little.”

Bostic said last week that he didn’t think it was “prudent” to adjust monetary policy with so little visibility about the path ahead. Fed officials kept interest rates steady at their most recent gathering, and said they see increased risks of both higher unemployment and inflation. Fed Chair Jerome Powell made clear the central bank is in no hurry to lower borrowing costs.

Bostic said economists at the Atlanta Fed see tariffs as putting upward pressure on inflation. That’s a view shared by many forecasters.

“That means that our policy is going to have to anticipate — and to some extent — potentially push against those inflationary forces to the extent that we see them, so that will put a limit on where our current policy stance is,” Bostic said.

The EUR/USD pair remained steady near 1.1196 on Friday, closing the week with little movement.

Earlier in the week, the US dollar strengthened as the US-China trade dispute showed signs of easing. However, this optimism was short-lived due to disappointing economic data.

The greenback initially rose by around 1% after Washington and Beijing agreed to reduce tariffs temporarily for 90 days, fuelling hopes of progress toward a broader trade deal. Yet, weak US economic indicators soon dampened sentiment:

These concerning figures have led traders to price in additional Fed rate cuts for 2025.

The EUR/USD continues to consolidate around 1.1173. A temporary rise to 1.1276 (testing resistance from below) remains possible, but this uptick is considered a corrective phase within the broader downtrend. Once complete, the pair may resume its decline toward 1.0950, this being the first key support level. The MACD indicator confirms this outlook, with its signal line below zero and pointing downward.

The pair has already met a local bullish target at 1.12653, followed by a pullback to 1.1170. Today, another test of 1.1276 is plausible, but the broader expectation remains bearish, with a potential drop towards 1.1100. This scenario is reinforced by the Stochastic oscillator, whose signal line is above 80, suggesting an imminent downward reversal towards 20.

The EUR/USD remains range-bound amid mixed fundamentals and technical signals. While a short-term rebound is possible, the dominant downtrend is expected to prevail, with key support levels at 1.0950 (H4) and 1.1100 (H1). Traders should monitor Fed policy expectations and upcoming economic data for further direction.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up