Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)A:--

F: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Nov)

U.S. Manufacturing Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Nov)

U.S. Manufacturing Capacity Utilization (Nov)A:--

F: --

U.S. Industrial Output YoY (Nov)

U.S. Industrial Output YoY (Nov)A:--

F: --

P: --

U.S. Industrial Output MoM (SA) (Nov)

U.S. Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Nov)

U.S. Capacity Utilization MoM (SA) (Nov)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Dec)

U.S. Richmond Fed Manufacturing Shipments Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Dec)

U.S. Richmond Fed Services Revenue Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Dec)

U.S. Conference Board Consumer Expectations Index (Dec)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Dec)

U.S. Conference Board Present Situation Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Dec)

U.S. Richmond Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Dec)

U.S. Conference Board Consumer Confidence Index (Dec)A:--

F: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

no bro ppl are on holiday

no bro ppl are on holiday

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

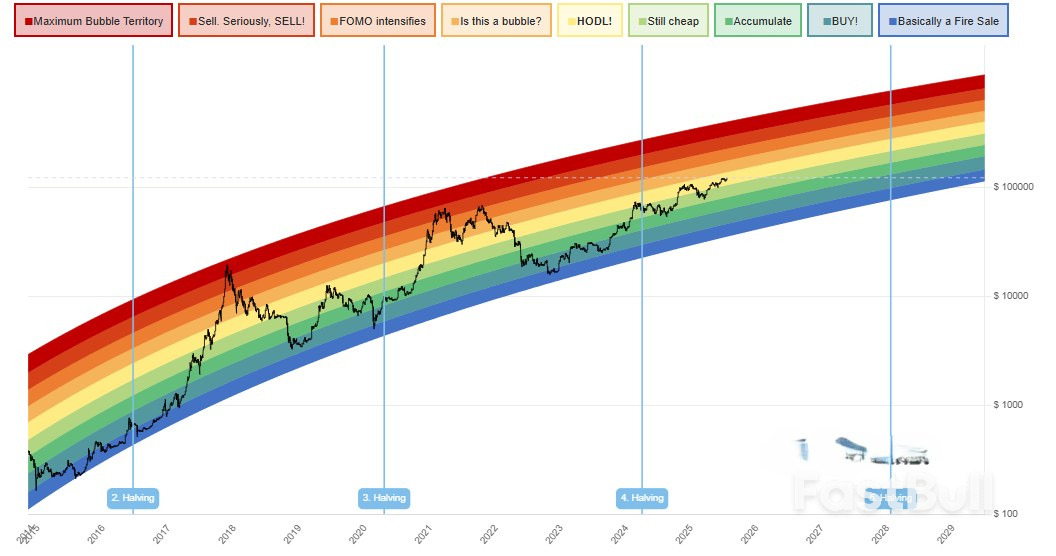

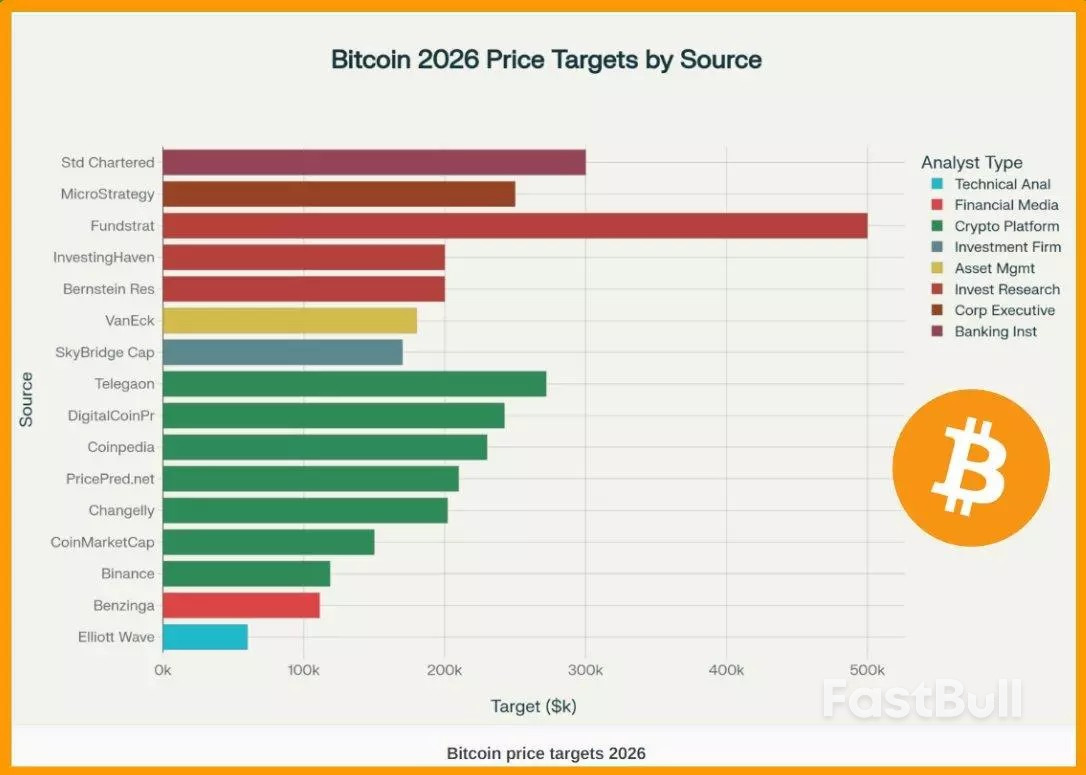

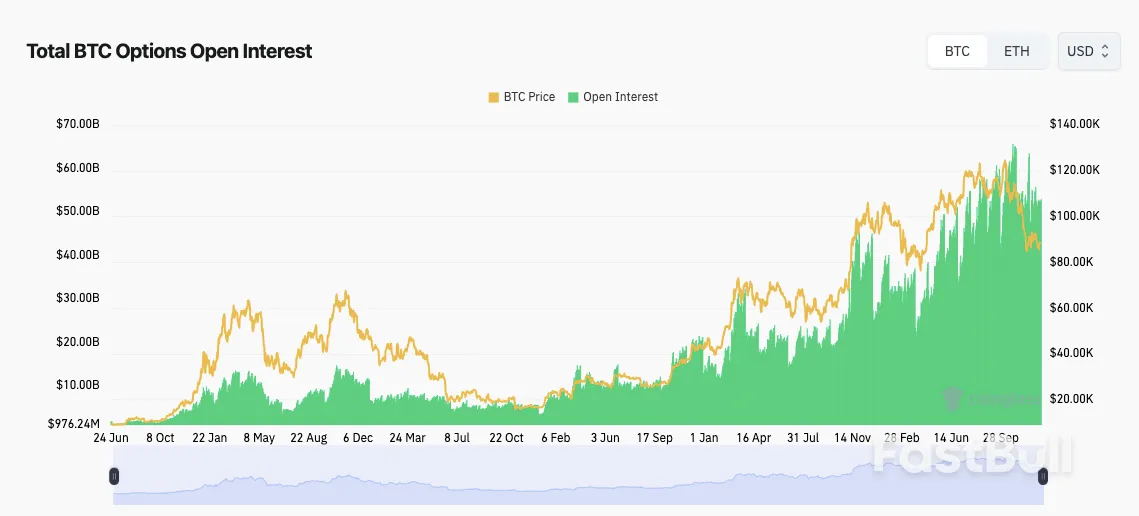

Bitcoin enters 2026 with tightening supply, resilient institutional demand, and improving liquidity, but faces risks of ETF outflows and a potential extended correction after a completed multi-year rally.

The NASDAQ 100 looks like it is going to be very quiet on Wednesday, which is not a surprise. It is Christmas Eve, and it is a shortened session, and most Americans just really cannot be bothered. There will be, of course, some electronic trading, and in pre-market trading, we have done very little, but it looks more positive than negative if nothing else.

I do think the short-term pullbacks will continue to be buying opportunities over the next several weeks. Keep in mind that volume shrinks quite a bit this week and next week, so you could get erratic moves, but at this point, I see no reason to look at this as a market you should be shorting. I am still paying close attention to the 25,000 level for support.

The Dow Jones 30 is slightly positive as well, but again, this is a situation where the volume just is not going to be there to get the market overly excited, at least unless, of course, something happens externally.

The 47,750 level continues to be support, and the 49,000 level above continues to be resistance. All things being equal, I am a buyer of dips, and I do think this is a market that, given enough time, will have to challenge 50,000. That is obviously a story for 2026, but I think that is where we are going.

The S&P 500 sits right here at all-time highs or within about 15 points of it as I record the video, and it does look like it wants to break out to the upside. I do think that the S&P 500 will find the $7,000 level before it is all said and done.

Short-term pullbacks are buying opportunities, and there is nothing on this chart that even remotely suggests that we should be thinking about going short. 6,800 continues to be supported, especially with the 50-day EMA reaching that level. Therefore, I am looking for dips and buying the right-hand side of the V in order to continue to take advantage of a longer-term uptrend.

Total BTC options open interest (screenshot). Source: CoinGlass

Total BTC options open interest (screenshot). Source: CoinGlass

XAU/USD one-hour chart. Source: Cointelegraph/TradingView

XAU/USD one-hour chart. Source: Cointelegraph/TradingViewThe pound held around a three-month high against a broadly softer dollar and near its firmest in two months against the euro on Wednesday, although trading was thin ahead of the Christmas holiday.

Sterling briefly inched up to as high as $1.35335 in early trading, its highest since mid-September, though was last flat on the day just below that level.The dollar is at similar levels against other European currencies including the euro.

For the pound it was a similar story versus the euro. The common currency nudged down to 87.21 pence, its lowest since mid October, but was last flat on the day just above that.

With the Christmas holiday approaching in Britain, and many market participants already off, trading was thin.

That left sterling still largely shaped by last week's Bank of England meeting.

The BoE cut interest rates after a narrow vote by policymakers but it signalled that the already gradual pace of lowering borrowing costs might slow further.

Should that materialise, that would see the pound remain supported versus other currencies, particularly the dollar, with the Federal Reserve expected to continue easing next year.

The number of Americans filing new applications for jobless benefits unexpectedly fell last week, but the unemployment rate likely remained high in December amid sluggish hiring.

Initial claims for state unemployment benefits dropped 10,000 to a seasonally adjusted 214,000 for the week ended December 20, the Labor Department said on Wednesday. Economists polled by Reuters had forecast 224,000 claims for the latest week. The report was published a day early because of the Christmas Day holiday.

Claims have been volatile in recent weeks amid challenges adjusting the data for seasonal fluctuations ahead of the holiday season. The labor market remains locked in what economists and policymakers describe as a "no hire, no fire" mode.

Though the economy remains resilient, with gross domestic product increasing at its fastest pace in two years in the third quarter, the labor market has almost stalled. Labor demand and supply have been impacted by import tariffs and an immigration crackdown, economists say.

The number of people receiving unemployment benefits after an initial week of aid, a proxy for hiring, increased 38,000 to a seasonally adjusted 1.923 million during the week ending December 13, the claims report showed.

The so-called continuing claims covered the period during which the government surveyed households for December's unemployment rate.

The elevated continued claims aligned with a survey from the Conference Board on Tuesday showing consumers' perceptions of the labor market deteriorated this month to levels last seen in early 2021. The unemployment rate increased to a four-year high of 4.6% in November, though part of the rise was because of technical factors related to the 43-day government shutdown.

The record-long shutdown prevented data collection for October's unemployment rate. The Federal Reserve this month cut its benchmark overnight interest rate by another 25 basis points to the 3.50%-to-3.75% range, but signaled borrowing costs were unlikely to fall in the near term as policymakers await clarity on the direction of the labor market and inflation.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up