but later you will

but later you will

Signal Accounts for Members

All Signal Accounts

All Contests

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Security Committee's Vice Chairman Medvedev: Behind The So Called 'Chaos' Of Trump, He Is An Effective And Original USA Leader

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

but later you will

but later you will

but later you will

but later you will

Envious of Trump, who can freely control gold prices.

Envious of Trump, who can freely control gold prices.

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Australia’s consumer confidence surged in August after the Reserve Bank cut interest rates for the third time this year and signaled further easing is likely.

Australia’s consumer confidence surged in August after the Reserve Bank cut interest rates for the third time this year and signaled further easing is likely.

Sentiment advanced by 5.7% to 98.5 points, a 3-1/2 year high, a Westpac Banking Corp. survey showed Tuesday. While pessimists persist in outweighing optimists, with a dividing line of 100, the gap is narrowing.

It has been 42 months since Australian consumers last registered a sentiment reading above 100 – the second-longest period of continuous pessimism since the survey began in 1974, behind only the early 1990s recession, said Matthew Hassan, Westpac’s head of Australian macro forecasting.

The data suggest “this long run of consumer pessimism may finally be coming to an end,” Hassan said, adding that all components of the index posted gains. “Consumers appear much less anxious about their finances.”

The RBA has lowered borrowing costs by 75 basis points since the start of the year for a cash rate of 3.6%. Governor Michele Bullock last week signaled a “couple more” cuts will be required to achieve the bank’s latest forecasts.

Economists see another rate reduction in November and a final one early next year, taking the terminal rate to 3.1%.

The prospect of further easing “looks to have reinforced consumer expectations that mortgage interest rates are headed lower, giving a broad-based boost to sentiment,” Hassan said. “Consumer attitudes towards major purchases are starting to turn positive.”

In Australia, where consumption accounts for about half of the economy, households’ attitudes toward purchases are closely monitored by policymakers.

Oil prices slipped in early Asian trade on Tuesday as market participants contemplated planned three-way talks among Russia, Ukraine and the U.S. to end the war in Ukraine, which could lead to an end to sanctions on Russian crude.

Brent crude futures fell 7 cents, or 0.11%, to $66.53 a barrel by 0000 GMT. U.S. West Texas Intermediate crude futures for September delivery, set to expire on Wednesday, fell 6 cents, or 0.09%, to $63.36 per barrel.

The more active October WTI contract was down 9 cents, or 0.14%, at $62.61 a barrel.

Prices settled around 1% higher in the previous session.

Following talks with Ukraine President Volodymyr Zelenskiy and a group of European allies in the White House on Monday, U.S. President Donald Trump said in a social media post he had called his Russian counterpart Vladimir Putin and begun arranging a meeting between Putin and Zelenskiy, to be followed by a trilateral summit among the three presidents.

"An outcome which would see a ratcheting down of tensions and remove threats of secondary tariffs or sanctions would see oil drift lower toward our $58 per barrel Q4-25/Q1-26 average target," Bart Melek, head of commodity strategy at TD Securities said in a note.

Zelenskiy described his direct talks with Trump as "very good" and said they had spoken about Ukraine's need for U.S. security guarantees.

Trump has pressed for a quick end to Europe's deadliest war in 80 years, but Kyiv and its allies worry he could seek to force an agreement on Russia's terms.

"A result which would see the U.S. apply pressure on Russia in the form of broader secondary tariffs against Russia's oil customers (as those now faced by India) would no doubt move crude to the highs seen a few weeks ago," Melek added.

Brazil is forcefully rejecting Washington’s allegations of unfair trade practices, describing an investigation launched by the US Trade Representative into the matter as an illegitimate use of unilateral US trade law.

In a 91-page response to the so-called Section 301 probe, Brazil said its digital, intellectual property, ethanol and environmental policies are consistent with international trade rules. Brazil’s comments were submitted to the USTR earlier on Monday and published on its website a few hours later.

Launched in July, the investigation is seen as an attempt to justify the 50% tariffs imposed by President Donald Trump on all Brazilian exports to the US, excluding some 700 items ranging from aviation parts to select agricultural exports.

Trump has linked the penalties to Brazil’s prosecution of former President Jair Bolsonaro, portraying the case as a US national security concern. Brazil countered that the tariffs are political in nature and not grounded in economic harm to American firms.

In its filing, the government stressed the US has consistently run a trade surplus with Brazil — $29.3 billion in 2024 — and that American firms already enjoy broad access to the Brazilian market. More than 70% of US exports enter duty-free, while Brazil’s fast-growing electronic payments system, Pix, is open to global platforms such as Google Pay and WhatsApp. Officials also pointed to joint enforcement efforts on corruption and intellectual property, citing US recognition of Brazil’s progress in reducing patent backlogs and cracking down on piracy.

The submission also devotes significant attention to environmental concerns, asserting that deforestation has dropped by nearly 50% since 2023 thanks to stricter enforcement of the Forest Code and satellite monitoring systems. It argued that Brazil’s major US-bound farm exports — coffee, orange juice, sugar and tobacco — are not related to Amazon clearing.

On ethanol, Brazil contrasted its own 18% tariff with Washington’s 52.5% levy on Brazilian shipments, accusing the US of protecting subsidized corn-based ethanol while blocking sugarcane-based fuel that meets California’s low-carbon standards.

“Unilateral measures under Section 301 risk undermining the multilateral trading system and could have adverse consequences for bilateral relations,” the filing said.

President Luiz Inacio Lula da Silva has promised to keep channels of dialogue open while taking the dispute to the World Trade Organization. He has also rolled out domestic credit lines to cushion exporters from the sudden tariff shock.

US President Donald Trump's meeting with a coterie of European leaders, including Ukraine President Volodymyr Zelenskyy, did not yield any immediate progress on peace in the Russia-Ukraine conflict on Aug. 18, with the prospect of potential secondary sanctions on crude purchases from Russia undecided and Republicans in the US Senate still pushing a harsh sanctions bill on buyers of Russian crude.

Trump has repeatedly threatened the largest buyers of Russian crude with sanctions if a deal to end the war in Ukraine is not reached. On Aug. 6, Trump issued an executive order raising tariffs on US imports from India from 25% to 50%, in response to what Trump described on Truth Social as India's "massive" purchases of Russian crude.

After the White House meetings, US Senate Majority Leader John Thune, Republican-South Dakota, wrote in a social media post that the Senate would pass its own sanctions package if the talks fail to lead to an agreement.

"As peace talks continue today in Washington, the US Senate stands ready to provide President Trump any economic leverage needed to keep Russia at the table to negotiate a just and lasting peace in Ukraine," Thune said.

The bipartisan Senate bill, the Sanctioning Russia Act of 2025, would impose a 500% duty on all goods or services imported by the US from any country that "knowingly sells, supplies, transfers, or purchases oil, uranium, petroleum products, or petrochemical products that originated in the Russian Federation."

Still, as long as negotiations continue, the US is unlikely to levy harsher penalties on Russia's crude buyers, Rachel Ziemba, Senior Advisor at Horizon Engage, said.

"While negotiations are in play, there is no prospect of new sanctions from the US that might reduce supplies of Russian energy," Ziemba said. "This was signaled by Trump after the Alaska meeting. Trump is unlikely to use either tariffs or sanctions until he believes that Putin is blocking an agreement."

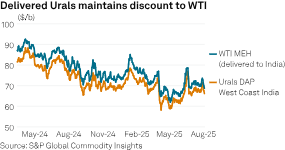

India remains the largest buyer of Russian crude. On Aug. 18, India's state-run refiner India Oil Corp. said in an earnings call that it had continued its purchases despite sanctions and narrowing discounts for heavy Urals supply.

Between April and June, IOC used Russian crude to satisfy a quarter of its feedstock needs. "We are continuing to buy Russian crude in the ongoing quarter," IOC Director of Finance Anuj Jain said on the call. In 2026, the EU will impose an import ban on products made from Russian crude oil.

Platts, part of S&P Global Commodity Insights, assessed Urals crude at a $2.74/b discount to the Dubai benchmark on Aug. 15, reflecting a 76-cent wider discount for the grade than the previous week. However, the delta remains far below recent levels of over $5/b in January.

India, China and Turkey are the largest importers of Russian crude. In July, India received 1.7 million b/d, China received around 1 million b/d and Turkey received around 400,000 b/d, according to S&P Global Commodities at Sea data. Trump's additional tariffs on Indian goods, effective Aug. 27, combined with new EU policies targeting refined products made from Russian crude, are already impacting flows, CAS said on Aug. 14 in its Weekly Crude Oil Report.

On Aug. 18, White House trade advisor Peter Navarro wrote that India was "cozying up to both Russia and China," and said if "India wants to be treated as a strategic partner of the US, it needs to start acting like one."

"An outcome which would see a ratcheting down of tensions and remove threats of secondary tariffs or sanctions would see oil drift lower toward our $58/b average target," TD Securities Head of Commodity Strategy Bart Melek said. "In sharp contrast, a result which would see the US apply pressure on Russia in the form of broader secondary tariffs against Russia's oil customers (as those now faced by India) would no doubt move crude to the highs seen a few weeks ago.

The tone of Trump's meeting with Zelenskyy marked a contrast from their previous meeting in March, when an Oval Office press conference descended into an argument. The two met for several hours in the East Room of the White House on Aug. 18, per reports, after Trump's meeting with Russian President Vladimir Putin in Alaska on Aug. 15. Both pressed for a trilateral meeting of the US, Ukraine and Russia.

Trump continued to push back against reporters' questions that he had given Putin a diplomatic victory by hosting the Russian President in Alaska, while pledging support for Ukraine without specific defense guarantees. While Trump insisted Europe would be the first line of defense against further Russian aggression, the US would "help them out," Trump said.

"There'll be a lot of help when it comes to security," Trump said.

The crude futures market settled slightly higher on the day. NYMEX September WTI settled 62 cents higher at $63.42/b, and ICE October Brent climbed 75 cents to $66.60/b.

No agreement was reached, and the prospect of sanctions remained unknown.

"It's too early to talk substantially about sanctions relief, but I wouldn't see much more fuel production coming from Russia any time soon," Ziemba said. "Sanctions did more to cap new production than to reduce current volumes, although Ukrainian drone attacks on refineries have reduced some volumes. Overall, there are many questions whether sanctions will just be suspended or lifted in the case of any longer-lasting agreement."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up