Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Australian dollar's constructive outlook was bolstered by Reserve Bank of Australia (RBA) Governor Michelle Bullock's 'hawkish' comments on the economy.

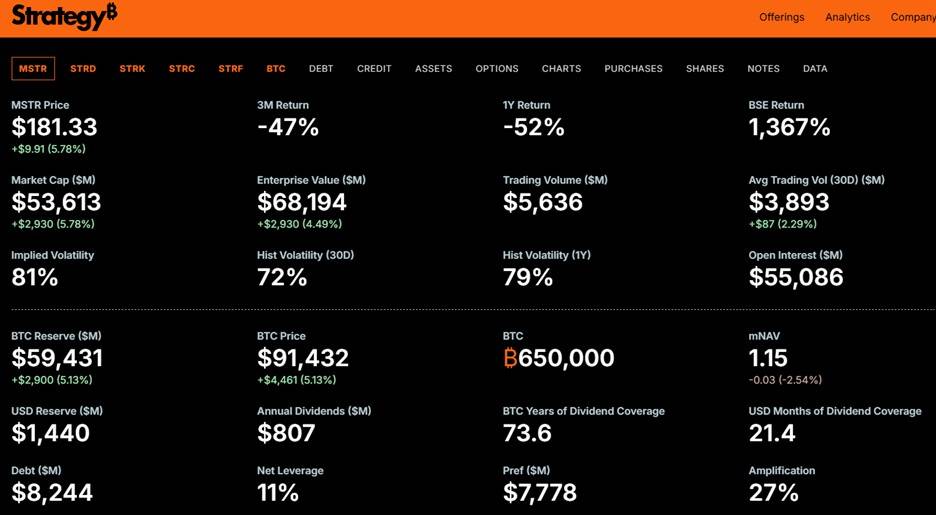

The irony is that Strategy is relying on fiat to fund the $807m per year in interest and dividend payments across its debt and preferred-share tranches. Meeting these obligations is essential if Saylor is to keep the good ship MSTR afloat and keep the holders of the $17bn in preferred stock and convertible notes satisfied.

To achieve this in 2026 (and beyond), Strategy will need either to continue issuing new shares or sell part of its 650,000 BTC holdings on the balance sheet.Given the choice, Saylor has made it clear he will never willingly sell Bitcoin - but in 2026 that decision may well be taken out of his hands. Ultimately, Mr Market could decide it for him.

On Monday, Schiff incorrectly claimed that MSTR had sold BTC on-market to fund upcoming interest payments. This misstep didn't help his argument, even if his broader critique of MicroStrategy's increasingly complex capital structure still resonates.

MicroStrategy subsequently disclosed a US$1.44bn reserve fund to cover senior-debt obligations - providing around 21 months of dividend and coupon cover. This may offer short-term support to the MSTR share price. But the short sellers are circling, with short interest is now around 41%, a level that adds fuel to both upside squeezes and downside volatility.

Until recently, traders were focused on market net asset value (mNAV) - now around 1.15, meaning MSTR trades at a small premium to the total BTC value on its balance sheet. It has even traded at a slight discount, which historically would be extremely bearish for MicroStrategy.

With the company's capital structure changing - and $17bn of senior claims above the equity — the market has pivoted to TEV mNAV (Total Enterprise Value / Bitcoin Value).This metric captures:

TEV mNAV remains well above 1.0, suggesting Saylor still has options to raise capital and maintain the company's leveraged Bitcoin strategy.

As long as MSTRs TEV mNAV ratio stays comfortably above 1, Saylor can be reasonably confident that investors will support further equity issuance, enabling MicroStrategy to continue using leverage to accumulate more BTC.

However, with $17bn above the equity, if BTC were to fall significantly below $74,436 (MicroStrategy's average BTC purchase price) and traders increased its concerns for its future solvency, the deep subordination would radically increase the risk premium for MSTR common equity stockholders – a factor which could catalyze the selling.

This is why, when Bitcoin rises, MSTR often sees a much larger percentage gain, with the move amplified by heavy short interest. It's exactly why traders view MSTR as a leveraged, high-beta play on Bitcoin, not simply a proxy for BTC.

Conversely, when Bitcoin trades lower, MSTR almost always suffers a larger percentage decline, reflecting its leveraged capital structure. In 2026, should we continue to see strong drawdown, the big debate will focus on the possibility that MSTR and many other crypto treasury entities could be forced to deleverage and sell down part of their crypto holdings.

MicroStrategy owns around 3% of all BTC in circulation - a meaningful share, though not dominant. But Saylor is unquestionably the most prominent spokesperson for institutional Bitcoin adoption, making his financing decisions and interest-payment strategy highly relevant for BTC markets in 2026–27.

If BTC collapses and MicroStrategy is forced to sell part of its holdings, Peter Schiff will be the first to celebrate — loudly. In that scenario, MSTR could even start leading Bitcoin's price action on down days, particularly when cross-asset volatility rises.

This developing standoff between Saylor's leveraged Bitcoin empire and Schiff's warnings of structural fragility will make for fascinating market theatre — and a source of exceptional trading opportunities in 2026.

Who do you think ultimately wins this battle - Saylor or Schiff?

Senior Ukrainian negotiator Rustem Umerov will hold talks in Brussels on Wednesday with European leaders' national security advisers and then visit the United States, Ukrainian President Volodymyr Zelenskiy said.

He was speaking after U.S. President Donald Trump's special envoy, Steve Witkoff, and son-in-law Jared Kushner met Russian President Vladimir Putin on Tuesday for talks. The Kremlin said on Wednesday no compromise had been reached on a possible peace deal to end the war in Ukraine.

"Ukrainian representatives will brief their colleagues in Europe on what is known following yesterday's contacts by the American side in Moscow, and they will also discuss the European component of the necessary security architecture," Zelenskiy said on Telegram.

After visiting Brussels, Umerov and Andrii Hnatov, Chief of the General Staff of the Armed Forces of Ukraine, will begin preparations for a meeting with Trump envoys in the U.S., he added.

"This is our ongoing coordination with partners, and we ensure that the negotiation process is fully active," Zelenskiy said.

A leaked set of 28 U.S. draft peace proposals, opens new tab emerged last week, alarming Ukrainian and European officials who said it bowed to Moscow's main demands on NATO, Russian control of a fifth of Ukraine and restrictions on Ukraine's army.

European powers then came up with a counter-proposal, and at talks in Geneva, the United States and Ukraine said they had created an "updated and refined peace framework" to end the war. Details of those talks have not been released made public.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up