Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)A:--

F: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Nov)

U.S. Manufacturing Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Nov)

U.S. Manufacturing Capacity Utilization (Nov)A:--

F: --

U.S. Industrial Output YoY (Nov)

U.S. Industrial Output YoY (Nov)A:--

F: --

P: --

U.S. Industrial Output MoM (SA) (Nov)

U.S. Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Nov)

U.S. Capacity Utilization MoM (SA) (Nov)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Dec)

U.S. Richmond Fed Manufacturing Shipments Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Dec)

U.S. Richmond Fed Services Revenue Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Dec)

U.S. Conference Board Consumer Expectations Index (Dec)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Dec)

U.S. Conference Board Present Situation Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Dec)

U.S. Richmond Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Dec)

U.S. Conference Board Consumer Confidence Index (Dec)A:--

F: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

no bro ppl are on holiday

no bro ppl are on holiday

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Asia’s 2025 saw stark contrasts: cyber scam victims and disaster-hit communities suffered most, Gen Z protests had mixed results, economies showed resilience, while Chinese soft power emerged strongest through tech, culture, and brands.

Foreign footwear makers have canceled plans to invest in Indonesia, and shoe factory managers in Vietnam are absorbing some additional costs, accelerating automation and tapping the brakes on hiring as U.S. President Donald Trump's "reciprocal" tariffs infiltrate a key sector for Southeast Asian economies.

Slowing demand in the U.S. is also driving Asian-based manufacturers to seek new markets, but some American buyers have indicated the new levies will not prompt them to abandon their current suppliers in the region. This suggests that the tariffs, which Trump said are meant to push manufacturers to move production to the U.S., are not having the desired effect.

Vietnam and Indonesia are the world's second and third largest footwear exporters after China, according to the World Footwear Yearbook 2025, shipping 1.6 billion and 600 million pairs respectively in 2024. Cambodia is also in the top 10.

After much negotiating, U.S. President Donald Trump imposed so-called reciprocal tariffs of 19% on goods from Indonesia and Cambodia, and 20% on those from Vietnam.

Yoseph Billie Dosiwoda, executive director of the Indonesian Footwear Association (Aprisindo), said the uncertainty triggered by the tariffs had prompted some investors to cancel plans to build factories in the country.

"The investment trend is now downward," he told Nikkei Asia, although he declined to name any companies. "We hope the [U.S.] government can lower the 19% reciprocal tariff to 15% or 10%."

Visitors watch robots making shoes on a production line at an exhibition in Fuzhou, Fujian province, China. Footwear makers in Vietnam say the new U.S. tariffs have prompted them to accelerate their automation drives. © Getty Images

Visitors watch robots making shoes on a production line at an exhibition in Fuzhou, Fujian province, China. Footwear makers in Vietnam say the new U.S. tariffs have prompted them to accelerate their automation drives. © Getty Images

Indonesian footwear exports to the U.S. were valued at $2.39 billion in 2024, accounting for 33.7% of the sector's exports.

But Dosiwoda said U.S. demand for Indonesian footwear products decreased by some 23% in the first nine months of 2025 compared to the same period last year. While October and November data have yet to be published, he said the slump was exacerbated in these months by the decline in American purchasing power due to the U.S. government shutdown for 43 days. The downturn has led to layoffs across the industry.

If tariffs remain above 15%, Indonesian-made products will no longer be competitive, he added, citing high production costs and low labor productivity. "Industry players need domestic deregulation to improve many things, including productivity, a conducive [business climate], and friendly wages [for employers]," Dosiwoda said. Indonesian unions are demanding a 10% wage hike, while in Vietnam the overall minimum wage will rise about 7%.

Vietnam's shoe exports to the U.S. dropped 4% in November versus a year earlier after falling 13% in the previous three months, national statistics show. Companies have reacted to the tariffs by looking for new customers, cutting costs and selling more expensive products.

One executive managing tens of thousands of workers said the increased costs were being shared by the buyers and manufacturers, with many factories pushing increased automation. "These are things we need to do anyway," the industry veteran said. "This gives us no choice but to go faster."

Maybank economist Brian Lee confirmed the trend. "Lower external demand could weigh on the employment outlook," he told Nikkei. "Indeed, firms have become more cautious on hiring."

Indonesia's Aprisindo and the Vietnam Leather, Footwear and Handbag Association say they are increasingly looking toward markets like the European Union -- and Japan in Vietnam's case -- for new opportunities. Indonesia and the E.U. signed a trade deal in September that is likely to remove almost all tariffs on footwear, although this is unlikely to come into effect before the second half of 2027.

Ken Loo, secretary general of the Textile, Apparel, Footwear and Travel Goods Association of Cambodia, said he expects "all players in the supply chain" will share the increased costs of the U.S. tariffs on Cambodian exports.

A boy in a New York shoe store. Footwear sellers in the U.S. are predicting demand will soften in the coming months as tariffs lead to higher prices.

A boy in a New York shoe store. Footwear sellers in the U.S. are predicting demand will soften in the coming months as tariffs lead to higher prices.

The tariffs are also being felt in the U.S. Footwear prices began climbing in July due to the tariffs. According to consumer price index data for September, the latest available, footwear rose 1.3% year over year, while women's shoes went up 2.8%.

Edward Rosenfeld, CEO of casual footwear brand Steve Madden, said in a November earnings call that the price increases have not fully offset the tariffs, and so the levies have eaten into his company's profit margins. He added that the company will be prudent about any more price hikes. Athletic apparel maker Nike, meanwhile, said its U.S. sales rose 9.3% in the three months to the end of November but warned of only modest growth in the current quarter.

VF Corporation, which owns Vans and Timberland, said in an earnings call that it began increasing prices in the fourth quarter of this year to pay for the tariffs.

More turmoil could be on the way as some U.S. importers hold off on placing orders as they await a decision from the U.S. Supreme Court on whether Trump's sweeping tariffs were imposed illegally. The decision could be months away.

The National Retail Federation is therefore forecasting U.S. imports will continue to decline in 2026.

Nevertheless, Indonesia, India and Cambodia are the three most popular emerging sourcing destinations, according to a U.S. Fashion Industry Association survey, with more than 60% of respondents planning to expand sourcing from these countries over the next two years.

Patrick Soong, who helps U.S. companies source in Asia, said none of his customers have shifted sourcing because of the tariffs. Some 20% of Soong's customers source from Vietnam, Thailand and Indonesia.

"It doesn't truly matter in the eyes of the U.S. brand, on where you source," he said. "It's more about the factories' capabilities and the output they can reach."

The NASDAQ 100 looks like it is going to be very quiet on Wednesday, which is not a surprise. It is Christmas Eve, and it is a shortened session, and most Americans just really cannot be bothered. There will be, of course, some electronic trading, and in pre-market trading, we have done very little, but it looks more positive than negative if nothing else.

I do think the short-term pullbacks will continue to be buying opportunities over the next several weeks. Keep in mind that volume shrinks quite a bit this week and next week, so you could get erratic moves, but at this point, I see no reason to look at this as a market you should be shorting. I am still paying close attention to the 25,000 level for support.

The Dow Jones 30 is slightly positive as well, but again, this is a situation where the volume just is not going to be there to get the market overly excited, at least unless, of course, something happens externally.

The 47,750 level continues to be support, and the 49,000 level above continues to be resistance. All things being equal, I am a buyer of dips, and I do think this is a market that, given enough time, will have to challenge 50,000. That is obviously a story for 2026, but I think that is where we are going.

The S&P 500 sits right here at all-time highs or within about 15 points of it as I record the video, and it does look like it wants to break out to the upside. I do think that the S&P 500 will find the $7,000 level before it is all said and done.

Short-term pullbacks are buying opportunities, and there is nothing on this chart that even remotely suggests that we should be thinking about going short. 6,800 continues to be supported, especially with the 50-day EMA reaching that level. Therefore, I am looking for dips and buying the right-hand side of the V in order to continue to take advantage of a longer-term uptrend.

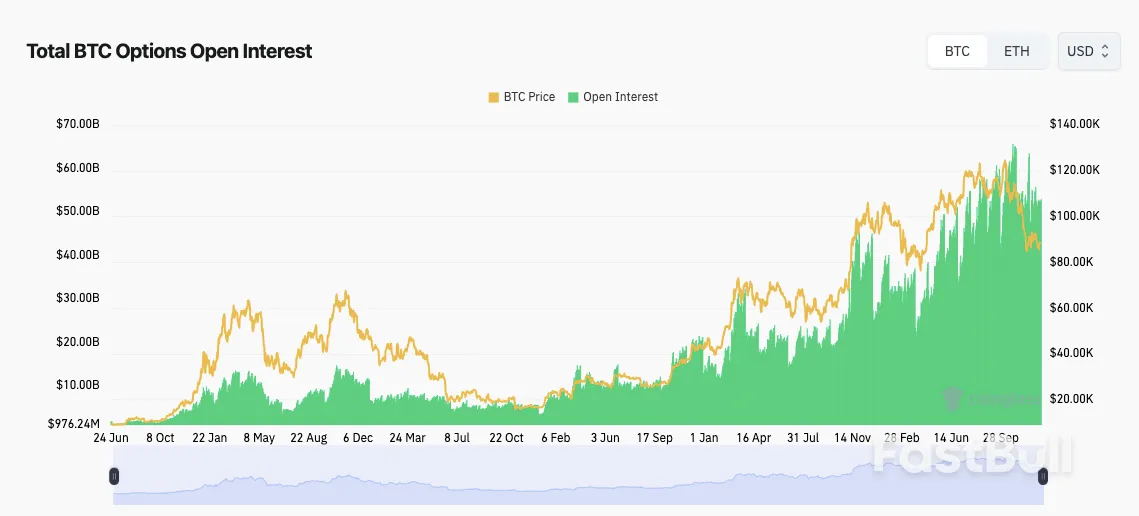

Total BTC options open interest (screenshot). Source: CoinGlass

Total BTC options open interest (screenshot). Source: CoinGlass

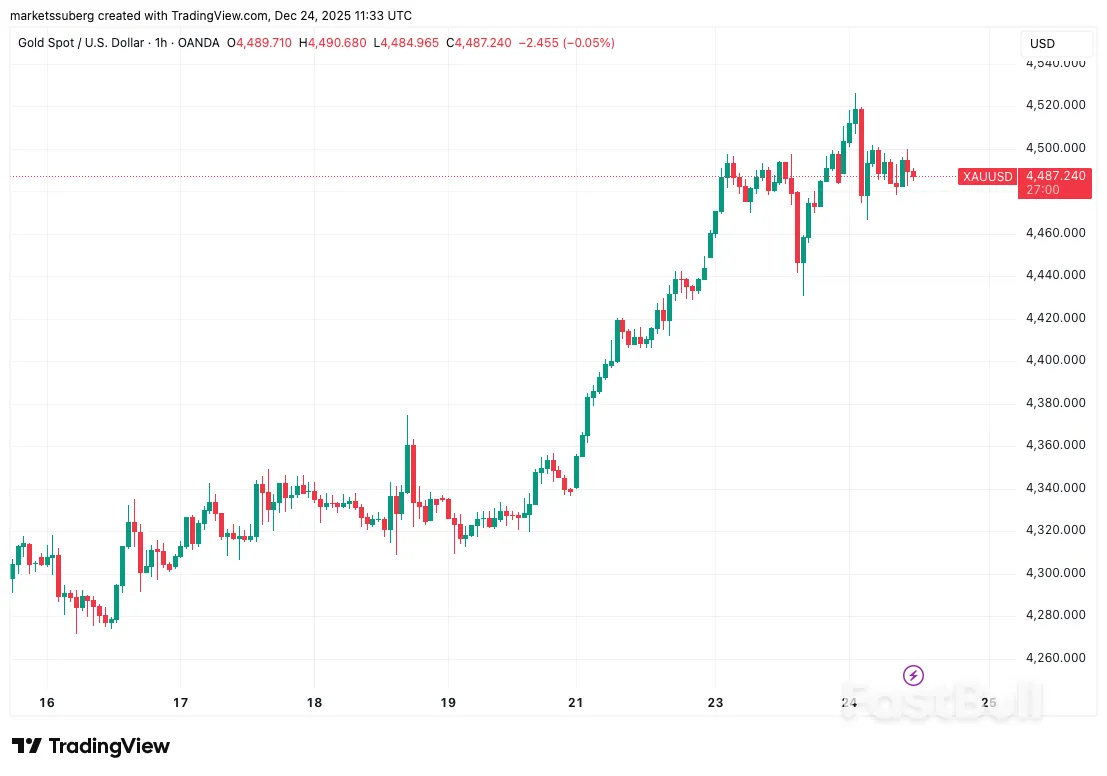

XAU/USD one-hour chart. Source: Cointelegraph/TradingView

XAU/USD one-hour chart. Source: Cointelegraph/TradingViewWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up