Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Goldman Sachs, JPMorgan Chase, And Bank Of America Will See Their Prize Pools Grow By At Least 10%

Joint Statement: Turkish Foreign Minister, EU Commissioner Kos Welcome Gradual Resumption Of Eib Operations In Turkey

Joint Statement: Turkish Foreign Minister, EU Commissioner Kos Agreed To Continue Enlargement On Improving Implementation Of Customs Union

[Cui Dongshu Of The China Passenger Car Association: China To Account For 68.4% Of Global New Energy Passenger Vehicle Market Share In 2025] Cui Dongshu, Secretary-General Of The China Passenger Car Association, Stated That China's Share Of The Global New Energy Passenger Vehicle Market Will Reach 68.4% In 2025, With The Fourth Quarter Alone Reaching A High Of 71.9%. From January To December 2025, China's Share Of The Global Pure Electric Vehicle Market Will Be 64.3%, A Slight Increase Of 1 Percentage Point Compared To 2024

Bank Of England Survey Shows Markets Expect Bank Rate To Bottom Out At 3.0% In Q1 2027 (Nov Survey: 3.25% In July 2026)

India 10-Year Benchmark Government Bond Yield Ends 9 Bps Higher At 6.7363%, Previous Close 6.6472%

Reserve Bank Of India - India Forex Reserves At $723.77 Billion On Jan 30 Versus$709.41 Billion In The Week Earlier

Russian Foreign Minister Accuses Ukraine Of Assassination Attempt On Top Russian General In Moscow

Ukraine's Defence Minister Says Canada Is Transferring Aim Missiles To Strengthen Ukraine's Air Defense

ECB Governing Council Member Koch Said The Euro Exchange Rate Is Not A Good Anchor For The ECB's Decisions

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending RateA:--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit RateA:--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing RateA:--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. Japan Foreign Exchange Reserves (Jan)

Japan Foreign Exchange Reserves (Jan)A:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

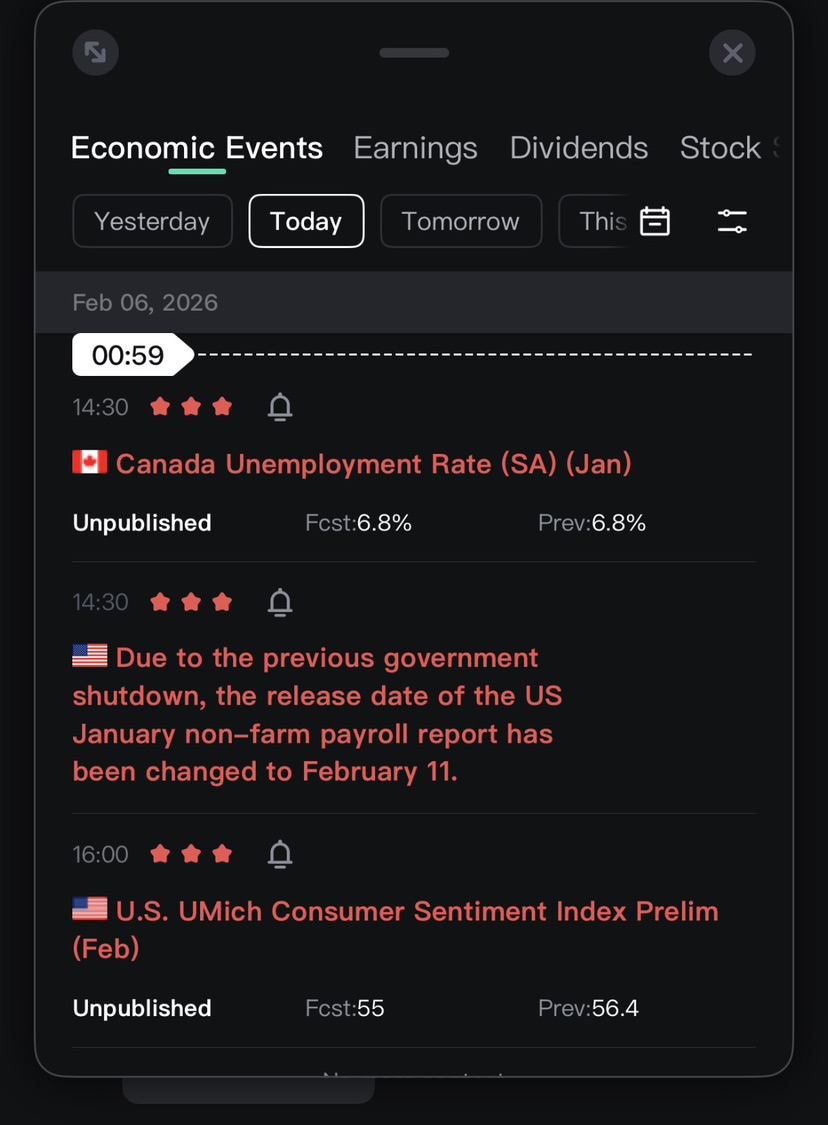

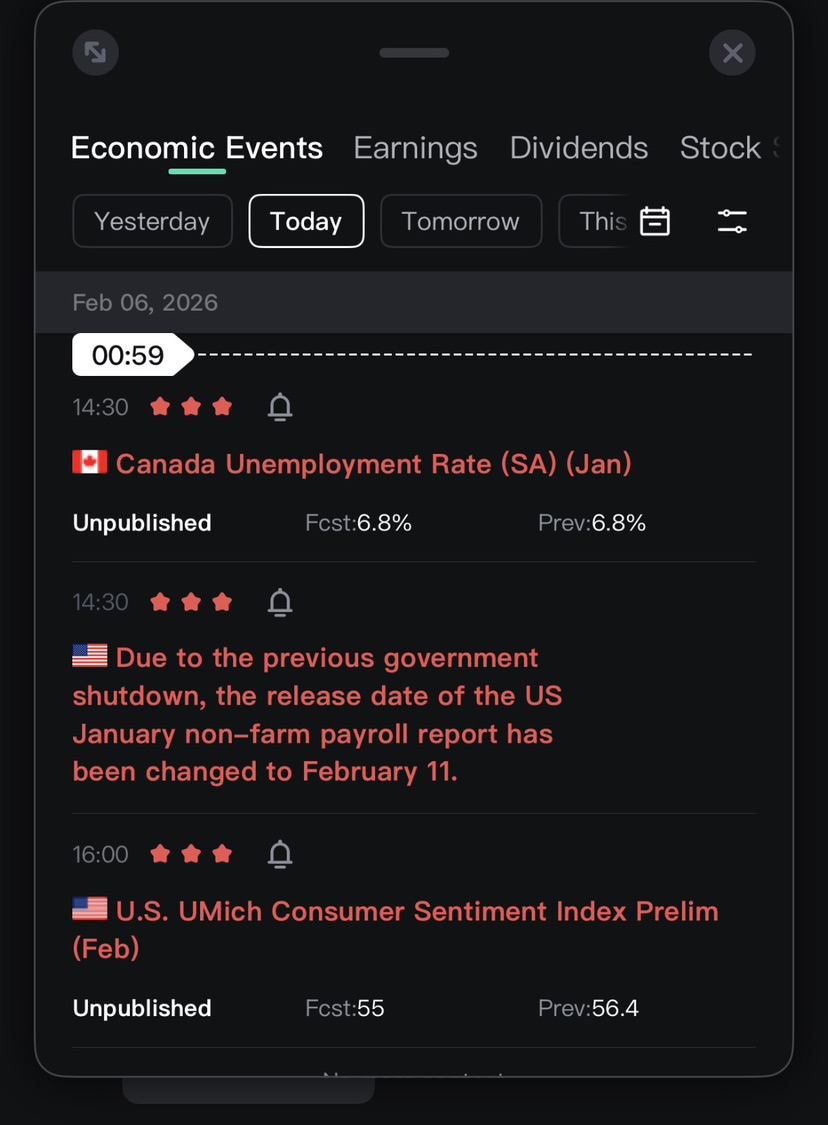

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

No matching data

View All

No data

Asian stock markets retreated as a deepening technology selloff weighed on sentiment, while Indonesian assets came under sharp pressure after a negative shift in the country’s credit outlook intensified investor concerns....

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up