Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

84% of crypto investors admit making FOMO-driven decisions. To avoid emotional pitfalls, focus on research, long-term strategy, ignoring hype, and patience—key habits to build a balanced, informed, and resilient crypto portfolio.

Trump has said trade talks with China and the EU were going 'very well'

The European Union said Wednesday it could strike an outline trade deal with the United States within days — just as US President Donald Trump ramped up threats of new tariffs.

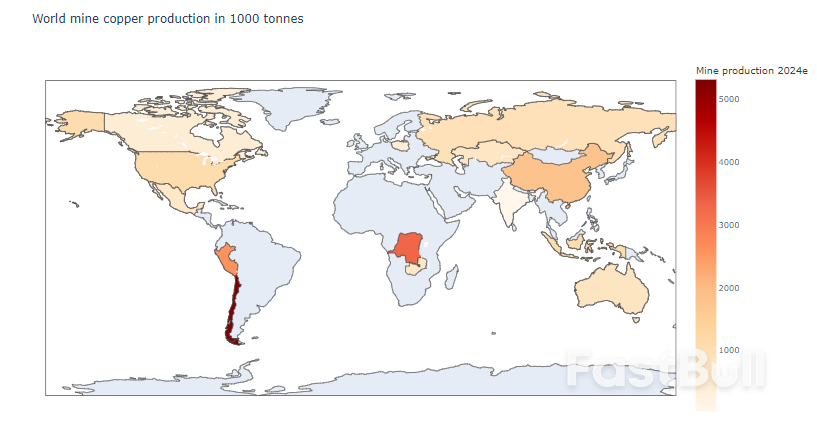

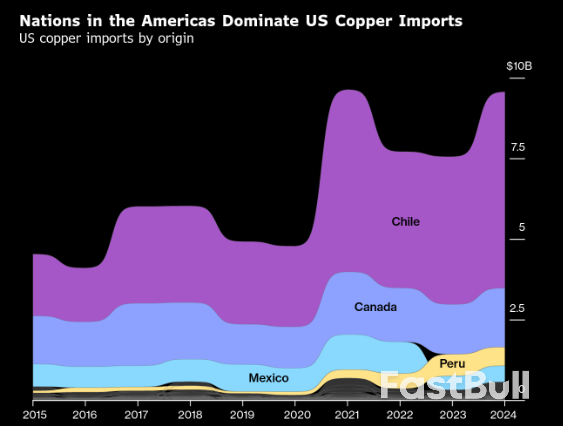

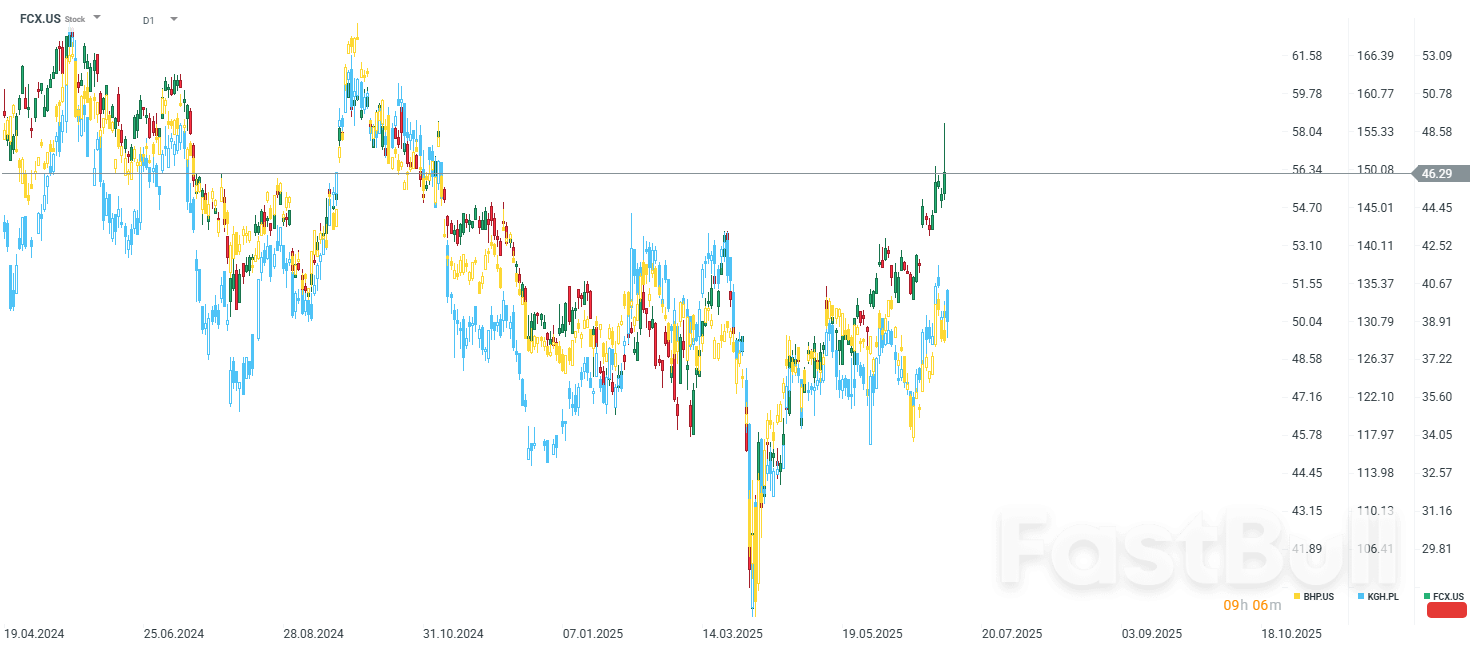

Trump, widening a trade war that has unsettled the global economy, announced a day earlier he would slap a 50% tariff on imported copper and soon roll out long-threatened levies on semiconductors and pharmaceuticals.

Trump issued a fresh round of tariff letters targeting six countries, the White House confirmed Wednesday.

The letters call for tariffs of 30% on Algeria, 25% on Brunei, 30% on Iraq, 30% on Libya, 25% on Moldova and 20% on the Philippines.

The US president had said that "a minimum of seven" new tariff notices would land Wednesday morning, with more to follow.

The latest threat comes a day after he sent tariff letters to 14 trading partners — including major trading partners South Korea and Japan — warning of 25% and higher duties from August 1.

Trump said trade talks with China and the EU were going "very well" and promised to reveal the EU's new export rates "probably" within two days.

"They treated us very badly until recently, and now they're treating us very nicely. It's like a different world, actually," he said on Tuesday.

EU trade chief Maros Sefcovic told lawmakers good progress had been made on a framework agreement and a deal might be possible within days.

He told EU lawmakers he hoped that EU negotiators could finalize their work soon, with additional time now after the US deadline was extended from July 9 to August 1.

"I hope to reach a satisfactory conclusion, potentially even in the coming days," Sefcovic said.

However, Italian Economy Minister Giancarlo Giorgetti cautioned that talks remain "very complicated" and could drag on until the last moment.

If the new measures go ahead, they would push US tariffs to their highest levels since 1934. Markets shrugged off Trump's latest salvo, while the yen weakened further after Japan was hit with new tariff threats.

Oil fluctuated as traders weighed a large gain in US crude stockpiles against fresh US efforts to crimp Iranian crude exports.

West Texas Intermediate swung between gains and losses to trade above $68 a barrel, following two days of advances. US crude stockpiles rose 7.1 million barrels last week, the biggest gain since January, the Energy Information Administration said Wednesday. At the same time, the US Treasury Department sanctioned 22 foreign entities for their roles in facilitating the sale of Iranian oil.

“Despite a material drop in imports week-on-week, a tick lower in refining activity and subdued exports have encouraged a sizeable crude inventory build,” said Matt Smith, Americas lead oil analyst at Kpler.

The sanctions helped to soothe investors’ uncertainty surrounding US policy on Iranian exports, just weeks after US President Donald Trump baffled markets by encouraging China to carry on buying Tehran’s crude. Those surprise remarks represented a reversal of years of US sanctions and briefly allayed concerns that the Israel-Iran conflict would severely disrupt supplies.

Still, sanctions news will have limited upside until the market sees a material loss of barrels, said Joe DeLaura, global energy strategist at Rabobank.

“It’s all kayfabe,” he said. “By the end of the week, all those sanctioned companies will exist under new names in new locations, and the oil will flow.”

Renewed Houthi attacks on cargo ships in the Red Sea — a key trade route for oil — have also notably failed to inject a risk premium into oil prices. The attacks have so far killed at least three crew members and sank two vessels.

“Most ships are already avoiding the Red Sea,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. The developments “indicate some escalation, but do not really change the supply-demand picture.”

Oil surged during the Israel-Iran conflict, with Brent topping $80 a barrel, but prices have since retreated sharply. Attention has now shifted to OPEC+ supply and US trade policy, with multiple analysts highlighting near-term market tightness.

The EIA data somewhat undermined earlier comments by UAE Energy Minister Suhail Al Mazrouei’s comments that a lack of major inventory buildups shows the market needs the production that OPEC+ is reviving, while Saudi Aramco sees healthy global demand despite trade challenges and tariffs.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up