Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Alibaba beat profit forecasts with net income up 78%, driven by strong cloud growth and e-commerce revival. Despite heavy instant commerce investment and softer revenue, shares surged 40% this year on AI-fueled cloud momentum.

Argentina increased foreign-currency restrictions at commercial lenders yet again, as President Javier Milei’s government ramps up efforts to support the peso and ease inflation ahead of midterm elections.

The central bank issued new rules Friday in a bid to tighten oversight of the foreign-exchange market and curb volatility, according to a statement published on its website. The peso strengthened as much as 1.4% before paring the advance to almost 0.7% as of 11:45 am local time.

Effective immediately, banks can’t increase their daily spot FX position on the last business day of the month, compared with the previous day’s balance. The measure is aimed at limiting end-of-month balance sheet maneuvers that could amplify demand for dollars and add to pressure on the peso.

Starting Dec. 1, lenders will also be required to comply with the negative global net FX position limit on a daily basis, rather than the monthly average used until now. The change marks a shift toward stricter, day-to-day monitoring of bank exposure to the currency market.

The rule limits the ability of banks to purchase foreign currency in the spot market on the same day their futures contracts mature, underscoring the monetary authority’s determination to curb dollar demand during periods of financial stress.

Milei has been stepping up efforts to defend Argentina’s currency by tightening monetary policy, adding strain on the banking system and the broader economy as he fights inflation. This week, the government rolled over all of its notes in a debt auction. To ensure demand, policymakers increased the share of commercial bank deposits that must be parked at the central bank, effectively forcing them to absorb more government debt.

Those measures drained liquidity and helped shore up a fragile peso that had threatened to reignite inflation. Friday’s move in the market may also be an extension of the post-auction rally.

Milei’s libertarian party is looking to make gains in a Sept. 7 election in the province of Buenos Aires, which is home to nearly 40% of Argentina’s population and consistently votes for the Peronist opposition. Investors will be eyeing those results as a barometer of voter appetite for the president’s shock-therapy polices ahead of national midterms in October.

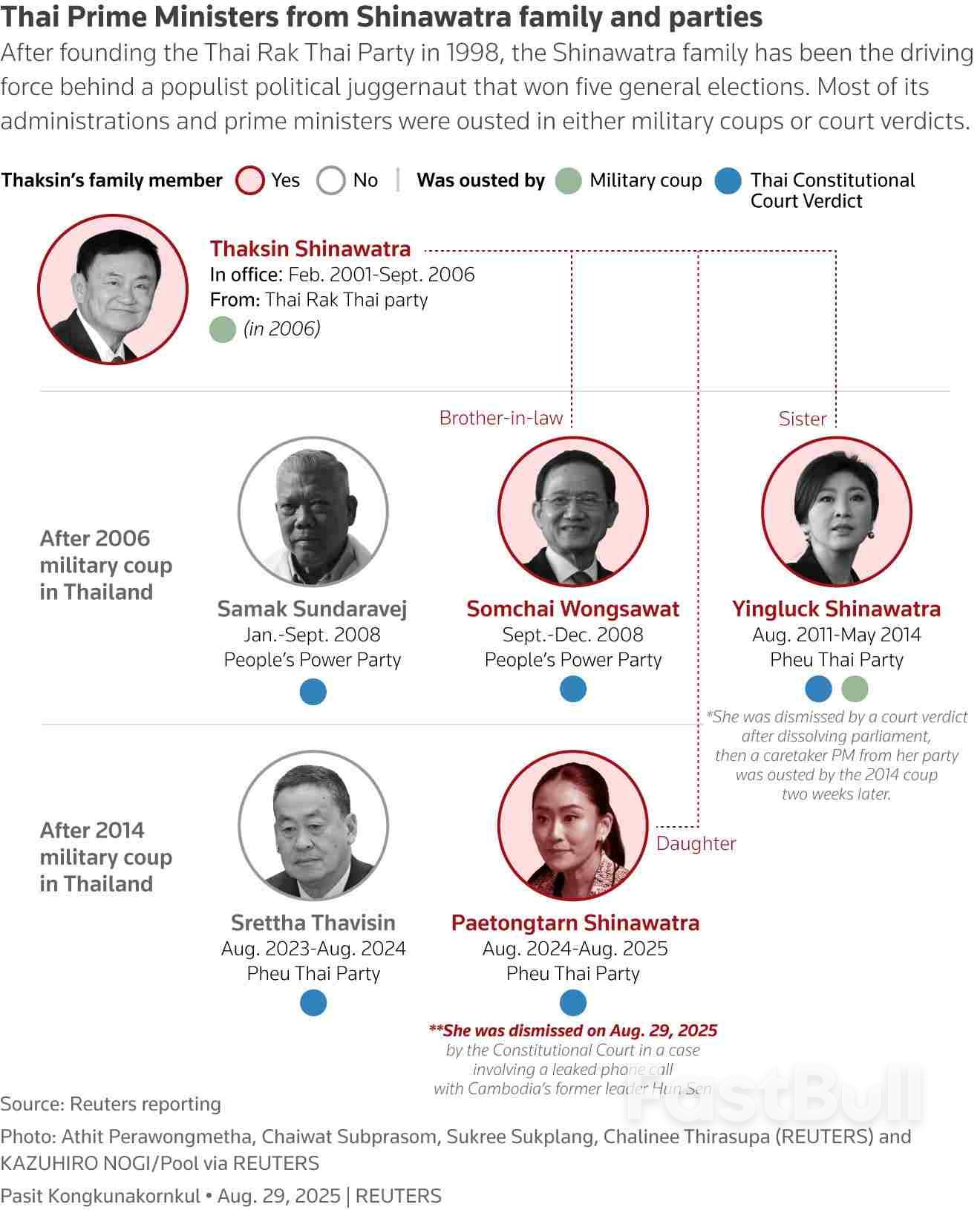

Thailand's Constitutional Court dismissed Prime Minister Paetongtarn Shinawatra on Friday for an ethics violation, in another crushing blow to the Shinawatra political dynasty that triggered a flurry of deal-making aimed at filling the void.

Paetongtarn, who was Thailand's youngest prime minister, becomes the sixth premier from or backed by the billionaire Shinawatra family to be removed by the military or judiciary in a tumultuous two-decade battle for power between the country's warring elites.

The ruling paves the way for the election by parliament of a new prime minister, a process that could be drawn out, with Paetongtarn's ruling Pheu Thai party losing bargaining power and facing a challenge to shore up a fragile alliance with a razor-thin majority.

The court said Paetongtarn violated ethics in a leaked June telephone call, during which she appeared to kowtow to Cambodia's powerful former leader Hun Sen - until recently a close Shinawatra family ally - when both countries were on the brink of an armed conflict. Fighting erupted weeks later, lasting five days.

Hours after the decision, the Bhumjaithai Party that had quit Paetongtarn's coalition over the call emerged as the early frontrunner in forming a new government, with leader Anutin Charnvirakul shuttling across Bangkok to rally support from parties, with pledges that included dissolving parliament within four months.

The ruling brings a premature end to the premiership of the daughter and protégé of divisive tycoon Thaksin Shinawatra and will be a major test of his outsized political clout. Paetongtarn, 39, was a political neophyte when she was abruptly thrust into power after the surprise dismissal of Srettha Thavisin by the same court.

In a 6-3 decision, the court said Paetongtarn had put her private interests before those of the nation and had damaged Thailand's reputation.

"Due to a personal relationship that appeared aligned with Cambodia, the respondent was consistently willing to comply with or act in accordance with the wishes of the Cambodian side," it said.

Reacting to the decision, Paetongtarn called for all parties to work together to bring political stability to Thailand.

"All I wanted was to safeguard the lives of people, whether soldiers or civilians. I was determined to do all I can to protect their lives before the violent clashes," she said.

She is the fifth premier in 17 years to be removed by the Constitutional Court, underlining its central role in an intractable power struggle between the governments of the Shinawatra clan and a nexus of powerful conservatives and royalist generals with far-reaching influence.

The focus quickly shifted to who will replace Paetongtarn, with Thaksin expected to be in the thick of horse-trading between parties and other power-brokers to try to keep Pheu Thai at the helm.

Deputy premier Phumtham Wechayachai will be in charge as caretaker until a new prime minister is elected by parliament, which on Friday called a special session from September 3-5 but made no mention of a vote on a new premier.

Phumtham said the coalition was still together and would agree on a prime ministerial candidate with Pheu Thai at the core.

Five people are eligible to become premier, with only one from Pheu Thai, 77-year-old Chaikasem Nitisiri, a former attorney general with limited cabinet experience, who has maintained a low profile.

Others include ex-premier Prayuth Chan-ocha, who has retired from politics and led a military coup against the last Pheu Thai government in 2014, and former deputy prime minister Anutin, who late on Friday said he already had the votes.

"This will be a government for the people, that will help find a way out for the country ... and return the power to the people," he said.

The ruling thrusts Thailand into more uncertainty, with potential for political deadlock at a time of simmering public unease over stalled reforms and a stuttering economy.

Any Pheu Thai-led administration would likely have a slender majority and could face street protests and parliamentary challenges from an opposition with huge public support that is pushing for an early election.

"Appointing a new prime minister...will be difficult and may take considerable time," said Chulalongkorn University political scientist Stithorn Thananithichot. "Pheu Thai will be at a disadvantage."

The European Commission proposed on Thursday removing duties on imported US industrial goods in return for reduced US tariffs on European cars, a key part of the trade agreement the EU and the US struck last month.The proposals mark the EU's first step in enacting the framework agreement between US President Donald Trump and Commission President Ursula von der Leyen on July 27, which saw the EU accept a broad 15% tariff to avoid a damaging trade war.

The US agreed to reduce its tariffs on cars built in the EU to 15% from 27.5% from the first day of the month in which the EU's legislative proposal was presented — meaning now from Aug 1.The agreement ended conflict between the world's two largest trading and investment partners, although it is an asymmetric deal, with Brussels required to cut its duties and buy more US energy products while Washington retains tariffs on 70% of EU exports.

Trump has periodically railed against the EU, saying in February that it was "formed to screw the United States" and has been critical of the US merchandise trade deficit with the EU, which in 2024 amounted to US$235 billion (RM990.99 billion).

EU governments have broadly said they accept the deal as the lesser of evils, mindful that Trump was otherwise set to impose 30% tariffs on almost all imported EU goods.The impact of removing industrial goods tariffs may in fact be modest, with two-thirds already tariff-free. The average EU rate for US goods is 1.35%, according to economic think tank Bruegel, although the EU does charge 10% for cars.The EU proposals also include farm produce concessions, such as zero tariffs on potatoes, reduced rates for tomatoes and quotas with zero or low tariffs for pork, cocoa and pizza.

It has excluded beef, poultry, rice and ethanol.

"We are protecting our defensive interests there. What we are giving are commitments that are certainly meaningful, but at the same time, I would observe that are not very costly for us today," a Commission official said, adding that other G7 countries had already liberalised trade with the EU.

The EU's legislative proposal will need to be approved by a majority of the EU's 27 members and by the European Parliament, which could take several weeks.Proponents of the deal recognise that increased US tariffs remain, but point to a unique arrangement for the European Union whereby pre-existing US duties, such as 2.5% for cars and up to 20% for cheeses, are not added to the broad 15% rate.Some products, including aircraft, cork and generic drugs are exempt from the 15% tariff, but steel, aluminium and copper are stuck at 50%.The agreement makes little mention of digital services. However, Trump on Monday threatened additional tariffs on all countries with digital taxes or regulations.

U.S. consumer spending increased by the most in four months in July while services inflation picked up, but economists did not believe the signs of strong domestic demand would prevent the Federal Reserve from cutting interest rates next month against a backdrop of softening labor market conditions.

The report from the Commerce Department on Friday showed mild price pressures fromtariffson imports. Economists said the import duties have been slow to feed through to inflation as businesses are selling stocks accumulated before PresidentDonald Trump'ssweeping duties kicked in. Businesses have also been absorbing some of the costs.

"Sticky service sector inflation all point towards a difficult September policy decision in which we expect the Fed to cut rates by 25 basis points," said Joseph Brusuelas, chief economist at RSM.

Consumer spending, which accounts for more than two-thirds of economic activity, rose 0.5% last month after an upwardly revised 0.4% gain in June, according to the Commerce Department's Bureau of Economic Analysis.

Economists polled by Reuters had forecast spending would rise 0.5% after a previously reported 0.3% advance in June.

Motor vehicle purchases led the broad increase in sales, helping to lift outlays on long-lasting manufactured goods by 1.9%. There were also increases in spending on recreational goods and vehicles, clothing and footwear as well as furnishings and durable household equipment. Spending on food and beverages jumped. But outlays on gasoline and other energy goods declined.

Overall spending on goods increased 0.8% after rebounding 0.3% in June. Outlays on services rose 0.4%, matching June's gain, and were lifted by financial services and insurance, healthcare as well as housing and utilities. Spending at restaurants and bars as well as on hotel and motel rooms fell.

Consumption is being supported by low layoffs that are underpinning solid wage growth. Wages increased 0.6% last month, but rising operating costs because of tariffs have left employers reluctant to increase headcount.

Employment gains have averaged 35,000 jobs per month over the last three months through July compared to 123,000 during the same period in 2024, the government reported this month.

A survey from the Conference Board on Tuesday showed the share of consumers viewing jobs as "hard to get" jumped to a 4-1/2-year high in August. Fed Chair Jerome Powell last week signaled a possible rate cut at the U.S. central bank's September 16-17 policy meeting, in a nod to increasing labor market risks, but also added that inflation remained a threat.

The Fed has kept its benchmark overnight interest rate in the 4.25%-4.50% range since December.

Economists anticipate inflation will start rising in the second half of the year due to rising business costs and an inventory drawdown in the second quarter. Companies from retailers to motor vehicle manufacturers have warned that tariffs are raising their costs, which economists expect will eventually be passed on to consumers.

The Personal Consumption Expenditures (PCE) Price Index increased 0.2% last month after an unrevised 0.3% rise in June, the BEA said. Goods prices fell 0.1%, pulled down by a 1.7% drop in the costs of gasoline and other energy goods. Recreational goods and vehicles declined 0.9%.

In the 12 months through July, the PCE Price Index rose 2.6%, matching the gain in June.

Excluding the volatile food and energy components, the PCE Price Index increased 0.3% last month, matching the rise in June. Services prices increased 0.3%, the most since February, after rising 0.2% for four straight months. It was fueled by a 1.2% jump in the costs of financial services and insurance.

In the 12 months through July, the so-called core inflation figure advanced 2.9%. That was the largest rise in core PCE inflation since February and followed a 2.8% increase in June. The Fed tracks the PCE price measures for its 2% inflation target.

The solid consumer spending bodes well for economic growth in the third quarter. But the strong demand is pulling in imports, which could blunt some of the boost to gross domestic product from consumer spending.

A separate report from the Commerce Department's Census Bureau showed the goods trade deficit soared 22.1% to $103.6 billion last month as imports jumped $18.6 billion to $281.5 billion. Goods exports dipped $0.1 billion to $178.0 billion.

An ebb in import flows led to a sharp contraction in the trade deficit in the second quarter, which added a record 4.95 percentage points to GDP growth that period.

The economy grew at a 3.3% annualized rate last quarter. GDP contracted at a 0.5% rate in the January-March quarter, weighed down by a sharp deterioration in the trade deficit that was driven by businesses front-running imports at a record pace as tariffs kicked in.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up