Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

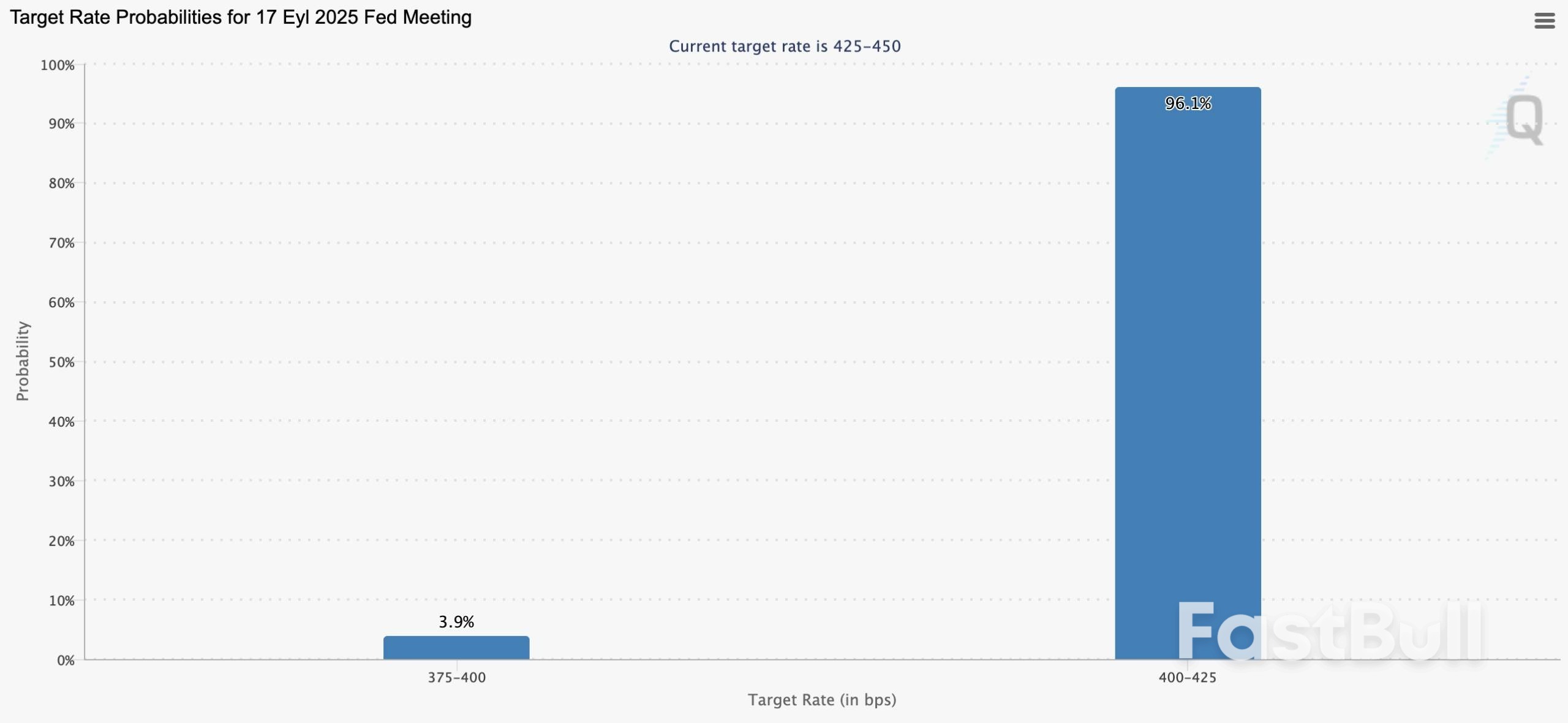

The United States Federal Reserve is anticipated to lower interest rates today, which has already been factored into the cryptocurrency market with a 25-basis-point reduction.

The United States Federal Reserve is anticipated to lower interest rates today, which has already been factored into the cryptocurrency market with a 25-basis-point reduction. Investors are eagerly anticipating the interest rate announcement at 21:00 Turkish Standard Time (TSI) and the subsequent press conference by Fed Chairman Jerome Powell at 21:30 TSI. According to CME FedWatch data, there is a 96% likelihood of a quarter-point rate cut. Ahead of this decision, Bitcoin (BTC) has surged past the $117,000 mark, approaching its highest level in a month.

Juan Leon, investment strategist at Bitwise, suggests that the markets have already absorbed the expectation of a rate cut, indicating that the real impact will emerge from Powell’s remarks after the meeting. While CME FedWatch suggests a high probability of a rate cut, the possibility of the Fed surprising markets with a significant 0.50-point reduction remains on the table.

Weakness in the United States’ employment data has reinforced the prospect of a rate cut. Although the Fed has held rates steady through the last five meetings, it last enacted a 25-basis-point reduction in December of the previous year. Powell has consistently emphasized that inflation remains above the 2% target, and decisions are driven by economic data. Consequently, forthcoming statements will be pivotal in determining the direction of both cryptocurrency and traditional markets.

In the last 24 hours, Bitcoin has gained 1.17%, reaching up to $117,300. Ethereum (ETH) has risen by 0.93%, XRP by 1.30%, and Solana (SOL) is up by nearly 0.5%. Notably, Solana has made significant progress, appreciating nearly 10% over the past week, linked to the expansion of network treasuries in the altcoin sector.

The broader cryptocurrency market has experienced an upswing, consistent with the strengthening anticipation of a rate cut. A surprising 50-basis-point reduction could potentially trigger even stronger market movements. Powell’s forthcoming messages are expected to provide insights into the Fed’s trajectory for the rest of the year.

It's FOMC day, and the Fed is widely expected to cut rates by 25bp. There are many moving parts to today's meeting, but let's go through a few of them. First at 20CET, we'll get the FOMC statement and an update of the Summary of Economic Projections (SEP), which includes the Dot Plots on median expectations for the Fed Funds rate over 2025, 2026, 2027 and the longer term. In the statement, beyond the 25bp cut, we'll be looking for a phrase like 'In considering additional adjustments to the target range' which the Fed used last year to signal a succession of cuts. The alternative: 'In considering the extent and timing of additional adjustments', would reflect hesitancy and lift short-dated rates and the dollar. The statement will also show the voting pattern, which could be something like eight for a 25bp cut, three for 50bp (Waller, Bowman, Miran) and perhaps one for unchanged rates (Schmid).

On the Dot Plots, the majority of economists think the median 2025 Dot Plot will continue to see just two cuts – i.e. policy ending the year in the 3.75-4.00% target range from 4.25-4.50% now. This could be a problem for the short end of the US curve, which prices 70bp of rate cuts. Expectations are that the 2026 Dot will add one extra cut to the June projection, so it would shift to 3.25-3.50%, while the 2027 Dot would also shift by one cut to 3.00-3.25%. In short, the Dot Plot could show a slower trajectory of getting to 3.00-3.25% compared to current pricing of that zone being hit late next summer.

After the statement/SEP at 20:30CET, we'll get Chair Jerome Powell's press conference. A market widely bearish on the dollar will want to hear greater concerns over the jobs market and less concern over tariff-induced inflation. He'll probably highlight that monetary policy can become slightly less restrictive, but stop short of suggesting any urgency to cut rates more deeply.

The dollar is going into this meeting on the soft side as the Fed prepares to restart its easing cycle. There are some upside event risks to the dollar from the Dot Plot – and perhaps from Powell's press conference too. Nonetheless, today should confirm that the Fed is embarking on a 125bp easing cycle. We would see any upside spike in the dollar as temporary and corrective – eg, DXY sellers could re-emerge in the 97.50/98.00 area. And we doubt a slightly more gradual easing cycle than the market expects needs to trigger a sharp re-pricing of risk assets.Alternatively, if Chair Powell throws in the towel on the inflation threat and wholly focuses on the need to prevent job losses with precautionary rate cuts, DXY can just break down towards a near-term target at 95.

EUR/USD has broken to the topside of a 10-week trading range, and it looks hard to resist the move. Two-year EUR:USD swap rate differentials have narrowed around 50bp in favour of the euro over those 10 weeks. As above, tonight's FOMC will be the dominant theme now, and we'd expect good demand for EUR/USD on any corrective dip to the 1.1750/1780 area during Powell's press conference. Seasonality now builds against the dollar – especially in November and into December – and 1.1910 looks like the final resistance level before 1.20 is hit.

For today's European session, look out for the ECB's release of its wage tracker index. The last release showed wage agreements down at 1.7% in 1Q26 from 4.6%in 1Q25 and the ECB will be interested in whether this has picked back up to 2.0% given improving business optimism this summer. For reference, investors currently price just 11bp of ECB easing by next summer. We think the easing cycle is over.

The rug was pulled from under the sterling rally yesterday when the Financial Times reported that the Office for Budget Responsibility had indeed lowered its productivity forecasts for the UK economy. This will deprive Chancellor Rachel Reeves of expected revenues and potentially add £9bn to the fiscal gap she faces in November's budget.The negative event risk of November's budget is offset by the recently turned hawkish Bank of England. Sterling has sold off this morning on a slightly sub-consensus August CPI services reading at 4.7%, even if the BoE's preferred measure of services inflation has remained unchanged at 4.2% YoY.

We think the dollar will be the dominant FX theme, and GBP/USD should find support near 1.3600 before being dragged above 1.37. Sterling's fiscal vulnerability looks more like a story for EUR/GBP. Yet a still hawkish BoE (see tomorrow's event risk) may mean EUR/GBP continues to trade in a 0.8650-0.8715 range.

Markets are fully pricing in a 25bp rate cut by the Bank of Canada today. As discussed in our preview, that is also our call. Yesterday, Canada reported headline inflation at 1.9%, below the 2.0% consensus, while core measures were unchanged at 3.0/3.1% as expected. It’s an inflation picture that isn’t concerning enough to prevent a resumption of rate cuts, given the backdrop of job market deterioration. Unemployment has reached 7.1%, the highest since 2021, the economy contracted by -1.6% QoQ annualised in the second quarter, and activity surveys point to further downside risks.

We expect another cut by the BoC in December, which is now also almost fully priced in. The BoC has kept its guidance very open-ended, and we doubt policymakers want to push back against easing bets at this meeting. The reaction in CAD today may not be that significant as markets retain strong data dependence for any material adjustments in rate expectations. We retain a bearish bias on CAD against most of the G10, although USD weakness can keep USD/CAD stable or slightly offered around 1.37.

The U.K.'s annual inflation rate was steady at 3.8% in August, according to data released by the Office for National Statistics (ONS) on Wednesday.

Economists polled by Reuters had expected inflation to reach 3.8% in the twelve months to August.

August core inflation, which excludes more volatile energy, food, alcohol and tobacco prices, rose by an annual 3.6%, down from 3.8% in the twelve months to July.

The data comes after the consumer price index hit a hotter-than-expected 3.8% in July, exceeding forecasts.

Finance Minister Rachel Reeves commented that she recognized that "families are finding it tough and that for many the economy feels stuck. That's why I'm determined to bring costs down and support people who are facing higher bills."

Pound sterling was slightly lower against the dollar after the data release, at $1.3637.

The Bank of England is closely watching inflation data after forecasting the consumer price index could peak at 4% in September, before retreating in the early half of 2026.

The central bank cut interest rates in August, taking the key rate from 4.25% to 4%, and saying it would take a "gradual and careful" approach to monetary easing, mindful of inflationary pressures but aware of the need to promote growth and investment.

It next meets on Thursday, but it is not expected to adjust rates this month, and there's uncertainty as to whether it could cut in November.

Sticky inflation is restricting the opportunity for a fourth rate by the BOE this year, Scott Gardner, investment strategist at J.P. Morgan-owned digital wealth manager, Nutmeg, commented Wednesday.

"While wage growth has fallen in recent months, more progress is required on the inflation front to convince the Bank's policymakers that a further rate cut is possible in the current economic environment. A fourth rate cut in 2025 will require further labour market weakness, a somewhat pyrrhic victory," he said in emailed comments.

"With forecasts suggesting inflation could rise even further in the short-term and hit 4% going into the autumn, the cost-of-living strain on household finances will persist in the months ahead," Gardner said, adding that "in short, already sticky inflation is likely to get stickier."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up