Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Three surprise rate cuts in Europe—by central banks in Switzerland, Sweden, and Norway—signal growing concern over inflation and trade uncertainty, as officials diverge from the Fed and BOE amid fallout from Trump’s tariff threats.

Bitcoin continues to hover near $104.7K as volatility tightens and macro headwinds grow. With rising geopolitical tensions and cautious monetary signals, global investors are shifting away from risk assets. This environment places downside pressure on Bitcoin and MicroStrategy (MSTR), which acts as a leveraged proxy to the cryptocurrency.

Bitcoin traded around $104.7K this week, posting a 7-day decline of nearly 3%. The Euro Area Stock Market Index also retreated, closing near 5,237 amid weakening sentiment. These moves reflect heightened caution following reports of potential U.S. strikes in the Middle East.

The Federal Reserve held rates steady but warned of renewed inflation risks tied to tariff policy. These developments reinforced risk-off behavior across global markets. As a result, capital rotated away from high-beta assets, including Bitcoin and crypto-related equities.

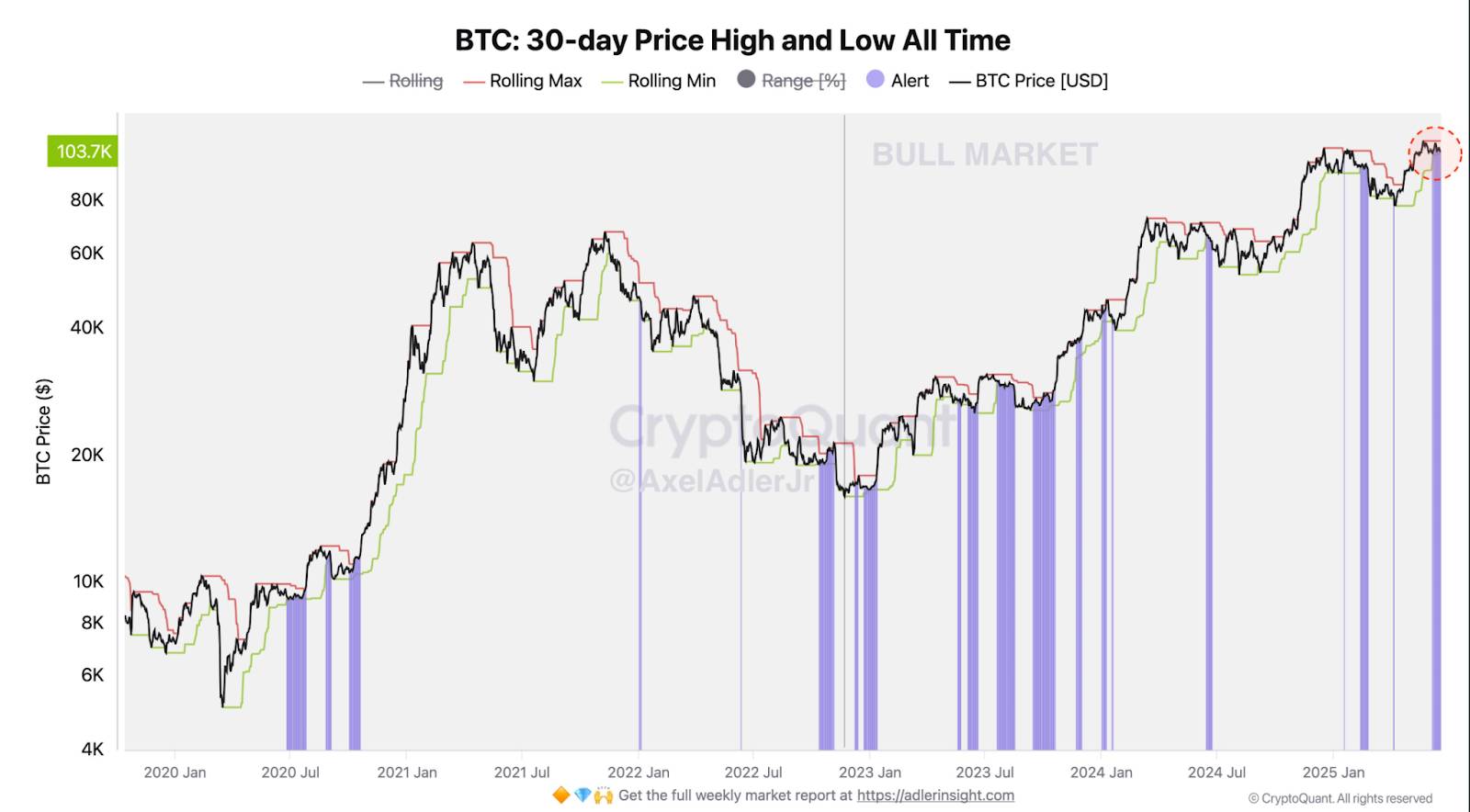

Meanwhile, Bitcoin’s price has compressed into a tight 30-day range, reflecting a pronounced volatility squeeze. This setup often precedes a breakout, but the direction remains uncertain. Rolling high and low bands are narrowing, signalling indecision.

Based on realised prices and moving averages, on-chain models show a confluence of support between $97K and $94K. The asset continues trading above key cost bases, but recent weakness raises the risk of downside breaks. If Bitcoin loses this cluster, broader liquidation may follow.

Technical indicators show Bitcoin is trading just below its recent 30-day high of $111K. Momentum has slowed, and buyers have failed to reclaim resistance levels. However, Spot Bitcoin ETFs recorded $216.48 million in net inflows yesterday, marking seven consecutive days of positive flows.

This steady accumulation signals sustained institutional interest despite market uncertainty. Continued inflows could eventually support a breakout from the current consolidation zone.

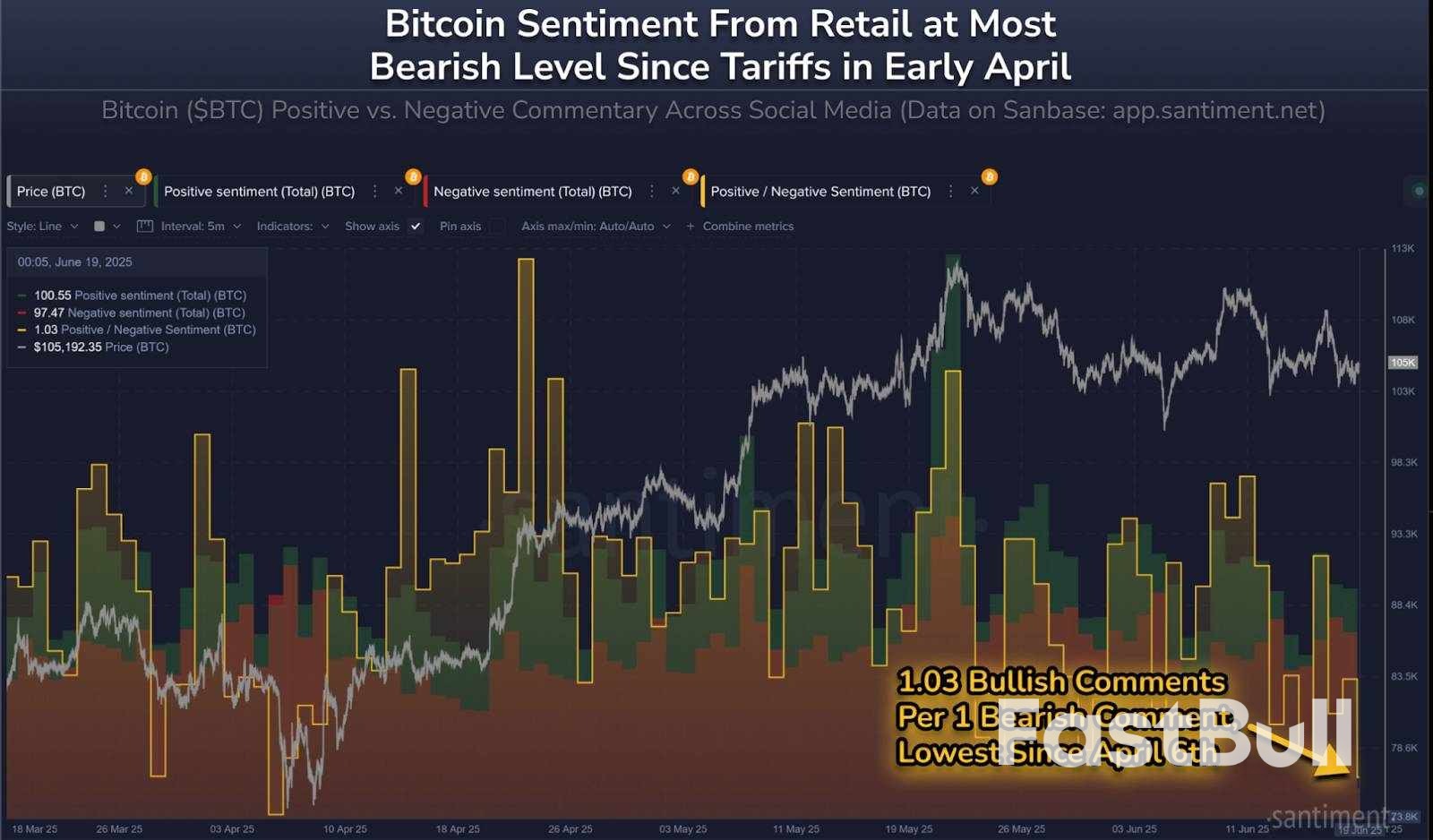

Retail sentiment toward Bitcoin has deteriorated sharply, reaching its most bearish level since early April. The positive-to-negative comment ratio on social media has dropped to 1.03, reflecting growing investor frustration. Historically, such sentiment imbalance precedes increased volatility.

The Crypto Fear & Greed Index sits at 48, pointing to neutral sentiment with a tilt toward caution. Altcoin Season Index remains weak at 23, confirming that investors are staying close to large-cap assets like Bitcoin. Low enthusiasm across altcoins highlights the broader uncertainty.

With bearish commentary rising and market participation thinning, price action could react sharply to external headlines. Bitcoin’s close tracking of macro indicators and social dynamics suggests it remains highly sensitive to global developments. MSTR is likely to follow in lockstep with Bitcoin’s next move.

China has evacuated more than 1,600 citizens from Iran and hundreds more from Israel, a Chinese foreign ministry spokesperson said on Thursday, as evacuees clog border crossings amid the intensifying conflict between the two countries.

Evacuation efforts are continuing and China has maintained communication with Iran, Israel, Egypt and Oman, spokesperson Guo Jiakun told a regular press conference while calling for immediate measures to cool down tensions as soon as possible.

China urges parties to the conflict, especially Israel, to immediately cease fire, Guo said.

Israel struck a key Iranian nuclear site on Thursday and Iranian missiles hit an Israeli hospital, as the conflict showed no signs of a detente nearly a week after Israel first launched what it called "pre-emptive strikes" against Iran.

The Chinese embassy in Iran renewed calls for citizens to leave the country via land routes, while also warning people about longer immigration processing time as congestion has formed at two border checkpoints - Astara heading into Azerbaijan and Bajgiran into Turkmenistan.

Those border crossing points are 490km (304 miles) and 910km away from Tehran, respectively.

Chinese people can also leave Iran via Turkey, Armenia and Iraq, the embassy advised.

Earlier on Thursday, China's embassy in Israel said it will begin evacuating people in batches from Friday, taking those who want to leave to the Taba Border Crossing into Egypt via bus, about 360 km from Tel Aviv.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up