Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Markets are shifting again, not in dramatic headlines, but in the underlying rhythm of currencies, yields, and central banks grappling with conflicting signals.

President Donald Trump said he’d impose increased tariffs on countries buying energy from Russia while clarifying that levies on semiconductor and pharmaceutical imports would be announced “within the next week or so.”

In a divergent approach toward Asia’s giants, Trump said he’d raise tariffs on India “very substantially over the next 24 hours,” accusing its Russian oil purchases of “fueling the war machine.” By contrast, he said he was “very close to a deal” with China to extend a trade truce that saw the two countries agree to reduce tit-for-tat tariff hikes and ease export restrictions on rare earth magnets and certain technologies.

India, which hoped to lure manufacturers amid Trump’s tariff blitz, will face a double squeeze as Trump said levies on pharmaceutical imports would be announced in the next week or so, along with tariffs on semiconductors. Unlike Beijing, which used its dominance of rare earths in trade dealings with Washington, Delhi has no such leverage.

Coming just days after Trump re-set his tariff plan with rates on imports from trade partners ranging from 10% to 41%, his latest blast of trade threats and deadlines shows his quest to remake global trade in America’s favor is far from done. That’s even as the latest economic data suggests the US economy is grappling with the fallout.

Asian stocks struggled for direction in early trade Wednesday. The S&P 500 was on the brink of all-time highs on Tuesday, before losing steam.

Trump is threatening secondary tariffs on buyers of Russian oil as he ratchets up pressure on Russian President Vladimir Putin to halt the war in Ukraine. The Kremlin is weighing options for a concession that could include an air truce with Ukraine to try to head off the threat of such sanctions.

When asked if he’d follow through on a previous threat to impose tariffs on additional countries, including China, Trump said “we’ll be doing quite a bit of that.”

In an interview with CNBC earlier Tuesday, Trump indicated he would push forward with escalated tariffs on India in particular.

“We settled on 25% but I think I’m going to raise that very substantially over the next 24 hours, because they’re buying Russian oil,” Trump said. “They’re fueling the war machine. And if they’re going to do that, then I’m not going to be happy.”

He also detailed timing and discussed potential levels of US tariffs on semiconductor and pharmaceutical imports.

“We’ll be putting a initially small tariff on pharmaceuticals, but in one year — one and a half years, maximum — it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” Trump said Tuesday in the interview on CNBC.

Trump said the US was “getting along with China very well.”

“It’s not imperative, but I think we’re going to make a good deal,” Trump said.

Still, Trump downplayed the notion that he was eager for a meeting with Chinese President Xi Jinping, saying he would only want to see his Chinese counterpart as part of an effort to conclude trade negotiations.

“I’ll end up having a meeting before the end of the year, most likely, if we make a deal,” Trump said. “If we don’t make a deal, I’m not going to have a meeting.”

“It’s a 19-hour flight — it’s a long flight, but at some point in the not too distant future, I will,” Trump added.

A preliminary deal between the US and China is set to expire on Aug. 12. That initial truce eased worries of a tariff war that threatened to choke off bilateral trade between the world’s two largest economies and also gave the countries more time to discuss other unresolved issues such as duties tied to fentanyl trafficking.

Last week, US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng met in Stockholm — the third round of trade talks between the US and Beijing in less than three months.

While Chinese officials and the Communist Party’s official newspaper had signaled satisfaction with the Stockholm talks, the pact remained fragile. Bessent had said that any agreement to extend the arrangement would be up to Trump.

Japanese workers saw their nominal wages rise at the fastest pace in four months, reflecting gains won in annual negotiations with employers and fueling market speculation that the Bank of Japan may hike its benchmark rate in coming months.

Nominal wages increased 2.5% in June from a year earlier, accelerating from a revised 1.4% gain the previous month, the labor ministry reported Wednesday. While the figure fell short of economists’ forecast of a 3.1% rise, it still marked the steepest increase since February.

Base salaries rose 2.1%, and a more stable measure, which avoids sampling issues and excludes bonuses and overtime, climbed 2.3% for regular workers. Real cash earnings fell 1.3%, a deeper decline than the 0.7% retreat expected by economists.

Wednesday’s data provide the latest evidence of robust wage growth momentum, likely keeping the BOJ on course to consider another interest rate hike this year. Following the decision last week to keep the policy rate steady at 0.5%, Governor Kazuo Ueda reaffirmed the central bank’s commitment to raise borrowing costs if economic conditions improve, emphasizing the importance of confirming a “positive mechanism” between wages and prices.

After a US-Japan trade deal was announced late last month, BOJ watchers brought forward their predictions on when the bank might next hike, with more than 40% forecasting the BOJ will move at its October policy meeting. No economists expect a move when authorities next set policy on Sept. 19, but over half of respondents expect another increase before the end of the year.

The strong wage data reflect the outcomes of this year’s annual pay negotiations, in which workers represented by the largest umbrella group for unions secured their steepest pay increases in over three decades. Roughly 70% of those gains were likely reflected in workers’ paychecks by mid-June, based on last year’s results referenced in the Cabinet Office’s monthly economic report.

Despite robust nominal wage growth, real wages continued to decline, as rising prices outpaced salary increases. The nation’s key inflation gauge reached 3.3% in June, led by surging food prices. The number of price increases by Japan’s major food and beverage companies will exceed 1,000 in August, a 53% increase compared with the same month in 2024, according to Teikoku Databank.

With persistent inflation weighing on private consumption, gross domestic product figures for the three months through June due Aug. 15 are expected to show signs of anemic growth.

The continued retreat by real wages is likely to intensify pressure on Prime Minister Shigeru Ishiba to take stronger action to help households contend with soaring costs of living. Ishiba may be forced to propose broader price relief steps beyond his party’s pledge to make one-off cash handouts.

The ruling coalition’s historic setback in last month’s upper house election left it without a majority in either house of parliament, forcing it to collaborate with opposition parties to pass legislation. Those groups are currently working to finalize a unified proposal to press for a temporary cut to the consumption tax.

Looking ahead, policymakers including those at the BOJ expect upward pressure on wages to persist, driven largely by the nation’s chronic labor shortage, which forces businesses to raise pay in order to attract and retain workers. The nation’s unemployment rate stood at 2.5% in June, remaining below 3% for more than four years.

In the first half of 2025, a record 202 companies went bankrupt due to labor shortages, partly driven by the difficulty of raising labor costs and hiring workers.

The government has been pushing for higher wages, setting a target for a record minimum wage hike in the current fiscal year.

US trade policy poses a risk to wage growth in Japan. Washington will impose a 15% tariff on most imports from Japan. That rate is significantly higher than US import levies a year ago, potentially crimping companies’ ability to boost salaries by eroding their profit margins.

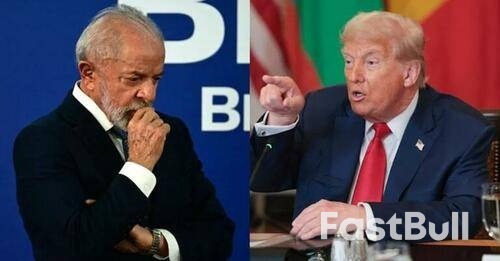

President Trump has sent a message to President Luiz Inacio Lula da Silva saying the Brazilian leader could "call him anytime" to discuss the trade dispute centered on the country's treatment of ex-leader Jair Bolsonaro.Lula has defiantly responded Tuesday with the statement, "I will not call Trump because he does not want to talk." He further asserted that nobody gives him lessons in negotiations.Speaking during an event held in Brasilia, he made clear: "I don’t want people to think I am afraid of Donald Trump" and that "the US president had no right to announced the tariffs on Brazil the way he did" - especially as they make no sense.

Additional vehement complaints about the US position, at a moment a record-setting 50% tariff has taken effect for many Brazilian goods entering the US, are as follows via Bloomberg:

The Trump administration is demanding that charges against Bolsonaro, stemming from his rejection of the election results which brought Lula back to power, be dropped.However, the government has emphasized the independence of the judiciary. A week ago the US slapped sanctions on Brazilian Supreme Court Justice Alexandre de Moraes.But regional analyst Bruna Santos of the Inter-American Dialogue in Washington DC, has explained that dropping the charges against Bolsonaro is simply not going to happen.

"The ask for Lula was undoable," he was quoted in the Associated Press as saying. "In the long run, you are leaving a scar on the relationship between the two largest democracies in the hemisphere."As of Monday Bolsonaro has been ordered under house arrest, with the federal top court citing violations related to stoking resentment via social media and public messaging. For now at least, it looks like the government is backing down, despite the damage to trade relations and future economic pain.

U.S. President Donald Trump said on Tuesday he will decide on a nominee to fill a coming vacancy on the Federal Reserve's Board of Governors by the end of the week, and had separately narrowed the possible replacements for Fed Chair Jerome Powell to a short list of four.

"I'll be making that decision before the end of the week," Trump said of his plans to name a replacement for Fed Governor Adriana Kugler, who last week unexpectedly announced she was leaving as of this Friday to return to her academic position at Georgetown University.

Trump, in comments to reporters at the White House, distinguished between picking Kugler's replacement for a term that only lasts until January, and the selection of Powell's replacement once he leaves the top Fed job in May.

But with the Fed board's other seats occupied with people, including Powell, whose terms run for years longer, Trump's choice of Kugler's replacement could have implications for his selection of a chair, a process Trump said has been narrowed to economic adviser Kevin Hassett, former Fed governor and Trump supporter Kevin Warsh, and two other people. Trump did not name those people, but one is thought to be current Fed Governor Christopher Waller.

"We're also looking at the Fed chair, and that's down to four people right now ... Two Kevins and two other people," Trump said.

Trump earlier in the day said in an interview with CNBC that he had removed Treasury Secretary Scott Bessent from consideration for

Fed chair because Bessent wanted to remain in the top Treasury job.

In the CNBC interview, Trump said Kugler's decision to vacate her seat early was a "pleasant surprise" that gives him an immediate opening to fill with a person who could also be promoted to take Powell's place.

Kugler's replacement would, at least initially, be appointed for just the few months remaining in Kugler's term.

But Trump could be explicit he plans for that person to then be nominated to a full 14-year term after that time, and to also be his choice to replace Powell, giving his nominee several months and several policy meetings to begin to influence the policy debate.

"A lot of people say, when you do that, why don't you just pick the person who is going to head up the Fed? That's a possibility too," Trump said in the CNBC interview.

The president has been critical of Powell for not cutting interest rates since Trump returned to power in January, and contemplated trying to fire him, even as Fed policymakers balance evidence of both a slowing economy and a weakening job market against the fact inflation remains well above the central bank's 2% target and is expected to move higher.

The Fed is charged by Congress to maintain stable prices and maximum employment, and is potentially facing a situation where the two goals conflict with each other, posing a painful set of tradeoffs.

The nominee to fill Kugler's seat will need to be confirmed by the Senate, and would require another Senate vote for a full 14-year term early next year. The nomination for the next Fed chief would require a separate Senate confirmation process.

James Fishback, the CEO of Azoria investment firm and a former advisor at efficiency department DOGE, spoke to Trump on Monday to pitch himself as a temporary Fed pick, and a presidential aide requested informative material from him, according to a source with knowledge of the interactions.

The White House did not immediately respond to a request for comment about Fishback.

Kugler's departure was announced the same day Trump, angered over data that showed job growth slowing in the first months of his administration, fired Bureau of Labor Statistics Commissioner Erika McEntarfer while alleging without evidence that BLS was manipulating the jobs data to make him look bad.

Economists have warned since Trump returned to the White House in January that his combination of import tariffs and erratic trade policy would likely lead to a labor market slowdown and higher inflation, a broadly shared outlook that has been among the factors keeping the Fed from lowering rates until the inflation impact becomes clearer.

The central bank last week held its policy rate steady in the 4.25%-4.50% range, though Waller dissented on the grounds the inflation risk from tariffs appeared modest at best, while the job market and growth in general appeared to be weakening.

The release on Friday of the jobs report for July, with weak monthly employment gains and downward revisions to prior months, appeared to validate those concerns and led to increased market bets the Fed would cut rates at its September 16-17 meeting.

The firing of the BLS commissioner touched off a global wave of concern about the continued integrity of U.S. government data, with Trump's actions being given a fire-the-messenger interpretation by much of the economics and statistics community.

The president's choice now to head the statistics agency and potentially to lead the Fed will be scrutinized all the more carefully, said Michael Strain, director of economic policy studies at the conservative American Enterprise Institute.

"Imagine if one of your concerns is that there's a lackey in charge of the agency and the numbers are fake. That's ... another level of problems," Strain said of the BLS. "Maybe he sees this independence thing really matters. Maybe he's got somebody from the outside saying 'Look, Mr. President, if you appoint somebody who's perceived to be a lackey as the Fed chair, take the BLS freakout and multiply by 1,000."

What to Know:

President Donald Trump announced he would reveal Adriana Kugler's replacement as Federal Reserve Governor by week's end, amid discussions to narrow down candidates for the Fed Chair position.While the announcement itself shows no immediate market reaction, historically such personnel changes have prompted shifts in macroeconomic sentiment, potentially influencing broader financial markets.President Donald Trump announced plans to name a new Federal Reserve Governor this week to replace Adriana Kugler, who resigns on August 8, 2025.The replacement is part of broader leadership decisions that may influence U.S. economic policy, drawing attention from markets.

President Trump indicated he will appoint a new Federal Reserve Governor by the end of the week. In his own words, President Trump said, "I'll be making that decision before the end of the week." The decision follows Adriana Kugler's resignation, effective August 8, as she returns to Georgetown University.In his announcement, Trump mentioned narrowing down the candidates to a select few. Kudler's departure was recognized by Chair Jerome Powell for her valuable contributions, noting, "She brought impressive experience and academic insights to her work on the Board."

The appointment could lead to potential shifts in financial markets perception of economic policies. Investor sentiment may react based on the new appointee's expected influence.With no specific mention of cryptocurrency impact, markets remain observant. Historically, changes in Federal Reserve leadership have occasionally affected digital asset classes.

Past replacements at the Federal Reserve have shaped macroeconomic environments. Previous resignations occasionally led to shifts in economic policy focus.Potential outcomes include alterations in interest rate policies and market stability, influencing traditional and cryptocurrency markets, depending on the new Governor's stance.

The U.S. dollar rose on Tuesday, but remained within sight of Friday's lows, with the market still consolidating after a weak jobs report that boosted bets of a rate cut by the Federal Reserve next month.

Investors also focused on President Donald Trump's nominations to the Federal Reserve Board, including his choice for commissioner of the Bureau of Labor Statistics.

"Where we are now is essentially settling after the (payrolls) data and you have a Fed that is ... not in a rush to cut and not really seeing any signs of inflation, or maybe just a little bit of inflation," said Eugene Epstein, head of trading and structured products, North America, at Moneycorp in New Jersey.

"So we're basically in this purgatory between now and the CPI (consumer price index) print next week. And the dollar is consolidating ... waiting for that data."

Wall Street economists expect the underlying CPI for July to have edged up to 0.3% and 3.0% on a monthly and year-on-year basis, respectively, according to a Reuters poll.

Apart from economic data, the market is also keeping an eye on the changing of the guard at the Fed, which could transform it into a more dovish central bank, in line with what Trump wants.

Trump on Tuesday said he would announce decisions soon on a short-term replacement for Fed Governor Adriana Kugler, who resigned last Friday, including his pick for the next Fed chair. He ruled out U.S. Treasury Secretary Scott Bessent as a contender to replace current chief Jerome Powell, whose term ends in May 2026.

Bessent wanted to remain in his current job, Trump said, adding that the White House is looking at four candidates to replace Powell.

"You can make the argument that a Kugler replacement is dovish for rates, and in turn, means a weaker U.S. dollar going forward," Moneycorp's Epstein noted.

In addition to Kugler's exit, Trump fired BLS Commissioner Erika McEntarfer on Friday as well after data showed weaker-than-expected employment growth in July and massive downward revisions to the prior two months' job counts. He said on Sunday he would announce a new BLS commissioner within three to four days.

Tuesday's data, meanwhile, had little impact on the currency market.

U.S. services sector activity unexpectedly showed a flat outcome in July, with little change in orders and a further softening in employment even as input costs climbed by the most in nearly three years.

The Institute for Supply Management said on Tuesday its non-manufacturing purchasing managers index (PMI) slipped to 50.1 last month from 50.8 in June. Economists polled by Reuters had forecast the services PMI would rise to 51.5.

In afternoon trading, the euro was last flat at against the dollar at $1.1569. That pushed the dollar index , which measures the U.S. currency against six counterparts with the euro as the biggest component, up 0.2% at 98.81, after touching a one-week low earlier in the session at 98.609.

Amid a soft U.S. jobs report, rate futures are now pricing in a 91% chance of the Fed cutting rates at next month's meeting, compared with 35% a week earlier, according to the CME's FedWatch.

They also indicate 60 basis points (bps) of cuts by end-December and 130 bps in rate declines by October 2026, 30 bps more than the levels seen on Friday before the U.S. jobs data.

Goldman Sachs, on the other hand, expects the Fed to deliver three consecutive 25-bp rate cuts starting in September, with a 50 bp move possible if the next jobs report shows a further rise in unemployment.

In other FX pairs, the dollar rose 0.4% to 147.66 yen , after minutes of a June policy meeting showed a few Bank of Japan board members said the BOJ would consider resuming rate increases if trade frictions de-escalate.

The focus, however, remains on tariff uncertainties, after the latest duties imposed by Trump on imports from dozens of countries last week increased worries about the health of the global economy.

The 15% tariff that European Union goods face when entering the U.S. is all-inclusive, a senior EU official said on Tuesday.

The Swiss franc was slightly lower on the day at 0.8077 per dollar, after dropping 0.5% in the previous session.

Switzerland is looking to make a "more attractive offer" in trade talks with Washington, to avert a 39% U.S. import tariff on Swiss goods that threatens its export-driven economy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up