Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US CPI report takes centre stage to gauge tariff impact.Progress in trade negotiations will also be watched, especially with China.US Retail Sales, UK and Japanese GDP on the agenda too.

Despite lingering worries about a recession, the available data suggests the US economy is at worst, headed for a slowdown. There are no signs yet either that inflation is accelerating, as both the CPI and PCE measures declined in March. However, the cooldown in inflation is likely to be temporary as the broad-based reciprocal tariffs kicked in on April 9. Although the higher levies that were set above the 10% universal rate were delayed for 90 days and some other exemptions were announced too, the price of most imports is expected to have gone up by at least the same amount, with many imports from China facing steeper 145% tariffs.

Yet, it’s expected that very little of those costs were passed on to consumers in April. Many businesses frontloaded their imports before ‘Liberation Day’, while others are likely hoping that most of the tariffs will disappear soon and are holding off from raising prices. But this is contingent on the Trump administration reaching trade deals with its main trading partners within months, something that may not be very realistic.

However, it does mean that the April CPI report won’t be the disaster it could have been. The consumer price index is expected to have increased by 0.3% month-on-month, staying unchanged at 2.4% on a yearly basis. Core CPI is also forecast to have risen by 0.3% over the month and to remain unchanged at 2.8% year-on-year.

The Fed warned of rising risks to both inflation and unemployment at its May policy meeting so any upside surprises to the data on Tuesday could lead investors to further pare back their rate cut expectations for 2025.

But with the Fed also having full employment as part of its dual mandate, rate cut bets are a tradeoff between inflation and what’s happening in the rest of the economy. At the moment, the Fed is being careful about managing inflation expectations, hence, it’s holding firm on its wait-and-see stance. But any sudden deterioration in the economy would prompt it to reconsider this position, as has already been indicated by some Fed officials.

Retail sales is one such dataset that could go in the opposite way of the inflation report. After surging by a revised 1.5% m/m in March, retail sales probably increased by just 0.1% in April. Those figures are out on Thursday alongside producer prices, industrial production and the Philly Fed manufacturing index. There’s a further flurry of releases on Friday, including building permits, housing starts, the Empire State manufacturing index and the University of Michigan’s preliminary consumer sentiment survey.

The latter will be particularly important as the UoM’s inflation expectations metrics have jumped significantly in recent months, likely contributing to the Fed’s caution.

But as investors desperately dissect all the data for clues, it’s possible that tariff-related headlines might have a bigger impact on the markets. US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are due to hold talks with senior Chinese officials in Switzerland on Saturday.

This is the first high-level meeting between the two countries since the escalation of trade tensions in February and the stakes are high. Markets are for the moment simply cheering the fact that two sides have agreed to engage in direct talks. But there’s plenty to suggest that Washington and Beijing are quite far apart on their starting points, so any disappointment could bring about a reversal in the positive sentiment, pulling risk assets lower at the start of the trading week.

Any potential selloff might be less severe for the pound and UK stocks following the deal reached between the US and Britain on trade that reduces the 25% tariffs on cars and steel to the baseline 10% rate. Whilst it doesn’t appear that the UK has managed to win many concessions in this preliminary agreement, it comes hot on the heels of a deal with India too, as well as improving relations with the European Union.

Subsequently, the pound has established strong support just above the $1.32 level, but at the same time, it’s lacking the momentum to make a convincing break above $1.34. In the absence of a global risk rally, next week’s UK economic releases might not be enough to recharge the bulls.

UK employment numbers for March are out on Tuesday, with the Bank of England keeping a close watch on wage growth, which is proving very sticky. The BoE doesn’t expect inflation to reach its 2% target until 2027 but concerns about growth are keeping it on an easing path. An update on the economy is due on Thursday when first quarter GDP readings are published.

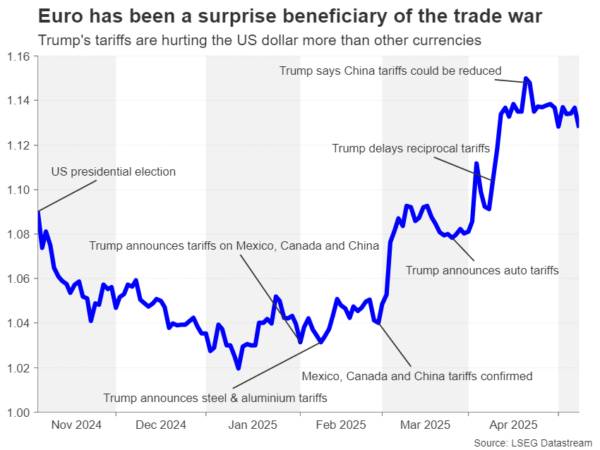

Across the channel, it will be a relatively quiet week for the euro area, with US-EU trade negotiations likely being the main focus for investors. The EU is reportedly mulling higher tariffs on up to 95 billion euros worth of US goods that the bloc could impose should the talks fail. On the other hand, any signs of progress could spur the euro, which has been consolidating its trade war-led gains over the past three weeks.

On the data front, the ZEW economic sentiment index out of Germany might attract some attention on Tuesday, while on Thursday, quarterly employment and the second estimate of Q1 GDP growth for the Eurozone will hit the wires.

Japan is also eager to reach a new deal on trade with the United States as the fragile economic recovery likely ran into trouble in the first three months of 2025. GDP figures out on Friday are expected to show that the Japanese economy contracted mildly, by 0.1%, in Q1.

The sluggish performance even before Trump’s tariffs have come into effect is one of the reasons why the Bank of Japan has turned less confident about hiking interest rates again. Having said that, policymakers are becoming increasingly concerned about the stickiness in food inflation, which may eventually push up underlying price pressures.

Hence, a rate hike is by no means off the table and any unexpected strength in the economy would increase the likelihood of further tightening later in the year, boosting the yen.

There might also be some hints on rate hike prospects in the BoJ’s Summary of Opinions of the April-May meeting that will be published on Monday. The Summary should shed some light on how strongly board members are sticking to their determination to normalize policy.

Finally, in Australia, the labour market will be in the spotlight, as Q1 wage growth numbers are out on Wednesday, to be followed by the employment report for April on Thursday. Investors have priced in about a 90% probability that the Reserve Bank of Australia will cut rates for only a second time at its policy meeting later in May. It’s hard to see the job figures materially shifting those odds.

Nevertheless, any big surprises could move the Australian dollar, although at the start of the week, the aussie’s focus will be on the developments from the weekend’s US-China trade talks, as well as on China’s CPI and PPI release on Saturday.

Gold prices moved higher Friday, holding just above the short-term pivot at $3318.50, a level that could determine whether XAU/USD reclaims the $3351.08 threshold or retreats toward deeper support levels. The week has seen choppy trading, with sentiment split between geopolitical risk and profit-taking after last month’s record high at $3,500.20.

At 11:31 GMT, XAU/USD is trading $3325.27, up $19.29 or +0.58%.

Daily US Dollar Index (DXY)

Daily US Dollar Index (DXY)A softer U.S. dollar provided a modest lift to gold, with the Dollar Index (DXY) slipping 0.3% on Friday. While the greenback is still up on the week—thanks in part to optimism around a limited U.S.-UK trade agreement and fading Fed rate cut bets—the short-term dip made gold more appealing to foreign currency holders. Despite the minor pullback, stronger dollar trends have weighed on gold for most of the week, acting as a headwind and capping rallies.

Investor focus is shifting to the U.S.-China trade discussions set for the weekend in Switzerland. The possibility of reduced tariffs on Chinese imports has buoyed some optimism, but broader tensions—especially fresh military activity between India and Pakistan—are keeping gold supported as a geopolitical hedge. Central bank demand, tariff concerns, and financial uncertainty remain key undercurrents in the market, although strong rallies are being met with increased profit-taking.

Daily Gold (XAU/USD)

Daily Gold (XAU/USD)Technically, the May 1 low at $3201.95 tagged the major retracement zone of $3228.38 to $3164.23, satisfying a typical “buy the dip” setup. However, with a lower top now in place at $3435.06, gold appears to be transitioning into a “sell the rally” mode. If bulls fail to clear $3351.08, price risks sliding back into the retracement zone, with deeper support eyed at the 50-day moving average of $3130.40. This zone could become the next value area for longer-term buyers.

With the market trading below a lower high and failure to decisively reclaim $3351.00, the near-term outlook for gold leans bearish. A close below $3318.50 would expose the $3228.38–$3164.23 retracement zone, with a further test of the 50-day MA at $3130.40 likely if sellers stay in control.

While safe-haven flows and trade risks support the broader bid, the technical setup now favors rallies being sold until a fresh breakout is confirmed. Traders should brace for a deeper pullback before renewed upside is considered.

U.S. tariffs are not likely to have a "dramatic" effect on Britain's economy and the Bank of England should not neglect longer-term domestic pressures that might push up on inflation, BoE Chief Economist Huw Pill said on Friday.

Pill, who voted against Thursday's quarter-point BoE rate cut, said he understood the BoE's "gradual and careful" approach to future rate cuts as requiring it to be agile and alert to changes in the economy that might require a different approach.

"The analysis in the baseline forecast does not suggest that there's a dramatic shift in the behaviour of the UK economy on the back of these trade announcements and trade uncertainties," Pill said in a presentation to businesses.

On Thursday, the BoE said the impact of tariffs "should not be overstated" and was likely to lead to a 0.3% hit to the size of Britain's economy over three years and reduce inflation by 0.2 percentage points in two years' time.

That was based on U.S. tariffs in effect on April 29, before a deal was announced on Thursday which should see a reduction in high tariffs on U.S. imports of British cars and steel, though a lower 10% tariff on most other goods will stay.

Governor Andrew Bailey said earlier on Friday that this deal was "good news" , relatively speaking, but still left tariffs higher than they had been previously.

Pill said the central bank would not allow the uncertainty over tariffs to distract it from returning inflation - set to rise to 3.5% later this year - back to its 2% target.

"There are other forces - and maybe more long-lasting and underlying forces in the UK economy itself. Fergal (Shortall, BoE director of monetary analysis) emphasised the dynamics in pay and wages, and I think correctly so (which) certainly we should not neglect," he said.

British wages are growing at an annual rate of around 6%, roughly double what most BoE policymakers think is a sustainable pace. On Thursday the BoE forecast private-sector wage growth would slow to 3.75% by the end of the year.

U.S. President Donald Trump’s tariff agenda is likely to push up inflation, weigh on employment, and dent growth later this year, according to Federal Reserve Governor Michael Barr.

Should prices and unemployment begin to rise, the rate-setting Federal Open Market Committee may be in a more difficult position as it assesses its next policy moves, Barr added in prepared remarks to the Central Bank of Iceland on Friday.

"The size and scope of the recent tariff increases are without modern precedent, we don’t know their final form, and it is too soon to know how they will affect the economy," Barr said.

The statement was the first Barr, who stepped from his prior role as Fed Vice Chair for supervision in February but stayed on as a Fed Governor, has delivered on monetary policy in roughly a year.

However, Barr argued that, given progress in corralling inflation back down to its 2% target level and the overall economy’s "strong starting point", the Fed’s monetary policy is in a "good position to adjust as conditions unfold". In the first quarter, U.S. gross domestic product contracted due largely to the spike in imports, although consumer spending and labor market indicators remained resilient.

Earlier this week, the central bank left interest rates on hold at a range of 4.25% to 4.5%, but flagged that risks to inflation and the job market are increasing. Fed Chair Jerome Powell later suggested that these risks were likely linked to Trump’s sweeping tariffs, adding that it was "not at all clear" what the appropriate response for interest rates should be in response to the tariff uncertainty.

In early April, Trump unveiled punishing levies on dozens of U.S. trading partners, saying the moves were necessary to reshore lost manufacturing jobs and bolster government revenues. However, he later instituted a 90-day pause to the duties on most of these countries, claiming it would give officials more time to negotiate a slew of individual trade agreements.

On Thursday, Trump and U.K. Prime Minister Keir Starmer announced a trade deal between the U.S. and Britain, bolstering hopes that the White House could secure aggrements with other nations. Talks are due to take place in Switzerland this weekend between U.S. and Chinese officials, with Trump suggesting that heightened levies of at least 145% on Beijing will eventually be lowered.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up