Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

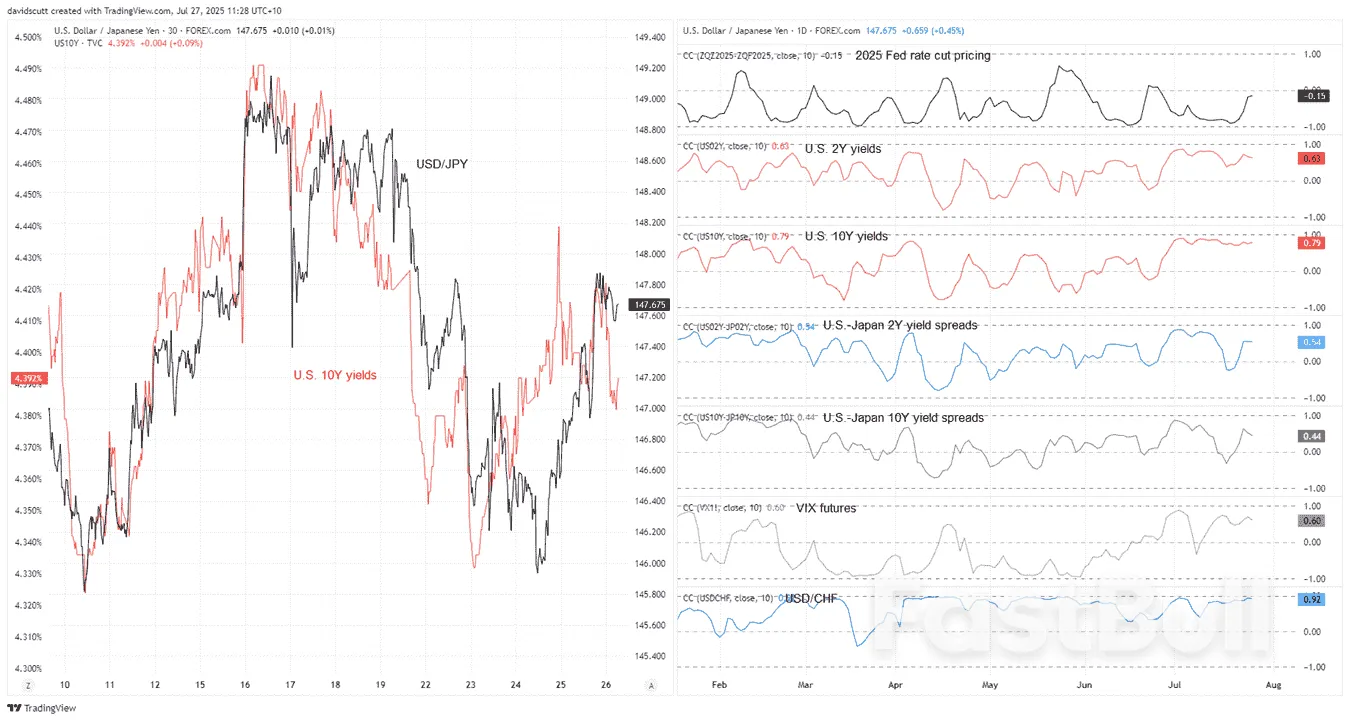

This week is shaping up to be a wild ride for USD/JPY traders with major U.S. economic data, rate decisions from the Fed and Bank of Japan, trade talks, tech earnings, and an update on U.S. borrowing needs fuelling volatility. Ahead of this convergence of event risk, price and momentum signals favour further USD/JPY upside. Whether that plays out is another story, especially given how quickly the macro landscape can shift in 2025.

As I have noted in previous reports, the bar for additional policy easing from the ECB remains high. Not only have the central bank already reduced rates by 200 basis points (bps) since beginning its easing cycle – bringing the deposit facility rate to 2.0% – economic output is stable and inflation is at the 2.0% target. Notably, the deposit rate falls within the ECB’s estimated neutral rate band of 1.75% to 2.25%.

Fortunately, we will not have to wait too long for updated GDP (Gross Domestic Product) and CPI inflation data (Consumer Price Index). Q2 25 preliminary GDP will be out on Wednesday and is expected to have stagnated, down from 0.6% recorded in Q1, while year-on-year (YY) GDP growth is forecast to have slowed to 1.2% from 1.5%. July CPI inflation will be released on Friday, expected to ease on both the headline (1.9% down from 2.0%) and core (2.0% down from 2.3%) levels YY.

I think one of the concerns regarding inflation is that it may undershoot the ECB’s 2% target, especially if the euro (EUR) continues to gather steam, which makes exports more expensive and imports cheaper. In fact, this was the first question posed at the recent ECB press conference. When questioned about Vice-President Luis de Guindos’ comment regarding the EUR’s strength above US$1.20, Lagarde clarified that the ECB does not target any specific exchange rate. She emphasised, however, that the ECB closely monitors exchange rates because they are a crucial factor in their inflation forecasts, directly quoting de Guindos’s previous statement: ‘we take into account exchange rates to forecast inflation’.

Should GDP growth dip into contractionary territory, this may trigger immediate weakness in the EUR – a weaker economy could eventually bring into question whether rates may need to move into accommodative territory and could serve as a headwind for the EUR.

A 15% tariff appears to be the baseline for any deal between the US and the EU. While higher than the initial 10% blanket tariff, a deal would help reduce the uncertainty plaguing the markets and business, which in itself could boost growth as businesses can then begin planning around this new environment. This, by extension, could provide additional fuel for EUR upside.

US President Donald Trump is golfing in Scotland over the weekend for a five-day trip, during which he will meet with the President of the European Commission, Ursula von der Leyen, on Sunday, which may provide more clarity on their relationship. As I am writing this, the situation remains uncertain. You may remember that the US plans to implement a 30% tariff on EU goods starting 1 August, which triggered warnings from EU officials of potential retaliatory measures.

Overall, the strength in the EUR will likely continue to be seen versus the US dollar (USD) until the US$1.20 handle according to chart studies. This, of course, would likely be underpinned if the central bank signals they are nearing the end of their easing cycle.

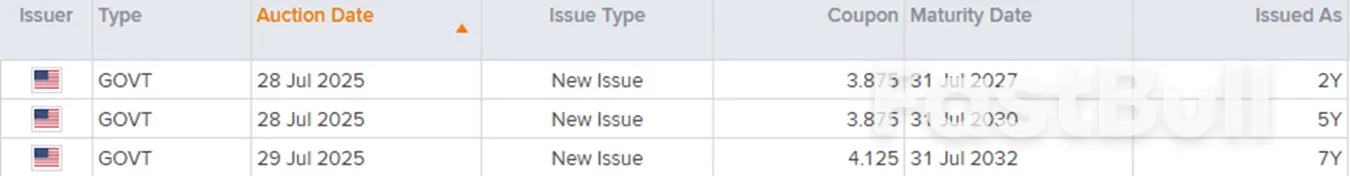

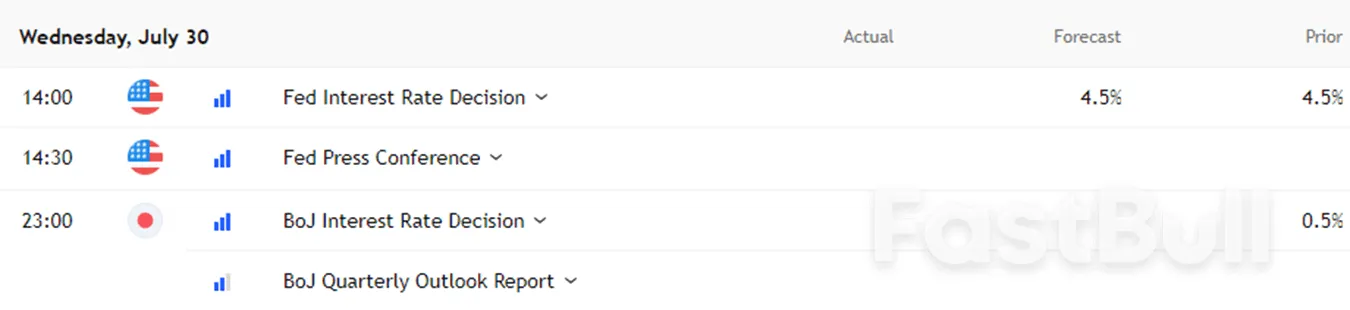

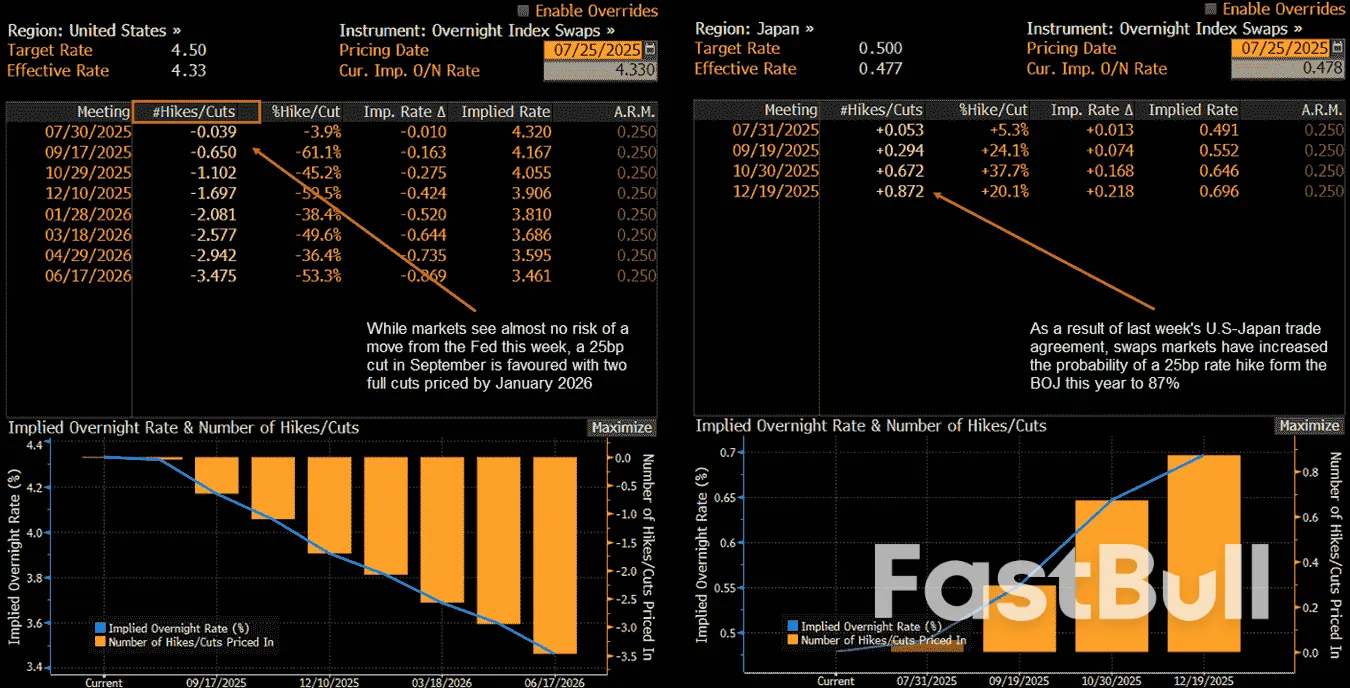

In what was a visibly tense meeting between Trump and Fed Chair Jerome Powell at the main Federal Reserve building last week, Trump said he ‘got the impression’ that Powell was ready to lower rates. I would like ‘to be a fly on the wall’ on Wednesday when the Fed keep rates on hold. Unquestionably, a rate hold will trigger more direct abuse towards Powell from Trump via social media. Despite the President’s incessant pressure to lower rates, it is unlikely that the Fed will reduce rates at this week’s meeting, given the global uncertainty, and consequently, the target rate will remain on hold at 4.25% – 4.50%.

From an economic standpoint, inflation has ticked higher, but not enough to warrant policy easing. GDP is expected to have grown in Q2 25, and while the jobs market is cooling, it is, again, not decelerating enough to justify easing policy.As a result, the primary focus at this week’s meeting will be on the central bank’s forward guidance relating to rates. As of writing, 18 bps worth of cuts are priced in for September’s meeting, with October fully priced in for a 25 bp reduction (-28 bps), and 44 bps of easing implied for the year-end, consistent with the Fed’s recent projections.

One of the major questions for policymakers is whether the tariff-induced inflation will indeed be a one-time spike or something more long-term. If the Fed lowered rates at this week’s meeting, the central bank cannot be sure whether this would stoke inflation, both because of tariff-induced inflation, and also the economy may be running hot enough to further prompt an uptick in price pressures. Should they lower rates and inflation begins rising, the Fed would be in a tricky spot, and may trigger a rise in US Treasury yields as the Fed may have to hike again to undo their mistake. This is the dilemma that the central bank currently faces.

The Fed has repeatedly stated that the economy is in a strong enough position to wait and see what happens with the economy and tariffs. This was evidenced in the last Summary of Economic Projections (SEP), which showed that seven Fed officials believed that the central bank should remain on hold this year, versus four members in the previous SEP – these are released on a quarterly basis, with the next batch out at September’s meeting. As you can see, the Fed is a voting committee. So, although Trump seems to think that it is solely down to Powell on whether the Fed lowers rates, it will need a majority to do so.

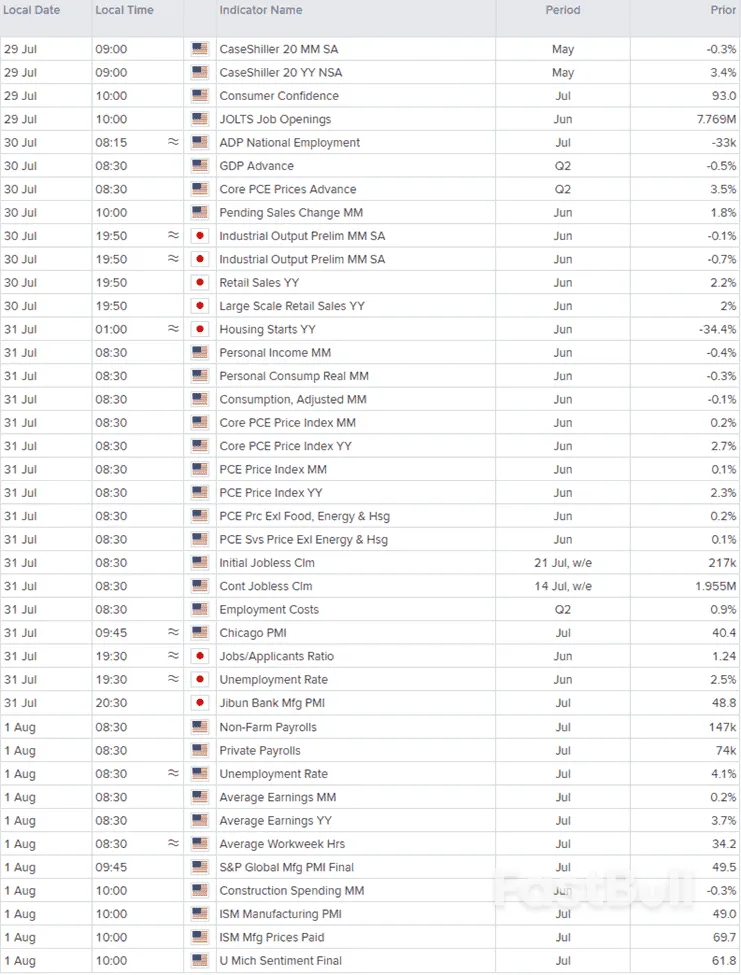

Overall, I think this will be another data-dependent meeting with Powell sticking to the script. There will likely be dissent from Fed Governors Christopher Waller and Michelle Bowman – who were both appointed by Trump – but it won’t be enough to trigger a rate cut. However, should more members dissent, this could pressure the USD southbound.In terms of US data this week, we have a busy slate ahead. In addition to a slew of job numbers, we also receive the latest reading on June PCE data (Personal Consumption Expenditures).

US Non-Farm Payrolls (NFP) data will be widely watched on Friday. Economists expect the July unemployment rate to have ticked higher to 4.2% (previous: 4.1%), with NFP data forecast that the economy added 110,000 new payrolls (previous: 147,000). Private payrolls, which essentially exclude government jobs, are expected to have added 100,000 new roles, up from June’s surprise fall of 74,000 in May. Before this, which will likely help shape market expectations further, we will see June JOLTS job openings (Job Openings and Labor Turnover Survey), July ADP employment (Automatic Data Processing), and weekly unemployment claims for the week ending 26 July.

In terms of PCE inflation data, core YY numbers are expected to have risen by 2.7%, matching May’s print, while headline YY PCE is forecast to have increased by 2.5%, up from 2.3%.If unemployment rises by more than expected, this could trigger USD downside as investors reassess rate cuts. Should inflation show a notable increase, however, this could lead the USD higher as investors will likely forecast a higher-for-longer Fed rate.

An update from the BoC is also scheduled for Wednesday. The central bank is widely expected to keep its overnight rate unchanged at 2.75%, marking a third consecutive meeting with no change. Notably, the BoC currently estimates the neutral rate of interest to be within a range of 2.25% to 3.25%. This range represents the interest rate level at which monetary policy is neither stimulative nor restrictive to economic growth. The BoC does not target this rate, but it is an essential consideration in their economic projections and policy decisions.

The June meeting reiterated that the BoC is not offering forward guidance, although it did, to some extent. BoC Governor Tiff Macklem noted that the central bank believed ‘that there could be a need for a further reduction in the policy rate if the economy weakens and if price pressures are contained’, but caveated this, saying that this is not forward guidance. Whatever way you spin it, that is a signal from the BoC Governor, no? The overarching theme, however, remains one of tariff uncertainty.

This week’s central bank announcement will follow June headline CPI inflation rising by 1.9%, following back-to-back increases of 1.7% in April and May. You will also note that the BoC’s preferred measures of inflation – the CPI Trim and Median – continue to fluctuate around the upper boundary of the central bank’s 1% – 3% inflation target band. Additionally, June unemployment fell back to 6.9% from May’s uptick to 7.0%, while Canadian employment rose by 83,000, which was considerably higher-than-expected, and far surpassed the 8,800 increase in May.

Understandably, tariffs remain an issue for the BoC, and according to Trump, a deal between the US and Canada is unlikely to make it over the line ahead of the 1 August trade deadline. Trump recently said he has not had ‘much luck’ negotiating with Canada, and the country ‘could be one where they’ll just pay tariffs, not really a negotiation’. If this comes to fruition, it could potentially worsen Canadian business/consumer sentiment, weighing on the Canadian dollar (CAD). The USD/CAD has been rangebound since the beginning of June, but ultimately, the longer-term trend is higher.

Given persistent inflationary pressures and a strong jobs market, it would be surprising to see the BoC alter rates this week. In fact, barring a notable deterioration in economic activity or a considerable rise in inflation, it is likely that the BoC will remain on hold for the remainder of this year, with markets pricing in just 13 bps of easing.

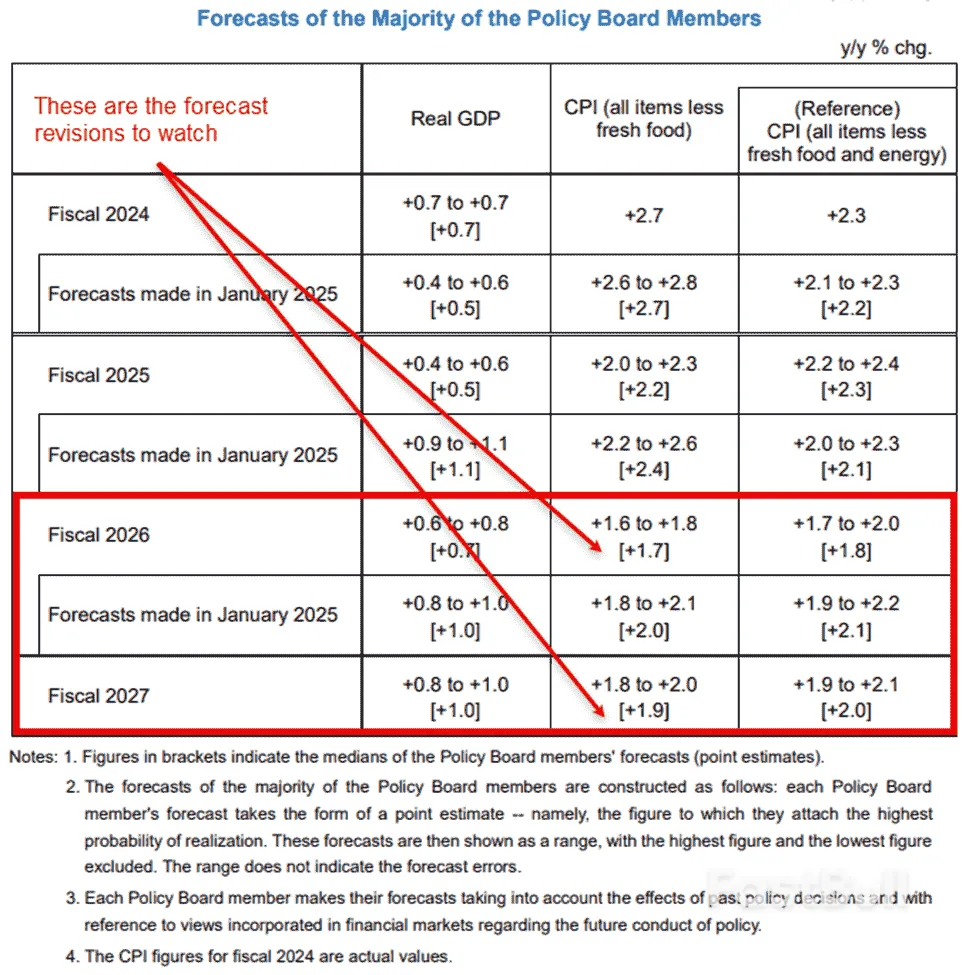

The BoJ is also expected to remain on the sidelines this week, with the nine-member policy committee forecast to keep the policy rate at 0.5% for a fourth straight meeting. 20 bps of hikes remain priced in by the market for this year.The previous meeting on 17 June saw the BoJ Governor Kazuo Ueda underscore that the central bank would continue to increase the policy rate provided the economic and price landscape improves, aligning with their goal of sustainably and stably meeting their price target.

Since then, several developments warrant consideration for policymakers. First and foremost, the ruling coalition’s fierce loss in the upper house election introduced political uncertainty. While Prime Minister Shigeru Ishiba appears has not signalled that he will resign, this outcome may increase pressure for fiscal loosening, a factor the BoJ will be watching closely for its potential impact on inflation. Another key point to take into account is the more optimistic trade outlook has emerged with the US and Japan striking a deal, setting a 15% tariff on Japanese exports to the US, a reduction from earlier threats.

The BoJ will also release updated quarterly economic projections for core inflation and growth, and given the central bank is expected to hold steady, this and communication from the rate statement and presser will be key. Some desks are expecting an upgrade to inflation here for 2025, which could underpin the Japanese yen (JPY). However, lower inflation forecasts, coupled with the BoJ’s signaling steady rates this year, could weaken the JPY. It will also be interesting to see if the BoJ update their 2026/27 forecasts given the trade deal announcement.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up