Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

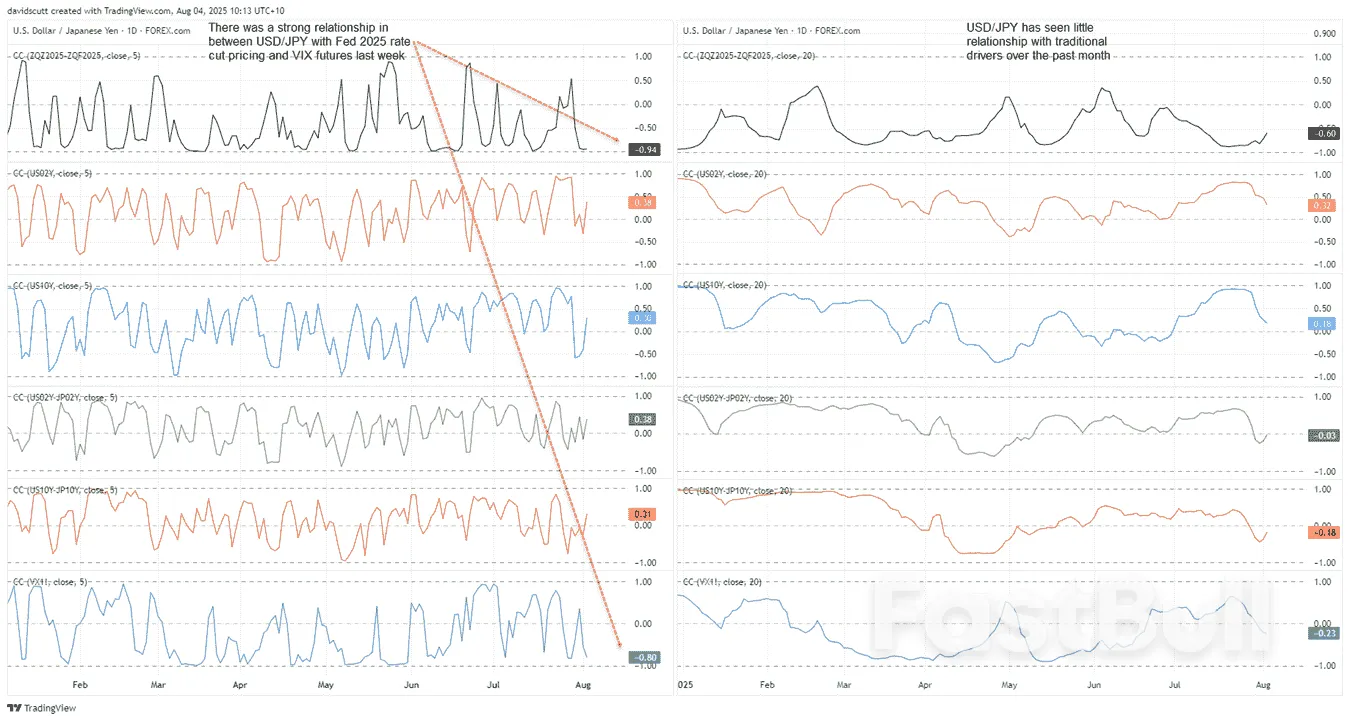

With Fed cut bets firming and political headlines unsettling investors, USD/JPY may hinge less on near-term data and more on whether long-end yields hold the line.

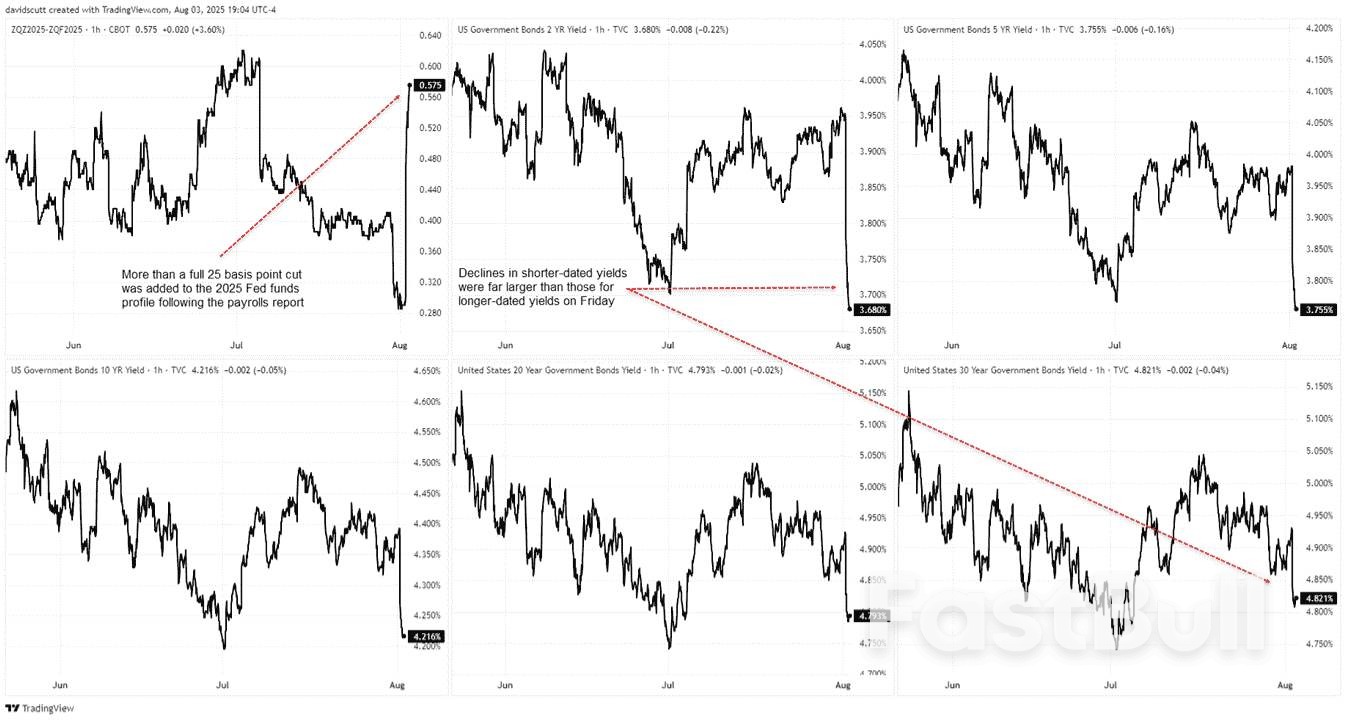

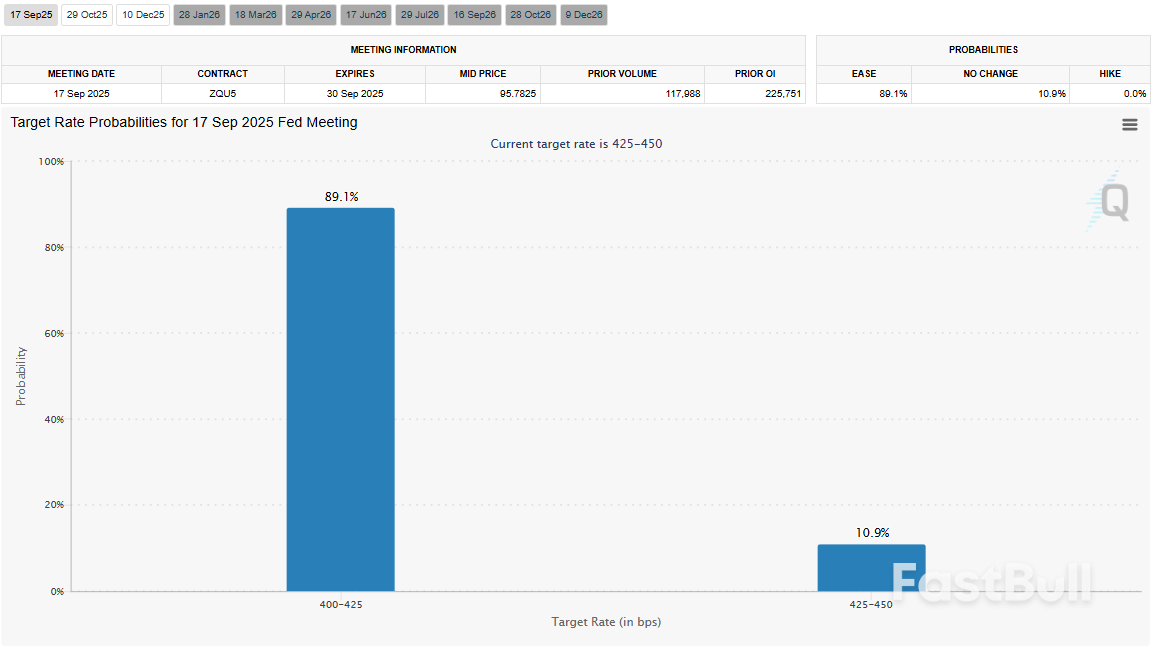

U.S. employment growth was weaker than expected in July while the nonfarm payrolls count for the prior two months was revised down by a massive 258,000 jobs, suggesting a sharp deterioration in labor market conditions that puts a September interest rate cut by the Federal Reserve back on the table.

The Labor Department's closely watched employment report on Friday also showed the unemployment rate rose to 4.2% last month as household employment declined. Labor market resilience has shored up the economy amid headwinds from President Donald Trump's aggressive trade and immigration policies.Import duties are starting to boost inflation, raising the risk that the economy could experience a period of tepid growth and high prices, known as stagflation, which would put the U.S. central bank in a difficult position. Domestic demand increased at its slowest pace in 2-1/2 years in the second quarter.

"The president's unorthodox economic agenda and policies may be starting to make a dent in the labor market," said Christopher Rupkey, chief economist at FWDBONDS. "The door to a Fed rate cut in September just got opened a crack wider. The labor market is not rolling over, but it is badly wounded and may yet bring about a reversal in the U.S. economy's fortunes."

Nonfarm payrolls increased by 73,000 jobs last month after rising by a downwardly revised 14,000 in June, the fewest in nearly five years, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast payrolls would increase by 110,000 jobs after rising by a previously reported 147,000 in June. Estimates ranged from no jobs added to an increase of 176,000 positions.Payrolls for May were slashed by 125,000 to only a gain of 19,000 jobs. The BLS described the revisions to May and June payrolls data as "larger than normal."

It gave no reason for the revised data but noted that "monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors."

Economists have raised concerns about data quality in the wake of the Trump administration's mass firings of federal workers.

Employment gains averaged 35,000 jobs per month over the last three months compared to 123,000 a year ago. Uncertainty over where tariff levels will eventually settle has made it harder for businesses to plan long-term, economists said.

Though more clarity has emerged as the White House announced trade deals, economists said the effective tariff rate was still the highest since the 1930s. Trump on Thursday slapped dozens of trading partners with steep tariffs, including a 35% duty on many goods from Canada.

Trump, who has demanded the U.S. central bank lower borrowing costs, stepped up his insults aimed at Fed Chair Jerome Powell, posting on the Truth Social media platform, "Too Little, Too Late. Jerome "Too Late" Powell is a disaster."

The Fed on Wednesday left its benchmark interest rate in the 4.25%-4.50% range. Powell's comments after the decision undercut confidence the central bank would resume its policy easing in September as had been widely anticipated by financial markets and some economists.

Powell is focused on the unemployment rate. Financial markets now expect the Fed to resume its monetary policy easing next month after pushing back rate-cut expectations to October in the wake of Wednesday's policy decision.

The case for a September rate cut could be reinforced by the BLS' preliminary payrolls benchmark revision next month, which is expected to project a steep drop in the employment level from April 2024 through March of this year.

The Quarterly Census of Employment and Wages data, derived from reports by employers to the state unemployment insurance programs, has indicated a much slower pace of job growth between April 2024 and December 2024 than payrolls have suggested.

Stocks on Wall Street were trading lower on the data and latest round of tariffs. The dollar fell against a basket of currencies. U.S. Treasury yields dropped.

Job gains in July continued to be concentrated in the healthcare and social assistance sector, which added a combined 73,300 jobs. Retail employment increased by 15,700 jobs and financial activities payrolls rose by 15,000.

There were small job gains in the construction and leisure and hospitality industries, which economists attributed to ongoing immigration raids. Several industries, including manufacturing, professional services and wholesale trade shed jobs.

The share of industries reporting job growth, however, rose to 51.2% from 47.2% in June. Federal government employment dropped by another 12,000 positions and is down 84,000 since peaking in January. More job losses are likely after the Supreme Court gave the White House the green light for mass firings as Trump seeks to slash spending and headcount. But the administration has also said several agencies were not planning to proceed with layoffs.The unemployment rate increased to 4.248% before rounding last month. It declined to 4.1% in June also as people dropped out of the labor force, and remains in the narrow 4.0%-4.2% range that has prevailed since May 2024.

The government's immigration crackdown has reduced labor supply, as has an acceleration of baby boomer retirements. Economists estimated the economy now needs to create less than 100,000 jobs per month to keep up with growth in the working-age population.

About 38,000 people left the labor force, which was offset by a drop of 260,000 in household employment. The labor force participation rate fell to 62.2% from 62.3% in June, now down for three straight months and capping the rise in the jobless rate.

"Without the participation rate decline, the unemployment rate would have added another tenth to a solid 4.3%," said Michael Gapen, chief U.S. economist at Morgan Stanley. "Immigration restrictions have and will continue to have a chilling effect on participation and will continue to add to downward pressure on the unemployment rate."

The number of foreign-born workers fell by 341,000. Economists said this decline along with the drop in the labor force kept annual wage growth at a lofty 3.9%. There were more part-time workers and a jump in the number of people experiencing long bouts of unemployment. The median duration of unemployment increased to 10.2 weeks from 10.1 weeks in June.

"One gets the sense that due to trade and immigration policy the domestic economy and labor market are paying a price," said Joseph Brusuelas, chief economist at RSM US. "Stagflation is the best description of the domestic economy as we enter the second half of the year.

Oil prices extended declines on Monday after OPEC+ agreed to another large production hike in September, with concerns about a slowing economy in the U.S., the world's biggest oil user, adding to the pressure.Brent crude futures fell 40 cents, or 0.57%, to $69.27 a barrel by 0115 GMT while U.S. West Texas Intermediate crude was at $66.96 a barrel, down 37 cents, or 0.55%, after both contracts closed about $2 a barrel lower on Friday.

The Organization of the Petroleum Exporting Countries and their allies, known as OPEC+, agreed on Sunday to raise oil production by 547,000 barrels per day for September, the latest in a series of accelerated output hikes to regain market share, citing a healthy economy and low stockpiles as reasons behind its decision.

The move, in line with market expectations, marks a full and early reversal of OPEC+'s largest tranche of output cuts, plus a separate increase in output for the United Arab Emirates, amounting to about 2.5 million bpd, or about 2.4% of world demand.Analysts at Goldman Sachs expect that the actual increase in supply from the eight OPEC+ countries that have raised output since March will be 1.7 million bpd, or about 2/3 of what has been announced, because other members of the group have cut output after previously overproducing.

"While OPEC+ policy remains flexible and the geopolitical outlook uncertain, we assume that OPEC+ keeps required production unchanged after September," they said in a note, adding that solid growth in non-OPEC output would likely leave little room for extra OPEC+ barrels.RBC Capital Markets analyst Helima Croft said: "The bet that the market could absorb the additional barrels seems to have paid off for the holders of spare capacity this summer, with prices not that far off from pre-tariff Liberation Day levels."

Still, investors remain wary of further U.S. sanctions on Iran and Russia that could disrupt supplies. U.S. President Trump has threatened to impose 100% secondary tariffs on Russian crude buyers as he seeks to pressure Russia into halting its war in Ukraine.At least two vessels loaded with Russian oil bound for refiners in India have diverted to other destinations following new U.S. sanctions, trade sources said on Friday, and LSEG trade flows showed.

However, two Indian government sources told Reuters on Saturday the country will keep purchasing oil from Russia despite Trump's threats.Concerns about U.S. tariffs impacting global economic growth and fuel consumption are also hanging over the market, especially after U.S. economic data on jobs growth on Friday was below expectations.U.S. Trade Representative Jamieson Greer said on Sunday that the tariffs imposed last week on scores of countries are likely to stay in place rather than be cut as part of continuing negotiations.

Canada says the U.S. hasn’t walked away from trade talks, even after new tariffs were slapped on Canadian exports.

This came straight from Dominic LeBlanc, Canada’s trade minister, during an interview on CBS’ Face the Nation on Sunday.

According to CBS, Dominic said President Donald Trump is still “negotiating in good faith” and talks aren’t dead. Dominic expects Trump and Prime Minister Mark Carney to speak in the next few days.

The tariffs went into effect last Thursday. They hit products that aren’t covered under the United States-Mexico-Canada Agreement. That deal, negotiated by Trump during his first term, still protects a large part of Canada’s economy.

But not everything is off the hook. The new levies are putting real pressure on Canada’s steel and aluminum industries, as Trump’s administration continues to push for more domestic manufacturing.

Dominic didn’t deny the impact. He said both countries should be able to keep supplying each other “in a reliable, cost-effective way” that keeps jobs going in both economies.

Dominic flew to Washington last week and stayed there for several days to meet with senior officials at the White House. He said the meetings were productive, even though the tariffs had already gone live.

He pointed to the decades-long economic relationship between the two countries, referencing the original free trade agreement from the Reagan era. He said the U.S. and Canada “build things together.”

That statement came as Dominic tried to make the case that the two economies are deeply connected. He said, “That’s why it’s difficult in this relationship when so much is integrated.” Dominic said the shared supply chains make it hard to fully separate the two sides, and that’s part of why Canada is still talking.

He also said Canada understands why Trump wants to protect national security, but still wants to find a way to make a trade agreement that works for both countries.

He said, “We understand and respect totally the President’s view in terms of the national security interest. In fact, we share it.” But he also pointed out that any deal must keep jobs alive on both sides of the border. Dominic framed the conversation as a search for a structure that protects critical industries in both countries without blowing up the trade flow.

Late last week, Trump posted on his platform that Mark Carney’s support for recognizing Palestinian statehood could get in the way of a deal. Trump wrote that the pledge makes it “very hard for us to make a Trade Deal with them.” That post added a political wrinkle to what had been mostly economic talks.

Dominic didn’t directly respond to the comment during his CBS appearance. But he didn’t change his tone either. He kept saying there’s still room for progress and repeated that Canada wants to keep things moving.

At the White House, Kevin Hassett, who leads the National Economic Council, gave his own update. He said Sunday on NBC that the new tariff rates are “more or less locked in,” though he added that there might still be “some dancing around the edges” when it comes to the fine print. Hassett confirmed that the reciprocal rates would kick in the following week for any country that didn’t have a deal in place, Canada included.

He also said that no amount of negative market reaction would push Trump to change his position, unlike what happened in April when the “liberation day” tariffs triggered backlash. This time, Hassett said, “The markets have seen what we’re doing and celebrated it. And so I don’t see how that would happen. I would rule it out. Because these are the final deals.”

So far, Canada hasn’t threatened retaliation. Dominic is keeping the focus on economic cooperation, and Carney hasn’t addressed the Palestine comment publicly. The talks remain tense but active.

Both sides know that pulling the plug on this relationship could cause real damage, especially to the industries now caught in the crossfire.

A couple of months ago it would have been a brave call to say that OPEC+ would be able to bring back 2.5 million barrels per day of crude production and still keep oil prices anchored around $70 a barrel.

But this is exactly what has occurred, with the eight members of the producer group winding back the last of their 2.2 million bpd of voluntary cuts by September, as well as allowing a separate increase for the United Arab Emirates.

The eight OPEC+ members met virtually on Sunday, agreeing to lift output by 547,000 bpd for September, adding to the increases of 548,000 bpd for August, 411,000 bpd for each of May, June and July, as well as the 138,000 bpd for April that kickstarted the unwinding of their voluntary cuts.

OPEC+ stuck to their recent line that the rolling back of production cuts was justified by a strong global economy and low oil inventories.

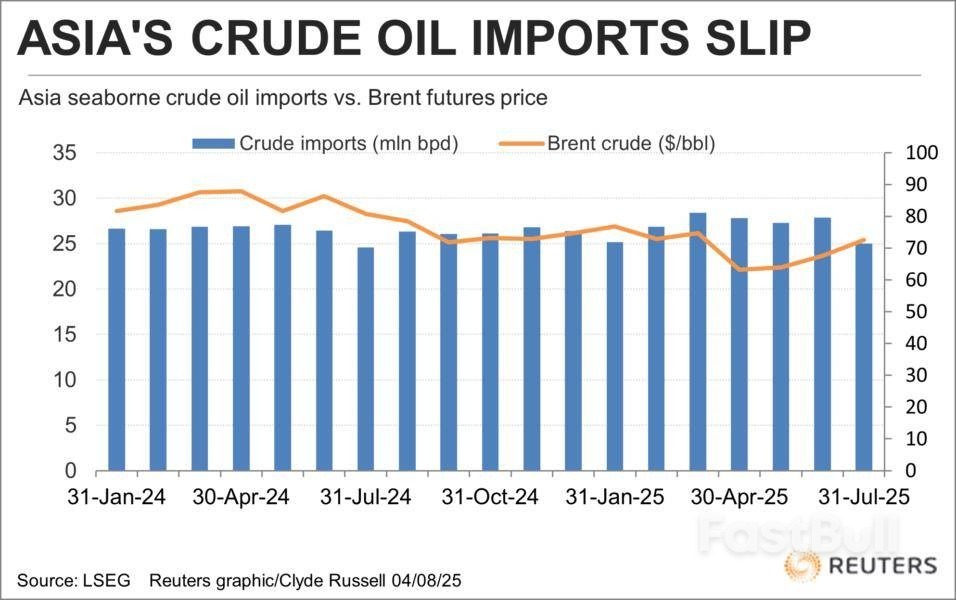

It's debatable as to whether this is actually the case. Certainly, demand growth in the top-importing region of Asia has been lacklustre.

Asia's oil imports were about 25.0 million bpd in July, down from 27.88 million bpd in June and the lowest monthly total since July last year, according to data compiled by LSEG Oil Research.

While China, the world's biggest crude importer, has been increasing purchases in recent months, much of this is likely because of lower prices that prevailed when June- and July-arriving cargoes were arranged.

It's also the case that China has likely been adding to its stockpiles at a rapid pace, and while it doesn't disclose inventories, the surplus of crude once refinery processing is subtracted from the total available from domestic output and imports was 1.06 million bpd over the first half of 2025.

It appears more likely that OPEC+ has largely been fortunate in that it has been increasing output at a time of rising risks in the crude oil market, largely from geopolitical tensions.

The brief conflict between Israel andIranin June, which was later joined by the United States, did lead to an equally brief spike in crude prices, with benchmark Brent futuresreaching a six-month high of $81.40 a barrel on June 23.

The price has since eased back to trade around the $70 mark, with some early weakness in Asia on Monday seeing Brent drop to around $69.35.

But the point is that the Israel-Iran conflict arrested a downtrend in oil prices that had been in place for much of the first half of the year.

Crude prices have also been supported in recent days by U.S. PresidentDonald Trump's threats of wide-ranging sanctions against buyers of Russian oil unless Moscow agrees to a ceasefire in itswar with Ukraine.

As with everything Trump, it pays to be cautious as to whether his actions will ultimately be as drastic as his threats. But it would also be foolhardy to assume that there will be no impact on crude supplies even if any eventual measures imposed by the United States are not as drastic as feared.

There are effectively only two major buyers of Russian crude, India and China.

Of these two, India is the far more exposed given its refiners export millions of barrels of refined products, many made with Russian oil.

India imported 2.1 million bpd of Russian oil in June, according to data compiled by commodity analysts Kpler, which is the second-highest monthly total behind only 2.15 million bpd in May 2023.

In recent months, India has been buying about 40% of its crude from Russia and if it were to replace that with other suppliers, it would have a severe impact on oil flows, at least initially.

It's likely that a combination of Middle East, Africa and Americas exporters could make up for India's loss of Russian barrels, but this would tighten supplies considerably and likely keep prices higher.

Whether Russia and its network of shadowy traders and shippers could once again work around sanctions remains to be seen, but even if they could, it would still take some time for them to get Russian crude through to buyers.

For now, much remains up in the air and OPEC+ members are following a smart strategy in taking advantage of the uncertainty to bring their production back and rebuild market share.

How long this play can work is the question.

Even if Russian barrels do leave the market, it's also possible that demand growth disappoints in the second half as the impact of Trump's trade war becomes more apparent, cutting global trade and lowering economic growth.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up