Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

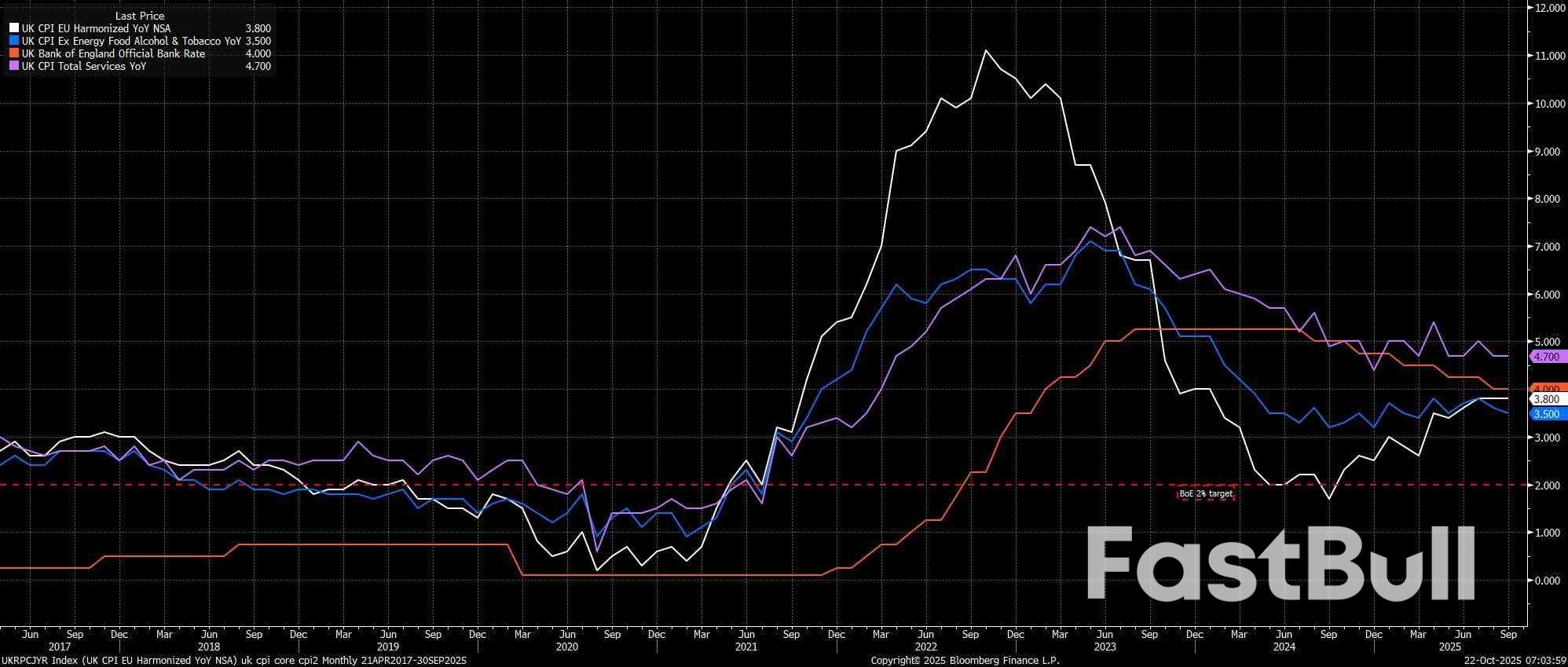

Headline CPI rose 3.8% YoY in September, well below both market expectations, and the BoE's forecast for a 4.0% YoY rise, and unchanged from the pace seen in August.

Headline CPI rose 3.8% YoY in September, well below both market expectations, and the BoE's forecast for a 4.0% YoY rise, and unchanged from the pace seen in August. Meanwhile, metrics of underlying price pressures also printed cooler than expected, as core CPI rose 3.5% YoY, and as services CPI rose 4.7% YoY, also unchanged from last time out, and considerably below the Bank's 5.0% YoY expectation.

The details of the report were also surprisingly optimistic, most notable as food prices fell 0.2% MoM, and rose by 4.5% YoY, mirroring declines seen elsewhere in Europe in recent months, and likely giving the MPC some cause for optimism, given how this component remains a key driver of consumer inflation expectations.

On the whole, however, it seems highly unlikely that this morning's figures will materially move the needle in terms of the BoE policy outlook, despite the figures being considerably better than expected.

While the 'Old Lady' expect September to mark the peak in terms of inflation this cycle, policymakers on the MPC will want to be sure that peak has indeed passed before taking further steps to remove restriction, something that is impossible to gleam from just one print.

Furthermore, the huge degree of pre-Budget uncertainty, chiefly in terms of where upcoming tax hikes are likely to fall, and whether those tax increases again prove to be inflationary.

Hence, while there remain significant splits among MPC members over the degree of slack emerging in the labour market, and the speed at which said slack is making itself known, it seems unlikely that a majority of policymakers will favour a rate reduction before the year comes to an end. As such, my base case remains that the MPC are now on hold until next February, at which point a 25bp cut is likely to be delivered, providing that greater certainty of inflation having peaked has been obtained. From then on, a resumption of the quarterly pace of 25bp cuts is likely, before Bank Rate gets to a terminal 3.25% this time next year.

The forex market turned noticeably quieter in Asian session today, with traders taking a breather after the risk-on rally seen earlier in the week. Most major pairs and crosses remain confined within last week’s ranges, reflecting a more balanced tone as global sentiment stabilizes. Canadian Dollar continues to hold firm, extending support from Tuesday’s hotter-than-expected inflation data, while Aussie and Kiwi are also chalking up steady gains for the week.

By contrast, the Japanese Yen remains under heavy pressure, ranking as the weakest performer among the majors, followed by Euro and Sterling. Dollar and Swiss Franc are trading in the middle of the pack. The consolidation reflects a market still awaiting the next round of data to offer clearer trading cues, including Friday’s U.S. CPI

Nevertheless, the day’s spotlight turns to UK inflation figures first, expected to show headline CPI rising to 4% year-on-year in September — its highest since early 2024 and double the BoE’s 2% target. An upside surprise would bolster the case for the BoE to hold rates steady at its November 6 meeting, reinforcing arguments from policy hawks like Chief Economist Huw Pill.

Meanwhile, even a mild downside surprise may not be sufficient to sway the MPC toward an immediate rate cut. The committee remains deeply divided, and with the UK Budget due on November 26, most members are likely to delay major policy moves until the fiscal outlook becomes clearer.

Elsewhere, trade developments are drawing attention in South Asia. Indian media outlet Mint reported that the U.S. is preparing to substantially reduce tariffs on Indian exports as part of an emerging trade deal with New Delhi. According to the report, tariffs could be slashed to 15–16% from the current 50%, contingent on India agreeing to scale back its purchases of Russian oil. The move would mark a significant thaw in bilateral trade ties.

U.S. President Donald Trump confirmed on Tuesday that he had spoken with Prime Minister Narendra Modi, who assured Washington that India would reduce its intake of Russian crude. In a post on X the following morning, Modi described the call as “productive,” saying both countries would continue to stand “united against terrorism in all its forms,” though he avoided any direct reference to energy imports.

In Asia, at the time of writing, Nikkei is up 0.16%. Hong Kong HSI is down -1.12%. China Shanghai SSE is down -0.46%. Japan 10-year JGB yield is down -0.007 at 1.656. Overnight, DOW rose 0.47%. S&P 500 rose 0.00%. NASDAQ fell -0.16%. 10-year yield fell -0.023 to 3.963.

Japan’s exports rose in September for the first time in five months, signaling tentative recovery in external demand even as shipments to the U.S. continued to contract sharply.

Exports climbed 4.2% yoy to JPY 9.41T, slightly below expectations of 4.6%. The rebound was driven largely by strength in Asia, where exports jumped 9.2%, including a 5.8% rise to China. In contrast, shipments to the U.S. fell -13.3%, with auto exports down -24.2%, extending months of weakness despite being a smaller drop than August’s 28.4% decline.

Imports also grew faster than expected, rising 3.3% yoy to JPY 9.65T, compared with forecasts of 0.6%. As a result, Japan posted a trade deficit of JPY 234.6B.

The data come just weeks after Washington finalized a new trade agreement with Tokyo, implementing a 15% baseline tariff on nearly all Japanese imports, down from the initial 27.5% rate.

Gold and Silver saw heavy selling this week, pausing their record-setting advance as traders took profits and liquidity conditions improved. The decline has raised questions about whether the market is entering a deeper downturn, but technicals suggest the move is more of a healthy correction within a still-bullish backdrop.Reports of increased Silver flows from the U.S. and China into London’s spot market added to the selling pressure, easing recent supply constraints that had intensified price momentum. The additional liquidity gave traders room to unwind speculative positions, accelerating the pullback but also helping to stabilize the market longer-term. This as part of a natural rebalancing after overbought conditions earlier in the month.

While the losses have been sharp, there is no clear structural threat to the broader uptrend. The latest pullback reflects profit-taking and short-term positioning adjustments rather than a breakdown in investor confidence. Demand for precious metals remains underpinned by global macro uncertainty, moderate inflation expectations, and central bank diversification away from U.S. assets.Technically, Gold remains supported above 3,944.57 cluster, a level that separates sideway consolidation from deeper correction. As long as this level holds, consolidations from 4,381.22 should remain relatively brief. Sustained break above 4,381.22 would signal renewed strength, opening the path toward 161.8% projection of 2,584.24 to 3,499.79 from 3,267.90 at 4,749.25.

However, break of 3,944.57 would argue the latest rise leg from 3,267.90 has completed, and bring deeper correction to 55 D EMA (now at 3,781.78). Such a move would extend consolidation but not necessarily signal a full trend reversal.

Silver is showing a similar pattern. As long as 47.30 cluster holds, correction from 54.44 should stay shallow and short-lived. Another rise to 200% projection of 28.28 to 39.49 from 36.93 at 59.30 should be seen sooner rather than later.

However, a fall below 47.30, would trigger deeper pullback toward 55 D EMA (now at 44.76), before uptrend resumes.

Daily Pivots: (S1) 150.87; (P) 151.53; (R1) 152.58;

Intraday bias in USD/JPY remains on the upside for retesting 153.26. Break there will resume larger rally from 139.87 to 100% projection of 142.66 to 150.90 from 145.47 at 153.71. Firm break there would prompt upside acceleration to 161.8% projection at 158.80. on the downside, below 150.45 minor support will dampen this bullish view and turn bias neutral again first.

In the bigger picture, current development suggests that corrective pattern from 161.94 (2024 high) has completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94 high. On the downside, break of 145.47 support will dampen this bullish view and extend the corrective pattern with another falling leg.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up