Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

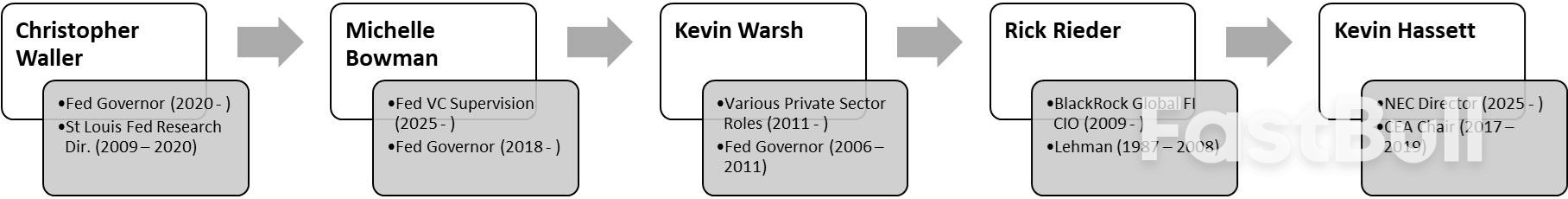

Numerous reports, as well as the White House themselves, have confirmed that the 'long-list' of as many as thirteen names has now been whittled down to a 'final five', comprising current Fed Governors Waller and Bowman, former Governor Warsh, BlackRock Global FI CIO Rieder, and NEC Director Hassett.

Numerous reports, as well as the White House themselves, have confirmed that the 'long-list' of as many as thirteen names has now been whittled down to a 'final five', comprising current Fed Governors Waller and Bowman, former Governor Warsh, BlackRock Global FI CIO Rieder, and NEC Director Hassett.

The order that those names are in is no accident, and broadly reflects a spectrum from 'most orthodox' to 'least orthodox' in terms of the candidates in question. That orthodoxy pertains not only to recent precedent, with Bernanke being the last Chair not to be a sitting Governor at the time of his elevation, but also to how positively, or otherwise, market participants are likely to react to the appointment.

Quite clearly, Governor Waller would represent the 'status quo' choice, not only having been a Governor since 2020, but also given how Waller has tended to lead the remainder of the Committee in policy pivots during his tenure, most recently this summer, in positing that a more dovish stance is required, and that any tariff-induced inflation can be 'looked through'. Governor Bowman would also be a 'status quo' appointment, though her recent elevation to Vice Chair for Supervision perhaps lessens her chances of becoming the second female Fed Chair, after Janet Yellen.

The other names in question would, clearly, be somewhat more left-field choices. Former Governor Warsh has undergone something of a damascene conversion in recent years, from uber-hawk at the height of the GFC, to now espousing as dovish a stance as possible. Rick Rieder, meanwhile, has also made numerous dovish overtures of late, though has worked in the private sector for his entire career. Undoubtedly the pick most likely to be poorly received by markets, though, is NEC Director Hassett, who has made no secret of his loyalty to President Trump over the last decade, and who would obviously be seen as a pick that substantially erodes the policy independence of the Fed.

While names in the running for the top job are well known, the precise timing of an announcement as to who will be given the gig is unclear.

Numerous potential deadlines have already slipped – Powell was named Chair in early-November, before his term began the following February; while, Treasury Sec. Bessent's prior remarks that a nomination would come prior to Thanksgiving now seem unlikely to ring true. Bessent's latest deadline, that a name will be known before Christmas, could well suffer the same fate as the deadlines that have already slipped, even if President Trump claims he already knows who he will appoint to the job.

Given Trump's background, it should perhaps be unsurprising that the race for Fed Chair is being run as if it were a real-life version of 'The Apprentice'. As for determining who receives the famous 'you're hired' message, and how that decision is made, there are a few factors that will likely feature, based off Trump's prior federal appointments.

The first, and probably most important, factor that will feature in the decision-making will be loyalty, to Trump of course. Clearly, Kevin Hassett holds the proverbial trump cards on this front, having been a member of 'Team Trump' since the first presidential campaign in 2016. Waller and Bowman also stand in relatively good stead here, with both being Trump appointments to the Board.

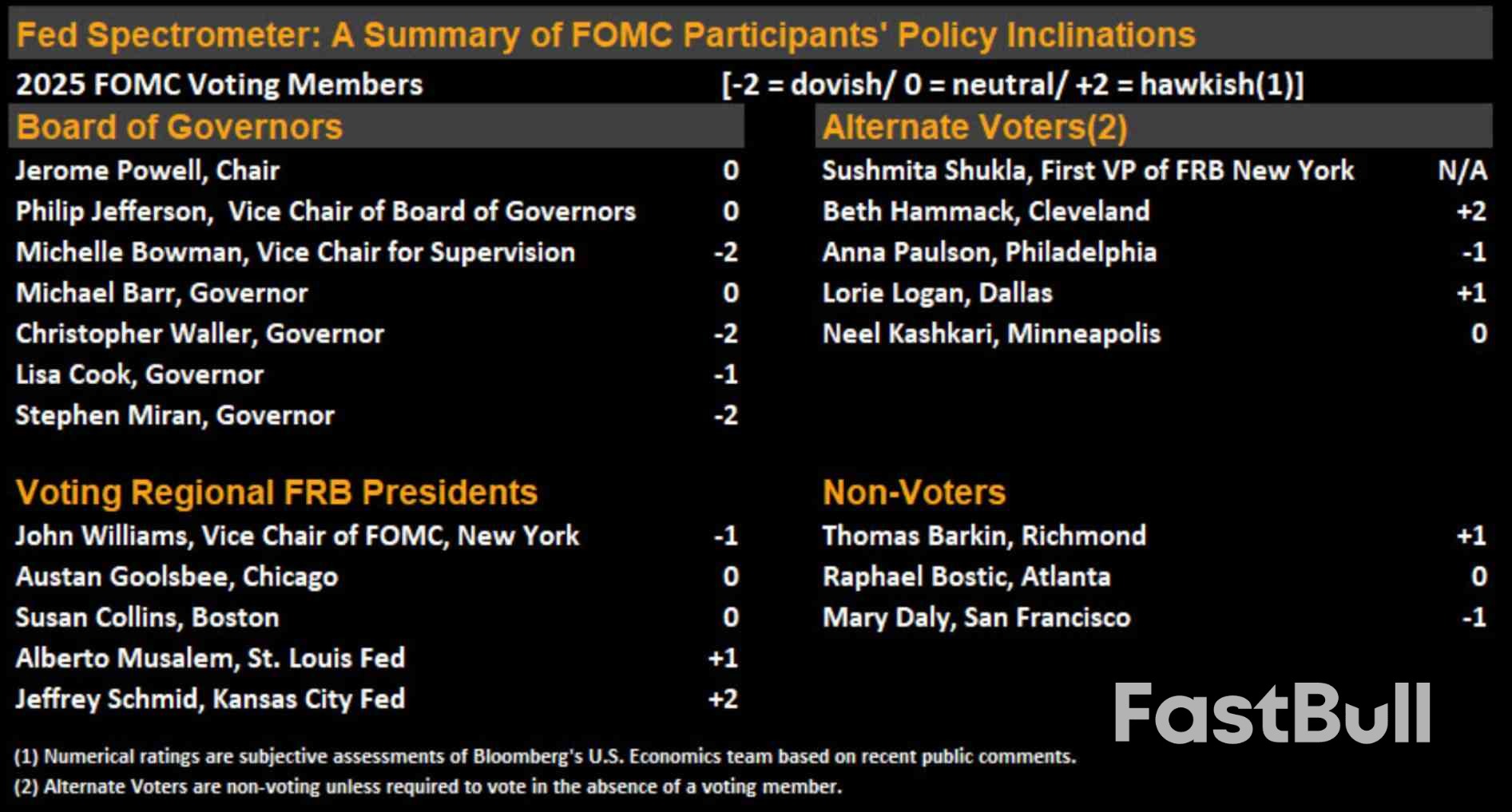

Secondly, is the matter of the Candidate's policy stance, especially considering President Trump's long-standing, and rather economically skewed, view that the better the US economy is performing, the lower its interest rate should be. This goes quite a long way to explaining why all names in the fray for the job, even back to the 13-contender 'long-list', have upped the dovish ante in recent months.

Finally, there is the question of overall economic acumen, and suitability for the job. Perhaps more than acumen in isolation, though, will be the question of whether the candidate's overall economic views mesh well with the supply-side policies that the Trump Admin are pursuing, something which has quite clearly been a significant bone of contention with Chair Powell in recent months.

The race for Fed Chair is not the only factor to watch when it comes to the world's most important central bank as we move into 2026.

In January, the Supreme Court will begin to hear arguments pertaining to Trump's attempts to fire Governor Cook 'for cause', relating to allegations of mortgage fraud, made by FHFA Director Pulte; Cook has denied those allegations, while also arguing that Trump lacks the authority to dismiss her from her post. Though the case will not be heard until January, initial indications appear to lean in Cook's favour, with SCOTUS having rejected, in October, an emergency request from Trump to remove Cook with immediate effect, though there remains the possibility that the final ruling may see Cook forced to leave her post, giving Trump another opportunity to fill a Board seat.

A month later, what is usually a formality, could turn into something much more significant. Every 5 years, the Board must vote in favour of reappointing the 12 regional bank presidents, a process that is typically routine, and attracts little attention. However, with there already being three Trump nominees on the Board (Waller, Bowman & Miran), plus there potentially being a fourth by then were Cook ousted, the Trump Admin may spy an opportunity to exert significant influence over the regional banks as well. Atlanta Fed President Bostic has already announced his retirement, effective next-February, which has cast fresh doubt on the reappointment process in recent weeks.

Then, in May, there is the huge question of what Jerome Powell does next. Though Powell's term as Chair expires, his term as a Governor runs through to January 2028, and he remains well within his rights to serve out that term if he chooses to do so. However, precedent suggests that Powell will leave the Fed entirely next May which would allow Trump another Board pick, potentially leaving just VC Jefferson & Governor Barr as the lone members he hasn't nominated, pending the outcome of the Cook case.

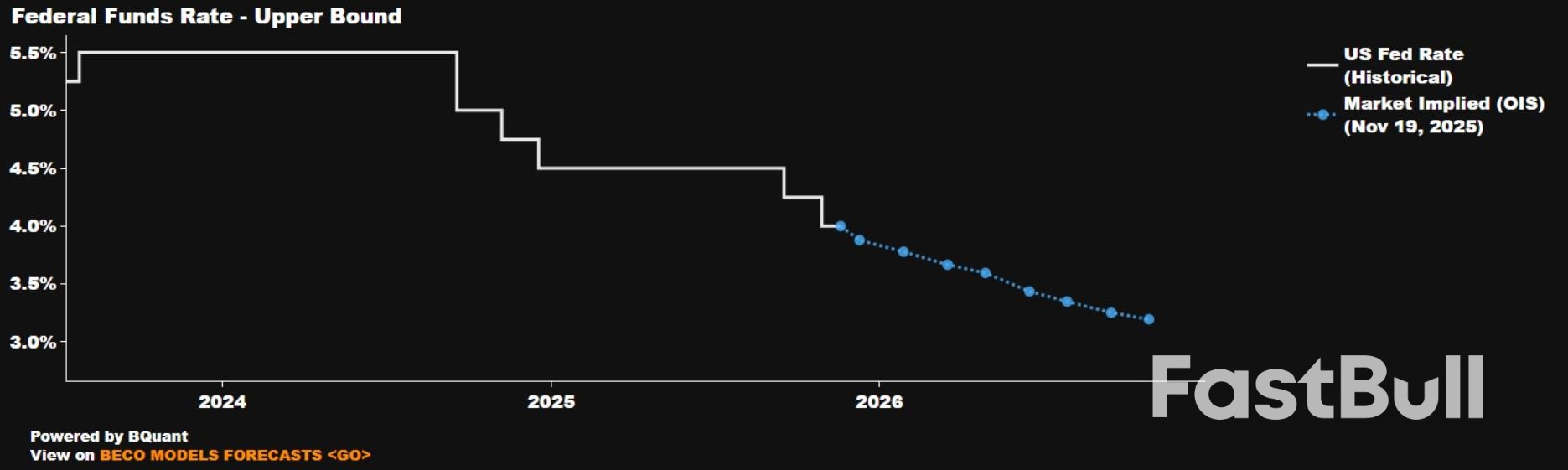

Putting all these moving parts together, it becomes relatively clear that 2026 will likely bring with it a Fed that works, to a much closer degree, in harmony with the Trump Administration. While the merits of such close co-operation are debateable, to say the least, such degree of closeness is likely, on balance, to result in a considerably more dovish policy stance, providing that the new Chair is able to bring the remainder of the FOMC with them.

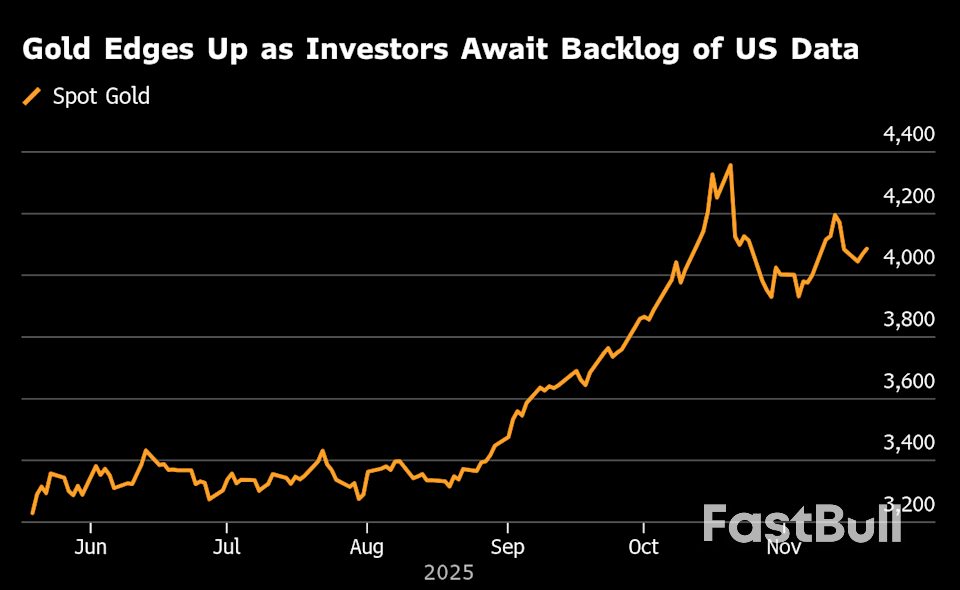

As a result, the 'Fed put' structure is likely to become an even stronger one, particularly with the fed funds rate already on its way back to neutral (3ish%), and the balance sheet set to bottom-out at a neutral level (roughly 20% of GDP). This structure, in turn, helps to reinforce the idea that the 'path of least resistance' continues to lead to the upside, particularly with there potentially also being a 'Trump put', in the run-up to next year's mid-terms.

For the commander in chief of the America First movement, Donald Trump has spent a surprising amount of his presidency focused on world affairs.

From Gaza to his sporadic attempts to rein in Vladimir Putin, his designs on Greenland and selected military strikes, this is a US leader who is sketching out a new foreign policy in the service of his domestic agenda.

Aiding him are Vice President JD Vance and Secretary of State Marco Rubio, two Republican stars who may not yet have reached the summit of their ambitions.

As this deeply reported piece shows, watching Trump's two top lieutenants offers some insight into the administration's emerging foreign-policy doctrine — as well as a gauge of who might carry the torch for the next US election in 2028.

Vance and Rubio downplay any rivalry, stressing their friendship. But that hasn't stopped Trump from pitching them as competitors for his crown.

Certainly their approaches to the world stage are very different. Rubio is a longtime anti-Communist hawk who seeks ways to deal in private, while Vance is a vocal torchbearer of the MAGA movement whose abrasive style, online and in speeches, is calculated to disrupt.

They've also worked in tandem, notably in regards to India and Pakistan, and on Trump's attempts to assert a US sphere of influence throughout the Americas.

Many international allies find Rubio's more reserved style, experience and background as a more traditional Republican hawk easier to work with, but they're also aware that they can't discount Vance's high-profile role in foreign affairs.

Matthew Bartlett, a State Department appointee during Trump's first term, compared them to Romulus and Remus, "the sons of MAGA."

But as anyone familiar with the foundational legend of ancient Rome knows, only one of the twins went on to prevail.

Trump said he'll designate Saudi Arabia as a major non-NATO ally in a further strengthening of US ties with the kingdom and capping a day of dealmaking in Washington between the president and Crown Prince Mohammed bin Salman. MBS was granted a defense agreement that includes cutting-edge F-35 warplanes and Trump publicly absolved him of the murder of Washington Post columnist Jamal Khashoggi; in return he got a vague promise for the Saudis to invest as much as $1 trillion in the US.

The European Union's deep economic ties to China are constraining its ability to pressure Beijing over Russia's war in Ukraine, Kaja Kallas, the bloc's top diplomat, said at a Bloomberg event in Brussels. Meanwhile, tankers carrying millions of barrels of oil from blacklisted Russian suppliers Rosneft and Lukoil are set to reach India after US sanctions take effect on Friday, raising questions on whether the crude will be able to discharge smoothly.

Volodymyr Zelenskiy wants to leverage growing US pressure on Moscow to revive stalled diplomatic efforts to end Russia's war, a source says, as the Ukrainian leader arrived in Turkey for talks with President Recep Tayyip Erdoğan. At least 16 people died and scores more were injured in a massive Russian missile and drone attack on Ukraine early today that also triggered emergency power cuts in parts of the country.

An airstrike killed at least 13 people in Lebanon's largest Palestinian refugee camp in Sidon, one of Israel's deadliest attacks on its neighboring country's southern region. The Israel Defense Forces said it struck a training compound affiliated to Iran-backed Hamas after "steps were taken to mitigate harm to civilians."

China escalated its retaliation against Japan, suspending imports of Japanese seafood and halting approvals for new films — the latest signs that their diplomatic spat is far from over. Chinese Foreign Ministry spokeswoman Mao Ning said that if Tokyo refuses to retract Prime Minister Sanae Takaichi's remarks on Taiwan that angered Beijing, China will take "serious countermeasures."

Trump's firm control of Washington showed signs of weakening as Congress voted to compel the Justice Department to release its files on sex trafficker Jeffrey Epstein.

Rap star Nicki Minaj made an appearance at the US mission to the United Nations to echo Trump's false claim that Christians are being systematically killed in Nigeria.

Dozens of countries are pushing for the COP30 climate summit to deliver a road map away from fossil fuel use as its key outcome, setting the stage for a frantic last few days of talks.

Elon Musk returned to the White House yesterday in a sign that tensions with Trump have thawed since a fierce split over deficit spending fractured a once-cozy relationship.

Three years ago, Chinese Premier Li Qiang took on a role largely stripped of its former glory. Now, he's becoming Xi Jinping's top emissary on the world stage. When China's No. 2 official steps out in Johannesburg at the Group of 20 summit, it'll mark his third stint representing the president at a major conference. The shift comes as Xi has dialed back his travel since Covid, mainly staying in Asia, and shows that despite a sweeping purge of ministers and top military generals, his reliance on an inner circle of loyalists appears to be growing.

South Americans are electing right-wing candidates this year for a variety of reasons: Empty fuel tanks and scarce dollars in Bolivia, economic turmoil in Argentina, fears over migration and violent crime in Chile. But they're all driving the region in the same direction. The realignment is unfolding as the US reasserts sway across Latin America, from the bombing of alleged drug boats off Venezuela and Colombia, to a $20 billion lifeline for Argentina, whose leader is a Trump acolyte. With more elections next year in Colombia, Peru and Brazil, presidential hopefuls are taking note.

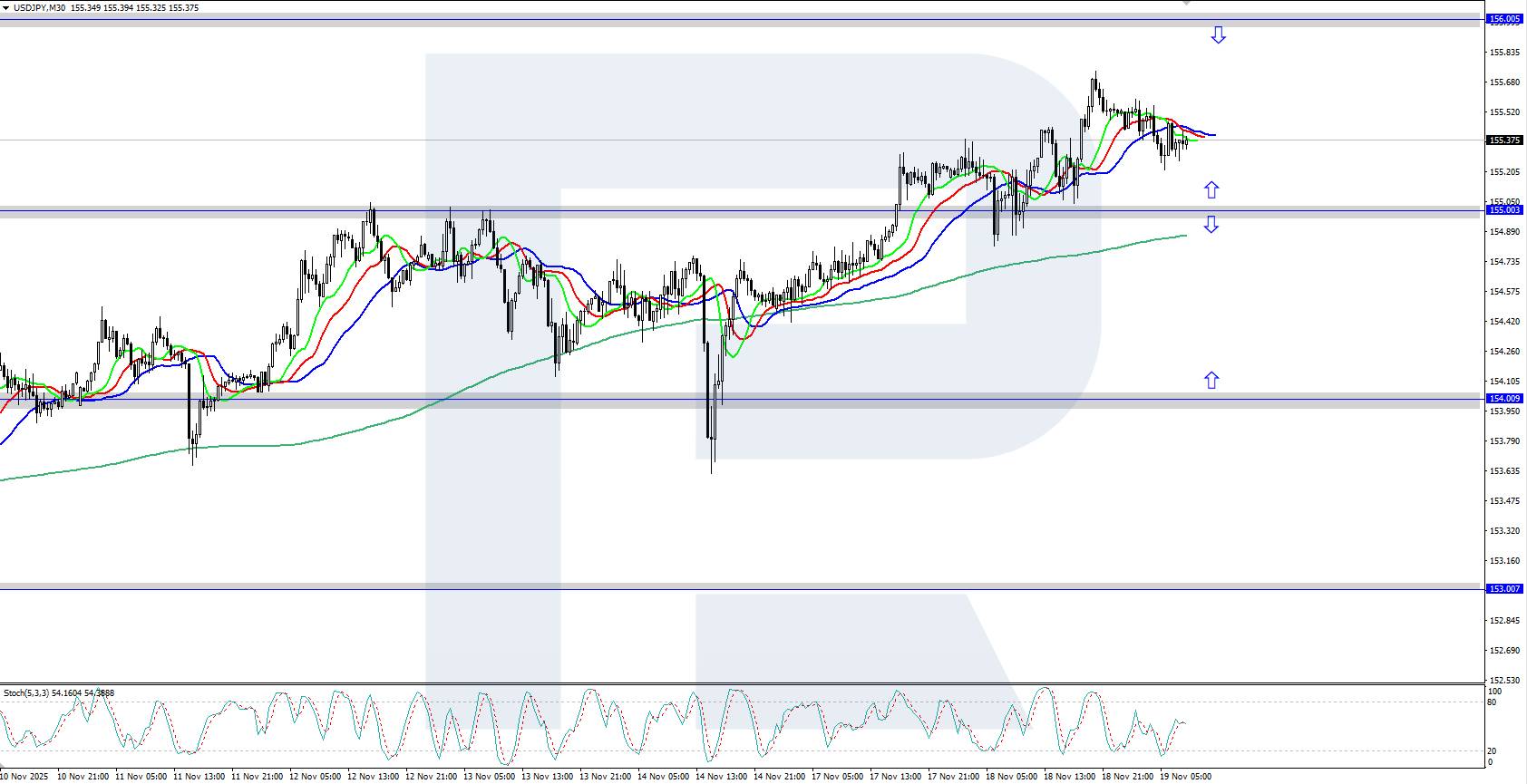

The USDJPY rate is rising, having consolidated above 155.00. Today, the market focuses on the minutes of the latest US Fed meeting. Find out more in our analysis for 19 November 2025.

USDJPY forecast: key trading points

On Tuesday, the Japanese government proposed an additional budget exceeding 25 trillion yen to finance Prime Minister Sanae Takaichi's economic stimulus program – a figure far above last year's supplementary budget of 13.9 trillion yen.

Meanwhile, Bank of Japan Governor Kazuo Ueda informed the prime minister that the central bank is gradually raising rates to maintain inflation at 2% while supporting stable growth. Ueda also told reporters that the prime minister did not make any specific requests regarding monetary policy.

Today, market participants await the release of the minutes of the latest Federal Open Market Committee (FOMC) meeting, which may offer investors insight into the regulator's next steps in monetary policy.

The USDJPY pair is rising confidently on the H1 chart, having consolidated above 155.00. The Alligator indicator is moving upwards, confirming the current bullish momentum. Further growth towards the local resistance level at 156.00 is possible.

The USDJPY forecast for today suggests that the pair may continue its ascent if buyers stay above 155.00. A decline will become possible if sellers regain control and firmly push the price below 155.00, which may trigger a correction towards the 154.00 support level.

The USDJPY pair is rising, holding above 155.00. Today, the market will focus on the minutes of the latest US Fed meeting.

China has suspended imports of Japanese seafood again, as the fallout over the Japanese prime minister's comments about Taiwan continues to escalate in one of worst bilateral disputes in years.

The ban was first reported by the Japanese outlets Kyodo News and NHK on Wednesday, and appeared to be confirmed by China's foreign ministry, which said there was "no market for Japanese seafood in the current climate".

The reports said China's government had informed Japan it was suspending all seafood imports, just months after it partly lifted a previous ban issued in 2023.

The original ban was imposed in response to Japan's decision to release wastewater from the damaged and decommissioned Fukushima nuclear plant. Chinese officials reportedly said Wednesday's decision was related to a need to further monitor the water source, but it has been widely received as part of China's retaliatory measures amid a deepening diplomatic row with Japan.

At a regular press briefing on Wednesday afternoon, the Chinese foreign ministry spokesperson Mao Ning said Japan had "failed to provide the technical documentation it committed to".

"I would also like to emphasise that due to [Japanese] prime minister Sanae Takaichi's recent actions that go against the tide and her erroneous remarks on major issues such as Taiwan, which have triggered strong public outrage in China, there would be no market for Japanese seafood in the current climate even if Japan were able to export it to China."

Before the 2023 ban, the Chinese market – including Hong Kong – accounted for more than one-fifth of Japan's exports.

The spat started after Takaichi told her country's parliament earlier this month that Japan could become militarily involved if China attacked Taiwan, because it would be a threat to Japan's existence.

Beijing claims Taiwan is a Chinese province and has vowed to annex it, with military force if it cannot coerce or convince Taiwan to accept "reunification".

Takaichi had been asked what would trigger Japan's 2015 "collective self-defence" laws, which give exceptions for Japan's postwar ban on using force to settle international disputes.

The remarks infuriated Beijing, which has repeatedly demanded Takaichi retract her comments, accusing her of issuing a "military threat" against China, and of pursuing a "revival" of Japan's prewar militarism.

Takaichi has not withdrawn her comments, although her government has said Japan's self-defence policy has not changed. Earlier this week she sent a high-ranking foreign ministry official to Beijing for talks, but they did not appear to lower tensions.

China's foreign ministry said on Tuesday that Takaichi's remarks "caused fundamental damage to the political foundation of China-Japan relations".

The reported seafood ban comes amid a swathe of rhetorical, symbolic, and economic retaliations.

Over the weekend, China sent a coastguard fleet through the disputed waters around the Senkaku Islands and military drones past Japan's most westerly territory, Yonaguni Island, close to Taiwan's east coast.

After China issued a travel warning to tourists and students planning to visit Japan, almost a dozen airlines offered refunds to passengers and about 500,000 people were estimated to have cancelled flights. Shares in Japanese retail and tourism companies fell sharply on Monday. State-owned enterprises, including Chinese banks, have also reportedly told staff not to travel to Japan.

Japanese film releases have also been suspended and numerous cross-cultural events have been cancelled. On Tuesday, China's permanent representative to the UN, Fu Cong, told a forum that Japan was "totally unqualified" for a permanent seat on the UN security council, citing Takaichi's remarks.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up