Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

An iceberg order is a type of execution strategy that hides the full size of a trade by revealing only small portions at a time. Used by institutions and large traders, it helps reduce market impact. Understanding how iceberg orders work, where they’re used, and their risks can help traders more accurately analyse market activity. This article breaks down everything you need to know about iceberg orders and their role in trading.

An iceberg order is a type of order designed to execute large trades without revealing the full size to the market. Instead of placing one massive position that could disrupt prices, traders split it into smaller portions, with the rest hidden. As each portion gets filled, the next one is placed automatically until the full order is executed.The key feature of this type of entry is that only a fraction—known as the display quantity—is visible in the order book at any given time. The rest remains hidden until it’s gradually revealed. This prevents other traders from immediately recognising the true size of the position, which helps avoid unnecessary market movements.

For example, if a trader wants to buy 50,000 shares of a stock, placing the full position in the market at once could cause prices to rise before execution is complete. Instead, they might set an iceberg order with a display size of 5,000 shares. Once the first 5,000 are bought, another 5,000 are automatically placed, repeating until the full 50,000 are executed.

They’re particularly useful for institutional traders, hedge funds, and high-net-worth individuals who want to build or reduce positions without attracting attention. However, some retail traders also use them when executing relatively large trades in markets that support this execution type. Many major exchanges, including those for equities, forex, and futures, allow icebergs, but their availability depends on the broker and trading platform being used.

Order Execution Process

When a trader places an iceberg order, they specify two key parameters:

For example, if a trader wants to buy 20,000 shares but only wants 500 to be visible at a time, the order book will show just 500 shares. Once those are bought, another 500 will appear at the same price (if still available), and the cycle continues until the entire 20,000 shares are filled.

Some trading platforms and institutional brokers use smart order execution algorithms to optimise how these orders are placed. These algorithms might adjust the display size dynamically based on market conditions, ensuring the order gets executed efficiently without drawing too much attention.

Although most of the order remains hidden, experienced traders and high-frequency algorithms can sometimes detect iceberg levels. If they notice an order constantly refreshing at the same price level without an obvious large sell or buy position, they may infer that an iceberg is in play.

They are most popular in liquid markets where frequent trading activity allows the hidden portions to be executed smoothly. In less liquid markets, there’s a higher risk that the order will be only partially filled or take longer to execute, making alternative execution strategies more practical.

Iceberg orders help traders hide their full intentions from the market. Here’s why they’re commonly used:

When a large position enters the market, it can shift prices before the full trade is completed. This is particularly an issue in less liquid markets, where even moderate positions can cause price swings. By splitting a large trade into smaller, hidden chunks, iceberg orders prevent sudden moves that could work against the trader.

Slippage occurs when an order is executed at a worse price than expected due to market movement. Large trades placed all at once can exhaust available liquidity at the best price levels, forcing later portions to be filled at less favourable prices. Iceberg orders help mitigate this by allowing the trade to be executed gradually without consuming too much liquidity at once.

Institutions and high-net-worth traders often prefer to keep their trading activity under the radar. If other market participants see a massive buy or sell entry, they may react by adjusting their own strategies, making it harder for the original trader to get a good price. Icebergs keep most of the position hidden, preventing this from happening.

High-frequency trading firms and aggressive traders actively monitor the order book for large transactions. When they spot them, they may enter positions ahead of the large trade, pushing prices in an unfavourable direction. By keeping most of the trade hidden, iceberg entries make it harder for others to exploit this information.

Iceberg orders are designed to be discreet, but experienced traders and algorithmic systems can sometimes detect them by analysing order book activity and price movements. Since only a small portion of the total order is visible at any given time, certain patterns can reveal the presence of an iceberg in action.

One of the most obvious signs is a persistent order at the same price level. If a bid or ask keeps refreshing with the same quantity after being partially filled, it may indicate that a much larger hidden position is sitting at an iceberg level. This is particularly noticeable in less liquid markets where large trades are more disruptive.

Another telltale sign is a large trade volume without corresponding large visible orders. If significant buying or selling occurs but the order book only displays small entries, there’s a chance that a hidden order is gradually being executed.

Traders can also look at time and sales data, which records every transaction. If the same price level repeatedly absorbs multiple trades without depleting, it suggests a hidden order replenishing itself after each execution.

Some trading algorithms are specifically designed to identify icebergs. These tools scan for patterns in order execution and attempt to infer hidden liquidity. While not always accurate, they can give traders an idea of when institutional activity is taking place.

While iceberg orders can help traders execute large trades discreetly, they are not without drawbacks. Market conditions, execution risks, and the rise of advanced trading algorithms can all impact their effectiveness.

The Bottom Line

Iceberg orders enable traders to execute large trades discreetly, minimising market impact and enhancing execution quality. While they offer advantages in managing liquidity, they also carry risks such as detection by advanced algorithms and potential slippage. Traders should exercise caution and conduct thorough market analysis.

FAQ

What Is an Iceberg Order?

An iceberg order is a type of order that splits a large trade into smaller visible portions, with the remaining size hidden from the order book. As each visible portion is filled, the next one is automatically placed until the full order is executed. This helps traders avoid moving the market or revealing their full position size.

How Do You Identify an Iceberg Order?

Traders can spot icebergs by looking for repeated small trades at the same price level. If an order keeps refreshing after partial fills without a visible large order in the book, it may indicate hidden liquidity. Time and sales data, as well as algorithmic tools, can help detect these patterns.

What Is the Difference Between an Iceberg Order and a Basket Order?

An iceberg order breaks a single large entry into smaller, hidden parts, while a basket order consists of multiple different trades executed together, often across various assets or instruments. Basket orders are used for portfolio adjustments, whereas iceberg entries focus on reducing market impact.

What Is an Iceberg Order in Crypto*?

In crypto* markets, iceberg entries function the same way as in traditional markets—hiding large trades to prevent price fluctuations. Many exchanges offer this feature, particularly for institutional traders handling large positions.

How Do I Place an Iceberg Order?

Availability depends on the broker or exchange. Traders typically set the total position size and the visible portion, allowing the system to execute the trade in smaller segments.

What Is the Iceberg Order Strategy?

The strategy involves using iceberg orders to accumulate or distribute large positions without drawing attention. It helps reduce slippage, maintain discretion, and avoid triggering unnecessary price movement.

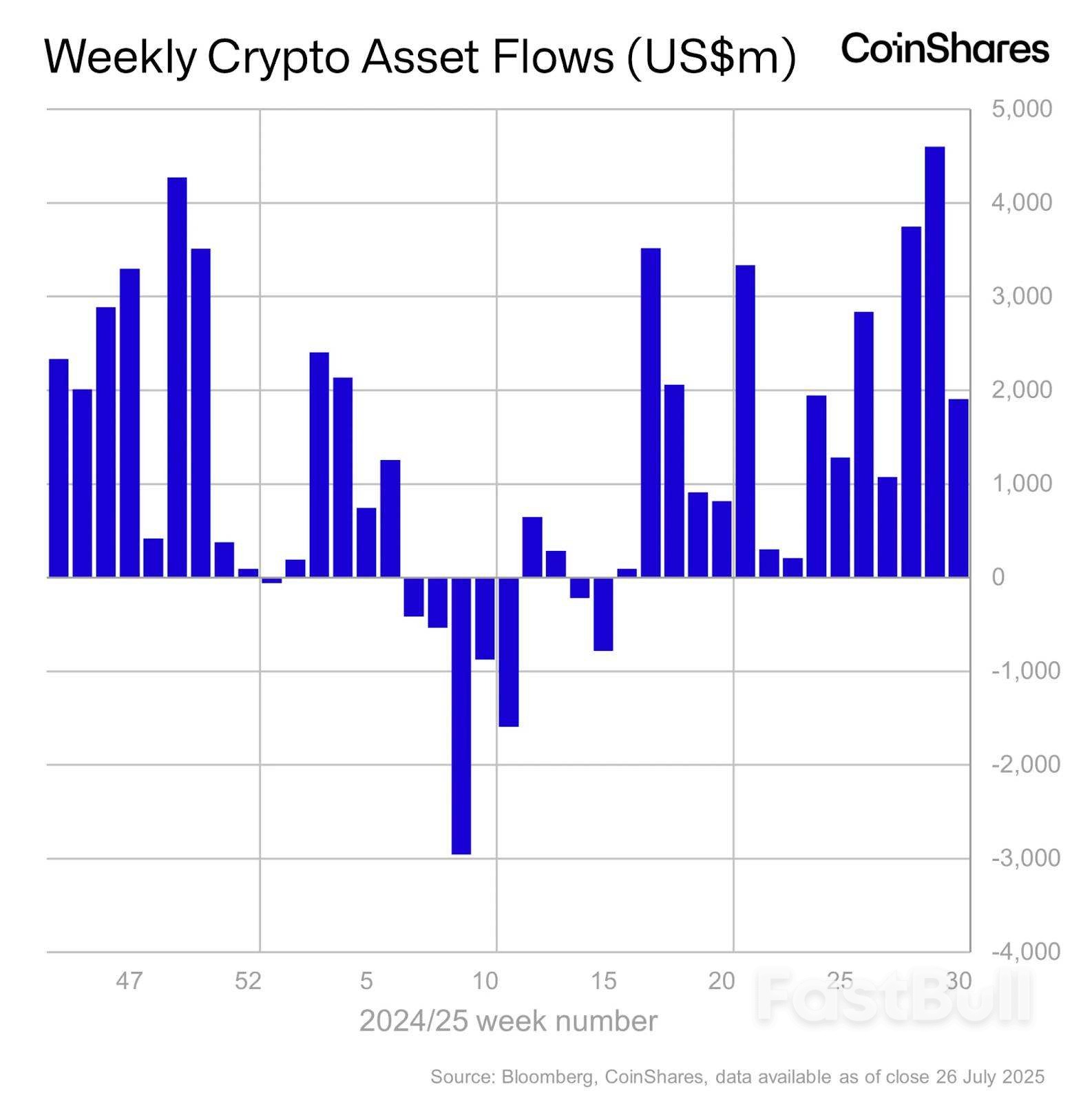

Digital asset investment products saw $1.9 billion in inflows this week, a 15-week run of positive sentiment, as reported by CoinShares. So far in July, inflows have hit $11.2 billion, outpacing the $7.6 billion recorded back in December 2024 after the U.S. election. The United States led the charge with $2 billion, while Germany contributed an additional $70 million. On the flip side, outflows from Hong Kong, Canada, and Brazil totaled $160 million, $84.3 million, and $23.2 million, which somewhat balanced out the demand from the U.S.

In Brief

Ethereum had its second-strongest weekly performance, with inflows of $1.59 billion. This year, Ethereum inflows have already surpassed all of last year, totaling $7.79 billion. In comparison, Bitcoin had outflows of $175 million during this increase.

Besides Ethereum, large-cap altcoins attracted targeted demand. Solana gained $311 million, while XRP followed with $189 million. SUI added $8 million in inflows. However, inflows tapered beyond these names, with Litecoin and Bitcoin Cash seeing small outflows of $1.2 million and $660,000. Hence, analysts warned that the current momentum does not yet qualify as a broad altcoin season.

James Butterfill, Coinshares’ head of research, said investors appear to be tactically positioning ahead of potential U.S. ETF approvals. He noted that flows remain concentrated in a few assets and regions. Moreover, Bloomberg analyst Eric Balchunas revealed that ETFs attracted nearly $100 billion in the last month, potentially breaking last year’s record.

Your 1st cryptos with Coinbase This link uses an affiliate program.

June recorded 108 ETF launches, the highest monthly figure ever, and 50% higher than last year’s pace. Nearly a quarter of the 450 ETFs launched in 2025 are leveraged products, 2.5 times the old record. However, Balchunas warned that many of these ETFs may fail to attract assets. Approximately 40% of existing ETFs remain unprofitable with less than $40 million in assets.

Historical data further highlights 2025’s volatility. Monthly launches hit major peaks in January, March, and June, with June’s 108 launches standing out. The trend continues to outperform the five-year historical average of 35–60 monthly launches.

Additionally, there was a surge in momentum toward ETFs. According to data released by Amonyx on X, Polymarket indicates a 98% chance of the XRP ETF being approved by December 31, 2025. Compared to 80% earlier in June, this sudden rise in market sentiment may have been brought on by recent regulatory changes.

Consequently, speculation that more large-cap cryptocurrencies may receive inflows is being fueled by anticipation for an XRP ETF. This reinforces the pattern of investors shifting their money from Bitcoin to Ethereum and a few other altcoins.

Strong rally in past three days started to run out of steam on Tuesday, as daily action was so far shaped in long-legged Doji candle that signals indecision.

Bulls show signs of fatigue after retracing over 76.4% of 149.18/145.85 bear-leg and hitting recovery high just under key near-term support at 149.18 (July 16 peak), where the rally faced headwinds.

Overbought daily Stochastic contributes to developing negative signals, but overall picture on daily chart remains firmly bullish, suggesting that consolidation or shallow correction may precede fresh push higher, with probe through 149.18 and 149.53 (200DMA) to expose psychological 150 barrier.

Dips should ideally find support at 147.70/50 zone (10DMA / Fibo 38.2% of 145.85/148.75 upleg) to mark a healthy correction and keep bulls intact.

Res: 148.75; 149.18; 149.53; 150.00.Sup: 148.06; 147.65; 147.50; 147.30.

What Exactly is the Altcoin Season Index?

What Exactly is the Altcoin Season Index?The cryptocurrency market operates in fascinating cycles, often driven by the performance of Bitcoin relative to other digital assets. The Altcoin Season Index, a widely recognized metric tracked by platforms like CoinMarketCap (CMC), serves as a barometer for these shifts. It helps investors gauge whether the broader market is currently favoring Bitcoin or if altcoins are stealing the spotlight.At its core, the Altcoin Season Index provides a snapshot of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) and how many of them have outperformed Bitcoin over the past 90 days. This 90-day window offers a balanced view, smoothing out daily fluctuations and providing a more reliable trend indicator.

The index is straightforward but powerful. Here’s a quick breakdown:

Let’s clarify what different scores signify:

| Index Score Range | Market Condition | Description |

|---|---|---|

| 75 – 100 | Altcoin Season | At least 75% of the top 100 altcoins have outperformed Bitcoin over the past 90 days. This is when altcoins generally see significant gains. |

| 26 – 74 | Neutral/Mixed | The market is balanced, with no clear dominance by either Bitcoin or altcoins. Performance can vary wildly among different assets. |

| 1 – 25 | Bitcoin Season | 25% or fewer of the top 100 altcoins have outperformed Bitcoin over the past 90 days. Bitcoin is typically the primary driver of market gains. |

As reported, the Altcoin Season Index recently registered 39. This figure, being well below the 75 threshold, clearly indicates that the market is currently in a ‘Bitcoin Season’. This means that over the last 90 days, Bitcoin has largely outperformed the majority of the top 100 altcoins.

Why might this be the case? Several factors contribute to Bitcoin’s dominance:

While the allure of massive altcoin gains is strong, understanding that we are in a Bitcoin Season is crucial for managing expectations and refining your investment approach. Here’s how you can strategically navigate this period:

1. Prioritize Bitcoin (BTC) Exposure

During Bitcoin Season, it’s logical to have a stronger allocation to Bitcoin itself. As the market leader, BTC is likely to capture the majority of the gains. For many investors, increasing their Bitcoin holdings or simply holding onto their existing BTC can be a sound strategy.

2. Research Strong Altcoins with Solid Fundamentals

Even in a Bitcoin Season, not all altcoins will perform poorly. This period can be an excellent opportunity for diligent research. Look for altcoins with:

This is not about chasing hype but identifying long-term winners that could thrive when the market eventually shifts back to Altcoin Season.

3. Employ Dollar-Cost Averaging (DCA)

Instead of trying to time the market, which is notoriously difficult, consider dollar-cost averaging into your preferred altcoins. This involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. DCA helps mitigate risk by averaging out your purchase price and reduces the impact of market volatility.

4. Practice Prudent Risk Management

Volatility is a constant in crypto. During Bitcoin Season, altcoins can experience sharper downturns. Ensure you are not over-leveraged and only invest what you can afford to lose. Diversify your portfolio within reason, and consider setting stop-loss orders to protect your capital.

5. Cultivate Patience and a Long-Term Outlook

Market cycles take time to unfold. A Bitcoin Season is not a permanent state. Patient investors who understand the cyclical nature of the market are often the ones who reap the greatest rewards. Focus on long-term growth rather than short-term gains, and avoid making impulsive decisions based on daily price movements.

When Will the Altcoin Season Return?

The million-dollar question! Predicting the exact timing of the next Altcoin Season is impossible, but we can identify potential triggers and indicators:

Keep a close eye on these macro and micro indicators to anticipate the shift back towards Altcoin Season.

While understanding market cycles is empowering, it’s essential to acknowledge the inherent challenges and risks:

To summarize, here are some actionable insights to guide you through the current market climate and beyond:

Understanding the Altcoin Season Index and its implications is a powerful tool in any crypto investor’s arsenal. While we are currently in a Bitcoin Season, history suggests that market cycles are inevitable. By staying informed, adapting your strategies, and focusing on long-term fundamentals, you can position yourself to potentially benefit from future shifts, including the eventual return of a thriving Altcoin Season. Happy investing!

Frequently Asked Questions (FAQs)

Q1: What is the Altcoin Season Index and who tracks it?

The Altcoin Season Index is a metric that indicates whether the cryptocurrency market is currently favoring Bitcoin or altcoins. It’s tracked by various platforms, most notably CoinMarketCap (CMC), and compares the performance of the top 100 altcoins against Bitcoin over the past 90 days.

Q2: What does it mean when the Altcoin Season Index is at 39?

An index score of 39 signifies that the market is currently in ‘Bitcoin Season’. This means that 25% or fewer of the top 100 altcoins have outperformed Bitcoin over the last 90 days, indicating that Bitcoin has been the dominant performer.

Q3: How is Altcoin Season determined?

Altcoin Season is declared when at least 75% of the top 100 altcoins (excluding stablecoins and wrapped tokens) have outperformed Bitcoin over the preceding 90 days. This typically signals a period of significant gains for a broad range of altcoins.

Q4: What are some strategies for investing during Bitcoin Season?

During Bitcoin Season, investors might consider increasing their Bitcoin allocation, conducting thorough research on altcoins with strong fundamentals for long-term holds, employing dollar-cost averaging, and practicing robust risk management.

Q5: What factors could trigger the next Altcoin Season?

Potential triggers for the next Altcoin Season include Bitcoin price consolidation, a sustained decrease in Bitcoin dominance, major upgrades or innovations within altcoin ecosystems, and a general increase in risk appetite across the broader financial markets.

Q6: Is it possible to predict the exact start of Altcoin Season?

No, predicting the exact start of Altcoin Season is not possible due to the inherent volatility and unpredictable nature of the crypto market. However, by monitoring key indicators and understanding market cycles, investors can better anticipate potential shifts.

It took less than 48 hours after the US and European Union’s handshake trade deal for markets and a growing chorus of critics to start wondering whether the preliminary agreement forged in Scotland will stabilize transatlantic relations.

The EU over the weekend agreed to accept a 15% tariff on most of its exports, while the bloc’s average tariff rate on American goods should drop below 1% once the deal goes into effect. Brussels also said it would purchase $750 billion in American energy products and invest $600 billion more in the US.

The euro fell to a five-week low of $1.1527 on Tuesday, and is now down about 1.8% since the trade deal was announced. That’s after the common currency had surged to a near three-year high last week on the prospect of an agreement with the US.

German Chancellor Friedrich Merz, who initially cheered having “succeeded” in avoiding a trade conflict and enabling the EU to safeguard its interests, seemed to sour on the accord. “The German economy will suffer significant damage from these tariffs,” he told reporters Monday.

There’s also some head-scratching over the EU’s offerings, especially the $750 billion promise to buy American energy goods over three years. That’s a pledge it will struggle to keep, Bloomberg News reports, because it’s hard to make the arithmetic add up.

The deal would require annual purchases of $250 billion of natural gas, oil and nuclear technology, including small modular reactors, according to EU officials.

European Commission President Ursula von der Leyen said the bloc’s estimates were based on the existing plan to shift away from remaining Russian fossil fuel supplies and purchase “more affordable and better” liquefied natural gas from US producers.

Yet it’s hard to see how the EU attains such ambitions over such a short time frame. Total energy imports from the US accounted for less than $80 billion last year. Total US energy exports were just over $330 billion in 2024.

Meanwhile, concerns about the EU remaining submissive in a world of mounting protectionism were growing.

“The free trade principles that have underpinned transatlantic prosperity since the end of World War II are being systematically dismantled,” Karin Karlsbro, a Swedish member of the European Parliament’s trade committee, said in a statement. “The risk of European economic and political marginalization grows with each concession made.”

In the midst of President Donald Trump’s dismantling of the rules-based trading system geared for low tariffs, news also emerged Monday that a White House economist is taking a top job at the institution responsible for overseeing the bylaws of global commerce.

On Monday, World Trade Organization Director-General Ngozi Okonjo-Iweala announced the appointment of Jennifer DJ Nordquist to be one of four deputy directors-general at the WTO, replacing Angela Ellard.

Nordquist currently serves as counselor with Trump’s Council of Economic Advisers and is expected to start in Geneva on Oct. 1.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up