Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

On Monday, as often happens after an initial emotional reaction to major news, the price corrected as market participants reassessed prospects in light of the Fed Chair’s softened rhetoric.

Powell’s speech on Friday had a distinctly dovish tone. Expectations of an interest rate cut strengthened, which led to a sharp weakening of the dollar — on the EUR/USD chart, a bullish impulse A→B was formed.On Monday, as often happens after an initial emotional reaction to major news, the price corrected as market participants reassessed prospects in light of the Fed Chair’s softened rhetoric.

What is particularly notable is that the correction was most evident on the EUR/USD chart, where the decline B→C almost completely offset Friday’s surge. This could point to underlying weakness in the euro, which seems justified when considering that the euro index EXY (the euro’s performance against a basket of currencies) has risen by roughly 13% since the beginning of the year.

The EUR/USD rate reacted less strongly to the news that President Trump had decided to dismiss Lisa Cook, a member of the Federal Reserve’s Board of Governors. While the media debates whether the President has the authority to remove her, traders may instead assess how EUR/USD could fluctuate following the A→B→C volatility swing.

Technical Analysis of the EUR/USD Chart

Recently, we outlined a descending channel using the sequence of lower highs and lows observed this summer. The upper boundary clearly acted as resistance for EUR/USD’s rise on Friday.

From the bears’ perspective:

→ the price has broken downward through an ascending trajectory (shown in purple), and the lower purple line has already changed its role from support to resistance (as indicated by the arrow);

→ today’s rebound from the 1.1600 support level appears weak, as highlighted by the long upper shadow on the candlestick;

→ if this rebound is merely an interim recovery following the bearish B→C impulse, it fails to reach the 50% Fibonacci retracement level.

In addition, the B peak only slightly exceeded the previous August high (which resembles a bull trap).

Taking all this into account, we could assume that in the near term we may see bears attempt to break the 1.1600 support level and push EUR/USD towards the median line of the primary descending channel.

The recent price actions of Gold (XAU/USD) have started to trade firmer since last Friday, 22 August, with a gain of 1%, on increased hopes that the US Federal Reserve is likely to enact its first interest rate cut of 2025 in the next month’s FOMC meeting.

Fed Chair Powell’s Jackson Hole Symposium dovish speech has led traders in the Fed Funds futures market to firm up bets that the Fed is likely to cut twice in 2025 (25 basis points each), with a probability of 81% that the Fed Funds rate will be at 3.75%-4.00% on 10 December 2025 FOMC meeting at the time of writing from the current range of 4.25%-4.50%.

Lower interest rates reduce the opportunity cost of holding gold, an asset that yields no interest, thereby boosting its appeal and increasing demand, which in turn puts upward pressure on prices.

In today’s early Asia session, Gold (XAU/USD) shot up by 0.6% to print a current intraday high of US$3,387, a two-week high before paring gains to 0.3% intraday at the time of writing due to safe haven demand as the independence of the US Federal Reserve gets eroded over the firing of Federal Reserve Governor Lisa Cook by US President Trump.

Let’s decipher the latest technical developments on Gold (XAU/USD)

Preferred trend bias (1-3 days)

Bullish bias within a medium-term sideways range configuration with key short-term pivotal support at US$3,352/347, with next intermediate resistances coming in at US$3,402 and US$3,432/3,435 (see Fig. 1).

Key elements

Alternative trend bias (1 to 3 days)

A break below US$3,347 on Gold (XAU/USD) invalidates the bullish bias for another round of choppy decline towards the lower limit of the medium-term sideways range configuration, exposing the next intermediate supports at US$3,324 and US$3,310 in the first step.

The United States Dollar recently demonstrated a significant resurgence, clawing back earlier losses and asserting its position in the global currency hierarchy. This Dollar rebound is not an isolated event but rather a confluence of several influential factors that reinforce its status as a safe-haven asset and a barometer of global economic health. Investors often flock to the Dollar during periods of global uncertainty, seeking its stability and liquidity.

Key Drivers Behind the Dollar’s Strength:

These elements collectively paint a picture of a Dollar gaining traction, reflecting both its intrinsic economic strengths and its role as a global reserve currency. The strength of the Dollar impacts everything from commodity prices to corporate earnings, making its movements a central focus for analysts and investors worldwide.

While the Dollar has found its footing, the Euro has faced considerable headwinds, leading to pronounced Euro weakness against its major counterparts. This decline is not solely a reflection of Dollar strength but also stems from specific challenges within the Eurozone, particularly the unfolding political landscape in France. The single currency’s performance is intrinsically linked to the economic and political stability of its member states, and any significant tremor in a core economy like France can send ripples throughout the entire bloc.

Factors Contributing to Euro’s Decline:

The combination of these factors creates a challenging environment for the Euro, making it susceptible to downward pressure. Understanding these drivers is crucial for anyone trading or investing in assets denominated in or influenced by the Euro.

The recent political developments in France have become a significant source of French uncertainty, casting a shadow not only over the Eurozone but also influencing broader global financial markets. The decision by President Emmanuel Macron to call snap parliamentary elections following a strong showing by the far-right in European Parliament elections has introduced a period of heightened political risk. This uncertainty is particularly potent given France’s central role as the Eurozone’s second-largest economy and a key player in European integration.

Implications of French Political Volatility:

| Aspect | Impact on Markets | Description |

|---|---|---|

| Fiscal Policy | Increased bond yields, wider spreads | Concerns about potential populist policies leading to higher government spending and increased national debt. This raises questions about France’s ability to meet EU fiscal rules. |

| European Union Cohesion | Pressure on Euro, investor jitters | A shift towards more nationalistic or anti-EU policies in France could destabilize the political cohesion of the European Union, impacting its future direction and stability. |

| Economic Reforms | Stalled progress, reduced investment | Uncertainty about the government’s ability to implement necessary economic reforms could deter foreign investment and hinder economic growth prospects. |

| Banking Sector | Stock market volatility | French banks, with their significant holdings of government bonds, face potential pressure if bond yields rise sharply and persistently. |

The market’s reaction to French uncertainty has been swift, with a sell-off in French government bonds and equities, and a noticeable weakening of the Euro. Investors are reassessing the risk premium associated with French assets, which in turn affects the broader Eurozone’s perceived stability. This situation underscores how domestic political events in a major economy can have far-reaching international consequences.

The current environment, characterized by a strengthening Dollar and a struggling Euro, creates a highly dynamic and potentially volatile Forex market. For investors, this period demands careful observation and strategic positioning. Understanding the interplay between these major currencies is not just for currency traders; it has implications for equity markets, commodity prices, and even the relative attractiveness of digital assets.

Key Considerations for the Forex Market:

The Forex market is a complex ecosystem where economic fundamentals, monetary policy, and geopolitical events constantly interact. Keeping a close watch on these drivers is essential for making informed decisions across various investment portfolios.

The current dynamics between the Dollar and the Euro are part of broader currency movements that resonate across the global economy. These shifts are not confined to a single pair but reflect a complex web of international trade, investment flows, and macroeconomic policies. The relative strength or weakness of major currencies has profound implications for global trade balances, inflation, and the overall financial stability of nations.

Wider Repercussions of Current Currency Trends:

These currency movements are not merely abstract numbers on a screen; they represent tangible economic forces that influence daily life, from the cost of goods to the profitability of businesses. For cryptocurrency investors, understanding these macro shifts is vital as they can indirectly affect market liquidity, risk appetite, and the broader financial environment in which digital assets operate.

In a world where the Dollar is rebounding and the Euro is facing significant headwinds from French uncertainty, investors need a clear strategy. Here are some actionable insights to consider:

These insights provide a framework for navigating the current global financial landscape, allowing investors to make more informed decisions in response to ongoing currency movements.

While the current trends of Dollar rebound and Euro weakness appear established, the global financial landscape is constantly evolving. Several factors could emerge or intensify, potentially reversing these trajectories and introducing new challenges for the Forex market.

Potential Reversal Triggers:

Investors must remain vigilant and adaptable, as these potential shifts could rapidly alter the prevailing trends and create new opportunities or risks within the Forex market. The interplay of economic, political, and monetary policy factors will continue to dictate the direction of major currency pairs.

The global financial arena is currently witnessing a significant Dollar rebound, asserting its strength after earlier dips, primarily driven by robust US economic data and its enduring safe-haven appeal. In stark contrast, the Euro is experiencing pronounced Euro weakness, largely exacerbated by escalating French uncertainty stemming from snap elections and the potential for a populist government. These developments are creating substantial volatility within the Forex market, influencing everything from bond yields to commodity prices and impacting investor sentiment globally.

Understanding these intricate currency movements is paramount for investors navigating the current economic climate. While the Dollar benefits from its perceived stability and the Federal Reserve’s cautious stance, the Euro struggles under the weight of political instability in a core member state. The implications are far-reaching, affecting trade balances, inflationary pressures, and the broader risk appetite that can indirectly influence digital asset markets. Vigilance, diversification, and a keen eye on central bank policies and geopolitical shifts are essential for making informed decisions in this evolving financial landscape. The coming weeks will be crucial in determining whether these trends consolidate or if new developments trigger a reversal, underscoring the dynamic nature of global finance.

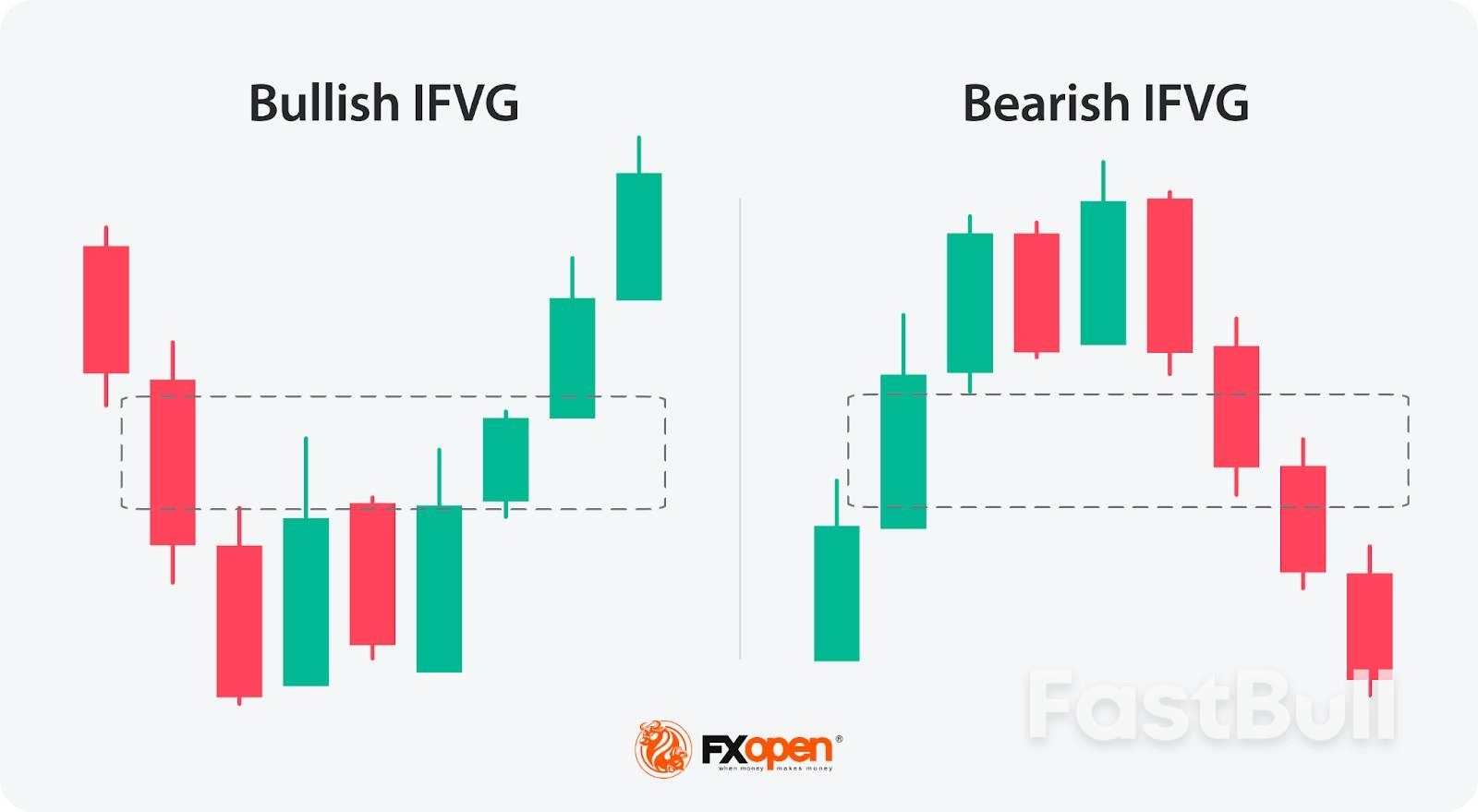

Inverse Fair Value Gaps (IFVGs) are a fascinating concept for traders seeking to refine their understanding of price behaviour. By identifying areas where market sentiment shifts, IFVGs provide unique insights into potential reversals and key price levels. In this article, we’ll explore what IFVGs are, how they differ from Fair Value Gaps, and how traders can integrate them into their strategies for more comprehensive market analysis.

What Is a Fair Value Gap (FVG)?

A Fair Value Gap (FVG) occurs when the market moves so rapidly in one direction that it leaves an imbalance in price action. This imbalance shows up on a chart as a gap between three consecutive candles: the wick of the first candle and the wick of the third candle fail to overlap, leaving a “gap” created by the second candle. It essentially highlights an area where buying or selling pressure was so dominant that the market didn’t trade efficiently.

Traders view these gaps as areas of potential interest because markets often revisit these levels to "fill" the imbalance. For example, in a bullish FVG, the gap reflects aggressive buying that outpaced selling, potentially creating a future support zone. On the other hand, bearish FVGs indicate overwhelming selling pressure, which might act as resistance later.

FVGs are closely tied to the concept of fair value. The gap suggests the market may have deviated from a balanced state, making it an area traders watch for signs of price rebalancing. Recognising and understanding these gaps can provide insights into where the price might gravitate in the future, helping traders assess key zones of interest for analysis.

Understanding Inverse Fair Value Gaps (IFVGs)

An Inverse Fair Value Gap (IFVG), or Inversion Fair Value Gap, is an Inner Circle Trader (ICT) concept that builds on the idea of an FVG. While an FVG represents a price imbalance caused by strong directional movement, an IFVG emerges when an existing FVG is invalidated. This invalidation shifts the role of the gap, turning a bearish FVG into a bullish IFVG, or vice versa.

Here’s how it works: a bearish FVG, for instance, forms when selling pressure dominates, leaving a gap that might act as resistance. However, if the market breaks through this gap—either with a wick or a candle close—it signals that the sellers in that zone have been overwhelmed. The bearish FVG is now invalidated and becomes a bullish IFVG, marking a potential area of support instead. The same applies in reverse for bullish FVGs becoming bearish IFVGs.

Traders use inverted Fair Value Gaps to identify zones where market sentiment has shifted significantly. For example, when the price revisits a bullish IFVG, it may serve as a zone of interest for traders analysing potential buying opportunities. However, if the price moves past the bottom of the IFVG zone, it’s no longer valid and is typically disregarded.

What makes these reverse FVGs particularly useful is their ability to highlight moments of structural change in the market. They can act as indicators of strength, revealing areas where price has transitioned from weakness to strength (or vice versa). By integrating IFVG analysis into their broader trading framework, traders can gain deeper insights into the evolving dynamics of supply and demand.

Want to test your IFVG identification skills? Get started on FXOpen’s free TickTrader trading platform.

How Traders Use IFVGs in Trading

By integrating IFVGs into their strategy, traders can refine their decision-making process and uncover potential setups aligned with their broader market outlook. Here’s how IFVGs are commonly used:

Traders begin by spotting FVGs on price charts—areas where rapid movements create imbalances. An inversion FVG forms when such a gap is invalidated; for instance, a bearish FVG becomes bullish if the price breaks above it. These zones are then marked as potential areas of interest, indicating where the market may experience significant activity.

The formation of an IFVG signals a shift in market sentiment. When a bearish FVG is invalidated and turns into a bullish IFVG, it suggests that selling pressure has diminished and buying interest is gaining momentum. Traders interpret this as a potential reversal point, providing context for the current market dynamics.

Once an IFVG is identified, traders monitor how the price interacts with this zone. If the price revisits a bullish IFVG and shows signs of support—such as slowing down its decline or forming bullish candlestick patterns—it may indicate a strengthening upward movement. Conversely, if the price breaches the IFVG without hesitation, the anticipated reversal might not materialise.

IFVGs provide traders with a structured way to identify and analyse price levels where sentiment has shifted. The process typically looks like this:

1. Establishing Market Bias

Traders typically start by analysing the broader market direction. This often involves looking at higher timeframes, such as the daily or 4-hour charts, to identify trends or reversals. Tools like Breaks of Structure (BOS) or Changes of Character (CHoCH) within the ICT framework help clarify whether the market is leaning bullish or bearish.

Indicators, such as moving averages or momentum oscillators, can also provide additional context for confirming directional bias. A strong bias ensures the trader is aligning setups with the dominant market flow.

2. Identifying and Using IFVGs

Once a Fair Value Gap (FVG) is invalidated—indicating a significant shift in sentiment—it transforms into an Inverse Fair Value Gap (IFVG). Traders mark the IFVG zone as a key area of interest. If it aligns with their broader market bias, this zone can serve as a potential entry point. For instance, in a bearish bias, traders may focus on bearish IFVGs that act as potential resistance zones.

3. Placing Orders and Risk Management

Traders often set a limit order at the IFVG boundary, anticipating a retracement and for the area to hold. A stop loss is typically placed just beyond the IFVG or a nearby swing high/low to manage risk. For exits, targets might include a predefined risk/reward ratio, such as 1:3, or a significant technical level like an order block or support/resistance area. This approach ensures trades remain structured and grounded in analysis.

Advantages and Disadvantages of IFVGs

IFVGs offer traders a unique lens through which to analyse price movements, but like any tool, they come with both strengths and limitations. Understanding these can help traders incorporate IFVGs into their strategies.

Advantages

Disadvantages

FAQ

What Is an Inverse Fair Value Gap (IFVG)?

The IFVG meaning refers to a formation that occurs when a Fair Value Gap (FVG) is invalidated. For example, a bearish FVG becomes bullish after the price breaks above it, creating a potential support zone. Similarly, a bullish FVG can transform into a bearish IFVG if the price breaks below it, creating a potential resistance zone. IFVGs highlight shifts in market sentiment, providing traders with areas of interest for analysing possible reversals or continuation zones.

What Is the Difference Between a Fair Value Gap and an Inverse Fair Value Gap?

A Fair Value Gap (FVG) is an imbalance caused by aggressive buying or selling, creating a price gap that may act as support or resistance. An Inverse Fair Value Gap (IFVG) occurs when the original FVG is invalidated—indicating a shift in sentiment—and its role flips. For instance, a bearish FVG invalidated by a price breakout becomes a bullish IFVG.

What Is the Difference Between BPR and Inverse FVG?

A Balanced Price Range (BPR) represents the overlap of two opposing Fair Value Gaps (FVGs), creating a sensitive zone for potential price reactions. In contrast, an Inverse Fair Value Gap (IFVG) is a concept based on a single FVG that has been invalidated, flipping its role. While both are useful, BPR reflects the equilibrium between buyers and sellers, whereas IFVG highlights sentiment reversal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up