Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan's Deputy Chief Cabinet Secretary: We Will Not Comment On The Federal Reserve's Interest Rate Decision And Its Impact At This Time

[US Treasury Secretary Threatens Carney: Don't Provoke Disputes Ahead Of USMCA Review] According To The Associated Press, US Treasury Secretary Bessant Threatened Canadian Prime Minister Carney On The 28th, Saying That His Recent Public Comments On US Trade Policy Could Backfire During The Upcoming Review Of The USMCA Trade Agreement, Which Aims To Protect Canada From The Significant Impact Of The Trump Administration's Tariff Policies

CCTV News: Chinese President Xi Jinping Will Meet With British Prime Minister Keir Starmer, Who Is On An Official Visit To China, At The Great Hall Of The People In Beijing

Philippines Economic Planning Secretary: We See 2026 As Our Rally Point, Accelerating Efforts To Restore Public Trust

Reuters Poll - Reserve Bank Of India To Keep Repo Rate Unchanged At 5.25% On February 6, Say 59 Of 70 Economists

China Expects 9.50 Billion Passenger Trips To Be Made During 40-Day Spring Festival Holiday Travel Period - State Planning Official

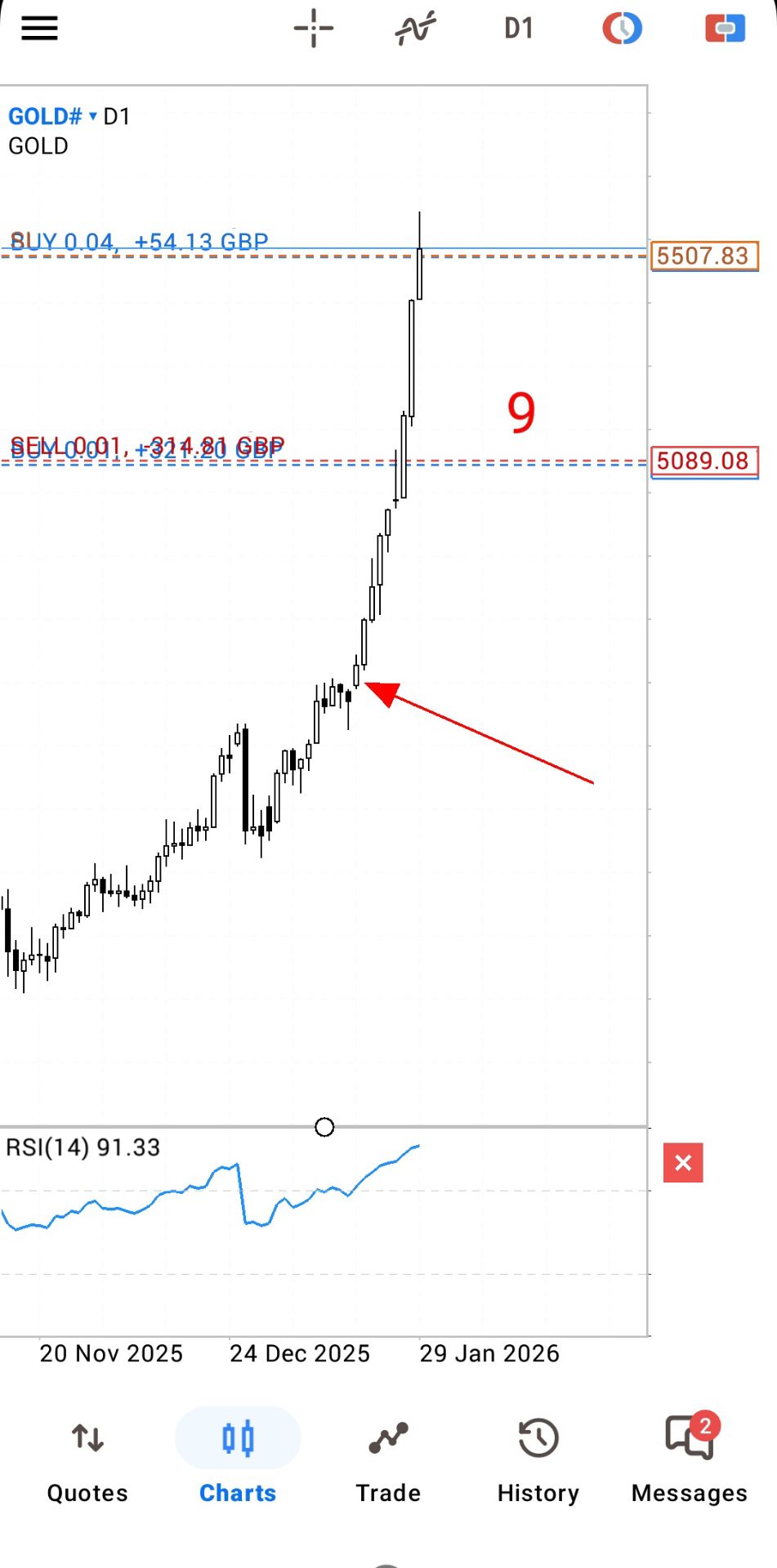

The Main Shanghai Gold Futures Contract Surged 8.00% Intraday, Currently Trading At 1250.52 Yuan/gram

The Main Lithium Carbonate Futures Contract Continued To Fall, Dropping More Than 6% Intraday, And Is Currently Trading At 160,020 Yuan/ton

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target RateA:--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)A:--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)A:--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. Yield--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. Yield--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)--

F: --

P: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)--

F: --

P: --

U.S. Exports (Nov)

U.S. Exports (Nov)--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)--

F: --

P: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)--

F: --

P: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)--

F: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Today’s national average for a gallon of gas is $3.30, 17 cents less than a month ago and 51 cents less than a year ago.

The financial markets are in a state of heightened anticipation as the much-awaited US non-farm payroll report is set to release today. This key data set will be critical in assessing whether the US economy is veering towards a recession, following the jump in the unemployment rate in July. For Fed, the NFP data will play a significant role in determining the size of the upcoming rate cut as the start of its policy easing cycle, which is expected at the FOMC meeting later this month. However, market reactions could be complex and volatile, as shifting dynamics between stocks, bond yields, and currencies may generate counteracting movements.

Dollar saw broad weakness overnight, but the selloff was tempered by ISM services PMI report, which indicated that the services sector remains in modest growth territory. As of now, Dollar and British Pound are positioned in the middle of the week’s performance chart. On the other hand, Japanese Yen is staying as the strongest performer, supported by declining US and European benchmark yields. Yen also extended its rally during today’s Asian trading session. Close behind are Swiss Franc and Euro. Meanwhile, Australian Dollar sits at the bottom of the performance ladder, followed by New Zealand Dollar and Canadian Dollar, signaling a cautious and risk-averse market atmosphere.

Technically, USD/JPY would be eyeing 141.67 support if current decline continues. Break there will resume whole decline from 161.94. But an important zone around 140 lies ahead with 140.25 support, as well as 38.2% retracement of 102.58 to 161.94 at 139.26. So, downside potential might be relatively limited. Yet, decisive break of 140 would risk deeper acceleration in the selloff.

In an interview with MarketWatch, Chicago Fed President Austan Goolsbee indicated that the current economic data justifies multiple interest rate cuts, with the process beginning soon.

Goolsbee pointed out that inflation is coming down “very significantly,” while the unemployment rate is “rising faster,” suggesting a cooling labor market.

He expressed concern that the persistent weakness in the job market could “turn into something worse” if the trend continues.

Given the balance of more favorable inflation data and deteriorating unemployment figures, Goolsbee suggested that the path forward is “not just rate cuts soon,” hinting at a sustained easing cycle by Fed.

Japan’s household spending edged up by 0.1% yoy in July, falling well short of the expected 1.2% yoy increase. While this marked the first annual rise in three months, the modest growth suggests that households are still holding back on spending due to inflationary pressures.

The increase was driven by a 17.3% yoy surge in housing outlays, with more people undertaking home renovations such as installing new kitchens and bathtubs, according to the Ministry of Internal Affairs and Communications. Entertainment spending also grew by 5.6% yoy, supported by purchases of televisions for the Paris Olympics. Expenditures on domestic and overseas package tours saw significant jumps of 47.0% yoy and 62.6% yoy, respectively.

Despite the tepid spending growth, the average monthly income of salaried households with at least two people rose by 5.5% yoy in real terms, marking the third consecutive monthly increase after 3.1% yoy and 3.0% yoy gains in June and May.

A ministry official noted that “spending has not increased as much as wages grew,” suggesting that some households might be saving part of their higher incomes. The ministry plans to continue monitoring how rising wages impact consumption going forward.

Today’s US non-farm payroll report is crucial for all market participants, as it could determine the size of Fed’s expected rate cut this month. Currently, fed fund futures are pricing in 43/57% chance of a 25/50 bps reduction. Market reaction to NFP will also likely set the trading tone for the remainder of the quarter.

Economists expect job growth of 163k in August, with the unemployment rate forecasted to tick down from 4.3% to 4.2%. Average hourly earnings are projected to increase by 0.3% mom, indicating solid wage growth.

Recent economic data offers a mixed outlook. ISM Manufacturing Employment rose to 46.0 from 43.4, but the ISM Services Employment fell to 50.2 from 51.1. Meanwhile, ADP Employment report showed a disappointing 99k new jobs, down from July’s 111k. Initial unemployment claims averaged 230k over four weeks, down from last month’s 240k.

A key data point to watch will be the unemployment rate. Last month’s unexpected rise to 4.3% triggered the “Sahm Rule,” a reliable recession indicator. If the unemployment rate doesn’t fall as expected, or worse, increases further, it could signal deeper labor market troubles. This scenario might prompt Fed to take pre-emptive action with a 50 bps rate cut at the upcoming FOMC meeting. Yet, markets’ bearish reaction could overwhelm Fed cut optimism.

The stock markets’ reaction to NFP today is worth high attention. S&P 500 top at 5651.37, just ahead of 5669.67 historical high. On the downside, decisive break of 55 D EMA (now at 5475.02) will argue that rebound from 5119.26 has completed. Corrective pattern from 5669.67 should have then started the third leg. In this case, deeper fall would be seen to wards 5119.26 support again.

But of course, strong bounce from 55 D EMA would set the stage for breaking through 5669.67 to resume the long term up trend, sooner rather than later.

Germany industrial production and trade balance, France industrial production and trade balance; Swiss foreign currency reserves, and Eurozone GDP revision will be released in European session. Later in the day, Canada will also publish job data, along with US NFP.

Daily Pivots: (S1) 1.1048; (P) 1.1071; (R1) 1.1107;

EUR/USD’s break of 1.1104 minor resistance suggests that pullback from 1.1200 has completed at 1.1025 already. Intraday bias is back on the upside for retesting 1.1200 first. Firm break there will resume larger rally and target 61.8% projection of 1.0776 to 1.1200 from 1.1025 at 1.1287. However, break of 1.1025 support will resume the fall from 1.1200 instead.

In the bigger picture, prior break of 1.1138 resistance indicates that corrective pattern from 1.1274 has completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.0947 resistance turned support holds.

The Institute of Supply Management (ISM) has released its August services purchasing managers' index (PMI). The headline composite index is at 51.5, slightly better than the forecast. The latest reading moves the index back into expansion territory for 48th time in the past 50 months.

Miller continues, "The increase in the Services PMI® in August is due to all directly factoring indexes (Business Activity, New Orders, Employment and Supplier Deliveries) with readings close to or above 50 percent. The Supplier Deliveries Index was in mild contraction (faster) territory in August. For a second straight month, the slow growth indicated by the Services PMI reading was reinforced by panelists' comments. Slow-to-moderate growth was cited across many industries, while ongoing high costs and interest-rate pressures were often mentioned as negatively impacting business performance and driving softness in sales and traffic. Although the Inventories Index increased by 3.1 percentage points into expansion territory in August, many respondents indicated their companies are still actively managing down their inventories."

Unlike its much older kin, the ISM manufacturing series, there is relatively little history for ISM's non-manufacturing data, especially for the headline composite Index, which dates from 2008. The chart below shows the non-manufacturing composite.

The more interesting and useful sub-component is the non-manufacturing business activity Index. The latest data point for August is 53.3, down from last month.

For a diffusion index, this can be an extremely volatile indicator, hence the addition of a six-month moving average to help us visualize the short-term trends.

Theoretically, this indicator should become more useful as the time frame of its coverage expands. Manufacturing may be a more sensitive barometer than non-manufacturing activity, but we are increasingly a services-oriented economy, which explains our intention to keep this series on the radar.

BRICS is an important tool for reducing the dependence of countries on the dollar, Prime Minister Datuk Seri Anwar Ibrahim said in an interview with RIA Novosti and RT, reported Sputnik.

"The issue of using local currencies, which we have done in the past with China, with Indonesia, and to an extent with Thailand...we are [also] talking to India. We are still quite dependent on the dollar, but at least to reduce the impact, we need to do that. And BRICS is of course another vehicle to do that," Anwar said on the sidelines of the Eastern Economic Forum (EEF).

Established in 2009, BRICS initially comprised Brazil, Russia, India, and China. South Africa joined in 2010, and Iran, Egypt, Ethiopia, and the United Arab Emirates joined as new members in January this year.

BRICS, he added, is important for strengthening cooperation among the countries of the Global South and containing the onslaught of rich industrial states.

"Well, we are very appreciative of the fact that [Russian] President [Vladimir] Putin officially invited me to attend the BRICS meeting in Kazan next month.

“Our policy is of course to strengthen the Global South. BRICS is a very important vehicle to strengthen that sort of collaboration among countries in the Global South, not necessarily in antagonism, but at least to contain the onslaught of other richer industrialised countries and to be able to at least withstand the pressure and together build up the force."

Anwar emphasised that the Global South must organise itself and become stronger to resist the pressure.

"We also have to then organise ourselves to be more strong, to be able to contain the pressures not within our control. So that is, to me, the wisdom."

The EEF began on Tuesday and will run through Friday. It is being hosted by the Far Eastern Federal University in Russia's Pacific coast city of Vladivostok. Sputnik is the general information partner of the EEF 2024.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up