Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Some contradicting headlines are influencing the US Dollar in a battle of wits right ahead of quintessential inflation data.

Some contradicting headlines are influencing the US Dollar in a battle of wits right ahead of quintessential inflation data.Markets have been unable to provide a clear answer on how the upcoming FOMC (September 17th) and its rate cut expectations will affect the future outlook for the Dollar.The thesis had been that despite negative news (Jerome Powell’s change in tone at Jackson Hole or the recent Non-Farm Payrolls), traders have failed to sell the US Dollar convincingly, with the DXY doomed in sideways action.

The freshly released downward revisioned BLS report (bearish for the USD) and the rising tensions in the Middle East with Israel-Hamas war taking another turn (bullish for the USD) are once again prevented a clear path ahead for the Greenback.However, some interesting technical patterns might be getting into play as we approach the surely decisive pair of inflation reports in the US PPI (8:30 E.T. tomorrow) and Thursday’s CPI report.

Let’s take a look at the Dollar Index.

The upcoming PPI report should bring back memories of the previous humoungous beat in the past month (0.9% vs 0.2% exp) pushing inflation expectations higher for the consecutive University of Michigan surveys (the FED hates that).This comes as Participants started to be less and less cocnerned by tariffs and their impact.Despite hurting producers before consumers, fears are that Producer Prices increases will repercutate in upcoming CPI releases, highlighting Thursday’s number even more.

A relatively weak PPI could help to support current sentiment quite largely, indicating that the past month increase was just a one off – This should support a 50 bps cut further (Dollar down).

CPI will really be in focus however as Participants look to see if the higher producing costs have started to bite in consumers pockets.Reactions should be similar to the PPI, but their extent could be much larger: A higher inflation for Consumers should prevent a 50 bps entirely, towards more gradual cut and spark stagflation fears.

US Dollar could hence maintain its sideways movement.

Dollar Index intraday outlook

Dollar Index 4H Chart

Last week’s data has brought some renewed selling momentum as bears have managed to form a downward tight bear channel (bear candles overlapping each other).The weekly open hence formed a small gap to test the July support/pivot zone, and this morning of action actually saw a decent rebound, undoing some of the bear advantage.Arriving at a key technical standpoint, bears entering here could take the hand by rejecting the 97.60 to 97.80 range lows (break-retest style).

Keep in mind that action will be swift tomorrow (expect spikes) and prices may just dawdle around until then.

Key levels of interest for the Dollar Index:

Support Levels:

Resistance Levels:

Dollar Index 30m Chart

Looking closer to the short-timeframe, the support zone that is currently trading will be a major test for bulls.Managing to hold the lows of the current support (97.40, immediate short-term support) would indicate balanced action, which would be more in the bulls favor after failing to hold lower.On the other hand, sellers appearing at the immediate short-term resistance (97.70) could trigger break-retest selling reactions.

A breakout in any direction should see continuation.

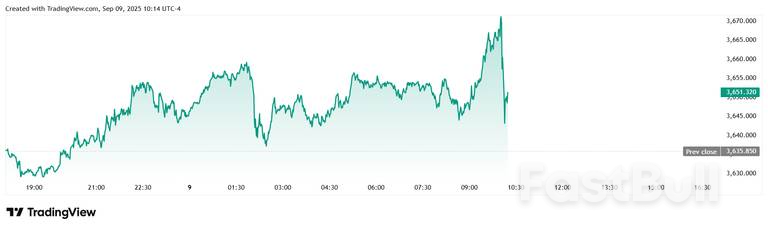

Gold prices spiked then sold off sharply after the preliminary revisions to U.S. employment subtracted nearly one million jobs – three times lower than the 10-year average and the worst print on record.

The preliminary estimate of the Current Employment Statistics (CES) national benchmark revision to total nonfarm employment for March 2025 is -911,000 (-0.6 percent), the U.S. Bureau of Labor Statistics (BLS) reported today.

The revision is 300% worse than the average over the last decade, the BLS said. “The annual benchmark revisions over the last 10 years have an absolute average of 0.2 percent of total nonfarm employment,” they wrote. Before today, 2009 saw the largest downward revision with 902,000, but today’s number is now the worst in the series’ history.

Gold prices saw significant volatility around the employment revision release, which is often a non-event, but which has added importance this year following the massive downward revisions over the previous quarter.

Spot gold spiked to a session high of $3,674.69 in the moments after the 10 am EDT release, but fell all the way to $3,643 less than ten minutes later.

Spot gold last traded at $3,651.42 per ounce, and remains up 0.43% on the daily chart.

Each year, CES employment estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW). These numbers are derived primarily from state unemployment insurance (UI) tax records.

“The preliminary benchmark revision reflects the difference between two independently derived employment counts, each subject to their own sources of error,” they said. “It serves as a preliminary measure of the total error in CES employment estimates from March 2024 to March 2025.”

The BLS said that preliminary research indicates that the overestimation of employment growth was “likely the result of two sources—response error and nonresponse error.”

“First, businesses reported less employment to the QCEW than they reported to the CES survey (response error),” they wrote. “Second, businesses who were selected for the CES survey but did not respond reported less employment to the QCEW than those businesses who did respond to the CES survey (nonresponse error).”

The final benchmark revision will be incorporated into official estimates with the publication of the January 2026 Employment Situation news release in February 2026.

Chris Zaccarelli, Chief Investment Officer for Northlight Asset Management, told Kitco News that the revisions could hurt the broad market rally.

"The jobs picture keeps deteriorating, and while that should make it easier for the Fed to cut rates this fall, it could also throw some cold water on the recent rally," he said. "Worse still, if the CPI shows a worsening trend of higher inflation on Thursday, then the market will begin worrying about stagflation."

"The bull market has been extremely resilient this year, but we could be approaching an inflection point where it is tested again."

Oil rose for a third session after President Donald Trump told European Union officials he’s willing to slap new tariffs on India and China in an effort to get Russia to negotiate with Ukraine.

However, it came with a caveat — Trump will only impose levies if EU nations do so as well. West Texas Intermediate climbed to trade near $63 a barrel during early Asian trading, while Brent closed above $66 on Tuesday. Futures gained in the previous session after Israel conducted a strike in Doha targeting senior Hamas leadership, raising concerns about escalating tensions.

The strike marks Israel’s first attack in Qatar’s capital since the onset of the nearly two-year conflict that has roiled global oil markets. It also threatens to derail US-led peace talks between Israel and Hamas, which might have eased lingering geopolitical risk premiums in crude prices. Israel has claimed full responsibility and Trump distanced himself from the attack.

Meanwhile, Trump’s tariff proposal amounted to a challenge given that nations including Hungary have blocked more stringent EU sanctions targeting Russia’s energy sector in the past. The US president has so far hit India with crushing levies for its oil trade with Moscow, but skipped similar measures on China.

Key points:

Indonesia's Finance Minister Sri Mulyani Indrawati was chairing a meeting with top ministry officials when she received a call from President Prabowo Subianto's office informing her she would be replaced within an hour, two sources said, underscoring the abruptness of the longtime finance czar's sacking.Sri Mulyani, known for her cautious steering of Southeast Asia's largest economy that won the confidence of markets, was widely regarded as one of the few checks on Prabowo's big growth and spending promises that had unnerved many investors.

Prabowo kept her on when he took power last year in a signal of policy continuity from the largely stable reign of his predecessor, but the relationship came to a sudden end less than a year in.Two sources with direct knowledge of events leading up to Sri Mulyani's ousting on Monday told Reuters on condition of anonymity that she was in a meeting after 2:30 p.m. (0730 GMT) when she got a call from one of Prabowo's closest aides.The official announcement came less than an hour later that she had been replaced by economist Purbaya Yudhi Sadewa.

"She was supposed to have a (meeting) agenda with the president in the morning that day, but it was cancelled," said one of the sources, who is close to Sri Mulyani.Sri Mulyani and the President's office did not immediately respond to Reuters' requests for comment.It had previously been unclear if she resigned or was removed. The sources, both close to the ousted minister, one of whom was in the ministry, confirmed Sri Mulyani was asked to leave.One more government source confirmed she did not resign, but did not comment on the chain of events.

Sri Mulyani and Prabowo were peers in the cabinet of President Joko Widodo from 2019 to 2024, with the latter serving as defence minister.One of the sources said Prabowo only hired Sri Mulyani because of a push from three former presidents and to give stability to the markets.They said Sri Mulyani's prudent approach was at odds with Prabowo's big spending plans, with projects such as the ambitious - and expensive - free meals programme for 82.9 million Indonesians.

The programme will get a massive boost with a $20.7 billion budget in 2026 - almost double that of this year - while other areas such as funding for regional governments were cut to control the fiscal deficit.While Sri Mulyani - who served under three presidents across two stints as finance minister - tried to accommodate Prabowo's policies, the two barely met, the source said, as communication with the president had become increasingly difficult.The sources told Reuters Sri Mulyani was shaken after one of her homes was looted during two weeks of protests and unrest against government spending priorities and tax plans.Prabowo asked during a cabinet meeting if she was okay after the looting and she responded in the affirmative and continued in the role, two sources said, adding everything ran normally until Monday.

While it was unclear why Sri Mulyani was replaced, economists believe the two did not see eye-to-eye on fiscal matters.Earlier this year, Prabowo established a new sovereign wealth fund and appointed high-profile advisers known for risk-taking in business and investment, with the aim of strategically leveraging more of its assets to spur growth.A source in the fund, who declined to be identified, said at least one adviser told Prabowo Sri Mulyani's fiscal conservatism was not compatible with higher growth targets.

Indonesian law says the fiscal deficit cannot exceed 3% of GDP - a safeguard against the kind of economic instability that rocked the country in the late 1990s under authoritarian leader Suharto.While that law has long been respected - particularly under Sri Mulyani - many detractors see fiscal conservatism as a growth impediment, including Prabowo, who said prior to taking office that Indonesia could take on more debt.

Sky News is citing Ukraine's air force to say that Russian drones have entered the airspace of Poland, threatening the city of Zamosc - which lies some 40 miles from the Ukrainian border. Some initial sources are citing a 'wave' of drones, but this remains unclear. Per Reuters:

Poland placed its air defenses on the highest state of readiness after Ukraine’s air force warned that Russian drones had crossed into Polish airspace, according to early reports.

The Polish Armed Forces said early Wednesday local time that all necessary procedures were activated to secure national airspace as Russia carried out large-scale overnight strikes on Ukraine.

“Polish and allied aircraft are operating in our airspace, and ground-based air defense and radar systems have reached the highest level of readiness,” the Operational Command said. It described the measures as preventive and aimed at protecting citizens in regions bordering Ukraine.

However, the initial Polish military statement itself did not specify a Russian breach of Poland's airspace:

This is not a first time that Russian drones have breached Polish airspace, prompting fighter jets to be scrambled, or else searches for crash or landing spots within the Polish side of the border. Some unconfirmed reports have said there have been intercepts over Poland.

Getting the attention of US Congressmen and likely the White House:

And open source monitoring sites are noticing an uptick in allied activity over eastern Poland...

Another Notice-to-Airmen (NOTAM) has been issued for Eastern Poland by the Polish Civil Aviation Authority within the last few minutes, this time for Lublin Airport, stating that the airport is unavailable due to “unplanned military activity related to ensuring state security.”

If indeed there has been waves of Russian UAVs breaching the Polish border, we can expect many jets from NATO to scramble, but as yet it's unclear what's going on in eastern European skies.

This coming winter could be one of the harshest yet for Ukrainians, given Russia has greatly ramped up it's nationwide drone and missile attacks, often targeting power and energy infrastructure - likely in response to Ukraine's own sustained cross border attacks on oil depots inside Russia.

Overnight, Ukraine's energy ministry said Russian forces struck a thermal power generation facility in the Kyiv region, which suffered some local blackouts and gas outages as a result. While much of the east of Ukraine has seen frequent mass outages throughout the war, this is a more rare occurrence for the capital area.

"The goal is obvious: to cause even more hardship to the peaceful population of Ukraine, to leave Ukrainian homes, hospitals, kindergartens and schools without light and heat," the ministry wrote on Telegram.

Illustrative: Thermal power plant near Kiev, Wiki Commons

Illustrative: Thermal power plant near Kiev, Wiki CommonsThis followed on the heels of the single largest aerial attack in three-and-half years of conflict, which resulted in a serious blaze at a government building (offices of the cabinet ministers) on Sunday. Russia's defense ministry confirmed that it targeted Ukrainian energy infrastructure in this newest strike.

Ukraine's electricity grid operator Ukrenergo later said several power sites for the country were hit. "Emergency repair work is ongoing, and most consumers had their power restored by Monday morning," it said.

Gas infrastructure was also damaged, resulting in over 8,000 properties in eight settlements suffering disconnect from their supply.

Serhiy Kovalenko, CEO of the Ukrainian energy company Yasno, wrote on X. "For several weeks now, the enemy has been striking energy system facilities in various regions." He further warned, "Of course, no one knows what will happen this autumn, but given the recent strikes, there is no particular cause for optimism."

Gazprom CEO Aleksey Miller is also warning of a cold winter full of needless suffering for the EU. Russian media carried his fresh comments as follows:

Citing data from Gas Infrastructure Europe (GIE), Gazprom said that as of end-August only two-thirds of the gas withdrawn from European storage facilities last winter had been replenished, after five months of injections. The shortfall of 18.9 billion cubic meters was the second largest on record for that date.

Gazprom, once the EU’s main supplier, reduced its exports to the bloc dramatically three years ago, following Western sanctions and the sabotage of the Nord Stream pipelines. Russian gas exports accounted for 40% of the bloc’s total supply before the escalation of the conflict and the imposition of unilateral sanctions by Brussels.

“We are now seeing the situation steadily worsening. This is what we have been talking about. Another year will pass, and where else can it go? If there is a normal cold winter, this will become a real problem,” Miller told Russia’s TASS news agency on the sidelines of the Eastern Economic Forum on Sunday.

Source: gazprom.ru

Source: gazprom.ruThis summer has seen several Ukrainian attacks on LNG pipeline infrastructure going to Europe. Also, this weekend another major Russian crude refinery was on fire after direct Ukrainian drone strikes.

The attack unleashed two active fires at the major Ryazan refinery, southeast of Moscow, with witnesses hearing explosions early and overnight last Friday, after which large flames and thick smoke were spotted above the southern outskirts of the city.

Lithium producers slumped on news that a Chinese mine idled last month may restart sooner than expected, threatening fresh pressure on prices for the battery material.Shares of Pilbara Minerals Ltd. fell as much as 17% in early trading in Sydney on Wednesday, while Liontown Resources Ltd., IGO Ltd., and Mineral Resources Ltd. all dropped by more than 10%. Earlier in New York, SQM and Albemarle Corp. fell 8.8% and 11%, respectively.Executives at Contemporary Amperex Technology Co. Ltd. told employees in a meeting early Tuesday to prepare for a resumption at the Jianxiawo site and recall front-line workers, said a person with direct knowledge of the matter, who asked not to be identified discussing private information. Battery giant CATL didn’t immediately respond to a request for comment.

The Jianxiawo mine in Yichun, a key Chinese lithium hub, has become a focal point for market sentiment. Its production halt due to an expired license stoked speculation that it was part of Beijing’s tougher stance on overcapacity and reflected a shift toward supply discipline. Days before Jianxiawo’s permit expired on Aug. 9 traders flew drones over the site in the hope of gauging the state of operation.“This signals the Chinese government is not keen to disrupt the value chain,” said Cameron Hughes, a battery markets analyst at industry consultancy CRU Group, adding the earlier return may trigger a decline for lithium prices. “The ease of the renewal process is a very positive sign that we will not see similar disruptions for other lepidolite producers.”

Prices of lithium carbonate — a refined form of the material used in batteries — have seen heightened volatility over supply uncertainties. On Tuesday, news of CATL’s plans to resume output sent shares of major lithium producers tumbling.“An earlier-than-expected restart of Jianxiawo can disrupt the theme of market rebalancing in the short term,” Jefferies analysts including Shuhang Jiang wrote in a note to clients. “We would not be surprised if China lithium stocks react negatively.”

Political tensions, fierce domestic competition and China's slowing economic growth are sapping the confidence of U.S. businesses in the country, with optimism about their five-year outlook falling to a record low, a survey showed.Only 41% of U.S. firms were optimistic about their five-year China business outlook, a drop of six percentage points from last year, according to the survey published on Wednesday by the American Chamber of Commerce in Shanghai. This was the weakest level of optimism reported since the AmCham Shanghai Annual China Business Report was introduced in 1999.

The survey of 254 member companies representing a range of industries was conducted just after U.S. President Donald Trump announced his sweeping so-called "Liberation Day" tariffs, which led to a tit-for-tat tariff escalation with China. A pause in trade hostilities has since temporarily lowered tariff levels.Geopolitics remains the biggest issue cited by companies, with 66% of respondents saying U.S.-China tensions are the top challenge facing their business over the next three-to-five years.

"We love this 90-day pause, but the issue is not going away, it's still here," said Eric Zheng, president of AmCham Shanghai, adding that the current uncertainty made it difficult for companies to plan for the future."Hopefully the two governments will work together to sort out their differences and hopefully there will be a deal soon," he said.Domestic competition from rising Chinese players was the second-biggest challenge cited by businesses, overtaking China's economic slowdown.The number of profitable firms picked up from last year's record low, with 71% posting profits. Revenue performance also improved, with 57% of members, up from 50% the year before, achieving year-on-year growth.

This said, only 45% of surveyed members expect revenue to grow in 2025, which would be a record low if it comes to pass. A majority of companies, 64%, expect new U.S.-China tariffs to drag on this year's revenue.On a positive note, there was a significant 13-percentage-point uptick from last year - to 48% - in businesses that reported believing China's regulatory environment is transparent. The number confident that China's regulatory environment would open up further rose to 41% from 22% last year.

Only 12% of respondents ranked China as their firms' top investment destination, another record low in the survey's history.In the past year, 47% of companies have redirected investment that had been earmarked for China, the AmCham report said, with Southeast Asia remaining the top pick for rerouting investment.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up