Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

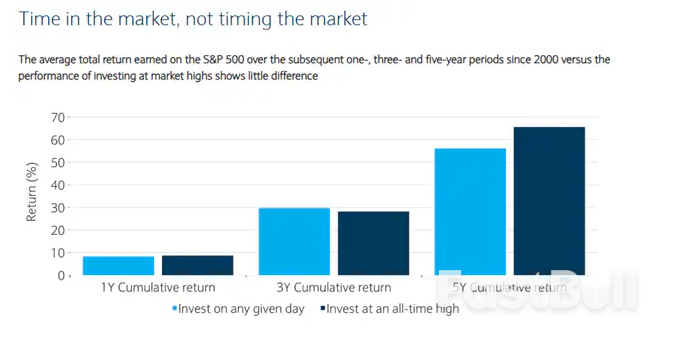

Markets continue to print record highs, and with them, investor uncertainty.Some worry that valuations have run too far. Others fear missing out on the next leg higher. And somewhere in between are those asking, “Should I wait for a correction before putting money to work?”It’s a fair question, but history suggests it’s the wrong one.

Key points:

The myth of waiting for the perfect entryIn theory, “buy low, sell high” sounds perfect. In practice, most investors struggle to do either.In fact, if you only invested on days when the S&P 500 hit an all-time high, your long-term returns would often be higher than if you invested on any random day.

That’s because record highs typically happen during bull markets, and bull markets tend to last longer than expected.The real challenge isn’t timing the market. It’s having a strategy that works when prices feel high, and sticking to it.

What to do instead: smart moves at market highs

Even when the overall market is rising, individual stocks and sectors often face short-term dips. Those can be opportunities.

What you can do:

While technology and AI stocks have led the charge, many parts of the market have lagged, and may offer better value and catch-up potential if the rally broadens out.

What to consider:

Market leadership today is shaped less by geography or sector, and more by macro forces like interest rates, trade policies, and geopolitical risk. Traditional diversification alone may not be enough. It’s time to think about how different parts of your portfolio respond to shifting policy and economic drivers.

How to position:

Even if some of these areas have gained attention recently, their relevance over the long term means they may still be underrepresented in many portfolios.

Waiting for the “perfect moment” to invest often leads to missed opportunities. Even when markets dip, fear and uncertainty can prevent action, leaving cash on the sidelines and long-term goals unmet.

What works better:

Buying at market highs can feel uncomfortable, but history shows that long-term investors are often rewarded for staying the course.If you diversify smartly, lean into underappreciated areas, and stay consistent with your investing plan, you won’t need to worry about whether you’re “too late.”Because long-term wealth isn’t built by picking the perfect moment.It’s built by showing up, again and again.

German business sentiment is still riding the wave of optimism. Even though we still see a large portion of wishful thinking, the seventh consecutive increase in Germany’s most prominent leading indicator remains remarkable. In July, the Ifo index came in at 88.6, slightly up from 88.4 in June, and stands now at its highest level since last summer. While expectations remained unchanged, the current assessment component finally improved, suggesting that growth in the third quarter could pick up again.

A wave of optimism seems to have caught the German economy, but it remains unclear whether it is really based on stronger fundamentals or just wishful thinking. It's probably a combination of both. And to be more precise, the wave of optimism has caught corporate life, not households. While the Ifo index looks almost unstoppable, consumer confidence has fallen for two months in a row and remains weak.

Returning to German businesses, there are several reasons for increasing optimism; after two years of inventory build-up and dropping orders, the inventory cycle started to turn for the better at the start of this year. Energy prices have come down from highly elevated levels, and the prospect of fiscal stimulus has played a role, too. In fact, German businesses seem to be focusing on the bright side of what could happen under the new German government, rather than fearing the downsides from ongoing uncertainty and trade tensions. And at least the optics of the new government are good. German businesses had grown disillusioned with the last government’s ongoing internal controversies. Now, the sheer fact that the new government has avoided big blunders like open controversies or erratic policy announcements and has begun to really implement the announced fiscal stimulus has boosted its popularity.

The latest episode in the government’s confidence-building was this week’s summit between the government and business leaders. An initiative of large German corporates, self-named ‘Made for Germany’, promised to invest €631bn over the next three years. While the headline figure looks impressive, only €100bn of that sum will actually be ‘new’ investments. The rest is previously planned investments. €100bn over three years equals some 0.7% GDP per year. Whether these investments will really reach the economy and how much crowding out of other investments will emerge remains to be seen, as does the question of whether these investments will materially boost innovation or new technologies.

In any case, just take a step back and remember where the German economy stood at the start of the year: completely in the doldrums with two years of recession, a huge investment gap and an economic business model that was up for a complete overhaul. Seven months later, there is a €500bn infrastructure fiscal stimulus, a ‘whatever it takes’ spending promise for defence, small tax incentives for private investments and a commitment by large corporates to step up investments. What a change!

Admittedly, there are still few signs of an overhaul of the country’s economic model, either in the government’s coalition agreement or in this week’s announcements by the ‘Made for Germany’ initiative. This increases the risk that all investments will lead to higher productivity. However, Germany had the deep fiscal pockets to avoid the policies it prescribed to many other eurozone countries during the euro crisis: structural reforms and austerity. Still, even with the deep pockets, Germany will have to address the weakness of its economic business model quickly. Investments can only be a first step and not the only step.

To be clear, the near-term outlook for the German economy will still be highly affected by the ongoing trade tensions, possible US tariffs and the stronger euro. It remains remarkable that German businesses seem to almost completely ignore these risks. This return of optimism could also get a cold shower next week when the first estimate of second-quarter GDP growth is released. Nevertheless, the longer-term outlook continues to improve. The jury is still out on whether money will be able to buy growth, but today's Ifo index once again shows that it can at least buy optimism.

The options expiry on Deribit may add to the price pressure for BTC. The leading coin traded at $115,549.15, pressured closer to the level of maximum pain at $112,000.

Deribit announced a total of $15.45B in options, down from June’s $17B. The monthly event is still considered significant, as the crypto market has not experienced a summer slump.

The BTC options expiring have a notional value of $12.66B, while ETH expects a $2.75B expiry event.

While ETH maximum pain price at $2,800 is less probable, BTC may see last-minute pressure. For the past few months, both BTC and ETH have expired above their options maximum pain price.The put/call ratio signals a more moderate stance, though still retaining a bullish trend. Deribit has seen a faster accumulation of open interest, already building up over $37B for the quarter to date. At the end of Q2, the open interest at expiry was just $35B.

BTC still trades in greed territory, with an index of 67. However, this does not preclude short-term price moves. Overall BTC volatility is near an all-time low, though the price still fluctuates between key levels. The BTC volatility index is down to 1.27%, with a brief spike during the July rally.

BTC may easily dip to the $114,000 range, where an accumulation of short positions may trigger an attack. Despite this, BTC retains its bullish factors, with a new accumulation of short positions all the way to $119,000.Despite the complex trading, the end of the month has historically performed as a good entry point. BTC still expects a breakout to a new price range, despite temporary setbacks.

ETH retains the $3,600 range, though the token saw the largest share of long liquidations in the past 24 hours. ETH is traded with more exuberance, with signs of being overheated. The market dominance of ETH expanded to 11.4% as more traders switched their attention, while BTC dominance sank to 59.6%.

BTC and ETH had a drawdown mostly driven by long liquidations, ahead of the monthly options expiry. | Source: CoingGlass.

BTC and ETH had a drawdown mostly driven by long liquidations, ahead of the monthly options expiry. | Source: CoingGlass.In the past 24 hours, ETH was a leader of liquidations, with $152.13M in predominantly long positions. BTC saw $152.04M in long positions liquidated.

BTC also faces added pressure from spot selling. Despite the general accumulation trend, in the short term some whales are sending their coins to exchanges.Galaxy Digital, one of the intermediaries for both retail and institutional traders, has sent 11,910 BTC to multiple exchanges.

The crypto service provider also kept sending a few hundred BTC to Bybit and Bitstamp.

The spot sales originating from the Galaxy Digital wallet follows a recent reawakening of a wallet from 2011. The wallet moved 3,962 BTC, after making a test transaction. The old whale wallet received the typical messages of proving coin ownership, which have made other whales move their coins to new addresses and split them to avoid easy tracking.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up