Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)A:--

F: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)A:--

F: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Dec)

U.S. Cleveland Fed CPI MoM (Dec)A:--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Imports (CNH) (Dec)

China, Mainland Imports (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

China, Mainland Imports YoY (USD) (Dec)

China, Mainland Imports YoY (USD) (Dec)--

F: --

P: --

China, Mainland Exports YoY (USD) (Dec)

China, Mainland Exports YoY (USD) (Dec)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)

U.S. EIA Natural Gas Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Jan)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)

U.S. EIA Short-Term Crude Production Forecast For The Year (Jan)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. YieldA:--

F: --

P: --

Argentina 12-Month CPI (Dec)

Argentina 12-Month CPI (Dec)A:--

F: --

P: --

U.S. Budget Balance (Dec)

U.S. Budget Balance (Dec)A:--

F: --

P: --

Argentina CPI MoM (Dec)

Argentina CPI MoM (Dec)A:--

F: --

P: --

Argentina National CPI YoY (Dec)

Argentina National CPI YoY (Dec)A:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Dec)

South Korea Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Jan)

Japan Reuters Tankan Non-Manufacturers Index (Jan)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Jan)

Japan Reuters Tankan Manufacturers Index (Jan)A:--

F: --

P: --

China, Mainland Exports YoY (CNH) (Dec)

China, Mainland Exports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (USD) (Dec)

China, Mainland Trade Balance (USD) (Dec)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Dec)

China, Mainland Outstanding Loans Growth YoY (Dec)--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction Yield--

F: --

P: --

Canada Leading Index MoM (Dec)

Canada Leading Index MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Core PPI YoY (Nov)

U.S. Core PPI YoY (Nov)--

F: --

P: --

U.S. PPI MoM (SA) (Nov)

U.S. PPI MoM (SA) (Nov)--

F: --

P: --

U.S. PPI YoY (Nov)

U.S. PPI YoY (Nov)--

F: --

P: --

U.S. Current Account (Q3)

U.S. Current Account (Q3)--

F: --

P: --

U.S. Retail Sales YoY (Nov)

U.S. Retail Sales YoY (Nov)--

F: --

P: --

U.S. Retail Sales (Nov)

U.S. Retail Sales (Nov)--

F: --

P: --

U.S. Core Retail Sales MoM (Nov)

U.S. Core Retail Sales MoM (Nov)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Nov)--

F: --

P: --

U.S. Core Retail Sales (Nov)

U.S. Core Retail Sales (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Nov)

U.S. Retail Sales MoM (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Nov)--

F: --

P: --

U.S. Core PPI MoM (SA) (Nov)

U.S. Core PPI MoM (SA) (Nov)--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech U.S. Commercial Inventory MoM (Oct)

U.S. Commercial Inventory MoM (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Dec)

U.S. Existing Home Sales Annualized Total (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Dec)

U.S. Existing Home Sales Annualized MoM (Dec)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

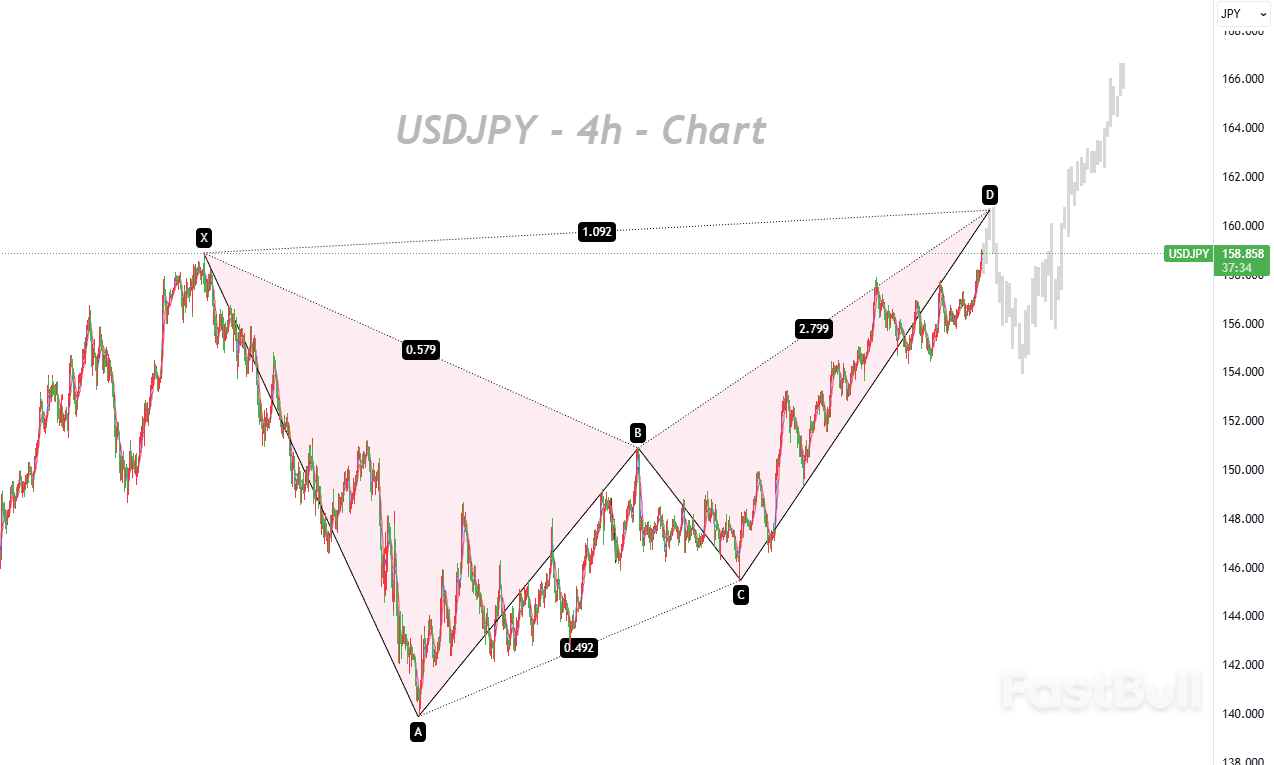

The USDJPY continued to strengthen in Tuesday trading, hovering near its highest level since July 2024. Japanese Prime Minister Takaichi Sanae may soon call an early election, leveraging her high approval ratings, which has boosted market expectations for further expansionary fiscal policies. (Negative for the yen)

160.200

Entry Price

153.910

TP

162.500

SL

--

Pips

PENDING

153.910

TP

Exit Price

160.200

Entry Price

162.500

SL

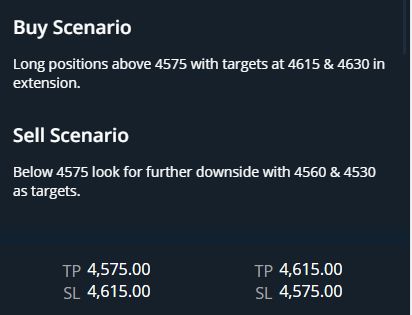

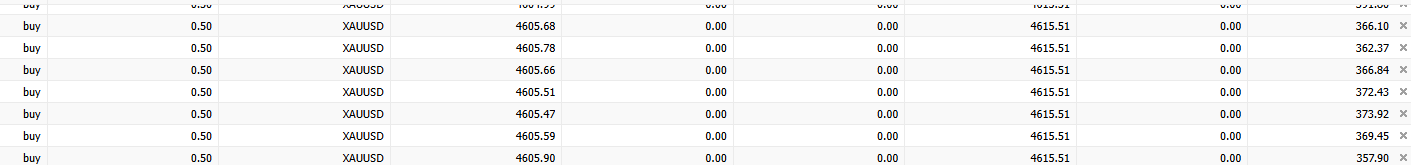

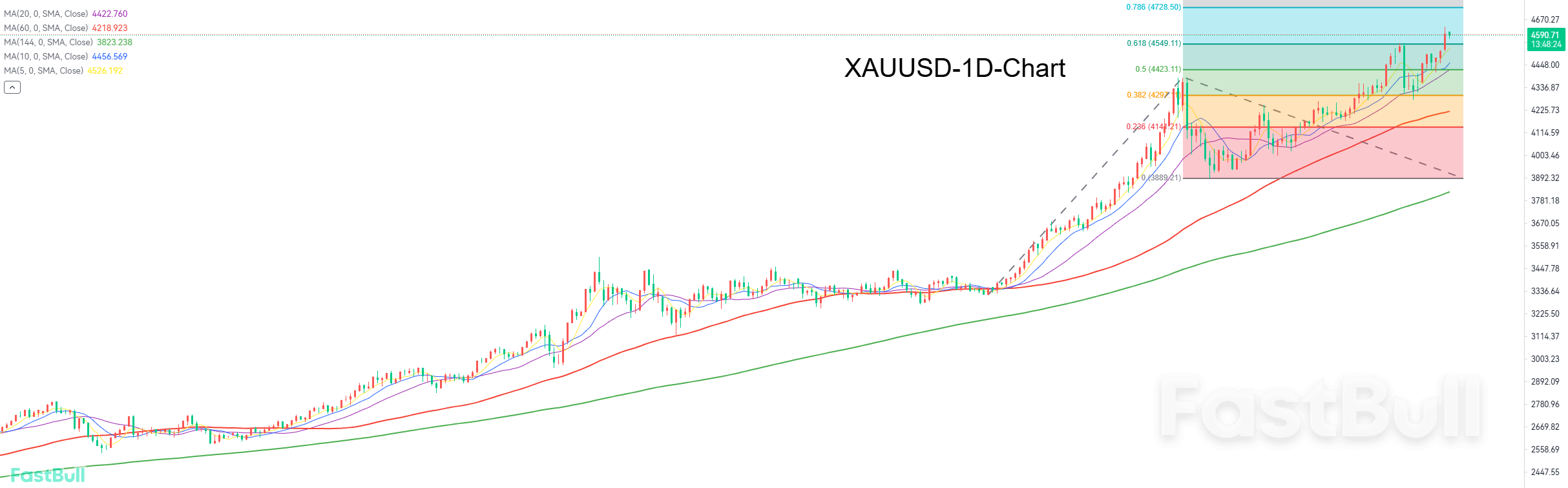

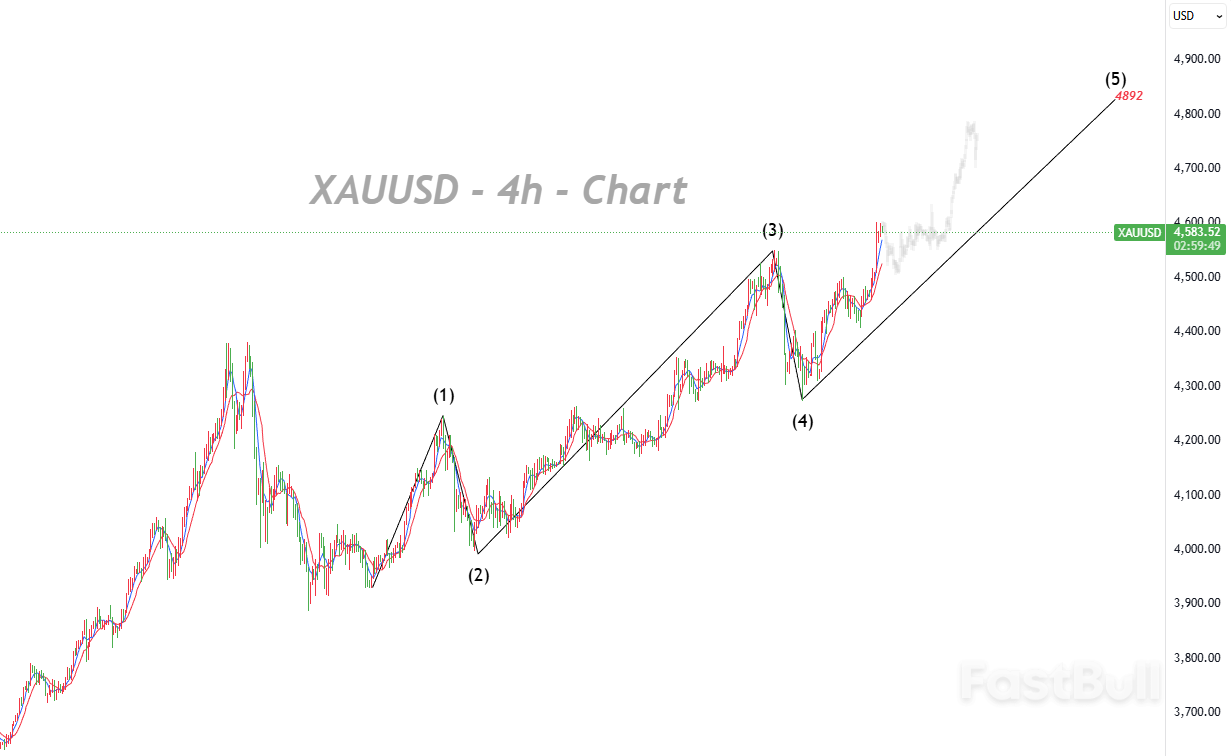

Gold has extended its rally on U.S. domestic political developments, slicing through USD 4,600 and clearing the way for a measured technical extension higher.

4595.39

Entry Price

4720.00

TP

4510.00

SL

0.0

Pips

Flat

4510.00

SL

Exit Price

4595.39

Entry Price

4720.00

TP

Influenced by uncertainties and geopolitical risks, gold prices retreated after hitting a historic high of $4,630 per ounce in the previous trading session, then continued their upward trend. The U.S. December Consumer Price Index (CPI) inflation data, to be released later on Tuesday, will be the market's focus.

4582.97

Entry Price

4300.00

TP

4700.00

SL

0.0

Pips

Flat

4300.00

TP

Exit Price

4582.97

Entry Price

4700.00

SL

This suggests that the recent bearish correction is rapidly losing velocity, potentially allowing buyers to reclaim control of the price action.

0.79650

Entry Price

0.80760

TP

0.79400

SL

--

Pips

PENDING

0.79400

SL

Exit Price

0.79650

Entry Price

0.80760

TP

A significant technical shift has occurred as the 200-period Moving Average, which previously functioned as a reliable support floor, is now acting as a resistance ceiling.

1.16643

Entry Price

1.16050

TP

1.17050

SL

0.0

Pips

Flat

1.16050

TP

Exit Price

1.16643

Entry Price

1.17050

SL

The DOJ investigation into Fed Chair Powell has triggered continued safe-haven demand, pushing gold to fresh record highs. The long-term outlook for gold remains constructive, but with prices at elevated levels, short-term pullback risk has also increased.

4627.52

Entry Price

4395.00

TP

4678.00

SL

318.1

Pips

Profit

4395.00

TP

4595.71

Exit Price

4627.52

Entry Price

4678.00

SL

Silver extends a powerful rally toward record highs as geopolitical tensions, US political uncertainty, and expectations of Fed rate cuts fuel safe-haven demand.

84.508

Entry Price

91.000

TP

82.000

SL

102.4

Pips

Profit

82.000

SL

85.532

Exit Price

84.508

Entry Price

91.000

TP

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up